Category Archive: 6a.) GoldCore

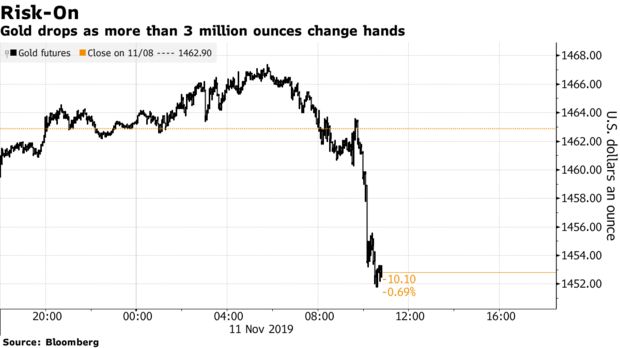

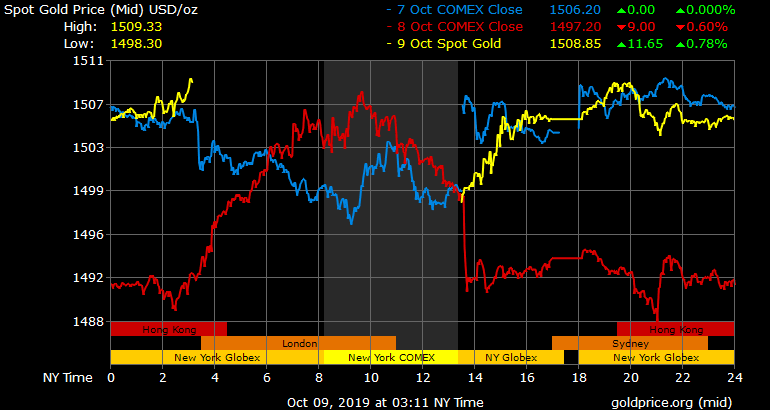

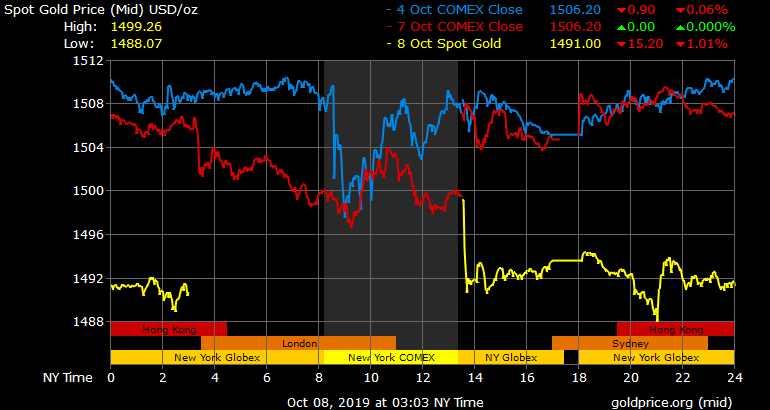

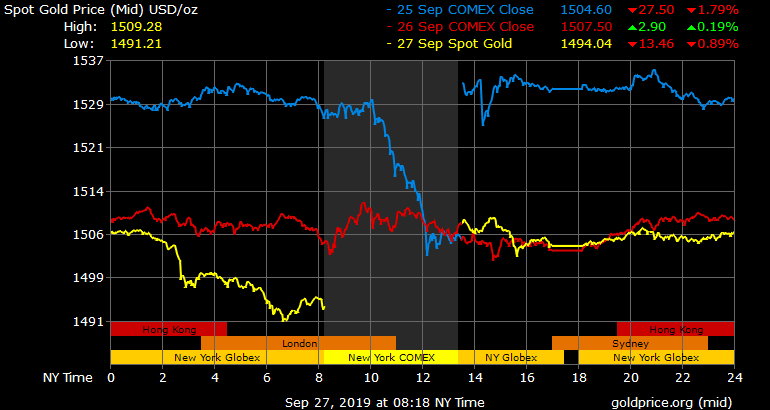

Gold Price Falls on Selling of Gold Futures Equal to 3 Million Ounces in 30 Minutes

◆ Gold price falls to a three-month low as concentrated selling of COMEX gold futures contracts equal to over 3 million ounces are sold in 30 minutes◆ 33,596 contracts were aggressively sold in the 30 minutes between 10:00 and 10:30 a.m. New York time which is more than triple the 100-day average for that time of day

Read More »

Read More »

Gold ETF and Central Bank Gold Buying Supports Gold Demand In Q3

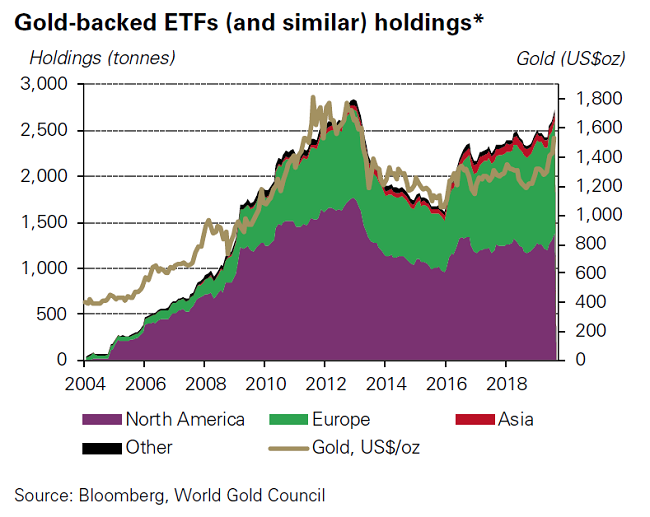

Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016. A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3. Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018.

Read More »

Read More »

Time To Replace Bonds With Gold

◆ “It may be time to replace bonds with gold”according to the just released excellent new Investment Update by the World Gold Council.◆ Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns.

Read More »

Read More »

Global Economy Faces ‘Scary Situation’ – Billionaire Investment Manager Dalio Warns

Likely to have a downturn while “there is not effective monetary policy and that is a ‘scary situation’ – Billionaire Investment Manager Ray Dalio

Read More »

Read More »

Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again.

Read More »

Read More »

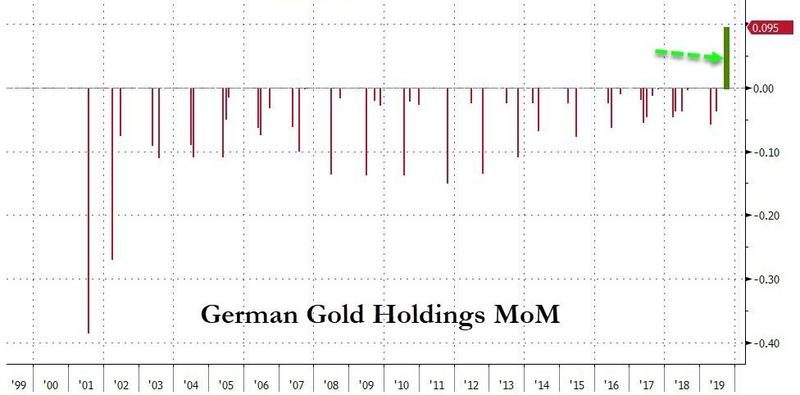

Bundesbank Buys Gold – Increasing Concerns About Deutsche Bank, European Banks, the Euro and Dollar

◆ The End Of Fiat In One Chart?◆ For the first time in 21 years, Germany has openly bought gold into its reserve holdings◆ With ECB mutiny and Deutsche Bank’s rapid demise, fears are rising of a looming financial crisis, and with that, Germany has shown a renewed interest in gold

Read More »

Read More »

JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’

◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch

Read More »

Read More »

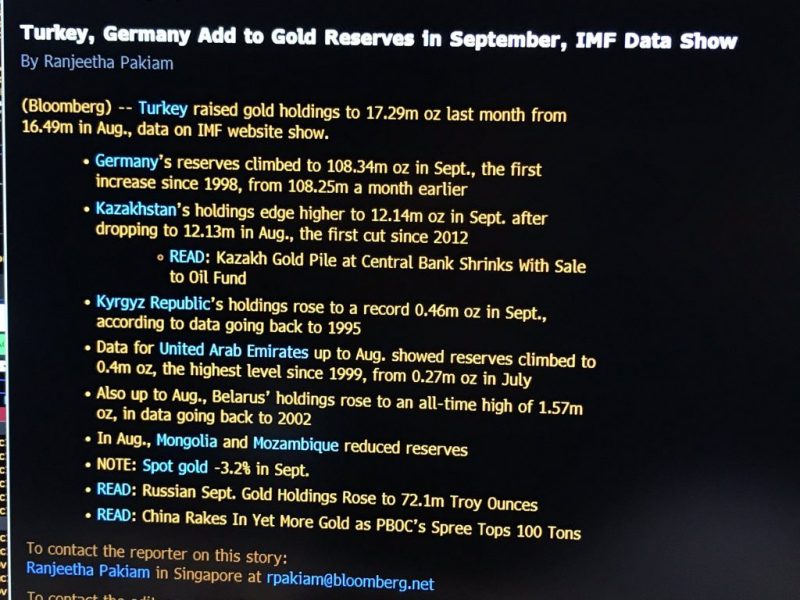

Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB

Read More »

Read More »

IMF Warning: ‘World’s Financial System Is More Stretched, Unstable and Dangerous Than It Was On the Eve of the Lehman Crisis’

The International Monetary Fund (IMF) has again warned that the world’s financial system is more stretched, unstable and dangerous than it was on the eve of the Lehman crisis. Quantitative easing, zero percent interest rates and massive financial repression has pushed investors – and in the case of pension funds or life insurers, actually forced them – into taking on ever more risk.

Read More »

Read More »

Dutch Central Bank: Gold Bars ‘Always Retain Their Value, Crisis Or No Crisis’

◆ “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system” says the Central Bank of the Netherlands ◆ “If the system collapses, the gold stock can serve as a basis to build it up again” astutely and prudently observes the Dutch Central Bank ◆ The Dutch people “hold more than 600 tonnes of gold. A bar of gold always retains its value, crisis or no crisis”

Read More »

Read More »

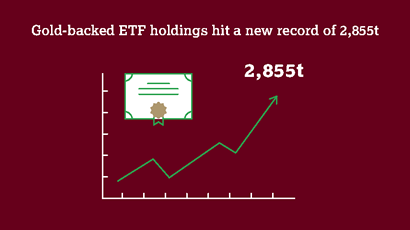

Gold ETFs See Holdings Reach All Time Record Highs In September

◆ Global gold ETF holdings reach all time record highs, increasing by 13.4% so far in 2019 on hedging and safe haven demand. ◆ Global gold ETFs, ETCs and similar products had US$3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2 tonnes(t) to 2,808t, the highest levels of all time in September.

Read More »

Read More »

China’s Central Bank Buys 100 Tons Of Gold As Trade and Dollar Tensions With U.S. Escalate

◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month. ◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious...

Read More »

Read More »

Chinese Buy Gold In Large Volume In Holiday Week as Gold Jewelry Sales ‘Soar’

Gold is marginally lower today at $1,503/oz and stocks are mixed ahead of what are set to be tense U.S. and China trade negotiations. Gold sales are expected to accelerate through the end of the year due to weakening global economic conditions, according to Mike McGlone, a Bloomberg Intelligence senior commodity strategist as quoted by China Daily (see below).

Read More »

Read More »

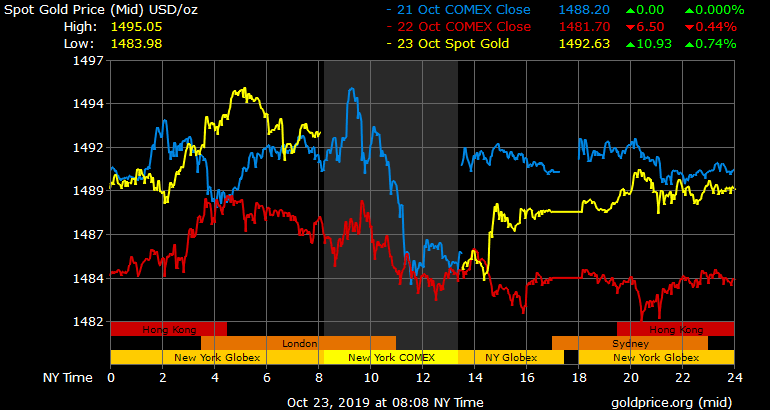

World’s Largest Gold ETF Sees Holdings Rise 1.8 percent to 924.94 Tonnes In One Day

◆ Gold prices have inched 0.3% higher today as a sharp drop of nearly 2% yesterday has attracted bargain hunters. ◆ Gold tested support at $1,500/oz after another peculiar sell off in the futures market saw prices fall $30 in two hours on the COMEX yesterday with most of the selling coming after European and London markets had closed.

Read More »

Read More »

Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech. ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal.

Read More »

Read More »

Central Bank Gold Buying Is “Sustainable and Indeed May Accelerate”

Why central banks including China and Russia will keep buying gold due to concerns about the outlook for currencies, including the dollar and the euro, Mark O’Byrne, Research Director of GoldCore told Marketwatch. While the gold tonnage demand from central banks in recent months has been significant and near records, gold remains a tiny fraction of most central banks’ massive foreign-exchange reserves,” O’Byrne says, adding that the trend is...

Read More »

Read More »

Gold Is Overvalued in Short-Term, Says Goldcore’s O’Byrne

Aug.26 -- Mark O’Byrne, executive director at Goldcore Ltd., discusses his outlook for gold amid the global uncertainty. He speaks on “Bloomberg Markets: European Open.”

Read More »

Read More »

Gold Consolidates Near All Time High In British Pounds

Sterling is under pressure today and gold near all time record highs in sterling (see chart) due to the likelihood that Britain’s ruling Conservative party will elect Boris Johnson (aka ‘BoJo’) as its new leader and Prime Minister today.

Read More »

Read More »

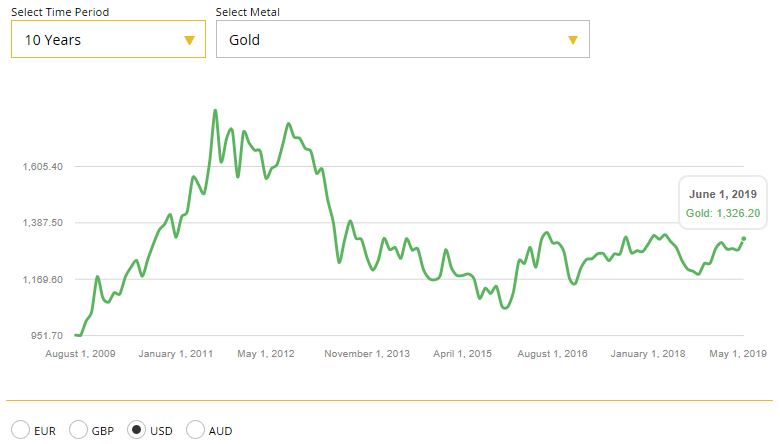

Gold and Silver Will Surge to Record Highs Over $1,900 and $50 Per Ounce – IG TV Interview

Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years.

Read More »

Read More »

Gold To Reach 6 Year High Over $1,400 on Uncertain Outlook for Global Markets

Gold is finally gaining the traction needed to boost prices to a level not seen since 2013 as concern mounts over increased trade war tensions and the global growth outlook. Bullion may touch $1,400 an ounce this year as investors hedge risk, according to Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone Inc.

Read More »

Read More »