Category Archive: 6a) Gold & Monetary Metals

What’s Next, Trillion-Dollar Coins?

The massive set of stimulus measures rolled out last month by the Treasury Department and Federal Reserve has left many Americans wanting more… and politicians scheming for new ways to dole out additional trillions in cash.

Most taxpayers have already received their $1,200 “stimulus” payments. However, that one-time payment will do little to repair the long-term financial health of the 26 million (and rising) who are newly unemployed.

Read More »

Read More »

THE BITCOIN HALVING REVISITED – With Ann Rhefn

What is the Bitcoin Halving and What Might it Mean for the Price Watch “THE BITCOIN HALVING REVISITED – With Ann Rhefn”

Read More »

Read More »

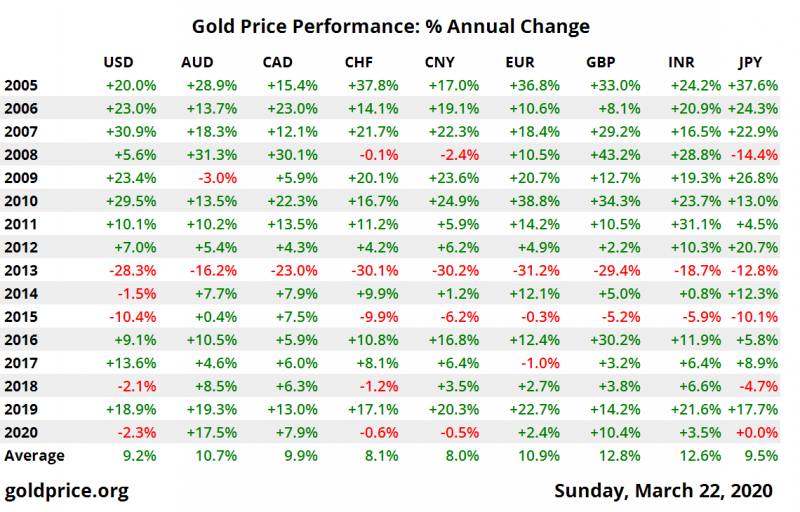

Gold Will Reach $3,000/oz: “Fed Can’t Print Gold” and Is “Ultimate Store Of Value” – Bank of America

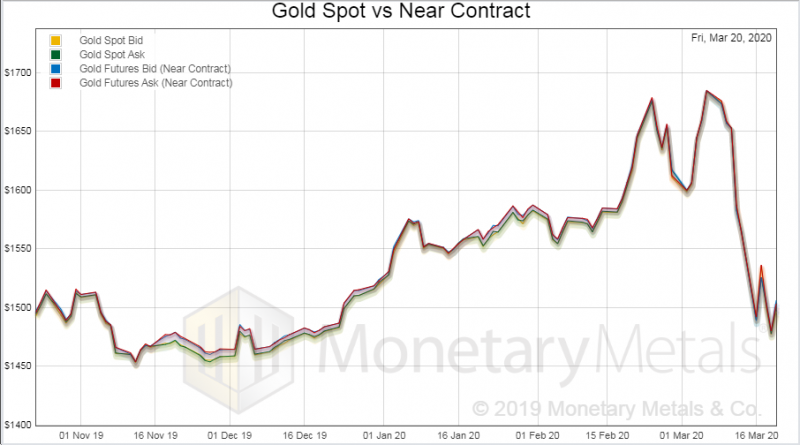

Gold in USD – 3 Days Gold prices are 0.7% higher today after falling just 0.3% yesterday as traders sought refuge in safe haven gold as oil prices collapsed lower again. Oil slumped to nearly $15 a barrel, its lowest since 1999 as the economic fallout from government lockdowns and the shutting down of entire economies impacts risk assets and commodities dependent on economic growth.

Read More »

Read More »

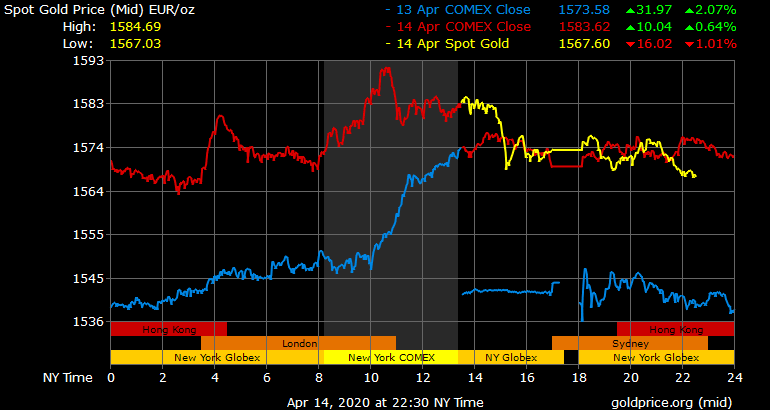

Gold Surges To New Record Highs in Euros at €1,581/oz and $1,726/oz in Dollars

Gold prices surged to new all time record highs in euros and other digital fiat currencies today due to concerns about the outlook for risk assets and currencies in an era of unprecedented economic and monetary risk.

Read More »

Read More »

All of the Economic Recovery Models Will Be Wrong Too

“All of the projection models were wrong. All of them,” admitted New York Governor Andrew Cuomo in an interview last week with MSNBC. Governor Cuomo had been issuing frantic demands for tens of thousands of ventilators... that turned out not to be needed as the rate of new hospitalizations for COVID-19 infections in New York plunged with surprising speed.

Read More »

Read More »

Jp Cortez joins Phillip Kennedy on Kennedy Financial

Sound Money Defense League Policy Director Jp Cortez joins Phil Kennedy of Kennedy Financial to discuss sound money on the state and federal level, and the harms of inflation.

Read More »

Read More »

Nothing Is What It Seems

My latest interview about Corona, Liberty, Private Property, Authoritarism, and a fear-mongering global media campaign, which I call borderline criminal

[embedded content]

Read More »

Read More »

Swiss regulator cracks down on fraudulent crypto activities

Switzerland’s financial regulator brought charges against eight “initial coin offering” (ICO) blockchain projects for breaching anti-money laundering rules last year. ICOs raise money from the public by selling digital tokens that promise to hold future value for the consumer.

Read More »

Read More »

Corona-Krise – Eine machbare, vertretbare Lösung

Nachdem ich mich systematisch mit den verschiedenen Teilproblemen beschäftigt habe, bin ich nun überzeugt, eine machbare, vertretbare und rasche Lösung für das Corona-Problem gefunden zu haben.

Read More »

Read More »

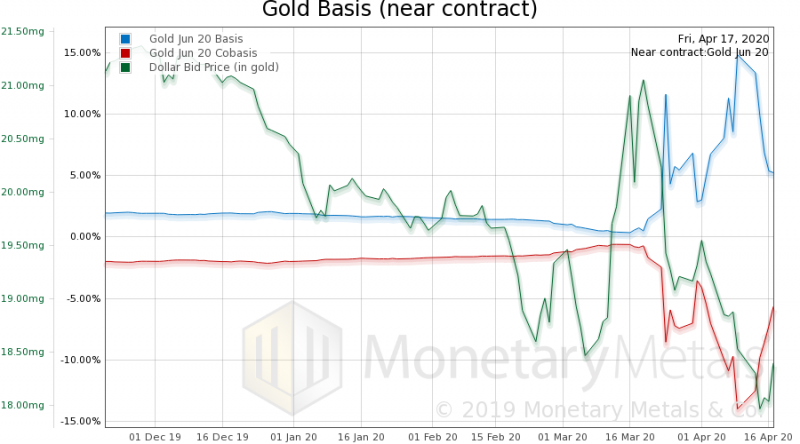

Is gold still a safe haven?

There have been moments in recent months when many gold owners, myself included, have asked themselves whether gold might have lost its safe haven status, at least in the western world. Was it enough for two generations, who grew up in a paper money system, to forget the history and the 5000-year-old status of gold as real money?

Read More »

Read More »

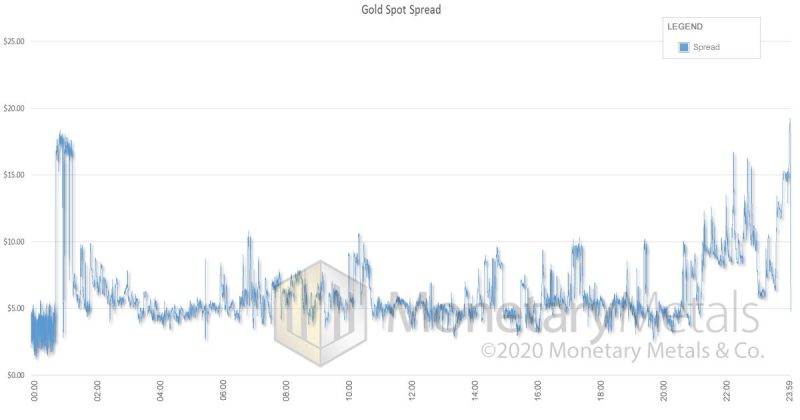

Global Supply of Gold and Silver Coins and Bars Evaporated In Safe Haven Rush

◆ GoldCore remain open for business unlike many dealers, mints and refineries (see News below) and we continue to buy bullion coins and bars and sell gold bars (1 kilo). The supply situation changes hour to hour. ◆ We, like the entire industry have experienced record demand in recent days and the global supply of gold and silver bullion coins (legal tender 1 oz) and gold bars (in 1 oz and 10 oz formats) has quickly evaporated. We continue to have...

Read More »

Read More »

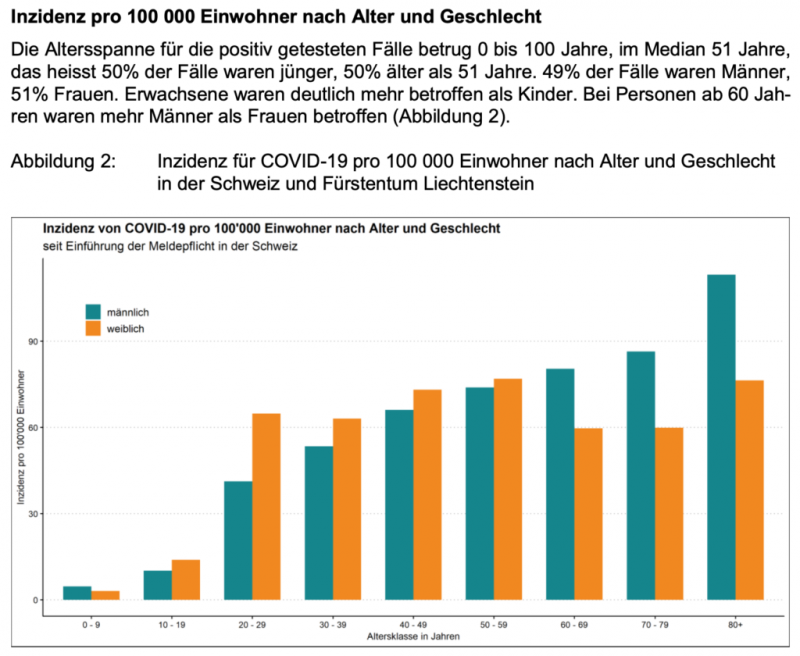

COVID-19 – Auslegeordnung

In den vergangenen Tagen habe ich mich immer wieder gefragt, “wo besteht eigentlich das Problem?” Zu oft habe ich das Gefühl, dass viele Experten, Medien und Politiker mit den Zahlen ein Durcheinander haben und so mehr zur Verwirrung als zur Klärung beitragen. Deshalb hier der Versuch einer strukturierten Aufschlüsselung.

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »