Category Archive: 6a.) GoldCore

Gold Hits 10 Week High At $1,328/oz as Trade Wars Spur Safe Haven Demand

Gold has consolidated on yesterday’s gains and is marginally higher as risk aversion creeps back into markets. Gold rose 1.5% yesterday to its highest level in more than three months. Concerns that trade wars look set to escalate globally and fears that President Trump’s threat of tariffs on Mexico will hurt the global economy are spurring safe haven demand.

Read More »

Read More »

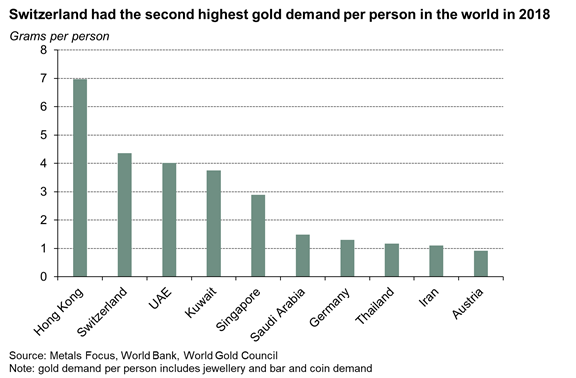

Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate20% plan to invest in gold in the next 12 monthsAlmost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online

Read More »

Read More »

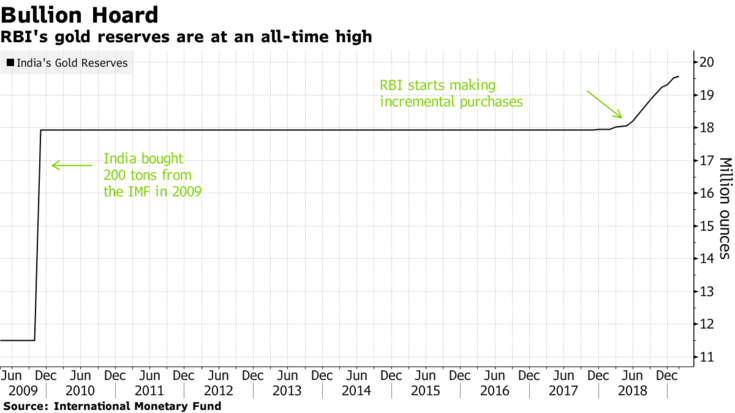

World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBCMany other central banks including large creditor nations Russia and China are also adding to gold holdings. India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their reserves.

Read More »

Read More »

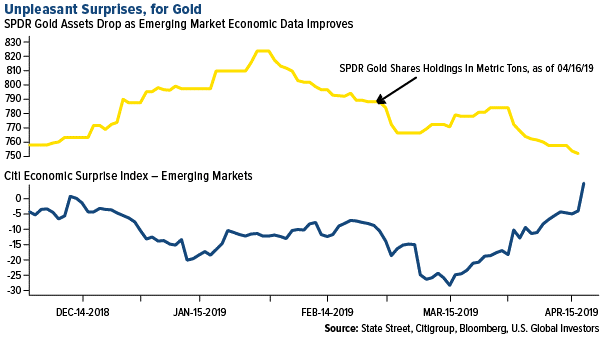

SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey.

Read More »

Read More »

JAN SKOYLES on Our Obsession With Being ‘Busy’

In this extract from the ‘Time VS Money: The Golden Question’ episode of Renegade Inc, Jan Skoyles discusses the idea of ‘Time Is Money’ and the fetishisation of being busy. Watch Renegade Inc. here: https://www.rt.com/shows/renegade-inc/ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ Renegade Inc. provides … Continue...

Read More »

Read More »

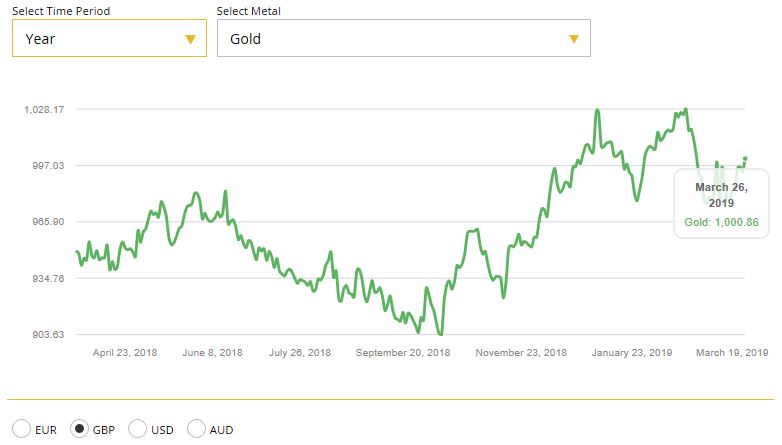

Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks

– Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland

– Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage

– UK sees sharp slowdown in mortgage approvals in February as housing market slows

– Gold surges to near all time record highs in Australian dollars at $1,860/oz

– Gold in sterling, euros and...

Read More »

Read More »

5 Key Ways to Prosper in the Coming Systemic Crisis

Time To Take Power and Control Back From The System

1. Diversify Your Investments and Savings

2. Invest and Own Gold and Silver in Safest Ways

3. Avoid Excessive Debt or Leverage

4. Prepare For Investment Opportunities

5. Invest In Your Education. Learn and Grow

Topics considered are

- Political, financial, economic and monetary systems are failing and will likely collapse

- Our human built economic systems are dependent on the...

Read More »

Read More »

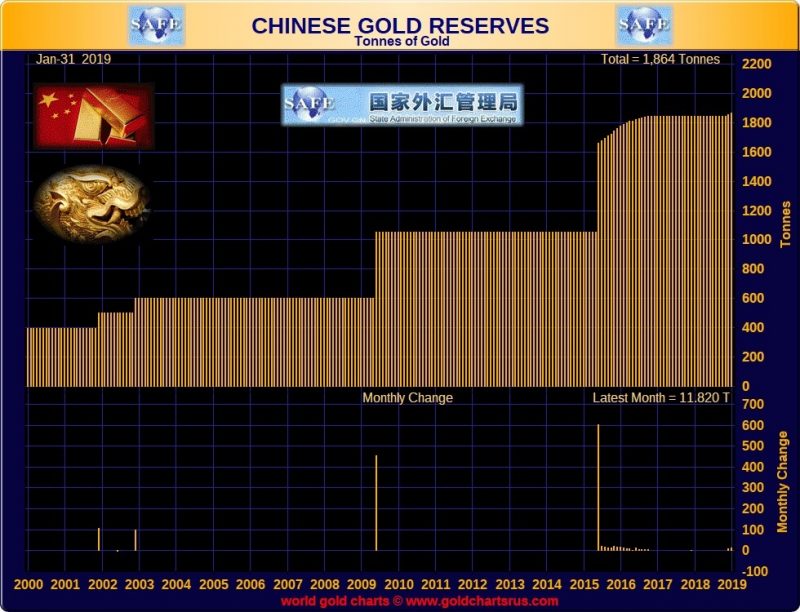

China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning.

The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces.

Read More »

Read More »

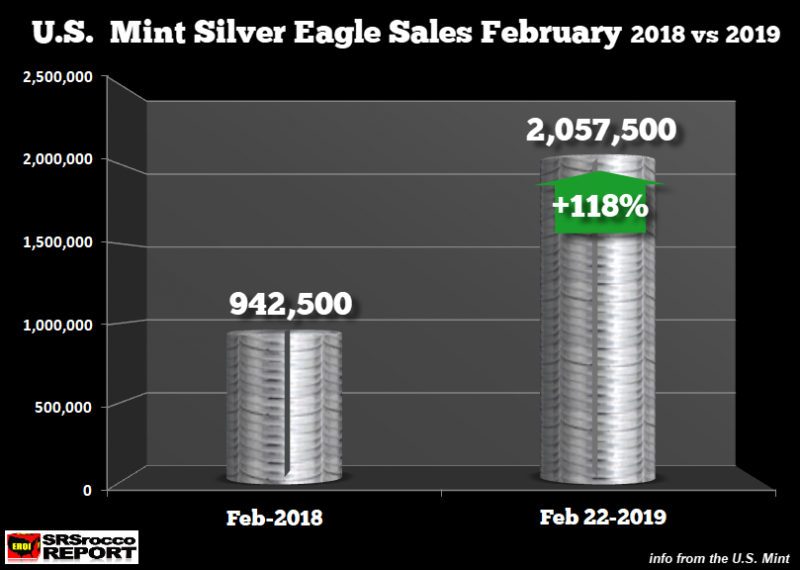

U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February. Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories. U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell.

Read More »

Read More »

Jim Willie Interviews GoldCore – Global Financial Crisis II Is Upon Us

- Event flow in the slowly erupting global financial crisis and what is to come for financial markets, bonds, banks including Wells Fargo and bankrupt governments in the UK, EU and US

- The brutal fate of paper wealth and assets including stocks, corporate and government bonds, US Treasuries and the "Third World" dollar with their inherent risk in the coming Global Monetary RESET

- US Treasuries are no longer a risk free asset and gold...

Read More »

Read More »

Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen

-Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen. – Growing demand from investors to relocate tangible assets out of the UK. – “Zurich continues to be the most sought-after location for storage, but Dublin has already surpassed Hong Kong and will likely usurp the second spot from London”.

Read More »

Read More »

Learning from Tragic Venezuela Today – Store Gold Bullion In Safest Ways

– Store gold bullion in the safest ways possible and learn from Venezuela’s gold battle with the Bank of England and Trump’s White House

– What in the world is happening in Venezuela and to the people of Venezuela’s gold?

– How you store gold and invest in gold is vitally important in these uncertain times

As a sovereign nation, Venezuela should have the right to take possession of and sell their gold on the open market. As sovereign individuals,...

Read More »

Read More »

Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures. Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S.

Read More »

Read More »

Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit. – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote. – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies.

Read More »

Read More »

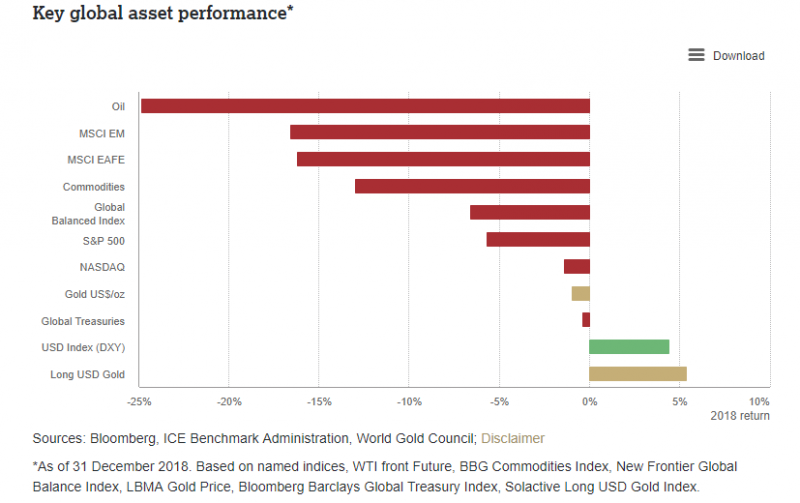

Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC

As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability, monetary policy and the US dollar, structural economic reforms.

Read More »

Read More »

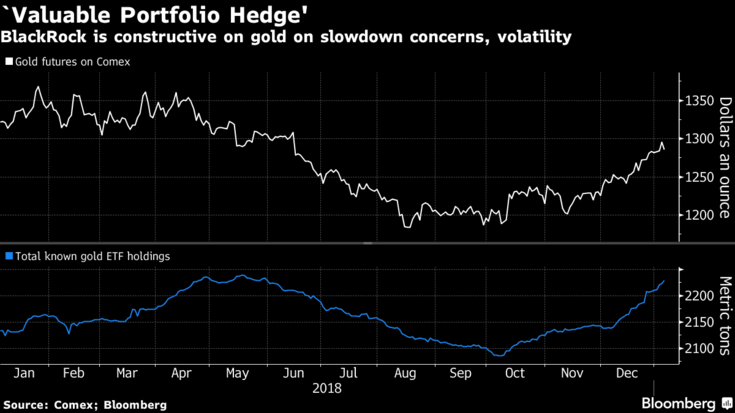

Blackrock Say Gold Will Be A “Valuable Portfolio Hedge” In 2019

“We’re experiencing a slowdown,” says Blackrock fund manager. Global Allocation Fund adding to gold exposure through ETFs. Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising”. Gold bullion has been a “store of value for a very long time”.

Read More »

Read More »

China Adds 320,000 Ounces To Gold Reserves – First PBOC Purchase Since October 2016

China increases gold holdings by large 320,000 ounces. Gold bullion remains a tiny component of the People’s Bank of China massive foreign exchange (FX) reserves which rose to $3.073 trillion. China’s gold reserves rose for first time since October 2016 to 59.56 million ounces by the end of December (1,853 metric tons) from 59.24 million ounces. Gold climbed 5% in December on equity rout, growth concerns

Read More »

Read More »

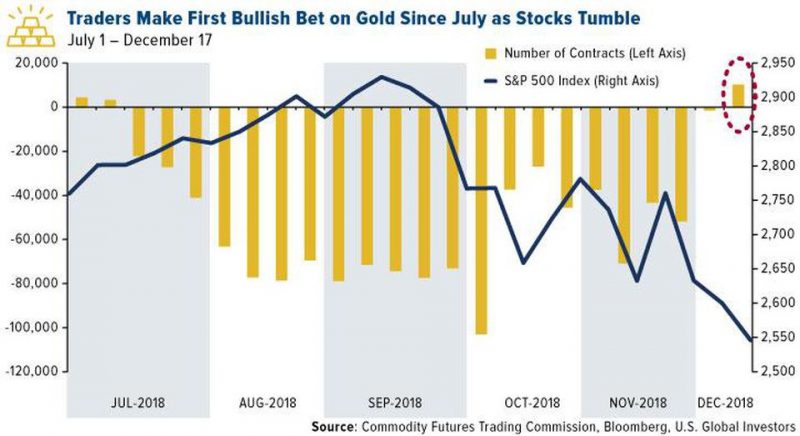

Gold Prices Likely To Go Higher In 2019 After 4 percent Gain So Far In Q4

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data.

Read More »

Read More »

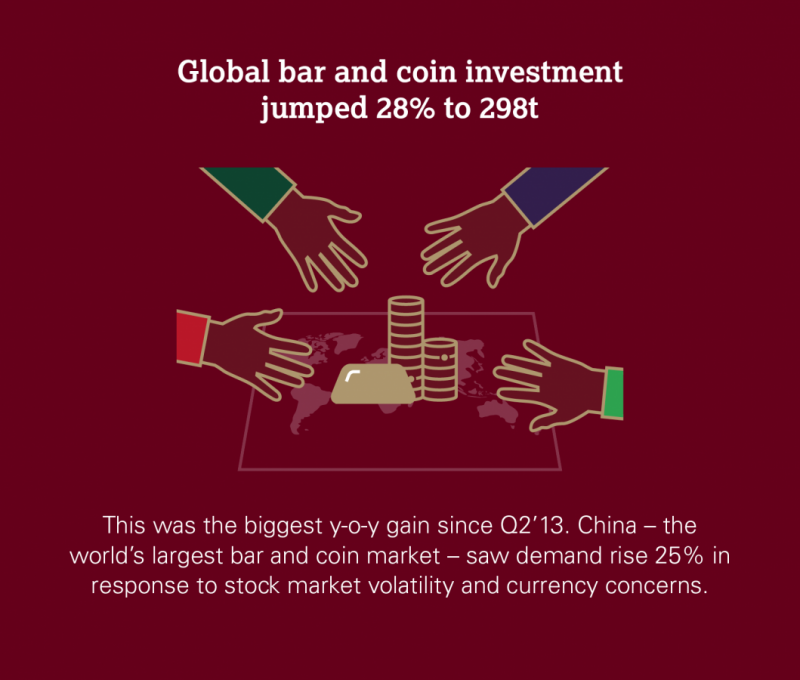

Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk. Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows. Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy.

Read More »

Read More »

Gold Analysts At LBMA See 25percent Return To $1,532/oz In 12 months

The price of gold is expected to rise to $1,532 an ounce by October next year, delegates to the London Bullion Market Association’s (LBMA) annual gathering predicted on Tuesday. A poll of delegates at the LBMA conference in Boston also predicted higher prices in a year’s time for silver, platinum and palladium.

Read More »

Read More »