Category Archive: 6a) Gold & Monetary Metals

The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian...

Read More »

Read More »

Fed Chairman: “We’re Not Even Thinking About Thinking About Raising Rates”

Market volatility has suddenly spiked in recent days came after the Federal Reserve vowed last Wednesday to keep its benchmark rate near zero through 2022. That’s an unusually long period for the Fed to be projecting rate policy. It reflects the fact that it will take many months and perhaps years for the tens of millions of jobs that were recently lost to return.

Read More »

Read More »

A Dollar Crash Is Coming

◆The world is having serious doubts about the once widely accepted presumption of American exceptionalism. The era of the U.S. dollar’s “exorbitant privilege” as the world’s primary reserve currency is coming to an end. In the 1960s French Finance Minister Valery Giscard d’Estaing coined that phrase largely out of frustration, bemoaning a United States that drew freely on the rest of the world to support its overextended standard of...

Read More »

Read More »

Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan. It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values.

Read More »

Read More »

Why Gold Is Safe Haven Money And Will Go Over $3,000/oz

That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the point?”

Read More »

Read More »

Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek

Read More »

Read More »

Global Silver Investment Demand To Surge While Supply Weak (World Silver Survey 2020)

◆ WORLD SILVER SURVEY 2020 from the SILVER INSTITUTE GLOBAL SILVER DEMAND EDGED HIGHER IN 2019, WITH INVESTMENT DEMAND UP 12%, WHILE SILVER MINE SUPPLY FELL FOR THE FOURTH CONSECUTIVE YEAR Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal.

Read More »

Read More »

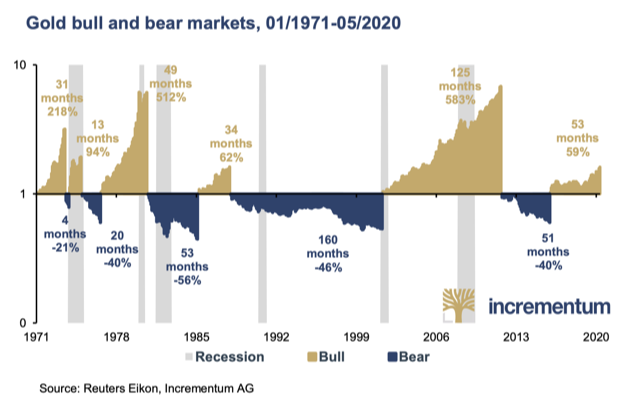

Pandemic, Economic Shutdowns, Debt Crisis and Gold At $5,000/oz

◆ GoldCore are delighted to publish the 14th edition of the annual “In Gold We Trust” report, “The Dawning of a Golden Decade” by by our friends Ronald-Peter Stoeferle & Mark J. Valek of Incrementum AG.Gold prices should rise to over $5,000/oz and may rise as high as $9,000/oz in the coming decade and by 2030, according to the respected report.

Read More »

Read More »

Is Your Pension ‘Good as Gold’?

With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver.It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered a ‘pride in possession’ article or...

Read More »

Read More »

An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB.

Read More »

Read More »

Clean gold: How Switzerland could set new supply chain standards

Switzerland is the undisputed top dog of the global gold industry, refining a majority of the world’s gold, as well as being the leading exporter. But how seriously does the country take its responsibility to ensure sustainable mining and the protection of human rights?

Read More »

Read More »

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

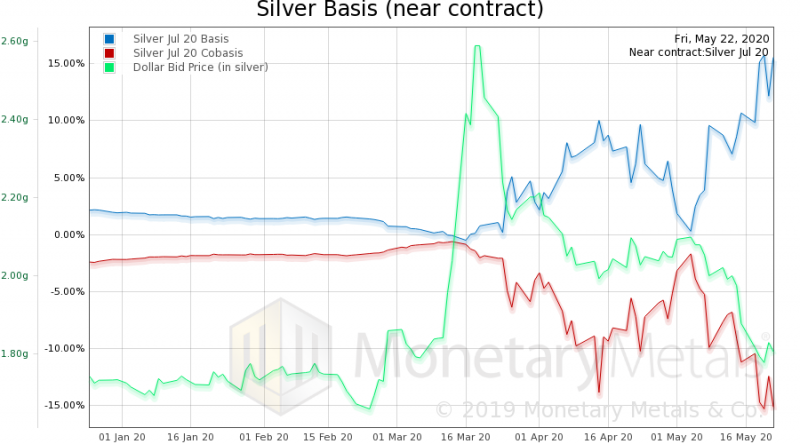

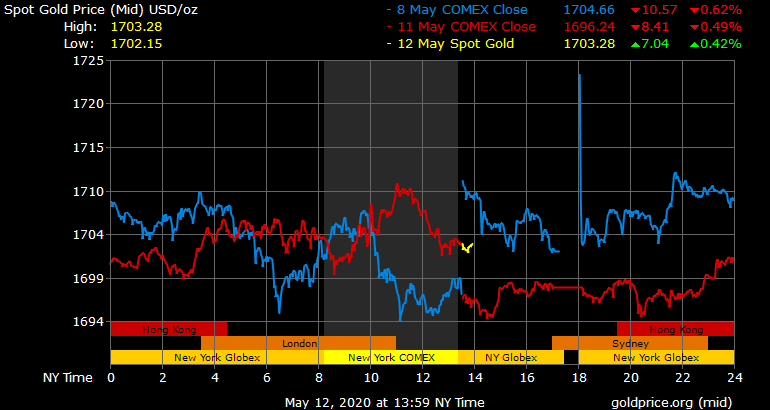

Pandemic, Lockdowns, Fake and Manipulated Markets – Gold and Silver Outlook

◆ The massive global debt driven “Everything Bubble” is bursting due to the pandemic and more specifically the governments draconian economic lockdowns. ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion

Read More »

Read More »

Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable.

Read More »

Read More »