Category Archive: 6a.) Monetary Metals

Keith Weiner, PhD, CEO & Founder of Monetary Metals

2019-05-22

by Keith Weiner

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

Read More »

Read More »

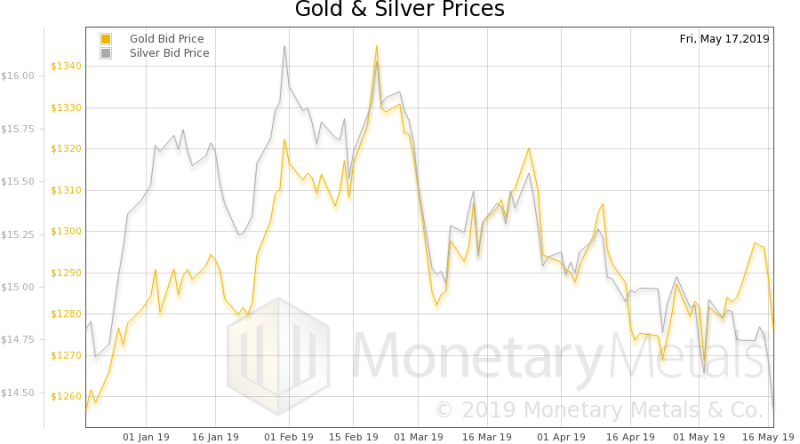

China’s Nuclear Option to Sell US Treasurys, Report 19 May

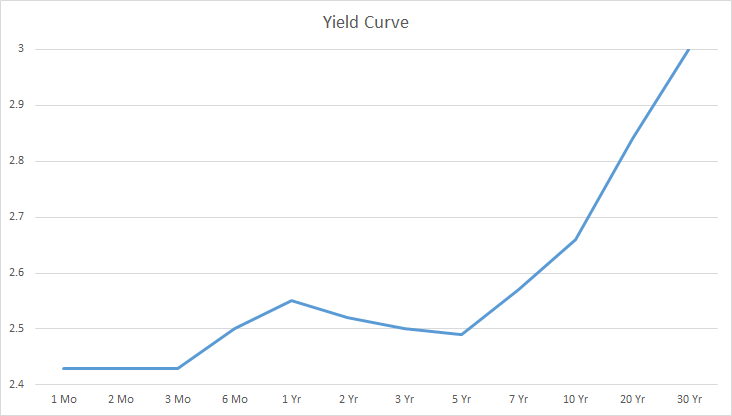

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy.

Read More »

Read More »

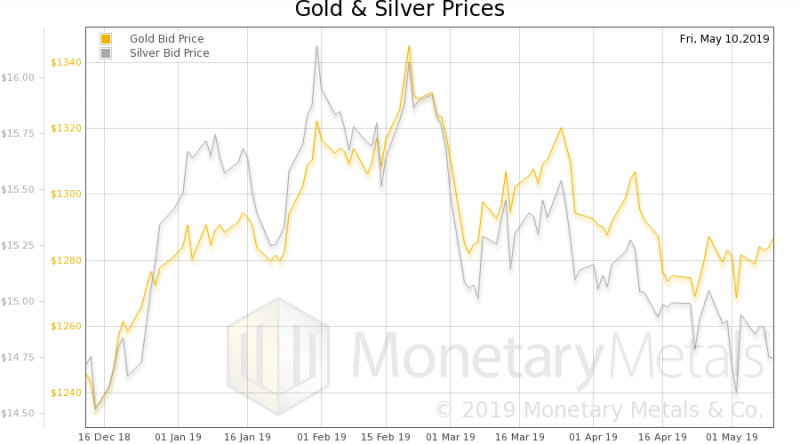

The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good.

Read More »

Read More »

Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc.

Read More »

Read More »

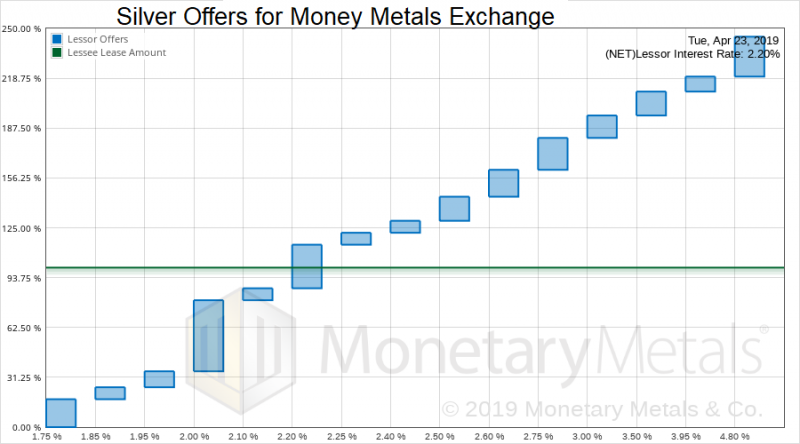

Money Metals Exchange Lease #1 (silver)

Monetary Metals leased silver to Money Metals Exchange, to support the growth of its gold and silver bullion business. The metal is held in the form of inventory in its vault. For more information see Monetary Metals’ press release.

Read More »

Read More »

Monetary Metals Leases Silver to Money Metals Exchange

Monetary Metals® announces that it has leased silver to Money Metals Exchange® to support the growth of its business of selling gold and silver at retail and wholesale. Investors earn 2.2% on their silver, which is held in Money Metals’ vault in the form of silver products.

Read More »

Read More »

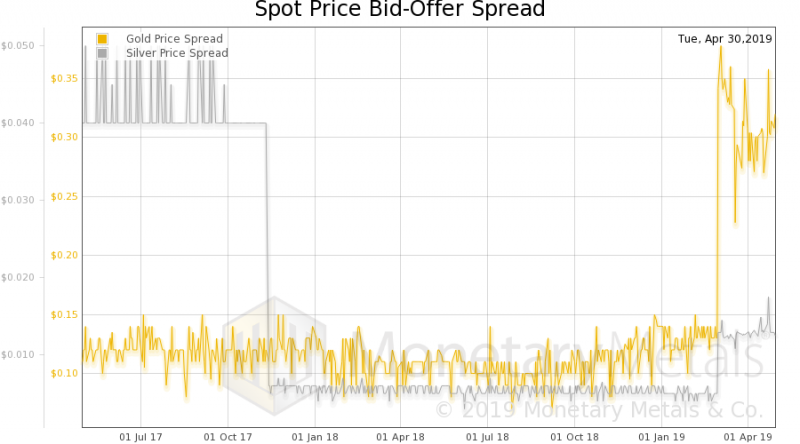

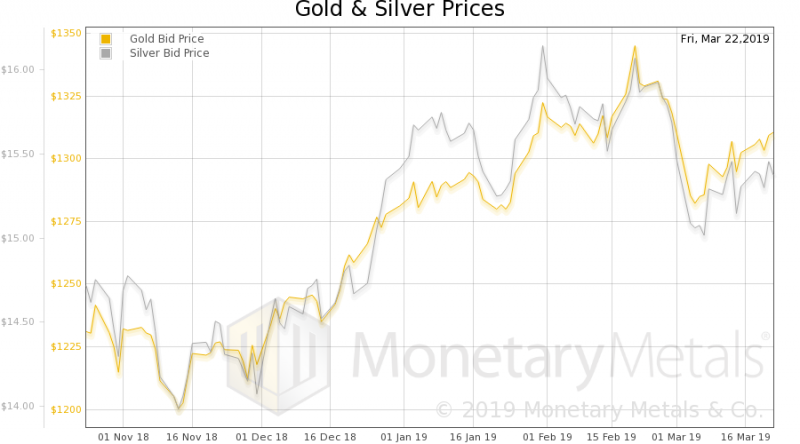

The Spreads Blow Out, Update 1 May

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide.

Read More »

Read More »

Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the price is down to $39.31. Down...

Read More »

Read More »

The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees.

Read More »

Read More »

New Inflation Indicator, Report 14 Apr

Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said: “For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.”

Read More »

Read More »

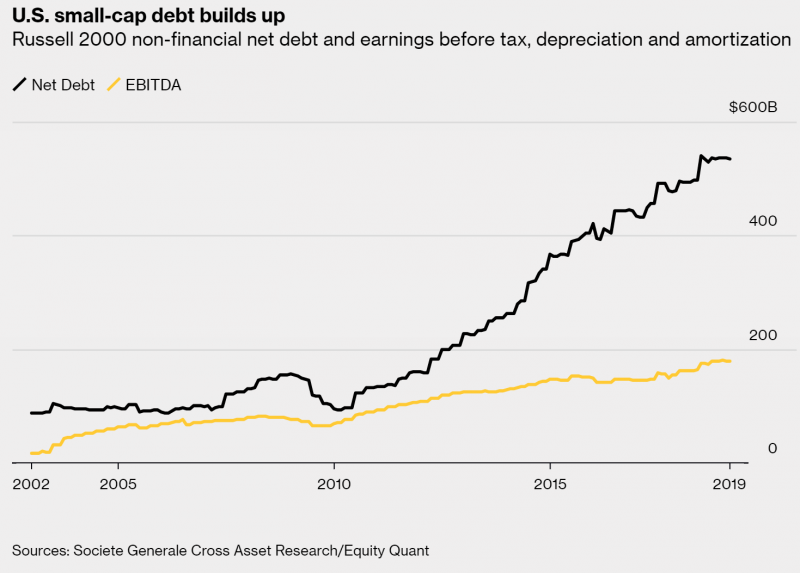

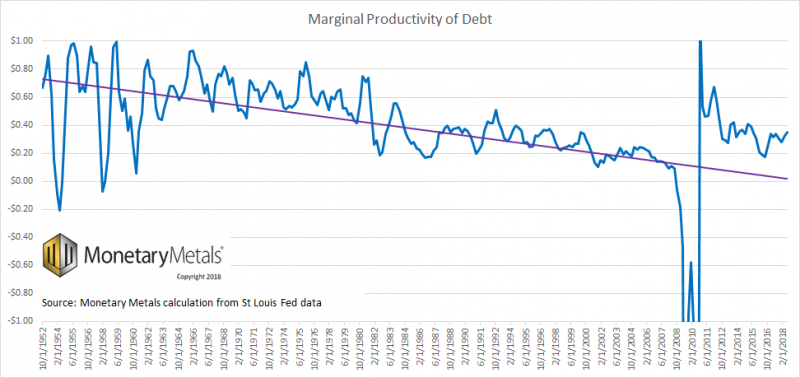

Debt and Profit in Russell 2000 Firms

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic).

Read More »

Read More »

What Causes Loss of Purchasing Power, Report 7 Apr

We have written much about the notion of inflation. We don’t want to rehash our many previous points, but to look at the idea of purchasing power from a new angle. Purchasing power is assumed to be intrinsic to the currency. We have said that the problem with the word inflation is that it treats two different phenomena as if they are the same.

Read More »

Read More »

Will Basel III Send Gold to the Moon, Report 2 Apr

A number of commentators have predicted that the rules of the Basel III bank regulations will cause gold to skyrocket (no, this article is not about our view that gold does not go up, that it’s the dollar going down, that the lighthouse does not go up, it’s the sinking ship going down in the storm).

Read More »

Read More »

On Board Keynes Express to Ruin, Report 24 Mar

Last week, I ranted about the problem with our monetary system and trajectory: falling interest rates is Keynes’ evil genius plan to destroy civilization. This week, I continue the theme—if in a more measured tone—addressing the ideas predominant among the groups who are most likely to fight against Keynes’ destructionism.

Read More »

Read More »

Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers.

Read More »

Read More »

The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings.

Read More »

Read More »

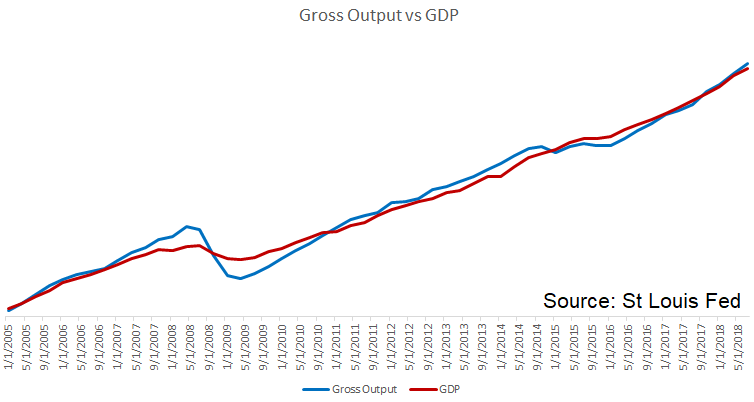

Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP).

Read More »

Read More »

Is Lending the Root of All Evil? Report 24 Feb

Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says: “So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them.

Read More »

Read More »

Central Planning Is More than Just Friction, Report 17 February

It is easy to think of government interference into the economy like a kind of friction. If producers and traders were fully free, then they could improve our quality of life—with new technologies, better products, and lower prices—at a rate of X. But the more that the government does, the more it burdens them. So instead of X rate of progress, we get the same end result but 10% slower or 20% slower.

Read More »

Read More »

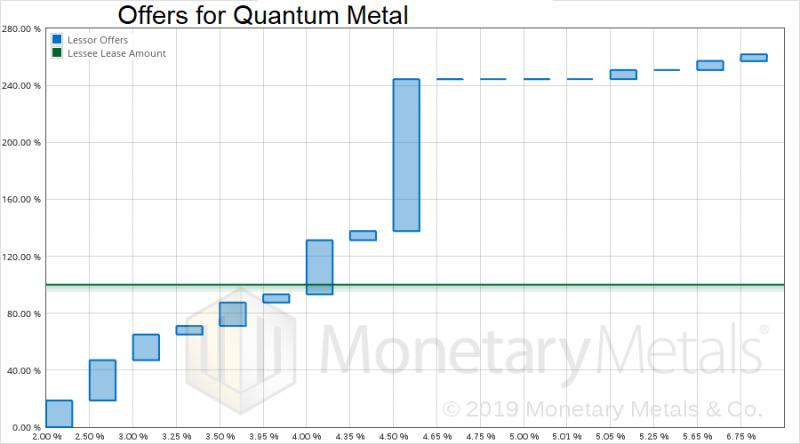

Quantum Metal Lease #1 (gold)

Monetary Metals leased gold to Quantum Metal, to support the growth of its gold distribution business through retail bank branches. The metal is held in the form of retail Perth Mint bars.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

3 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

3 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

4 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

4 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

10 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

3 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Boost Your Savings: Strategies for the Accumulation and Distribution Phases

Boost Your Savings: Strategies for the Accumulation and Distribution Phases -

4-19-24 Did You Pay Your Fair Share of Taxes?

4-19-24 Did You Pay Your Fair Share of Taxes? -

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner -

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station!

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station! -

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction -

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln -

Mein YouTube Einnahmen: Totale Transparenz

Mein YouTube Einnahmen: Totale Transparenz -

Renato Moicano Cares About His Country More Than Sohrab Ahmari

-

4-18-24 Are We On Japan’s Path to Stagnation?

4-18-24 Are We On Japan’s Path to Stagnation? -

The Tiny Island That Serves As a Tripwire for War between the US and China

More from this category

Boost Your Savings: Strategies for the Accumulation and Distribution Phases

Boost Your Savings: Strategies for the Accumulation and Distribution Phases19 Apr 2024

4-19-24 Did You Pay Your Fair Share of Taxes?

4-19-24 Did You Pay Your Fair Share of Taxes?19 Apr 2024

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner18 Apr 2024

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station!

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station!18 Apr 2024

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction18 Apr 2024

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln18 Apr 2024

Mein YouTube Einnahmen: Totale Transparenz

Mein YouTube Einnahmen: Totale Transparenz18 Apr 2024

4-18-24 Are We On Japan’s Path to Stagnation?

4-18-24 Are We On Japan’s Path to Stagnation?18 Apr 2024

Eilt: dramatische Wende im Ukraine-Konflikt!

Eilt: dramatische Wende im Ukraine-Konflikt!18 Apr 2024

Widerstand zwecklos (?): DJE-plusNews April 2024 mit Mario Künzel und Moritz Rehmann

Widerstand zwecklos (?): DJE-plusNews April 2024 mit Mario Künzel und Moritz Rehmann18 Apr 2024

Gold Technical Analysis – Where will we break out to?

Gold Technical Analysis – Where will we break out to?18 Apr 2024

Baerbock vermasselt Tagesthemen Interview komplett!

Baerbock vermasselt Tagesthemen Interview komplett!18 Apr 2024

Wichtige Morning News mit Oliver Klemm #284

Wichtige Morning News mit Oliver Klemm #28418 Apr 2024

Wichtige Morning News mit Oliver Klemm #285

Wichtige Morning News mit Oliver Klemm #28518 Apr 2024

ECBs Lagarde says exchange rates matter and it leads to a rotation higher

ECBs Lagarde says exchange rates matter and it leads to a rotation higher17 Apr 2024

Financial Trends for 2024: Banks, Bitcoin, and Real Estate – Robert Kiyosaki, Gerald Celente

Financial Trends for 2024: Banks, Bitcoin, and Real Estate – Robert Kiyosaki, Gerald Celente17 Apr 2024

Climate Change Efforts Must Be Practical and the Time is NOW

Climate Change Efforts Must Be Practical and the Time is NOW17 Apr 2024

Mir bleibt die Spucke weg! Desolates Stern Interview von SPD Ministerin!

Mir bleibt die Spucke weg! Desolates Stern Interview von SPD Ministerin!17 Apr 2024

Lance Roberts Explores the Long-Term Impact of Reflation on Money and Markets

Lance Roberts Explores the Long-Term Impact of Reflation on Money and Markets17 Apr 2024

Gold: Kursziel 5.092 US-Dollar?

Gold: Kursziel 5.092 US-Dollar?17 Apr 2024