Category Archive: 6a) Gold & Monetary Metals

Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the...

Read More »

Read More »

$1.9 Trillion American Rescue Plan Positive for Gold

The Massive $1.9 Trillion American Rescue Plan is Just the Start. Massive $1.9 Tr. American rescue plan to affect markets Yellen takes over at US Treasury, what to expectMore spending initiatives to comeHow all this is positive for gold and silver prices. The Biden Administration’s policies are positive for gold and silver prices.

Read More »

Read More »

The Problem with Record-Low Interest Rates

Are you familiar with the GoldNewsletter podcast? They boast over 200 episodes on the topics of investment, economics, and geopolitics.

Read More »

Read More »

A Georgia Gold Rush Story: The Rise and Fall of America’s First Private Gold-Coin Mint

(Note: This article is dedicated to the memory of Carl Watner, who died on December 8, 2020 at the age of 72. A long-time defender of individual liberty and free markets, his 1976 article in Reason magazine, “California Gold, 1849-65,” helped renew awareness and appreciation for private money in American history).

Read More »

Read More »

Episode 8: Why The Dollar Isn’t Money – PART 2

In a prior episode, we introduced the distinction between money and fiat currency, discussing what gives the dollar – or any fiat currency – its value. Now, we continue that conversation discussing additional characteristics of money, and illustrate how a false definition of money can lead to a corrupt state that wields blank checks.

Read More »

Read More »

Gold to $2,300 and Silver to $35 by Year End – 2021, the Year the Barometer Explodes?

The US dollar set for further dramatic declines?Negative interest rate policy spreadingIncreased global liquidity in attempt to ignite a recoveryDemocrats’ win paves way for massive stimulus packagesGold and silver set to rally strongly in a perfect storm.

Read More »

Read More »

Fed Recommits to Misleading the Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets.

Read More »

Read More »

Wieso (Teil-)Lockdowns nicht gerechtfertigt sind – Einer Kurz-Analyse der Zahlen.

Täglich werden wir von den Medien mit Behauptungen und Schocknachrichten in die kollektive Schockstarre getrieben.

Read More »

Read More »

The Great Reset vs. The Great Reset

In baseball, there is a situation where a base runner is sprinting to home plate and can’t see what is happening behind him. Totally focused on scoring, he doesn’t know if the outfielder is throwing a ball that will reach home plate first. That’s where we get the phrase “out of left field.” (If the ball were coming from right field, the runner could actually see it.)

Read More »

Read More »

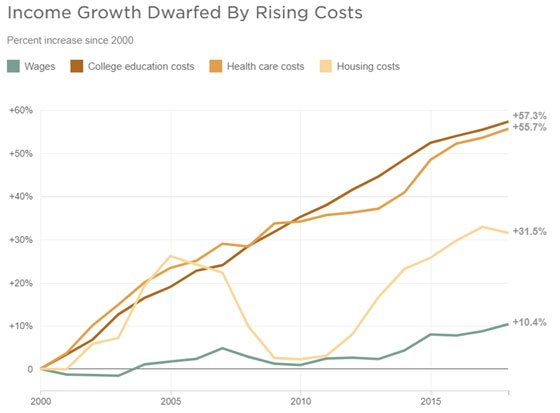

There is No Denying that Cash is Trash!

Governments are likely to continue printing money to pay their debts with devalued money. That’s the easiest and least controversial way to reduce the debt burdens and without raising taxes.

Read More »

Read More »

French blockchain firms offer tracing for Swiss watches

The market for second-hand luxury watches is booming. But for the average consumer, it is not easy to tell a fake from the genuine article and determine the real value of a particular timepiece. Certificates based on blockchain technology could provide more transparency.

Read More »

Read More »

Gold Price Forecast – LBMA Survey Published

2021-02-14

by Stephen Flood

2021-02-14

Read More »