Category Archive: 9a.) Real Investment Advice

Gold Is Getting Ahead Of Itself

To appreciate the recent gold price surge, we discuss three critical factors. Money Supply—The chart below shows that the ratio of gold to the money supply (M2) and the money supply tend to follow each other, albeit gold prices are more volatile. The ratio is well extended as it was in 2011. In September 2011, … Continue reading »

Read More »

Read More »

Why Bitcoin Will Not Replace The Dollar

Some will rightfully say we are a glutton for punishment. Our previous articles on Bitcoin and cryptocurrencies have been met with boos and hisses (to be kind) from laser-eyed crypto crusaders. Despite what many of our critics think, we are agnostic about cryptocurrency, but we are willing to expose details that most crypto supporters refuse …

Read More »

Read More »

Discover What Income Is Taxed in Investments Beyond Your IRA Distributions

Unpacking the evil formula of taxation and what's not included. ? #taxes #finance #moneytips

Watch the entire show here: https://cstu.io/9ccb65

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-18-25 Retail Exuberance Sets Up Market For Correction

It is the 90th anniversary of the establishment of Social Security; amazingly, some recipients over the age of 150 are apparently still receiving benefits (!). Could there be a clue here on how to help shore up the fund? Just sayin... Nvidia earnings are on the way; Meta has and a 20-day winning streak, not one down day for the pat6 20-trading days. Its performance as one of the Mag-7 stocks is what has helped, in part, keep markets elevated. The...

Read More »

Read More »

Eggflation Fears

Egg prices were up nearly 19.5% in last Wednesday's CPI report as the Avian flu wreaks havoc on the nation's egg supply. Despite its inconsequential role in determining inflation, Eggflation is getting much publicity. Given the Eggflation fearmongering on social media, it's worth putting some context on egg prices and their impact on CPI. Eggs …

Read More »

Read More »

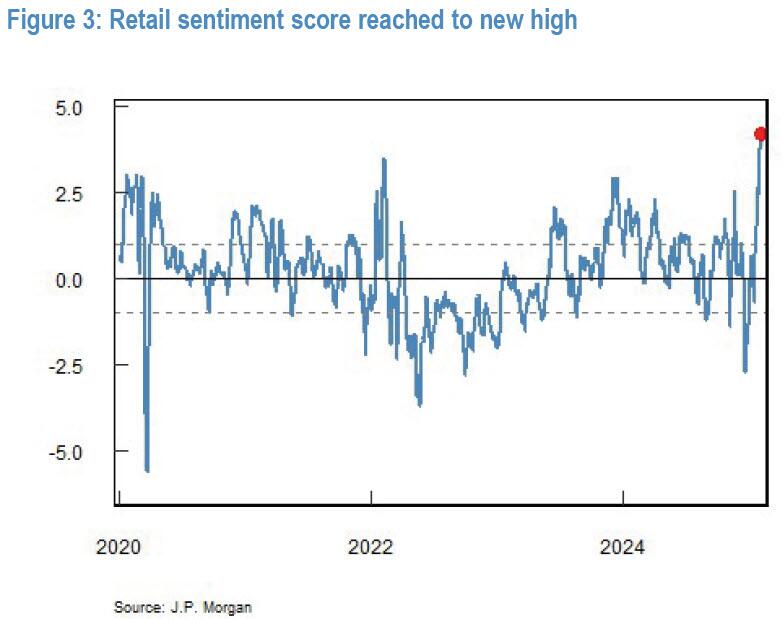

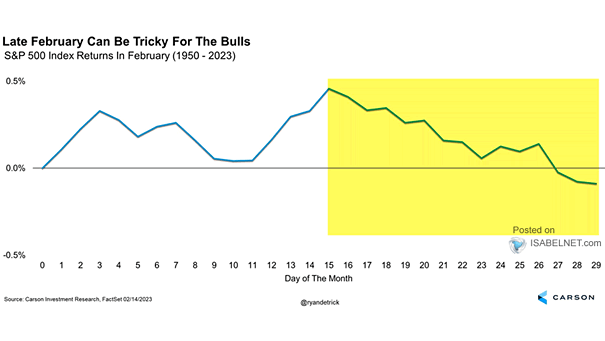

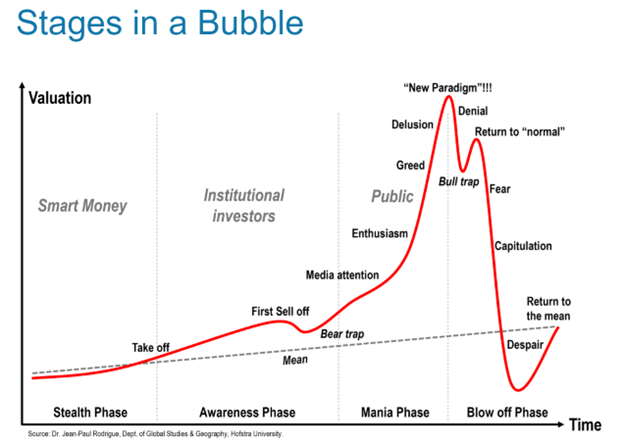

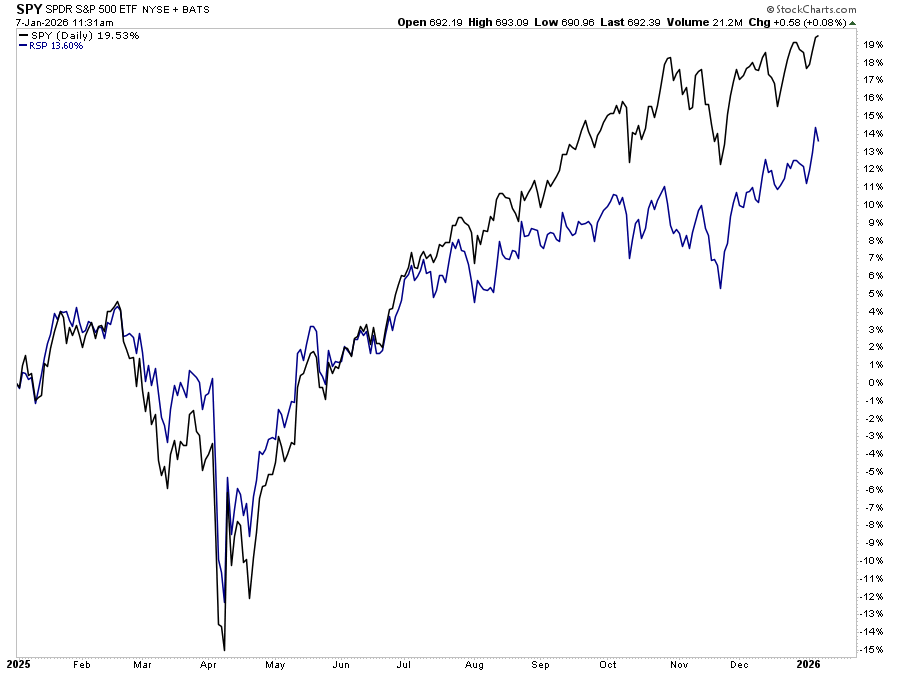

Retail Exuberance Sets Market Up For A Correction

Last week, we discussed the surge in retail exuberance in the market following the election of President Trump. "The market defies more negative news because retail investors continue to step in and "buy the dip." In our recent Bull Bear reports, we discussed the push by retail investors, but looking at retail sentiment is quite …

Read More »

Read More »

How Cryptocurrency Sellers Convert Your Investments Into Their Profit

Understand the system: people selling you different coins are making money off your assets. It's all about converting assets. #cryptocurrency #investing

Watch the entire show here: https://cstu.io/34c31d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Importance of Emergency Funds in Retirement Planning

When planning for retirement, most people focus on savings, investments, and budgeting for daily living expenses. However, one critical component that often gets overlooked is an emergency fund. Having an emergency fund in retirement is essential for maintaining financial stability and peace of mind. Unexpected expenses, such as medical bills or home repairs, can derail …

Read More »

Read More »

Understanding the True Value of Fiat Currency and Equity Shares

Did you know? Fiat currency isn't backed by nothing. It's like owning stocks - you own a piece of something valuable. ?? #Finance101 #Investing

Watch the entire show here: https://cstu.io/4b5af9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Navigating Yield Dynamics: Escalator Climb and Elevator Drop

Are you waiting for the other shoe to drop in the market? The challenge is timing - yields go up slowly but drop quickly. When to make your move? ?? #marketinsights

Watch the entire show here: https://cstu.io/3ae9c8

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Stability-Instability Paradox

Inside This Week's Bull Bear Report Market Shakes Off Inflation Data I am back from traveling, and we have a good bit to catch up on since our last report. If you missed it, I provided an update on Tuesday, updating all the weekly technical and statistical data we produce. Most noteworthy in that report was … Continue...

Read More »

Read More »

The Influence of Media on Stock Trading Decisions

Don't let media headlines dictate your investment decisions! Do your homework before making any moves in the market. ?? #InvestWisely

Watch the entire show here: https://cstu.io/498a02

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-14-25 What If You Live to 100?

Healthy living accounts for about 70% of longevity until one’s 90s, after which favorable genetics dominate, concludes a long-running study. Richard Rosso & Matt Doyle examine the financial implications of becoming a Centenarian: Retirement Planning for 100-Year Life, How to Retire and Live to 100, and the implications of Longevity and Financial Planning; also Investing for a Long Retirement and Outliving Your Savings Solutions.

Hosted by RIA...

Read More »

Read More »

The Impact Of Tariffs Is Not As Bearish As Predicted

There are many media-driven narratives about the impact of tariffs on the economy and the markets. Most of them are incredibly bearish, predicting the absolute worst possible outcomes. For fun, I asked ChatGPT what the expected impact of Trump's tariffs will likely be. Here is the answer: "One of the immediate consequences of increased tariffs …

Read More »

Read More »

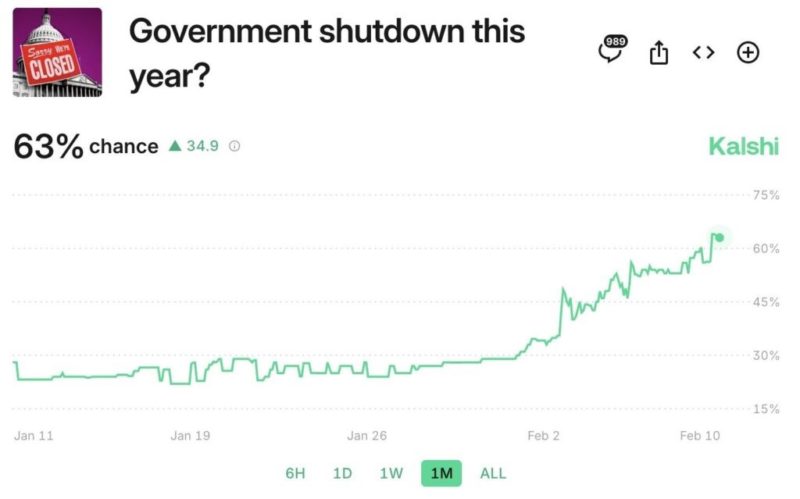

The Fiscal Freeze Is Coming

In mid-March, the government is expected to hit the debt ceiling. As has seemingly become the norm, dire threats from both political parties will start shortly. However, despite the fiery rhetoric, they often get resolved before the government shuts down. Might the coming fiscal standoff be a little different? Our colleague Greg Valliere, a long-time …

Read More »

Read More »

Fed’s Mortgage Strategy: Rates Cut But Markets React Differently

Fed cutting rates, but still doing quantitative tightening. Selling bonds increases yields. Will they expand balance sheet to bring rates down? ? #economics #Fed #interestrates

Watch the entire show here: https://cstu.io/455712

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Market Reactions to Rate Changes Are Influenced by Misleading Data

Small changes in economic numbers can have a big impact on the market! ?? #Stocks #Bonds #Economy #MarketReactions

Watch the entire show here: https://cstu.io/4d4e5d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Growth and Valuation Techniques in Investment Analysis

? Growth is key! ? Don't just focus on past valuations, look ahead! Some companies, like the Magnificent Seven, show consistent growth rates. #InvestingTips #GrowthIsKey

Watch the entire show here: https://cstu.io/bceba5

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Bond Strength During Market Volatility

Bonds shining during market volatility! ?? #InvestingTips #Bonds #MarketInsights

Watch the entire show here: https://cstu.io/0afee0

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-13-25 Inflation on the Rise: What Does it Mean?

Lance's Valentine's Day PSA (the short version) & Jerome Powell's annual Congressional testimony: Everything is volatile; headline generator. Cracks in the economy are emerging: Jobs numbers are full of "seasonal adjustments:" Indicators that employment and Labor Market are weakening. The impact of hot CPI: Markets hold support and price compression; in a wait-and-see mode. Trump reciprocal tariffs coming. Lance & Michael discuss...

Read More »

Read More »