Category Archive: 7) Markets

Günstig Land kaufen – Wie du profitabel kleine Grundstücke kaufst – mit Jack Bosch

Land kaufen - Dein kostenloses Immopreneur Starterpaket für Immobilieninvesotren: http://bit.ly/immobilienstarter

Im heutigen Interview habe ich Jack Bosch zu Gast. Wir sprechen darüber, wie du es schaffst mit einfach Methoden Land zu kaufen und so hohe Profite mitzunehmen.

Jack ist Experte für Land flipping und hat sich in den letzten Jahren ein starkes Immobilienportfolio in den USA aufgebaut. Zusätzlich ist er als Coach tätig und hilft...

Read More »

Read More »

Q&A mit Thomas Knedel und Gerald Hörhan als Gast

Q&A mit Thomas Knedel und Gerald Hörhan als Gast - Dein kostenloses Immopreneur Starterpaket für Immobilieninvesotren: http://bit.ly/immobilienstarter

Dieses Video ist bei einem Livestream auf Facebook entstanden, in dem Thomas Knedel und Gerald Hörhan die Fragen der Community beantwortet haben.

Jetzt für die Immopreneur Masterclass mit Thomas Knedel bewerben:

▶▶▶ https://thomasknedel.de

Immopreneur.de:

▶ http://immopreneur.de...

Read More »

Read More »

Immobilie finanzieren – Die richtige Tigung aus Sicht eines Bankers | Interview mit Kai Niklas

Immobilie finanzieren - Dein kostenloses Immopreneur Starterpaket für Immobilieninvesotren: http://bit.ly/immobilienstarter

Welche Art der Tilgung ist die richtige für meine Investition? Dies ist eine Frage, mit der wir uns als Immobilieninvestoren früher oder später befassen müssen. In der heutigen Folge interviewe ich Kai Niklas, der uns erklärt, welche Art der Tilgung, aus Sicht eines Bankers, die beste ist.

Wir freuen uns auf dein Feedback!...

Read More »

Read More »

The Stock Market is Stretched to Double Tech-Bubble Extremes

Leuthold Group has sounded the alarm on a valuation metric that shows the S&P 500 is twice as expensive as it was at the peak of the tech bubble. This development could have large implications for stock investors of all types, particularly value traders who make their living by finding discounts in the market. With the stock market within shouting distance of an all-time high, traders are readying their Champagne bottles. Just don’t tell them about...

Read More »

Read More »

IMMOBILIENHANDEL oder BUY & HOLD? – eine Diskussion mit Oliver Fischer und Thomas Knedel

IMMOBILIENHANDEL vs. BUY & HOLD - Dein kostenloses Immopreneur Starterpaket für Immobilieninvesotren: http://bit.ly/immobilienstarter

--------------------------------------

Die große Frage in der Immobilienwelt ist immer wieder: Welche Strategie bringt mehr Erfolg? Immobilienhandel à la Fix & Flip oder die Buy & Hold Strategie?

In diesem Video spreche ich mit dem Fix & Flip Experten Oliver Fischer und wir diskutieren genau über...

Read More »

Read More »

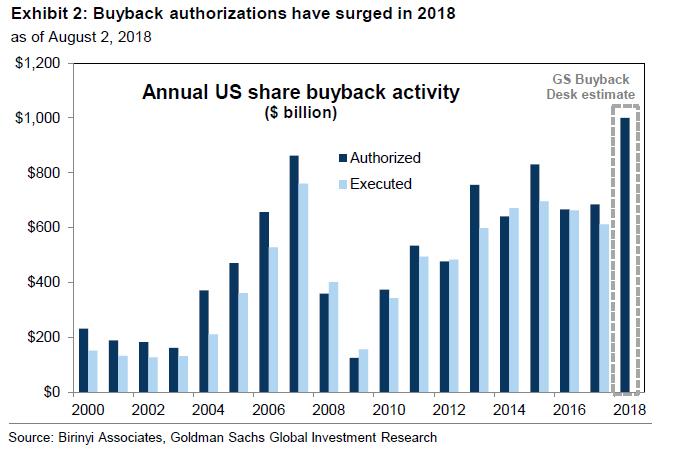

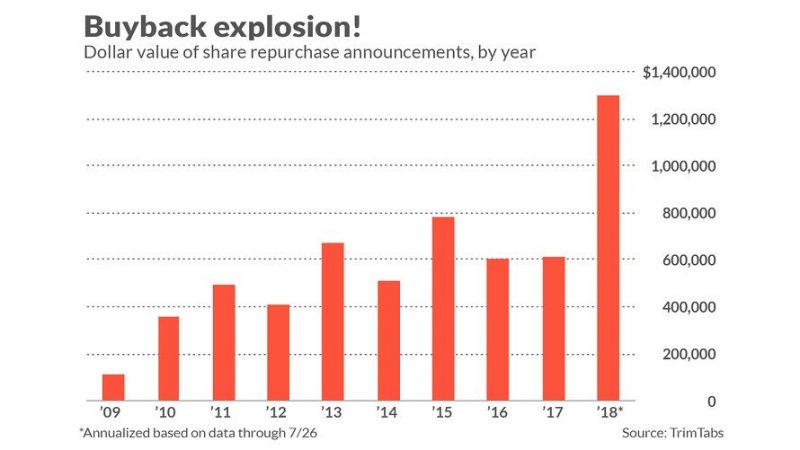

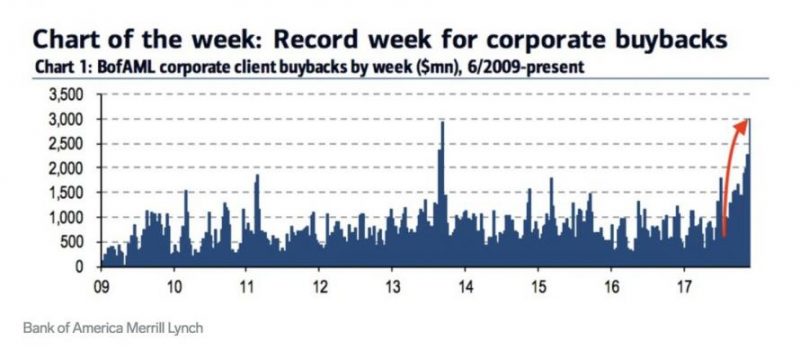

Goldman: You Are Asking The Wrong $1 Trillion Question

After several months of heated market speculation, to Amazon's chagrin the question of which stock would be the first to reach $1 trillion in market capitalization was answered when Apple reported strong Q2 results (which included $21 billion in stock buybacks) and its stock soared 9% this week, rising above the very round number and elevating its YTD gain to 23% (Amazon, with a market cap of just under $900 billion, will most likely be second).

Read More »

Read More »

Stock Market Manias of the Past vs the Echo Bubble

The Big Picture. The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history.

Read More »

Read More »

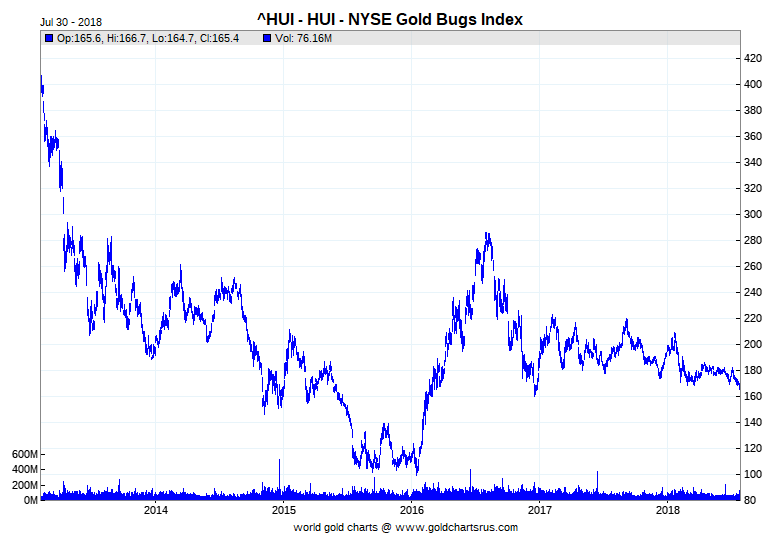

Spotlight on the HUI and XAU Gold Stock Indexes

Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and what they represent.

Read More »

Read More »

“Stock Markets Look Ever More Like Ponzi Schemes”

The FT has reported this morning that: Debt at UK listed companies has soared to hit a record high of £390bn as companies have scrambled to maintain dividend payouts in response to shareholder demand despite weak profitability. They added: UK plc’s net debt has surpassed pre-crisis levels to reach £390.7bn in the 2017-18 financial year, according to analysis from Link Asset Services, which assessed balance sheet data from 440 UK listed...

Read More »

Read More »

Sound Money Needed Now More Than Ever

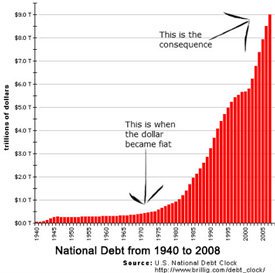

The sound money movement reemerged on the national political scene a decade ago. In 2008, the financial crisis brought in a fresh wave of U.S. gold and silver investors.

Ron Paul and the Tea Party advocated for limiting government and ending the Federal Reserve system. Sound money advocates made real inroads in recruiting Americans to their cause based on evidence that the nation is headed for bankruptcy.

Read More »

Read More »

Brent’s Back In A Big Way, Still ‘Something’ Missing

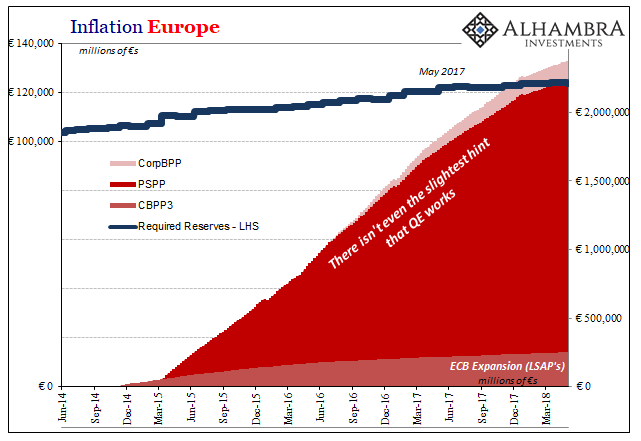

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status.

Read More »

Read More »

Die beste Lage für deine Immobilien – wie wichtig ist sie?

Die beste Lage für dein Investment zu finden, bedeutet nicht automatisch ausschließlich die hochwertigste Immobilien-Lage in Betracht zu ziehen. Wie wichtig ist die Lage für deine Investition mit Immobilien? Immobilien-Experte und Profi-Investor Thomas Knedel steht mit Rat und Tat zur Seite!

--------------------------------------

Immopreneur.de:

▶ http://immopreneur.de

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur Instagram:...

Read More »

Read More »

Endlich erfolgreich – 5 Tipps, wie du ein erfolgreicher Immobilien-Investor wirst

Erfolg ist kein Glück! Erfolgreiche Immobilien-Investoren brauchen Überblick, Mut, Arbeitsbereitschaft und Erfahrung. Aber vor allem brauchen sie Austausch unter einander. Immobilien-Profi und Investor Thomas Knedel spricht über seine Top 5 der besten Tipps für Immobilien-Investoren. Viel Spaß!

--------------------------------------

Immopreneur.de:

▶ http://immopreneur.de

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur...

Read More »

Read More »

Thomas Knedel: Immobilien günstig kaufen und Bankers Liebling werden

Warum eigentlich Immobilien günstig kaufen? Thomas Knedel erklärt auf dem Immopreneur Kongress 2017, warum es Deinem Banker gefäll, wenn Du Immobilien günstig einkaufst. Viel Spaß!

--------------------------------------

Jetzt Tickets für den Immopreneur Kongress 2018 sichern:

▶ http://bit.ly/2Jo4FeM

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

--------------------------------------

Bestelle Dir hier das neue Buch DAS SYSTEM IMMOBILIE...

Read More »

Read More »

Mit Immobilien 15.000€ Steuern sparen – Der Trick der Profis

Steuern sparen leicht gemacht: In diesem Video erklärt Dir Immobilien-Experte und Investor Thomas Knedel, wie Du 15.000€ Steuern mit deiner Immobilie sparen kannst. Viel Spaß!

--------------------------------------

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur PodCast Folge 41:

▶ http://immopreneur.de/041-steuern-sparen-immobilien-grundlagen/

--------------------------------------

Bestelle Dir hier das neue Buch DAS SYSTEM...

Read More »

Read More »

Immobilie verkaufen zu besten Preisen – Tipps vom Profi Investor

Immobilien zu verkaufen ist oft komplizierter als nötig und nur wenige erwirtschaften dabei den gewünschten Kaufpreis. Was man beachten sollte und wie sich die Preise zusammensetzen erklärt Immobilienfachmann und Investor Thomas Knedel in diesem Video. Viel Spaß!

--------------------------------------

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur Starterpaket:

▶ http://immopreneur.de/

Immopreneur Instagram:

▶...

Read More »

Read More »

“Sell In May And Go Away” – A Reminder: In 9 Out Of 11 Countries It Makes Sense To Do So

Most people are probably aware of the adage “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken in this context particularly with respect to US stock markets, and they confirm that the stock market on average exhibits relative weakness in the summer.

Read More »

Read More »

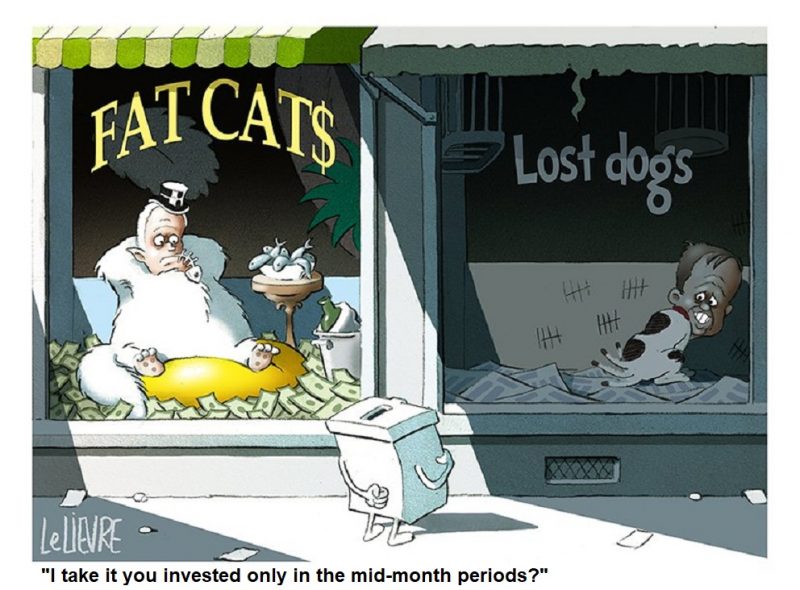

Global Turn-of-the-Month Effect – An Update

The “turn-of-the-month” effect is one of the most fascinating stock market phenomena. It describes the fact that price gains primarily tend to occur around the turn of the month. By contrast, the rest of the time around the middle of the month is typically far less profitable for investors. The effect has been studied extensively in the US market. In the last issue of Seasonal Insights I have shown a table detailing the extent of the...

Read More »

Read More »

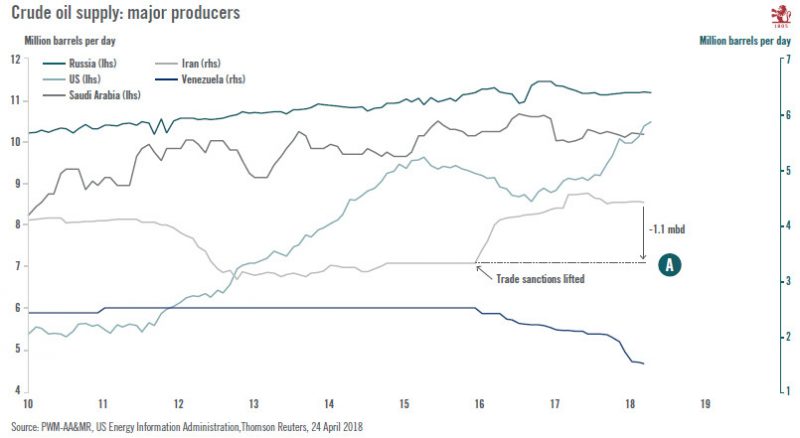

House View, May 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes. In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in the bond market once again.

Read More »

Read More »

The “Turn of the Month Effect” Exists in 11 of 11 Countries

I already discussed the “turn-of-the-month effect” in a previous issues of Seasonal Insights, see e.g. this report from earlier this year. The term describes the fact that price gains in the stock market tend to cluster around the turn of the month. By contrast, the rest of the time around the middle of the month is typically less profitable for investors.

Read More »

Read More »