Category Archive: 9a.) Real Investment Advice

5-15-25 What’s Up with Yields Now?

Are rising yields a warning sign, or are they reflecting renewed economic strength?

Lance Roberts & Michael Lebowitz dive into the latest movements in bond yields and what they signal for markets, the Fed, and your portfolio.

Lance and Mike analyze the shape of the yield curve, interest rate forecasts, and what it all means for investors in 2025:

* Why the 10-year Treasury yield is making headlines

* Is the inverted yield curve still...

Read More »

Read More »

The Best Investment Strategies for a High-Inflation Environment

Rising inflation can chip away at the value of your money and investments, making it one of the most persistent threats to long-term wealth. As prices increase and purchasing power declines, investors must be proactive in adjusting their strategies to protect their portfolios.

Read More »

Read More »

Homebuyers Are Paying More For Less

Below our Market Trading Update, we share analysis from the Atlanta Fed showing that housing affordability has been at its worst in the last twenty years. This is unsurprising given that potential homebuyers face the highest mortgage rates in 20+ years.

Read More »

Read More »

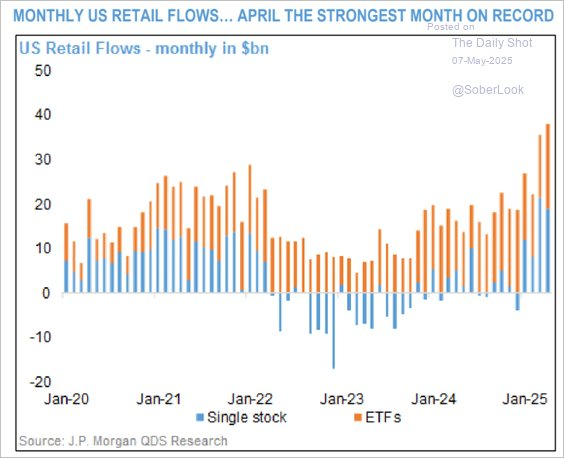

5-14-25 The Equity Chase is On

As markets climb higher, investors are rushing back into stocks. But is the chase for equity returns grounded in fundamentals—or just FOMO? Lance Roberts & Danny Ratliff dive into the sudden surge in equity markets and the renewed appetite for risk. Is this rally sustainable—or are investors simply chasing performance at the top? What’s fueling the stock market rally in 2025, how is sentiment shifting, and why chasing returns in bull markets...

Read More »

Read More »

The Wealth Effect Is Not Always Virtuous

In 2010, following the financial crisis and market meltdown in 2008 and early 2009, Fed Chairman Ben Bernanke made a notable speech explaining the virtues of the wealth effect. To wit: Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

Read More »

Read More »

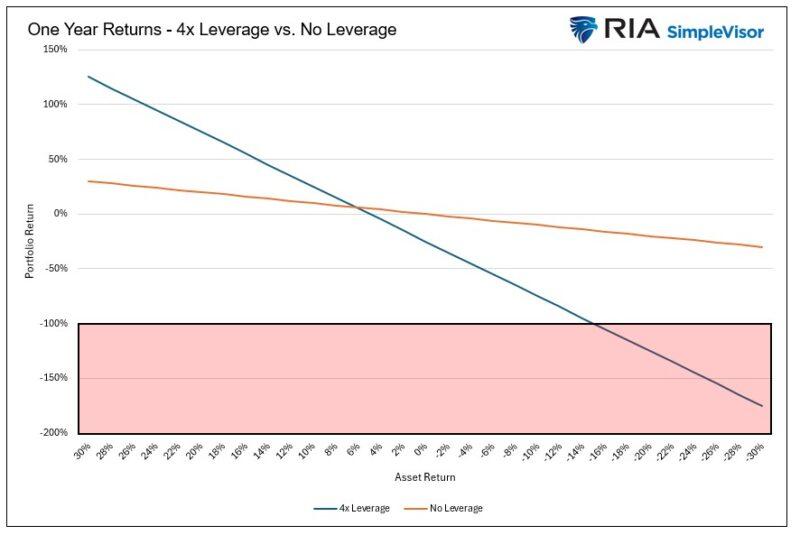

Leverage For Retirement Plans: Is The Risk Appropriate?

Bloomberg recently published, This 30-Year Old's Startup Is Bringing Leverage To 401K Savers. Their article details Basic Capital, a new startup providing institutional investment strategies to individual 401K and IRA savers.

Read More »

Read More »

5-13-25 Align Your Investing Goals with Your True Risk Persona

Typically, the more some investors handle their money, it's like a bar of soap: the smaller it gets. If you're going to take money off the table, align your approach with who you are as an investor.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

5-13-25 Is Tariff-driven Volatility Over?

Tariffs rattled markets. Then… silence. Are we in the clear—or is another shock coming? Lance Roberts and Jonathan Penn tackle the question: Is Tariff Volatility Over? The reversal of tariffs is only a 90-day reprieve; markets are very over bought, and after Monday's rally are due for some pullback (sooner or later); be patient and bide your time before jumping into the fray. Lance and Jonathan discuss why contrarian investing is smart. Preview of...

Read More »

Read More »

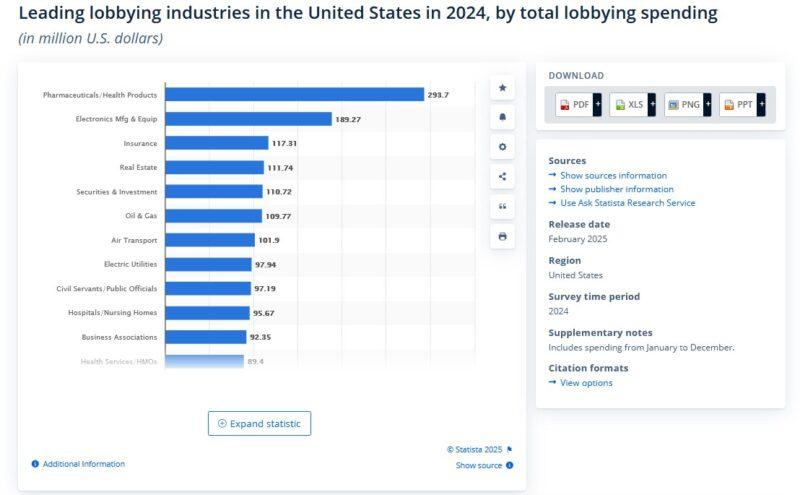

Executive Order On Drug Prices Rattles Healthcare Sector

Despite the weekend's positive news on China trade negotiations and the associated jump in most stock prices, the healthcare sector was hit hard. The culprit is an executive order aimed at reducing U.S. prescription drug prices. Donald Trump plans to implement a "Most Favored Nation" (MFN) policy.

Read More »

Read More »

The Essential Guide to Risk Management in Investment and Retirement Planning

Risk management is one of the most crucial elements of successful financial planning, serving as the foundation for both protecting your assets and achieving your long-term financial goals.

Read More »

Read More »

5-12-25 Emotions Have No Place in Your Investing Strategy

Valuations have been high for the past 25-years, but is that reason enough to not be in the markets?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢...

Read More »

Read More »

5-12-25 How to Deal with a Bear Market Rally

It's Lance Roberts' 60th birthday, and the birthday faery made an early visit to the studio. Markets will be boosted today by news of an agreement between the US and China over tariffs. Is the recent market rebound a sign of recovery—or just a classic bear market trap?

Lance Roberts breaks down what defines a bear market rally, why investors often get whipsawed by false hope, and how to position your portfolio amid short-term optimism and...

Read More »

Read More »

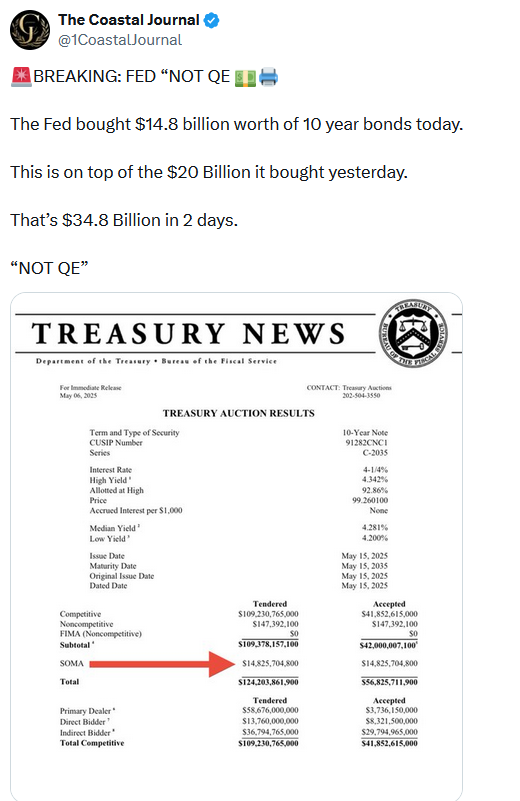

Stealth QE Or Routine QT? Unpacking Recent Fed Activity

Tweets like the one we share below allude that the Fed is doing stealth QE, despite the fact that they publicly claim to be conducting QT. Given the importance of the Fed balance sheet, let's dive into the stealth QE accusation and uncover the facts.

Read More »

Read More »

A Bear Market Rally? Or, Just A Correction?

Assessing a bear market rally proves challenging when you experience it firsthand. It is only in hindsight that the complete picture reveals itself to investors. Of course, after a bear market rally, investors tend to review their investments and speculate on what they should have done differently.

Read More »

Read More »

Earnings Revision Shows Sharp Decline

The #RealInvestmentReport is our weekly newsletter which covers our thoughts on the current market environment, the risk to capital relative to the market, and how we are positioned currently. It includes our MacroView, analysis on markets and sectors, and our 401k plan manager tool. The post Earnings Revision Shows Sharp Decline appeared first on RIA.

Read More »

Read More »

5-9-25 Hour-One: Will Tax Reform Stall?

With a new administration in Washington and control of Congress shifting, tax reform is once again a high-stakes issue for investors and business owners. RIchard Rosso & Matt Doyle analyze what’s on the table—proposals to adjust capital gains rates, reduce or expand corporate tax burdens, and modify personal income brackets. We’ll break down where negotiations stand, what’s likely to change, and how gridlock could delay progress. This episode...

Read More »

Read More »

5-9-25 Hour-Two: Financial Advice for Single Mom’s on Mother’s Day

Being a single mom means wearing every hat—and that includes the CFO of the household. In this special Mother’s Day edition of The Real Investment Show, Richard Rosso & Matt Doyle offer tailored financial planning advice for single moms, covering essential strategies for budgeting, building an emergency fund, managing debt, and long-term investing. Whether you’re raising toddlers or teenagers, this episode is filled with actionable money tips...

Read More »

Read More »

Smart Money Or Dumb Money? Who Will Be Right

The concepts of “smart money” versus “dumb money” refer to the level of investors’ information and experience. Smart money, typically institutional investors and often seasoned professionals, has extensive research and is more adept at data analysis. Therefore, they tend to […] The post Smart Money Or Dumb Money? Who Will Be Right appeared first on …

Read More »

Read More »

Employment Data Confirms Economy Is Slowing

While coming in much stronger than expected, the latest employment data confirmed what we already suspected: the economy is slowing. The reason the employment data is so important is that without employment growth, the economy stalls. It takes, on average, […] The post Employment Data Confirms Economy Is Slowing appeared first on RIA.

Read More »

Read More »

5-8-25 Some Trade Deficits are Okay

With all the focus on trade tariffs, we should not lose sight of the fact that some trade deficits are okay to have, and in some cases, needful things.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »