Category Archive: 6a.) Monetary Metals

Keith Weiner, ObLEFTivists, et al.

2019-08-16

by Keith Weiner

LANGUAGE ADVISORY – if you are an ObLEFTivist, I’m going to swear at and insult you. Gratuitously. ENJOY!!! Support this channel: https://www.patreon.com/MrCropper ADVChina’s video: https://www.youtube.com/watch?v=aW9YL81oICo&t=5s

Read More »

Read More »

The Economic Singularity, Report 11 Aug

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

Read More »

Read More »

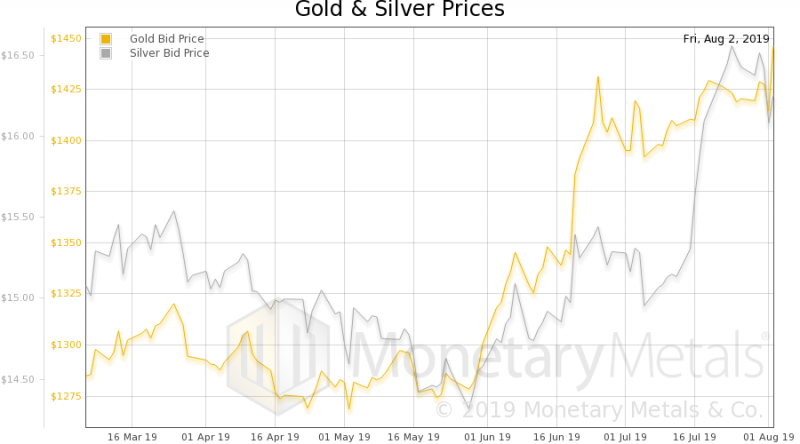

I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term…

Read More »

Read More »

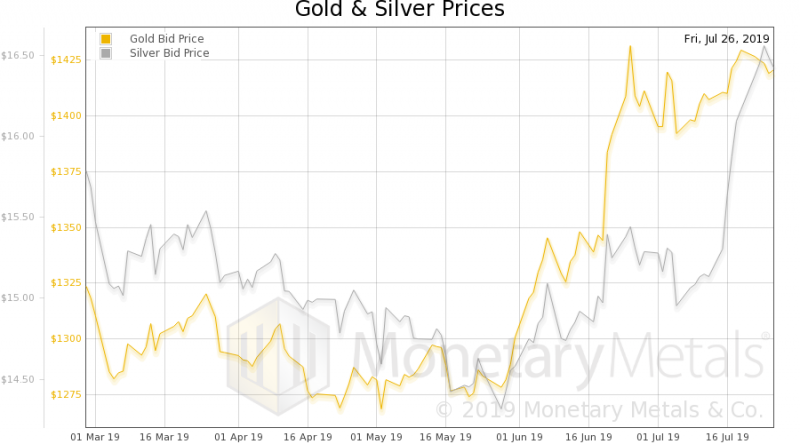

Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day.

Read More »

Read More »

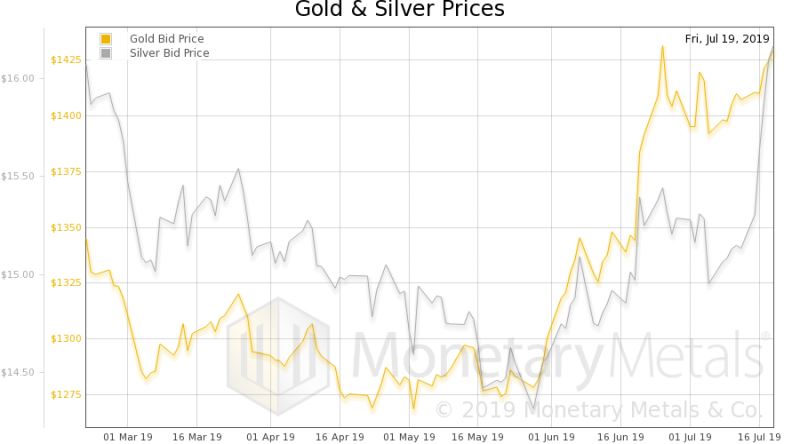

The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

Read More »

Read More »

How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Read More »

Keith Weiner, PhD, CEO & Founder of Monetary Metals

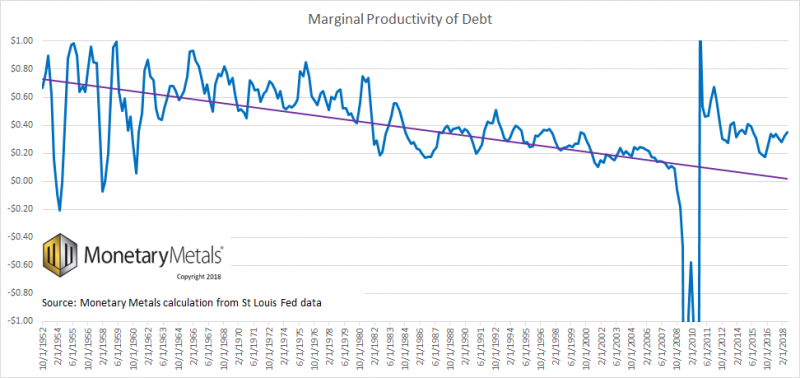

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

Read More »

Read More »

More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

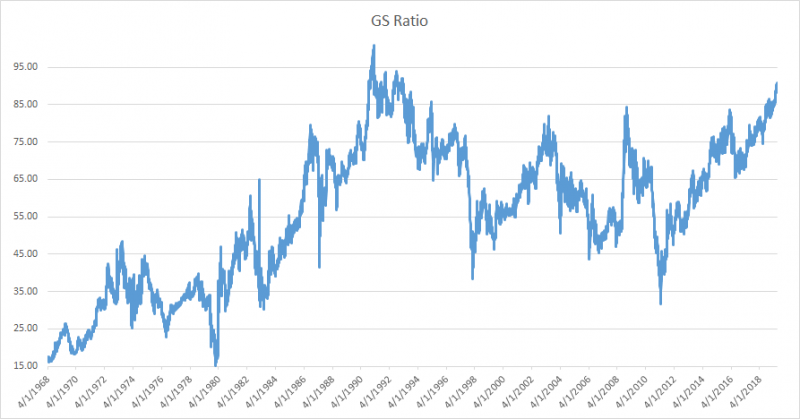

All this borrowing to consume is unsustainable and the bill is overdue

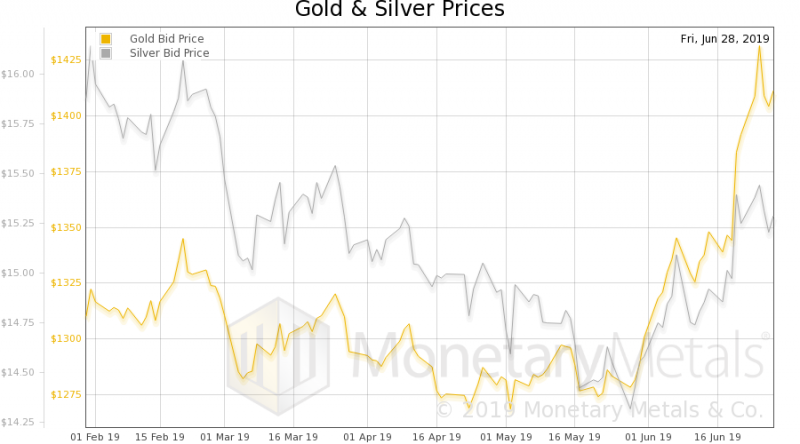

June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail, confirm the strategic superiority of precious metals holdings...

Read More »

Read More »

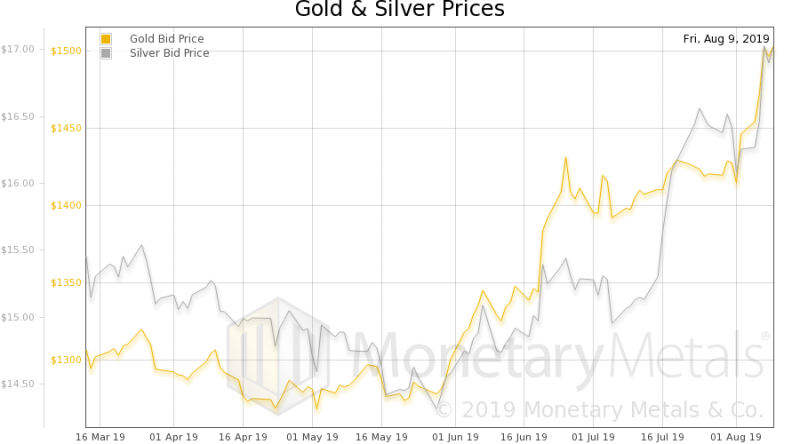

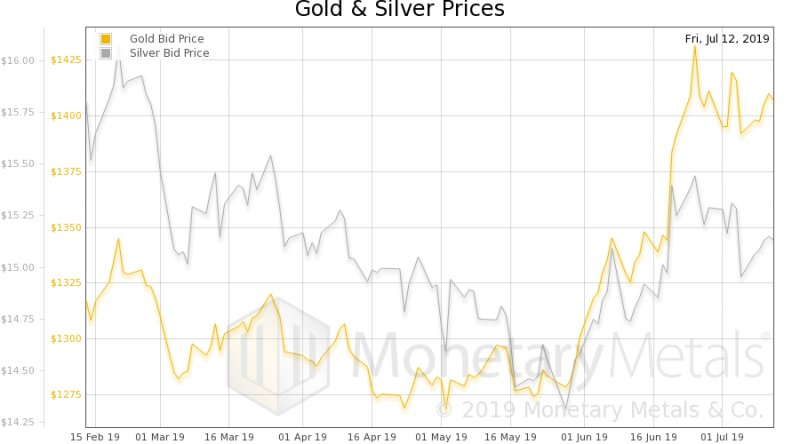

Keith Weiner – This Golden Bull is for Real #4402

2019-07-03

by Keith Weiner

As time goes by, Keith Weiner and others are more and more convinced that the long awaited bull market in gold has finally arrived. Both from a technical and fundamental point of view, there is agreement among most that this bull is the real deal. Of course anything can happen, and probably will, but things … Continue...

Read More »

Read More »

Keith Weiner Gets Interviewed

Our economic views and unique product are generating buzz. There have been a number of interviews recently (more will be posted soon). Lobo Tiggre interviewed Keith Weiner (video) about the unique Monetary Metals business model to pay interest on gold.

Read More »

Read More »

GDP Begets More GDP (Positive Feedback), Report 30 June

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth.

Read More »

Read More »

Keith Weiner – Basel III Is Not Good For Gold!

2019-06-27

by Keith Weiner

SBTV speaks with Keith Weiner, CEO of Monetary Metals, at The Safe House gold & silver vault in Singapore about the real impact of the Basel III reclassification of gold as a Tier 1 asset. Find out why it is not good for gold. Discussed in this interview: 02:58 Is gold an outdated asset for … Continue reading »

Read More »

Read More »

In The Pit: Keith Weiner, Founder and CEO, Monetary Metals (June 2019)

2019-06-26

by Keith Weiner

Monetary Metals is one of the most interesting companies I’ve come across in a long time. The idea is to fix the long-standing objection to gold as a financial asset in that it “doesn’t pay interest.” I’m not ready to invest yet, but if they can consistently deliver on what they’ve started, it could be …

Read More »

Read More »

What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”).

Read More »

Read More »

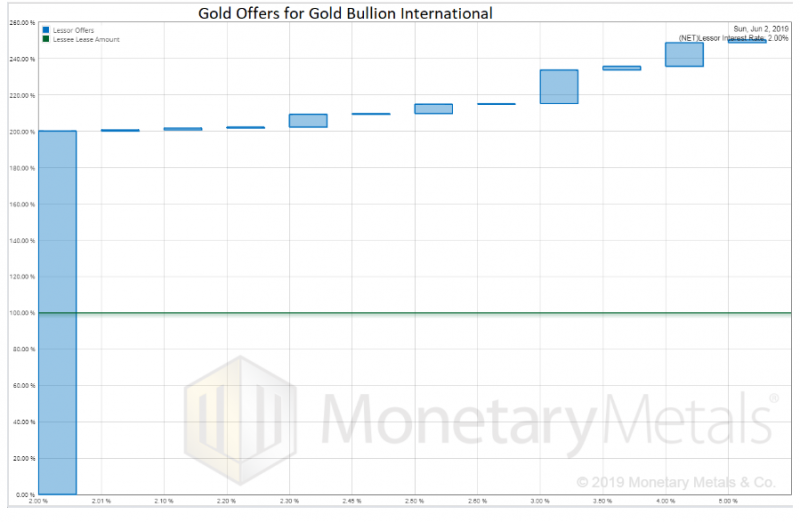

Gold Bullion International Lease #1 (gold)

Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository.

Read More »

Read More »

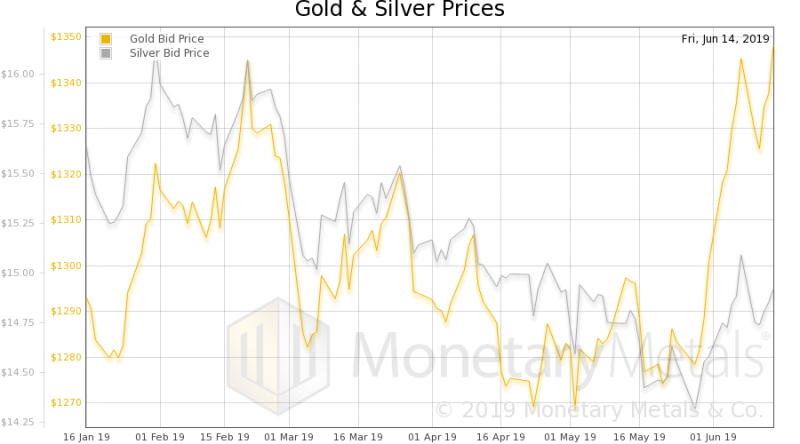

The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy!

Read More »

Read More »

Irredeemable Currency Is a Roach Motel, Report 9 June

In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes.

Read More »

Read More »

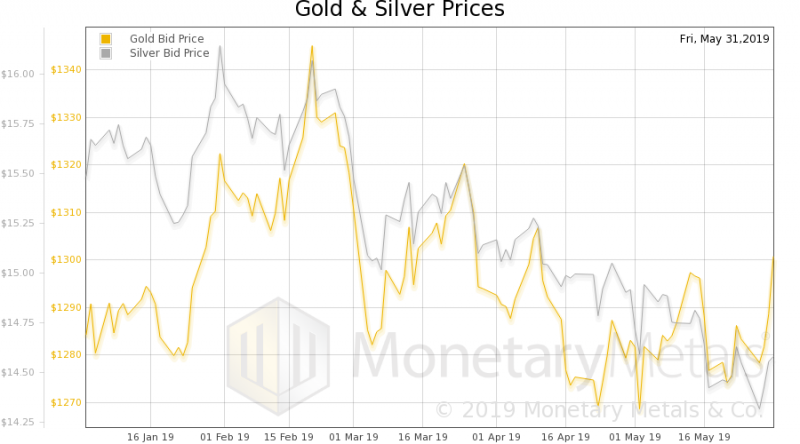

Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market.

Read More »

Read More »

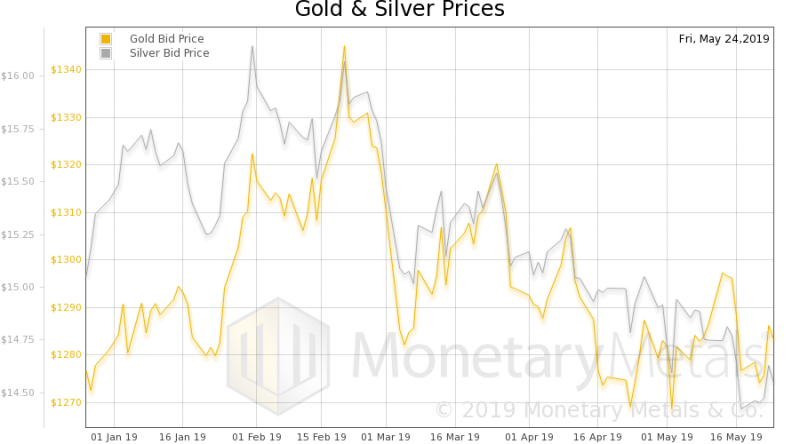

The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another currency, it merely tightens...

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

9 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

9 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

9 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

9 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

15 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

9 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

4-20-24 Candid Coffee – Open Season Episode

4-20-24 Candid Coffee – Open Season Episode -

Diese Aktien sind extrem günstig!

Diese Aktien sind extrem günstig! -

The DNA of Success: Habits of Millionaires Unveiled

The DNA of Success: Habits of Millionaires Unveiled -

Driver’s Licenses Waive Personal Responsibility and Contribute to Disorder on the Road

-

Chapter 4. Why the Classical Liberals Wanted Decentralization

-

Chapter 12. When It Comes to National Defense, It’s More than Size that Matters

-

Chapter 10. If California Secedes, What Happens to Locals Who Opposed Secession?

-

Chapter 7. A Brief History of Secession Plebiscites in Europe

-

Chapter 15. Democracy Doesn’t Work Unless It’s Done Locally

-

Chapter 8. Why the US Supports Secession for Africans, but Not for Americans

More from this category

4-20-24 Candid Coffee – Open Season Episode

4-20-24 Candid Coffee – Open Season Episode24 Apr 2024

Diese Aktien sind extrem günstig!

Diese Aktien sind extrem günstig!24 Apr 2024

The DNA of Success: Habits of Millionaires Unveiled

The DNA of Success: Habits of Millionaires Unveiled24 Apr 2024

4-24-24 What Does Realistic Retirement Look Like?

4-24-24 What Does Realistic Retirement Look Like?24 Apr 2024

Eklat: Grünen Politiker wirft genervt hin!

Eklat: Grünen Politiker wirft genervt hin!24 Apr 2024

Die größten Tagesgewinne an der Börse! #highlife

Die größten Tagesgewinne an der Börse! #highlife24 Apr 2024

Heftig: Maximilian Krahs Mitarbeiter verhaftet!

Heftig: Maximilian Krahs Mitarbeiter verhaftet!24 Apr 2024

EURUSD Technical Analysis – WATCH what happens around this key resistance

EURUSD Technical Analysis – WATCH what happens around this key resistance24 Apr 2024

Happy World Book Day!

Happy World Book Day!23 Apr 2024

EURUSD has a cap near the 38.2% retracement, but buyers are pushing.

EURUSD has a cap near the 38.2% retracement, but buyers are pushing.23 Apr 2024

Skandal-Studie: MEGA Gau für Grüne!

Skandal-Studie: MEGA Gau für Grüne!23 Apr 2024

Jeder spricht über finanzielle Ziele, aber der Weg dorthin ist meistens lang und mühsam. 🧗️

Jeder spricht über finanzielle Ziele, aber der Weg dorthin ist meistens lang und mühsam. 🧗️23 Apr 2024

Der beste Hedge der Welt!

Der beste Hedge der Welt!23 Apr 2024

150€ Strafe bei Grünem Pfeil? Das musst Du wissen #shorts

150€ Strafe bei Grünem Pfeil? Das musst Du wissen #shorts23 Apr 2024

Homelab Teil 3 – Backup, 3-2-1-Regel, Offsite Sicherung, Datentransfer, LTO Tape

Homelab Teil 3 – Backup, 3-2-1-Regel, Offsite Sicherung, Datentransfer, LTO Tape23 Apr 2024

AUDUSD reacts to the weaker US data. Pair moves higher as yields move lower/stocks higher.

AUDUSD reacts to the weaker US data. Pair moves higher as yields move lower/stocks higher.23 Apr 2024

Financial Mistakes to Avoid If You’re Retiring within Five Years

Financial Mistakes to Avoid If You’re Retiring within Five Years23 Apr 2024

The USDCHF is not doing much in trading today, but the buyers are trying to take control.

The USDCHF is not doing much in trading today, but the buyers are trying to take control.23 Apr 2024

The USDCHF is not doing much in trading today, but the buyers are trying to take control

The USDCHF is not doing much in trading today, but the buyers are trying to take control23 Apr 2024

Kickstart the FX trading day for April 23 w/a technical look at EURUSD, USDJPY and GBPUSD

Kickstart the FX trading day for April 23 w/a technical look at EURUSD, USDJPY and GBPUSD23 Apr 2024