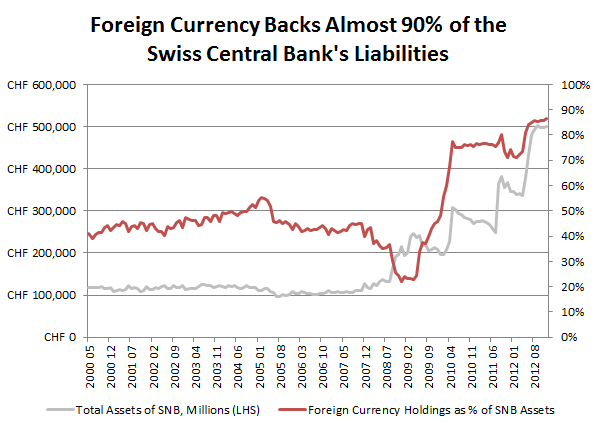

How the Swiss franc changed from a gold-backed currency to a euro and dollar-backed currency. Most of the holdings are German Bunds and US treasuries.

Graph thanks to @CoimbraAzevedo, now at BNP Paribas, who comments

“What do You think when You see this chart? Hint: it’s a spherical viscoelastic film filled with gas.”

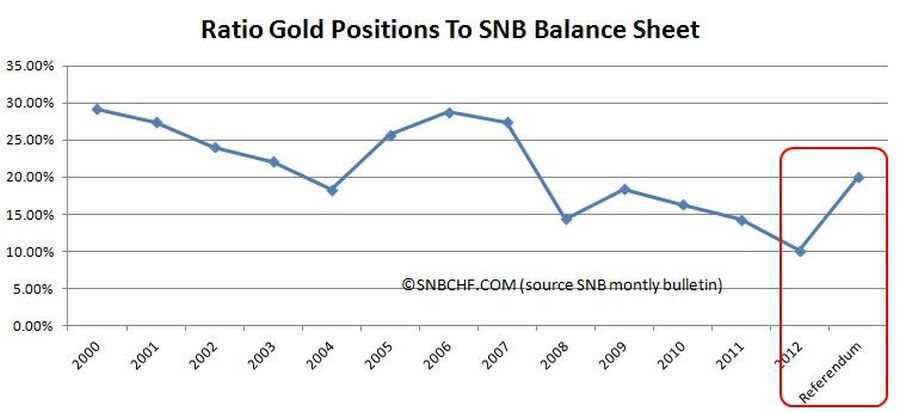

Effectively the gold share in Swiss currency reserves has fallen, from 30% in the year 2000 to 10% recently. In the case a yes to the upcoming gold referendum it must rise to 20% again.

Especially when we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling, it may get dangerous for the SNB.

On the other side, ECB and Fed interest rates seem to be nailed to zero for years: There is no real carry trade that could help the SNB to sell reserves.

Read also:

See more for