Category Archive: 6a.) Monetary Metals

Silver Update: Scarcity Gets More Extreme

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading.

Read More »

Read More »

The Silver Phoenix Market

Listen to the audio version of this article here.

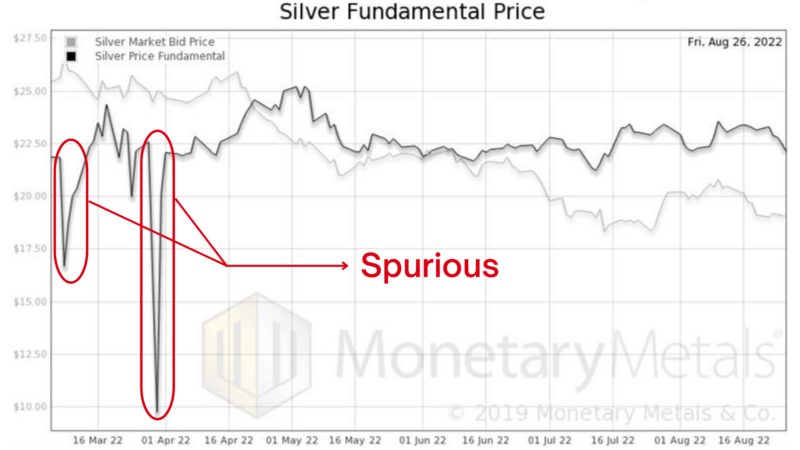

The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks.

Breaking Down Fundamental Silver Prices

However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price.

Read More »

Read More »

Gold Beats Inflation & Treasury Yields Too!

Keith Weiner and Michael Oliver return as guests on this week’s program. The U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits.

Read More »

Read More »

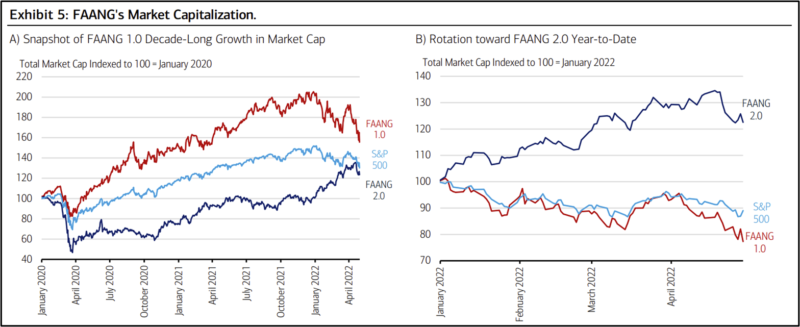

Ep 39 – Tavi Costa: Breaking Down the Pressures on the Market

Tavi Costa of Crescat Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the current state of the market, investing in good times and bad, and what future indicators to watch.

Read More »

Read More »

The Knockout Blow to Crypto

A New Type of Fighter Bonus. The UFC has started paying fan bonuses to its fighters in Bitcoin. The UFC buys crypto at a fixed dollar amount and pays their fighters a bonus in cryptocurrency. As someone who loves the UFC and monetary economics, I wanted to offer an alternative solution to the UFC and its athletes.

Read More »

Read More »

Buy Gold, Because…

It’s pretty, isn’t it? Gold, Liquid Gold, and Inflation. Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. It’s just an inch and a quarter in diameter yet weighs 0.075 pounds. Everyone should hold one in his hand (and own a few).

Read More »

Read More »

Ep 38 – Jp Cortez: Fighting for Sound Money

Jp Cortez of the Sound Money Defense League joins Keith and Ben on the Gold Exchange Podcast to talk about problems with central planning, the morality of sound money, which states are topping the Sound Money Index and why, and what you can do to support grass roots initiatives in the fight for sound money.

Read More »

Read More »

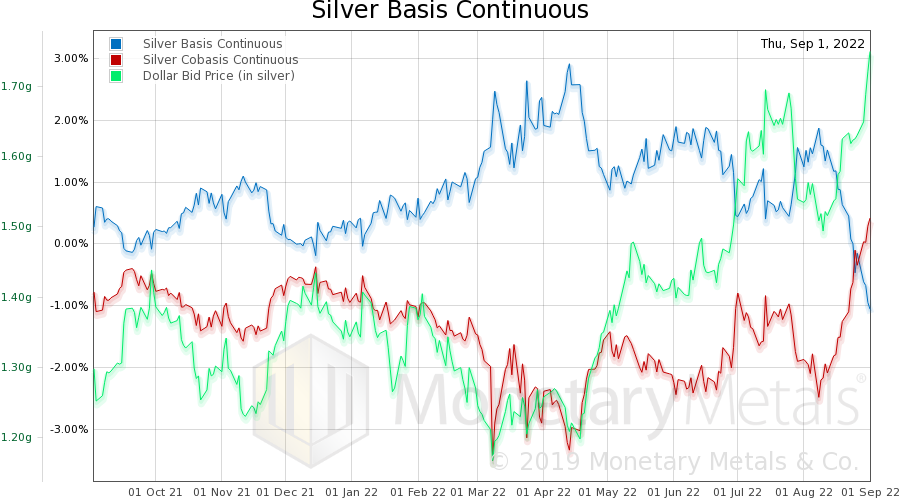

What the Heck Is Happening to Silver?!

The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%.

As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis.

Read More »

Read More »

Soho Forum Debate: Gold vs Bitcoin

The Soho Forum is a monthly debate series held in Soho/Noho, Manhattan. A project of the Reason Foundation, the series features topics of special interest to libertarians and aims to enhance social and professional ties within the NYC libertarian community.

Read More »

Read More »

Is Gold About To Go Mainstream?

Every week Merrill Lynch publishes a Capital Market Outlook Letter. The letters provide market commentary, research and analysis, and the occasional investment idea. Merrill Lynch (together with parent Bank of America) is the third largest brokerage firm, managing over $3 Trillion in client assets[1]. When a firm of that size speaks up, you should listen.

Read More »

Read More »

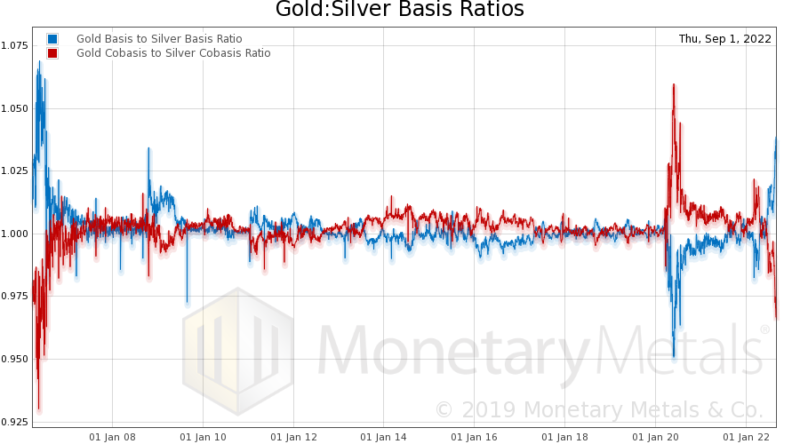

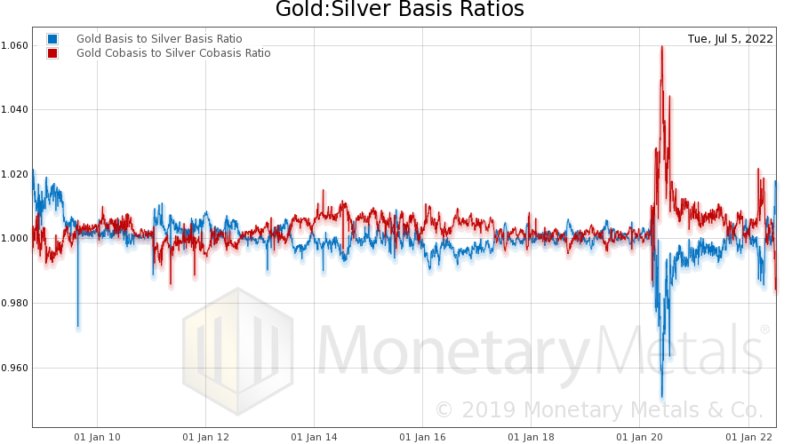

Rare Gold-Silver Crystal Sighting

Something has happened which has not occurred since 2009. The silver basis—our measure of abundance of the metal to the market—has gone way under the gold basis. This means silver is less abundant to the market than gold. Here is the picture.

Read More »

Read More »

CEO Keith Weiner on Real Talk with Zuby

CEO of Monetary Metals Keith Weiner was on Real Talk with Zuby discussing the difference between gold and “digital gold”.

Read More »

Read More »

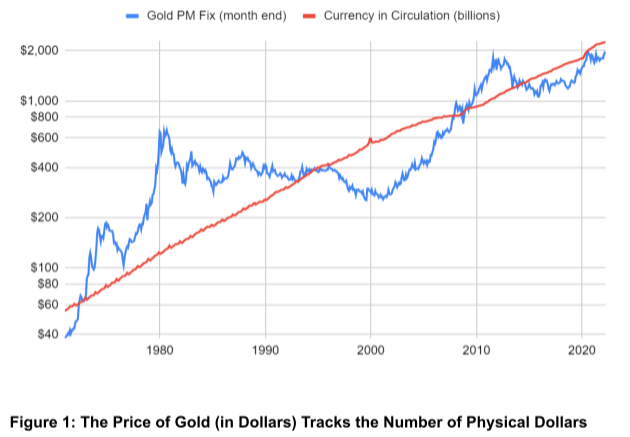

Unit of Account and Current Valuations by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com.

Read More »

Read More »

Investments, Speculations and Money by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals.

Read More »

Read More »

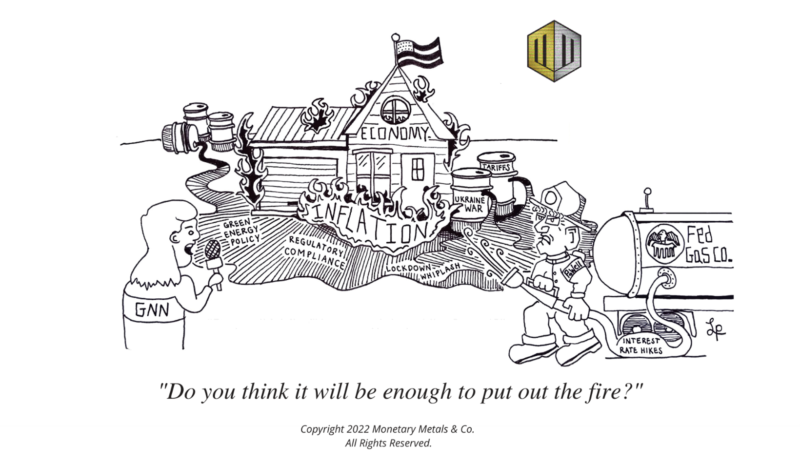

Will Interest Rate Hikes Fix Inflation?

Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same.

Read More »

Read More »

Ep – 34 The BearLord: A Recession Cometh

We welcome Travis Kimmel, AKA the Dollar Fatalist, the Wizard of Web1, the Crusher of Cryptocurrency dreams, and our favorite moniker, the illustrious BearLord, onto the Gold Exchange Podcast!

Read More »

Read More »

Analysis Featured In Gold We Trust Report 2022

For well over a decade, Ronnie Stoeferle has written the annual In Gold We Trust Report. Since 2013 it has been co-authored by his partner Mark Valek and has provided a holistic assessment of the gold sector and the most important factors influencing it, including interest rates, debt, central bank policy and fundamental analysis.

Read More »

Read More »

Monetary Metals CEO Keith Weiner Interviewed on RealVision

CEO of Monetary Metals Keith Weiner sat down with Michael Green of RealVision to discuss how Monetary Metals increases gold’s value proposition by paying interest on gold and silver holdings and the inevitable debasement of fiat currencies. Keith and Mike discuss the inherent volatility of Bitcoin, Costco’s ability to maintain its price point, and the colossal meltdown of the Terra stablecoin.

Read More »

Read More »

Understanding Gold and the Death Blow to Crypto

CEO of Monetary Metals Keith Weiner sits down with Matthew Piepenburg of Matterhorn Asset Management to discuss gold, fiat and crypto. What is real wealth? What’s the relationship between interest rates and Bitcoin? Do central banks know what they are doing? Matt and Keith sit down to discuss it all.

Read More »

Read More »

Open Letter to Lex Fridman and Michael Saylor

Gentlemen: I am writing to you in response to your Podcast #276. The first thing I want to say is—well done! You talked about economics and money for four hours and attracted over two million viewers. The monetary system faces grave problems and discussing them is important.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

11 days ago -

SNB Sight Deposits: increased by 3.4 billion francs compared to the previous week

18 hours ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

11 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

11 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

17 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 3.4 billion francs compared to the previous week

18 hours ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Did the MMT Camp Correctly Predict the Post-Covid Economy?

-

Word of the Day: Performative

-

In diesen Städten sind die #Mieten am stärksten gestiegen #wohnen #shorts

In diesen Städten sind die #Mieten am stärksten gestiegen #wohnen #shorts -

5 Entscheidungen, von denen Dein Wohlstand abhängt

5 Entscheidungen, von denen Dein Wohlstand abhängt -

Bayer Hauptversammlung: Damit müssen Aktionäre jetzt rechnen!

Bayer Hauptversammlung: Damit müssen Aktionäre jetzt rechnen! -

Chapter 9. From Taxes to Trade, More Secession Means More Freedom

-

Woods Exposes the Federal Reserve System

-

Increase of 1.7% in nominal wages in 2023 and 0.4% decline in real wages

-

SNB returns to quarterly profit thanks to Swiss franc weakness

SNB returns to quarterly profit thanks to Swiss franc weakness -

The Danger of the West’s Neglect of Individual Rights

More from this category

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

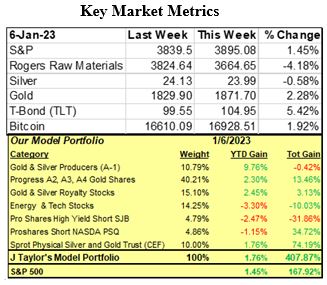

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

The Russians (Propaganda) Are Coming!

The Russians (Propaganda) Are Coming!15 Sep 2022

Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance8 Sep 2022

Keith Weiner on the VoiceAmerica Business Channel

Keith Weiner on the VoiceAmerica Business Channel7 Sep 2022