Category Archive: 6a.) Monetary Metals

What They Don’t Want You to Know about Prices, Report 10 Feb

Last week, in part I of this essay, we discussed why a central planner cannot know the right interest rate. Central planner’s macroeconomic aggregate measures like GDP are blind to the problem of capital consumption, including especially capital consumption caused by the central plan itself.

Read More »

Read More »

Monetary Metals Leases Gold to Quantum Metal

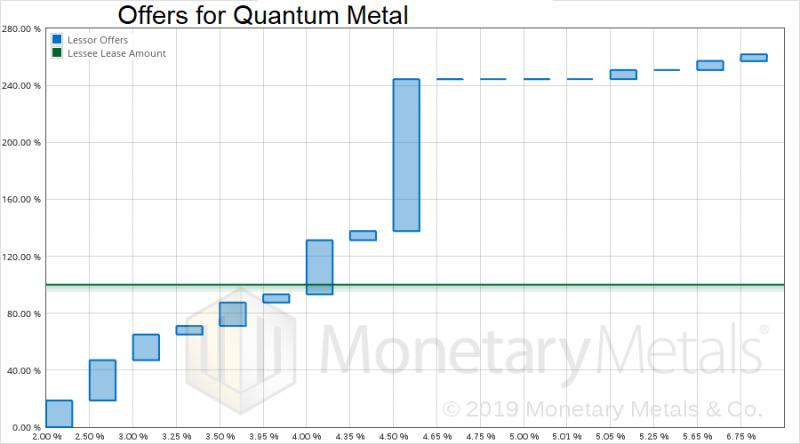

Scottsdale, Ariz, February 8, 2019—Monetary Metals® announces that it has leased gold to Quantum Metal, to support the growth of its business of selling gold through retail banks. Investors earn 4.5% on their gold, which is held as Perth Mint minted gold bars in inventory. Monetary Metals has a disruptive model, leasing gold from investors who own it and subleasing it to businesses who need it, typically for inventory or work-in-progress.

Read More »

Read More »

Know Your Risk Radio – Brent Johnson & Keith Weiner Interview

2019-02-06

by Keith Weiner

Clear Creek Financial Management, LLC is a Registered Investment Adviser dba Bulwark Capital Management. This brochure is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Clear Creek Financial Management, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. …

Read More »

Read More »

Who Knows the Right Interest Rate, Report 3 Feb 2019

On January 6, we wrote the Surest Way to Overthrow Capitalism. We said: “In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.” Today’s article is part I that promised article.

Read More »

Read More »

Modern Monetary Theory: A Cargo Cult, Report 20 Jan 2019

Newly elected Representative Alexandria Ocasio-Cortez recently said that Modern Monetary Theory (MMT) absolutely needed to be “a larger part of our conversation.” Her comment shines a spotlight on MMT. So what is it? According to Wikipedia, it is: “a macroeconomic theory that describes the currency as a public monopoly and unemployment as the evidence that a currency monopolist is restricting the supply of the financial assets needed to pay taxes...

Read More »

Read More »

The Dollar Works Just Fine, Report 20 Jan 2019

Last week, we joked that we don’t challenge beliefs. Here’s one that we want to challenge today: the dollar doesn’t work as a currency, because it’s losing value. Even the dollar’s proponents, admit it loses value. The Fed itself states that its mandate is price stability—which it admits means relentless two percent annual debasement (Orwell would be proud).

Read More »

Read More »

Rising Interest and Prices, Report 13 Jan 2019

For years, people blamed the global financial crisis on greed. Doesn’t this make you want to scream out, “what, were people not greedy in 2007 or 1997??” Greed utterly fails to explain the phenomenon. It merely serves to reinforce a previously-held belief.

Read More »

Read More »

Surest Way to Overthrow Capitalism, Report 6 Jan 2019

One of the most important problems in economics is: How do we know if an enterprise is creating or destroying wealth? The line between the two is objective, black and white. It should be clear that if business managers can’t tell the difference between a wealth-creating or wealth-destroying activity, then our whole society will be miserably poor.

Read More »

Read More »

Are Stocks Overvalued, Report 24 Dec 2018

We could also have entitled this essay How to Measure Your Own Capital Destruction. But this headline would not have set expectations correctly. As always, when looking at the phenomenon of a credit-fueled boom, the destruction does not occur when prices crash. It occurs while they’re rising.

Read More »

Read More »

Why Do Investors Tolerate It, Report 17 Dec 2018

For the first time since we began publishing this Report, it is a day late. We apologize. Keith has just returned Saturday from two months on the road. Unlike the rest of the world, we define inflation as monetary counterfeiting. We do not put the emphasis on quantity (and the dollar is not money, it’s a currency). We focus on the quality. An awful lot of our monetary counterfeiting occurs to fuel consumption spending.

Read More »

Read More »

Ep. 155: Corey Lewandowski, Keith Weiner, plus a short clip of Charlie Kirk

2018-12-10

by Keith Weiner

Ep. 155: Corey Lewandowski discusses Trump’s Enemies, How the Deep State is Undermining the President (his latest book with David Bossie), the Mueller Investigation, Trump’s view of the media, and how Trump can win back lost votes in 2020. We then provide a short clip Daves on-stage interview with Charlie Kirk and how Charlie, as …

Read More »

Read More »

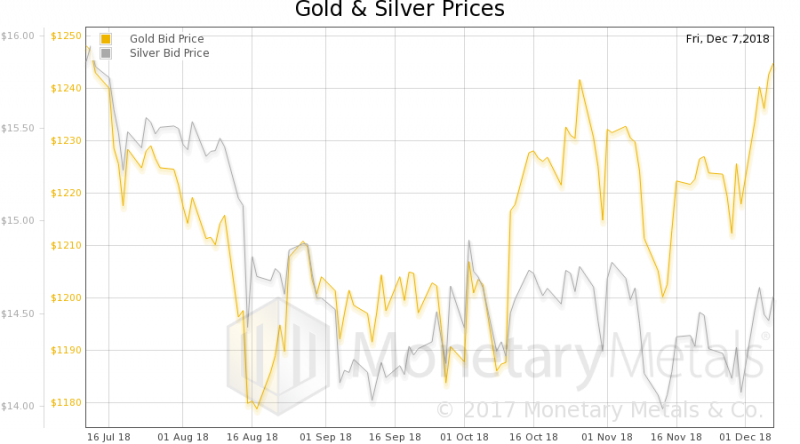

The Prodigal Parent, Report 9 Dec 2018

The Baby Boom generation may be the first generation to leave less to their children than they inherited. Or to leave nothing at all. We hear lots—often from Baby Boomers—about the propensities of their children’s generation. The millennials don’t have good jobs, don’t save, don’t buy houses in the same proportions as their parents, etc.

Read More »

Read More »

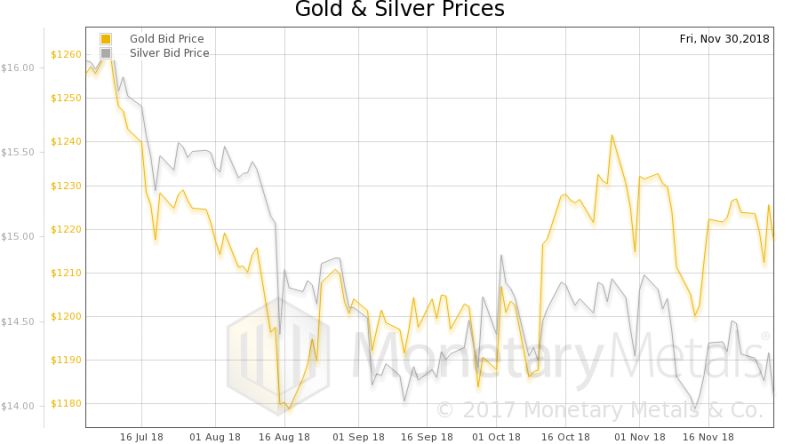

Inflation, Report 2 Dec 2018

What is inflation? Any layman can tell you—and nearly everyone uses it this way in informal speech—that inflation is rising prices. Some will say “due to devaluation of the money.” Economists will say, no it’s not rising prices per se. That is everywhere and always the effect. The cause, the inflation as such, is an increase in the quantity of money. Which is the same thing as saying devaluation.

Read More »

Read More »

A Golden Renaissance, Report 25 Nov 2018

There is the freedom of speech battle, with the forces of darkness advancing all over. For example, in Pakistan, there are killings of journalists. Saudi Arabia apparently had journalist Khashoggi killed. New Zealand now can force travellers to provide the password to their phones so the government can go through all your data, presumably including your gmail, Onedrive, Evernote, and WhatsApp.

Read More »

Read More »

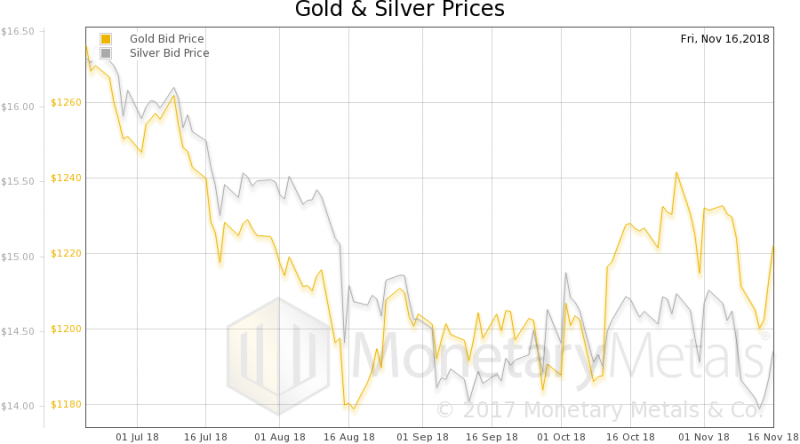

The Ultimate Stablecoin, Report 18 Nov 2018

A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year. Back in those halcyon days, volatility was deemed to be a feature.

Read More »

Read More »

Keith Weiner – Inflation is Counterfeiting

2018-11-18

by Keith Weiner

Keith Weiner is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. He is the founder of DiamondWare, a software company sold to Nortel in 2008, and he currently serves as President of the Gold …

Read More »

Read More »

The Failure of a Gold Refinery, Report 12 Nov 2018

So this happened: Republic Metals, a gold refiner, filed bankruptcy on November 2. The company had found a discrepancy in its inventory of around $90 million, while preparing its financial statements.

We are not going to point the Finger of Blame at Republic or its management, as we do not know if this was honest error or theft.

Read More »

Read More »

Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything.

Read More »

Read More »

What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / . When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other currency.

Redemptions Balanced With Deposits

No national...

Read More »

Read More »

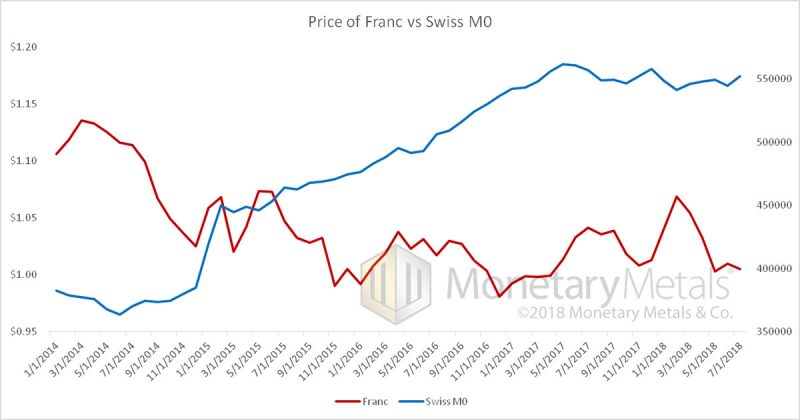

Useless But Not Worthless, Report 21 Oct 2018

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

9 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

9 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

10 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

10 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

16 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

9 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Bodemann flippt aus: “Wir brauchen mehr Kontrolle”

Bodemann flippt aus: “Wir brauchen mehr Kontrolle” -

Wichtige Morning News mit Oliver Klemm #289

Wichtige Morning News mit Oliver Klemm #289 -

Understanding Elliott Wave Theory and Investment Strategies – Andy Tanner and Bob Prechter

Understanding Elliott Wave Theory and Investment Strategies – Andy Tanner and Bob Prechter -

4-20-24 Candid Coffee – Open Season Episode

4-20-24 Candid Coffee – Open Season Episode -

Habecks Geheimakten enthüllt!

Habecks Geheimakten enthüllt! -

Diese Aktien sind extrem günstig!

Diese Aktien sind extrem günstig! -

Bitcoin Price Prediction and the Future of Crypto – Robert Kiyosaki, Mark Moss

Bitcoin Price Prediction and the Future of Crypto – Robert Kiyosaki, Mark Moss -

Gold Price Just Dropped! What Happened? (2024 Update)

Gold Price Just Dropped! What Happened? (2024 Update) -

The DNA of Success: Habits of Millionaires Unveiled

The DNA of Success: Habits of Millionaires Unveiled -

Driver’s Licenses Waive Personal Responsibility and Contribute to Disorder on the Road

More from this category

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

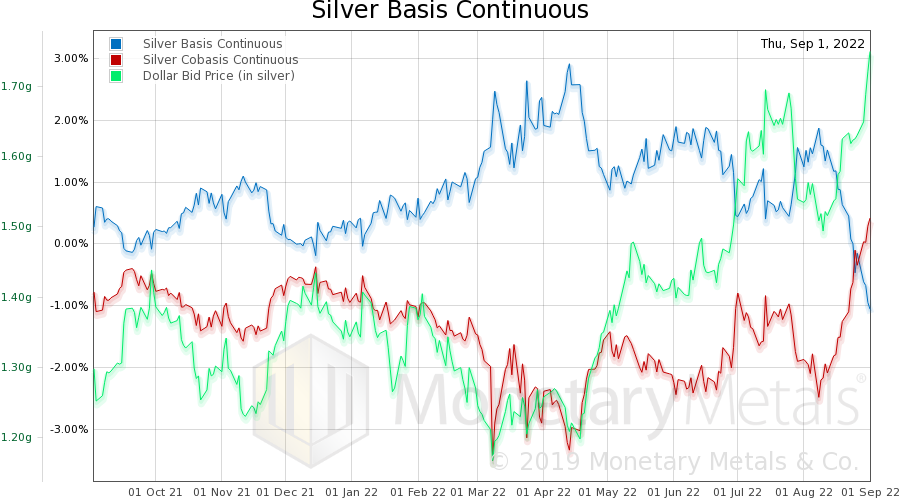

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

The Russians (Propaganda) Are Coming!

The Russians (Propaganda) Are Coming!15 Sep 2022

Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance8 Sep 2022

Keith Weiner on the VoiceAmerica Business Channel

Keith Weiner on the VoiceAmerica Business Channel7 Sep 2022