Category Archive: 6a.) Monetary Metals

Monetary Metals CEO Keith Weiner Interviewed on RealVision

CEO of Monetary Metals Keith Weiner sat down with Michael Green of RealVision to discuss how Monetary Metals increases gold’s value proposition by paying interest on gold and silver holdings and the inevitable debasement of fiat currencies. Keith and Mike discuss the inherent volatility of Bitcoin, Costco’s ability to maintain its price point, and the colossal meltdown of the Terra stablecoin.

Read More »

Read More »

Understanding Gold and the Death Blow to Crypto

CEO of Monetary Metals Keith Weiner sits down with Matthew Piepenburg of Matterhorn Asset Management to discuss gold, fiat and crypto. What is real wealth? What’s the relationship between interest rates and Bitcoin? Do central banks know what they are doing? Matt and Keith sit down to discuss it all.

Read More »

Read More »

Open Letter to Lex Fridman and Michael Saylor

Gentlemen: I am writing to you in response to your Podcast #276. The first thing I want to say is—well done! You talked about economics and money for four hours and attracted over two million viewers. The monetary system faces grave problems and discussing them is important.

Read More »

Read More »

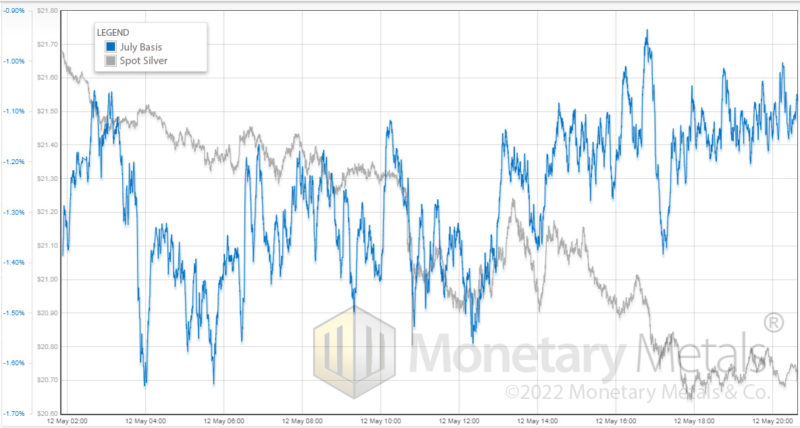

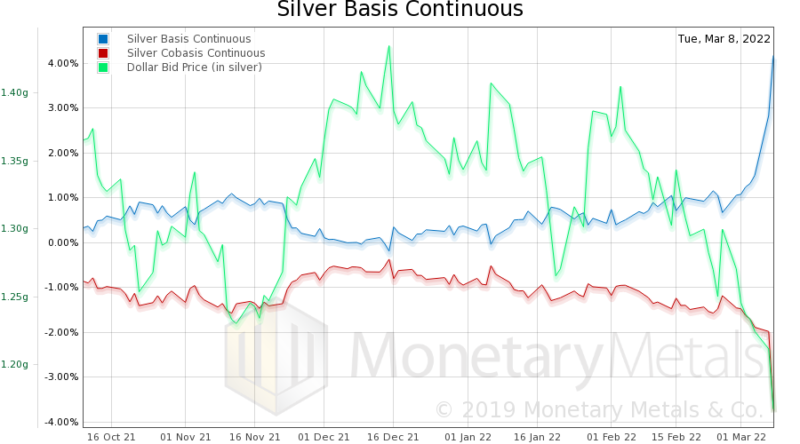

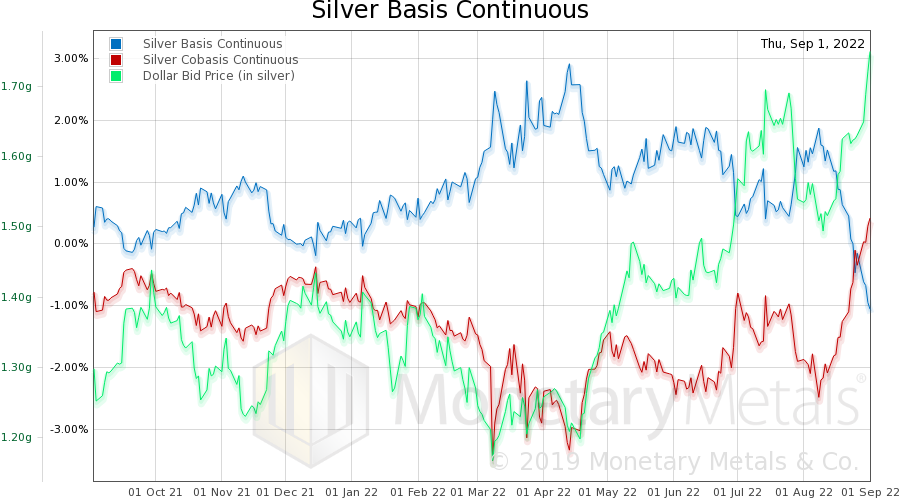

The Silver Chart THEY Don’t Want You to See!

On Thursday May 12, the price of silver fell about a buck. As with every one of these big price moves, the question is: what really happened? Below is a chart of the day’s action, with price overlaid with basis. Basis = future – spot. It is a great (i.e. the only) indicator of abundance or scarcity of metal to the market.

Read More »

Read More »

Monetary Metals is Hiring an Associate Account Manager

Monetary Metals is growing, and we’re looking for our next key hire: Associate Account Manager. We’re giving an ounce of gold to whoever refers the successful candidate.

Read More »

Read More »

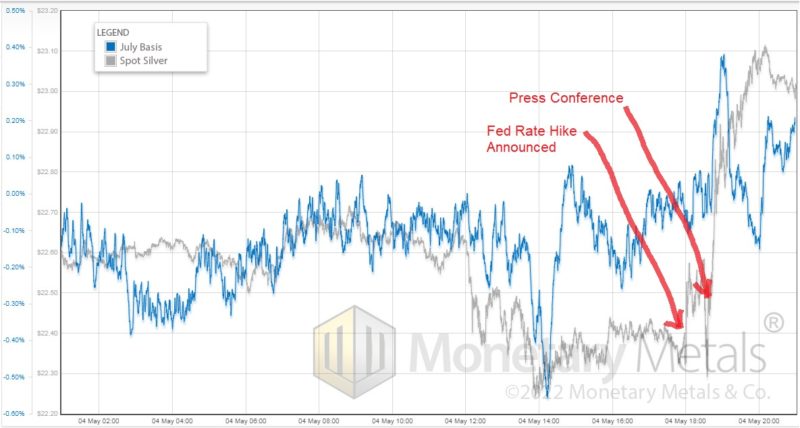

Forensic Analysis of Fed Action on Silver Price

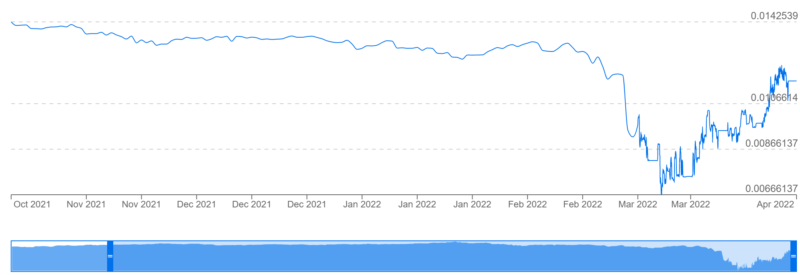

The last few days of trading in silver have been a wild ride.

On Wednesday morning in New York, six hours before the Fed was to announce its interest rate hike, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents.

At 2pm (NY time), the Fed made the announcement. The price had already begun spiking higher for about two minutes.

As an aside, we wonder a bit about how they keep...

Read More »

Read More »

Monetary Metals Completes Latest Capital Raise

Monetary Metals® has recently closed a $4.5 million equity capital raise, bringing the total funds raised to over $8.5 million. The goal of the capital raise is to support the company to scale up.

This round was oversubscribed, like all previous rounds. The company aimed to raise $3 million.

Read More »

Read More »

Ask Keith Anything, Part III

Welcome to the third installment of our Ask Keith Anything video series. We published the call for questions far and wide to our readership, and the response was overwhelming! We received questions from all over the world. Now we’ve published the results! In this episode, Keith answers your questions on Bitcoin, supply chain bottlenecks, banking, book recommendations, the gold and silver markets and so much more!

Read More »

Read More »

Time for a Silver Trade?

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month.

Read More »

Read More »

It’s Time for TINA to Retire

To listen to the audio version of this article click here. In the world of trends, history repeats more than it rhymes. Things which were considered “in” decades ago, reemerge as cool again decades later. From mom jeans to vinyl records and even Marxist ideology. The spotlight of today turns to things—both good and bad—once forgotten.

Read More »

Read More »

AKA Part I

Thanks for all of those great questions you submitted! Make sure you follow us on Twitter, Facebook and LinkedIn and are subscribed to our YouTube Channel so you can submit question and check out all of our audio articles, media appearances, podcasts episodes and more.

Read More »

Read More »

Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else?

Read More »

Read More »

Oil, the Ruble, and Gold Walk into a Bar…

Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause rain.”

Read More »

Read More »

Keith Weiner on the Gold Market and How to Replace Government Paper Money

Keith Weiner is founder and CEO of Monetary Metals, an investment firm that pays interest on gold, and the founder of the Gold Standard Institute USA. Weiner’s mission is to provide entrepreneurial services and education to help restore gold as the world’s money par excellence.

Read More »

Read More »

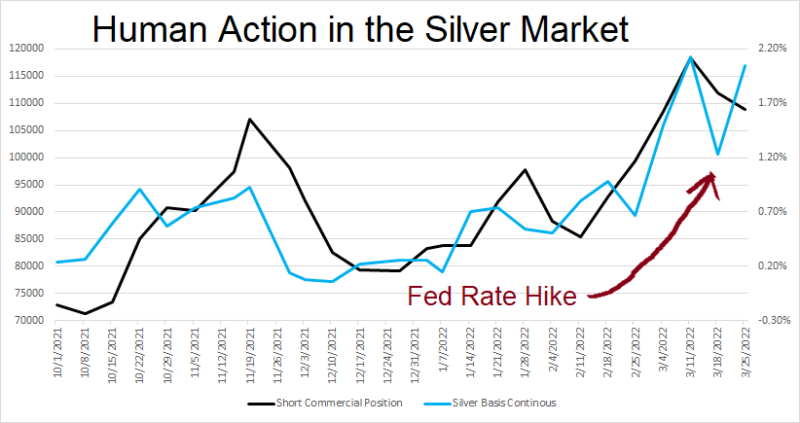

Human Action in the Silver Market

We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon? And doesn’t their shorting of silver push down the price?

Read More »

Read More »

Six Reasons Why Gold is the Best Money

J.P. Morgan is famous for testifying before Congress saying “money is gold, and nothing else.” But why is gold so uniquely suited to be money? Here are our top six reasons why we think gold is the best money, and why dollars and bitcoin don’t come close.

Read More »

Read More »

How Much is the Gold Cube Worth?

Here at Monetary Metals we love providing investors with A Yield on Gold, Paid in Gold®. So when we heard that German artist Niclas Castello designed a 186 kilogram pure 24-karat gold cube called the “Castello Cube” as an art installation in the middle of Central Park we couldn’t help but start doing a little math on Mr. Castello’s art piece.

Read More »

Read More »

This is Not The Silver Breakout You’re Looking For!

Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Read More »

Read More »

How Not to Think About Gold

Monetary Metals has been covering gold and silver markets for over ten years. Throughout that time, there’s been no shortage of new and old commentators talking about the drivers of gold and silver prices. Unfortunately, the vast majority of this analysis is just plain wrong.

Read More »

Read More »

Episode 26: Gold in the Time of Coronavirus

This week’s episode of the Gold Exchange Podcast, Keith Weiner interviews independent precious metals advisor Claudio Grass. Claudio explains his sound money origin story and how the rest of the world understands gold vs Americans’ understanding. The wide ranging conversation spans everything from history, to covid lockdowns, to how societies change, to our relationship to money and even political principles and philosophy.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

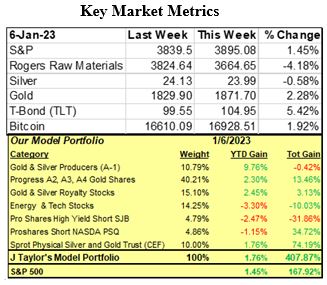

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022