Category Archive: 6a) Gold & Monetary Metals

Where Next for Gold & Silver

Markets have struggled to find a clear direction as they attempt to digest US election news, debate performance, the impact of increased Covid-19 restrictions in many countries and vaccine news.

Read More »

Read More »

We don’t have to kill the king, if we just can ignore the king

“The right of self-determination in regard to the question of membership in a state thus means: whenever the inhabitants of a particular territory, whether it be a single village, a whole district, or a series of adjacent districts, make it known, by a freely conducted plebiscite, that they no longer wish to remain united to the state to which they belong at the time, but wish either to form an independent state or to attach themselves to some...

Read More »

Read More »

Heavy Metal Selling

Anxiety about an increase in Covid19 cases and fears of a second wave coupled with revelations of historic money laundering practices of major global banks weighed heavily on financial markets yesterday.

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part II

In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks?

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part I

As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain.

Read More »

Read More »

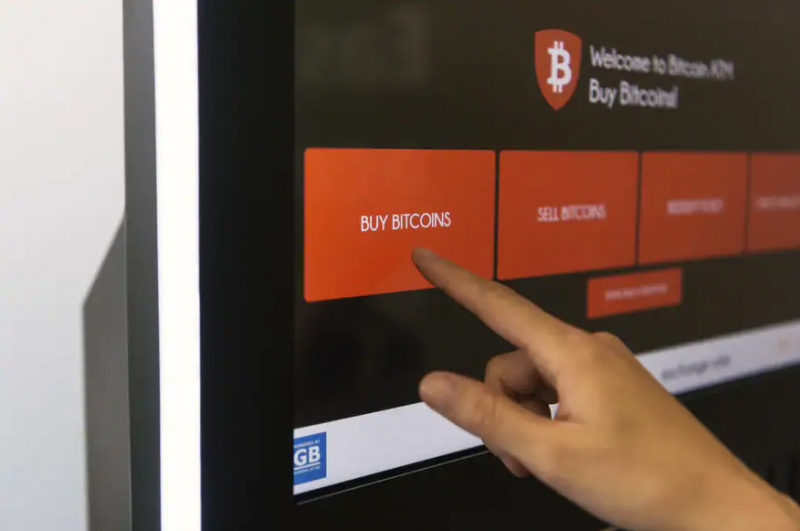

Crypto Nation Switzerland evades Covid’s clutches (for now)

The Swiss blockchain industry appears to be in rude health despite the economic fallout of the coronavirus pandemic. The number of new companies and jobs produced by the sector increased in the first six months of the year. Is this trend set to last?

Read More »

Read More »

Gold is Looking Strong as it Tests Resistance

Since it’s sell-off from it’s early August high, gold has been stuck in an ever decreasing range. Having had a remarkable rally to an intra-day high of $2,078 on the 7th of August Gold has traded sideways and consolidated. This has been viewed by many market commentators as a healthy pause in gold’s bull rally as when markets go parabolic they tend to retrace just as fast.

Read More »

Read More »

Swiss law reforms make crypto respectable

Bitcoin used to be something of a dirty word, associated with crime and money laundering. Switzerland has now amended its legal code to welcome cryptocurrencies and blockchain technology into the mainstream.

Read More »

Read More »

You cannot print your way to prosperity – Part II

Looking at the damage inflicted upon supply chains, production facilities and global trade in particular, how quickly could these operations snap back even if all COVID-related restrictions were lifted tomorrow? Do you think we’ll eventually get back to business as usual, or have we now experienced a permanent shift to a “new normal”?

Read More »

Read More »

High gold prices spur more illegal mining in Peru

The boom in gold prices during the Covid-19 pandemic has kept Swiss refineries in business but has also boosted illegal mining, imperiling lives and the environment.

Read More »

Read More »

Gold doing what it does best – Part II

While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time.

Read More »

Read More »

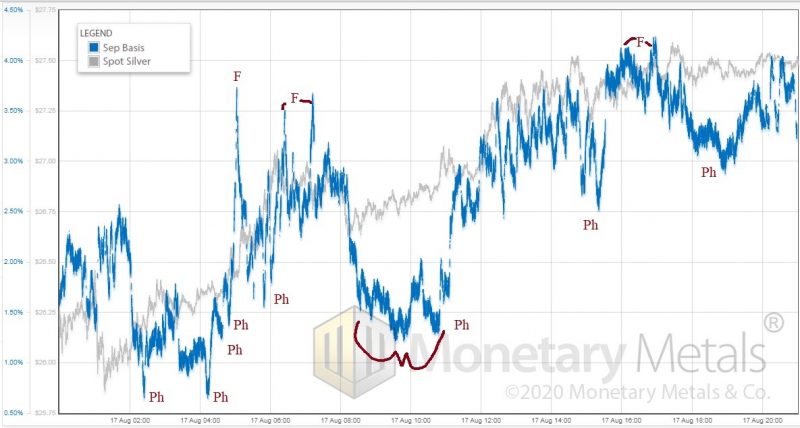

Gold, Silver Jump After Swings Amid Weak Dollar and Economic Woe

Spot gold headed for back-to-back gains as investors weighed the outlook for the metal’s record-setting rally after this week’s dramatic price swings. Silver climbed the most in more than five years.

Read More »

Read More »

Value of gold stored by Irish metals broker GoldCore surges past €100m

Investment in gold has risen during pandemic. The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

Gold prices last week topped the $2,000-per-ounce level for the first time as investors seek havens...

Read More »

Read More »

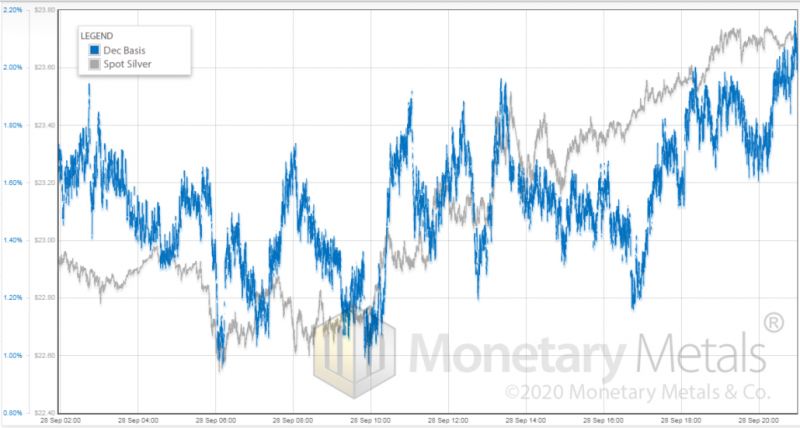

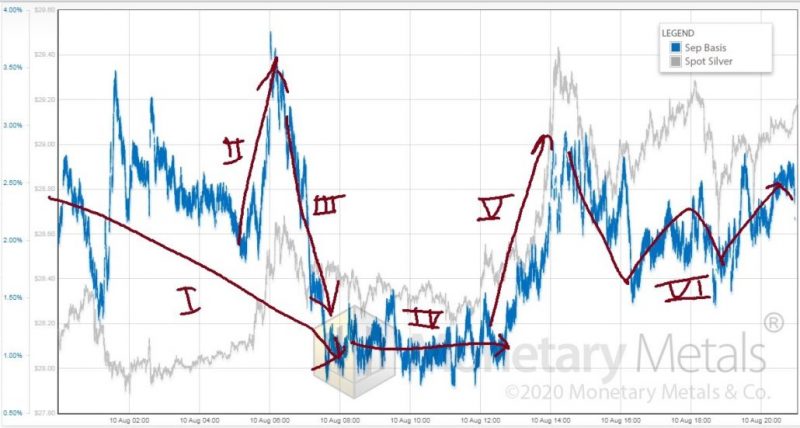

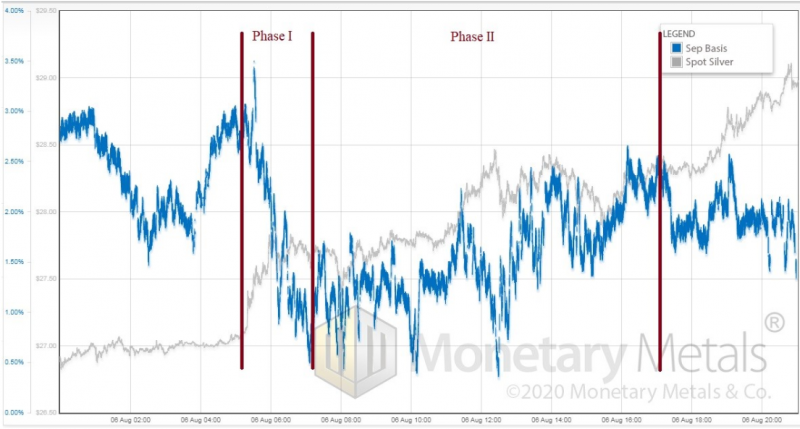

Perfect Storm for Precious Metals Leads to Price Correction

Gold fell by nearly 6% yesterday and silver by a whopping 15%, the largest one day loss in over 7 years. The futures market saw massive volumes of selling with over 1.6 bn ounces of silver contracts sold yesterday. That’s a value of over $40 billion.

Read More »

Read More »

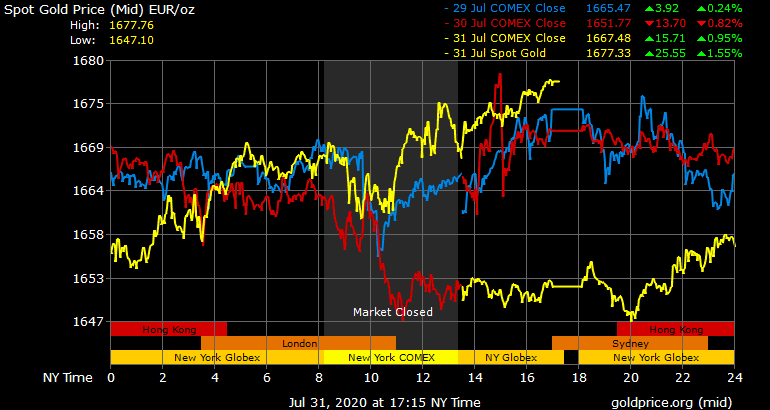

Short Term Weakness Likely Prior To A “Massive Short Squeeze Propels” Gold and Silver “To Much Higher Levels” – GoldCore

Gold and silver are set for a 5% and 6% gain this week and a significant 11% and 30% gain in the month of July.

Read More »

Read More »