Category Archive: 6a) Gold & Monetary Metals

Stefan Gleason: The Big Inflation Scam

Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power.

Read More »

Read More »

Rising Debt Means a Weaker Dollar

Americans appear to be growing more concerned about the skyrocketing national debt level – officially $28.1 trillion and counting. The Peter G. Peterson Foundation’s monthly Fiscal Confidence Index recently shed five points, dropping to a level of 47, in the wake of the Biden Administration’s latest $2 trillion stimulus package.

Read More »

Read More »

Is ESG Investment the Future of Gold & Silver?

‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked.

Read More »

Read More »

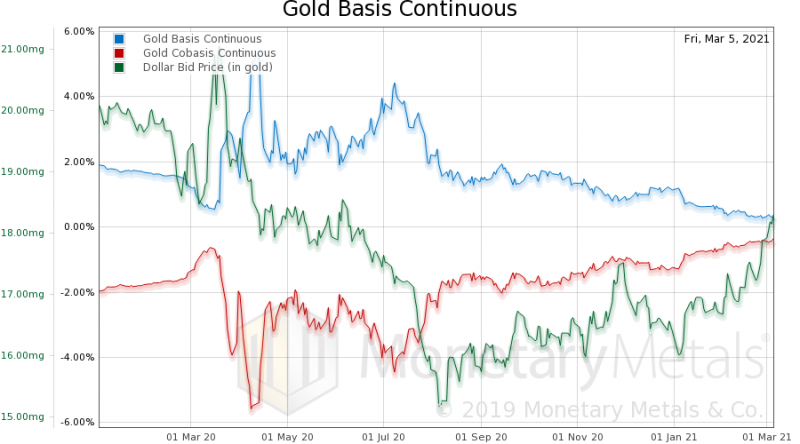

Is The Bull Market Over For Gold?

Gold has not made new highs in many months. Gold peaked last year at US$2067 on August 6. The 7 month down leg of more than 18% as been deep enough and long enough that some commentators are now saying that the bull market has now turned to a bear market for gold. Losing faith is understandable because falling prices feel bad. But this week we want to show that current prices may not reflect reality.

Read More »

Read More »

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold

Over the years I’ve written almost ad nauseum about the crazy I see (and saw) around me as a fund manager, family office principal and individual investor.The list includes: 1) an entire book on the grotesque central bank distortions of free market price discovery.

Read More »

Read More »

Prices Are Set to Soar

"Government,” observed the great Austrian economist Ludwig von Mises, “is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.” Mises was describing the curse of inflation, the process whereby government expands a nation’s money supply and thereby erodes the value of each monetary unit—dollar, peso, pound, franc, or whatever.

Read More »

Read More »

Getting Ready For Gold’s Golden Era

Authored by Matthew Piepenburg via GoldSwitzerland.com,Worried about gold sentiment? Don’t be.The mainstream view of gold right now is an open yawn, and sentiment indicators for this precious metal are now at 3-year lows despite the gold highs of last August.Is this cause for genuine concern?

Read More »

Read More »

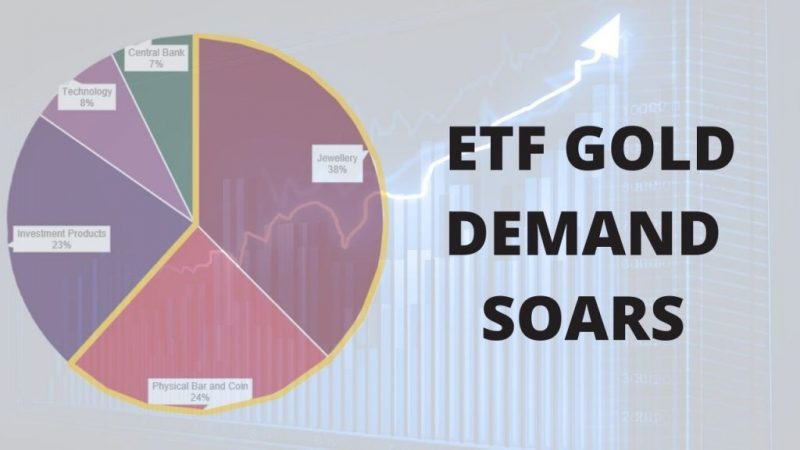

ETF Gold Demand Soars while Consumer Demand Slows

ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped.

Read More »

Read More »

Swiss refiner comes up with method to verify gold’s origin

Metalor, one of the world’s biggest gold refiners, has developed a way to quickly confirm where gold had been mined, potentially stopping illegal gold from entering supply chains.

Read More »

Read More »

Central Banks Will Still Do “Whatever It Takes”!

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels.

Read More »

Read More »

The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things.

Read More »

Read More »

How High is Too High for Rising Government Bond Yields?

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1.

Read More »

Read More »

Marriage of Gold and Cryptocurrencies: A New Future?

2021-04-16

by Stephen Flood

2021-04-16

Read More »