Category Archive: 6a.) GoldCore

Are Gold And Silver Obsolete In The Digital Age? – Mark O’Byrne Interview

Subscribe to our Free Financial Newsletter:

http://crushthestreet.com

Mark O'Byrne is our brand new guest to give us a diagnosis of the economy and the stock markets.

We get fresh insights on the outlook for Gold in 2018, and look at the long-term relevance of Precious Metals in the digital age, alongside Bitcoin’s emergence as a digital store of value.

TOPICS IN THIS INTERVIEW:

01:00 Diagnosis of the economy and rising inflation

06:00 Possible...

Read More »

Read More »

Oil price highest in 3 years, gold ready to follow

U.S. withdraws from Iran nuclear deal. Oil jumps past $70. Argentina hikes interest rates to 40%. S. 10 year disparity. Western buying returns to gold. Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%).

Read More »

Read More »

Gold Mining Supply Looks Set To Decline

Global demand for gold is increasing while new discoveries of gold remain small. Gold mining output in Australia is forecast to decrease by 50% in the next eight years. Decline in global gold mining supply makes a price increase almost certain.

Read More »

Read More »

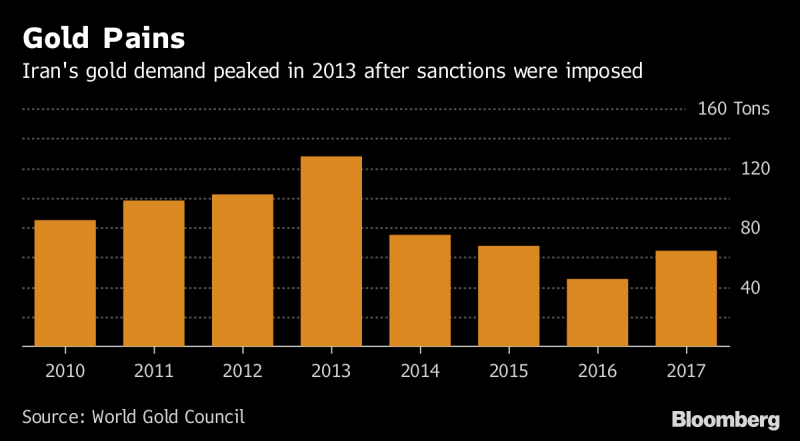

Iran’s Gold Demand May Surge On Trump Sanctions

Iran’s gold demand will probably be “strong” for the next few months and then gradually decline as U.S. sanctions start to take effect, according to the researcher who covers the country for Metals Focus Ltd. After a previous set of sanctions was imposed on Iran in 2012, it took two years for the country’s gold demand to start falling, according to data from the World Gold Council.

Read More »

Read More »

Own Some Gold and Avoid Overvalued Assets

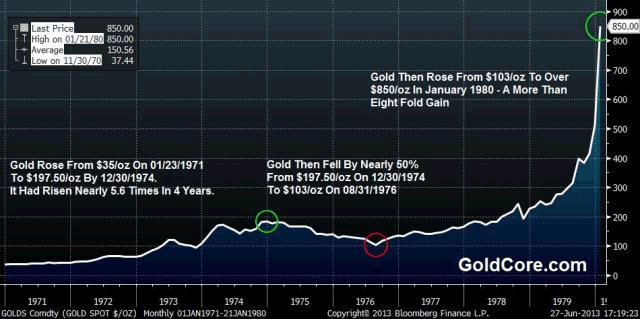

We could be heading for a golden age – or a return to the 1970s. The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number.

Read More »

Read More »

“Blood In The Streets” Of U.S. Gold Bullion Coin Market

Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25 percent from the year prior. However, April sales were up 29 percent from March.

Read More »

Read More »

New All Time Record Highs For Gold In 2019

New all time record highs for gold in 2019. ‘Powerful bull market’ will likely send gold to $5,000 to $10,000. If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’. Traditional portfolio of stocks and bonds will not protect investors. “Gold will replace bonds as the go-to hedge”.

Read More »

Read More »

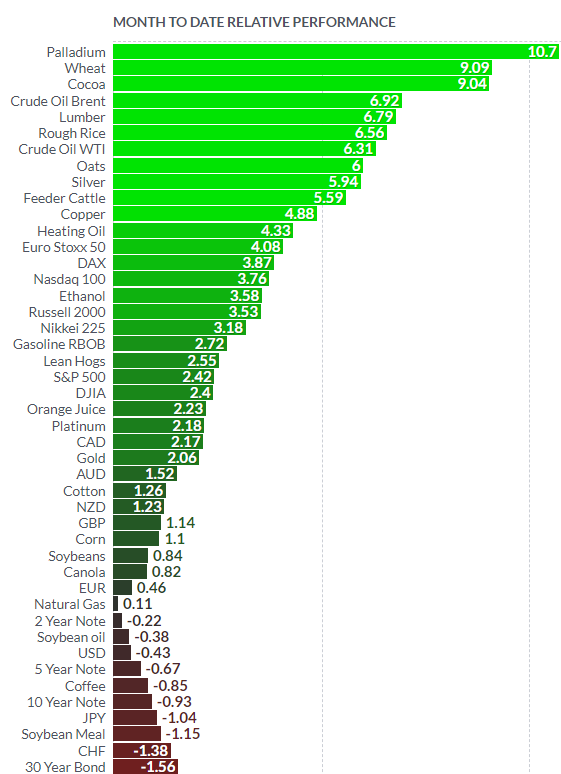

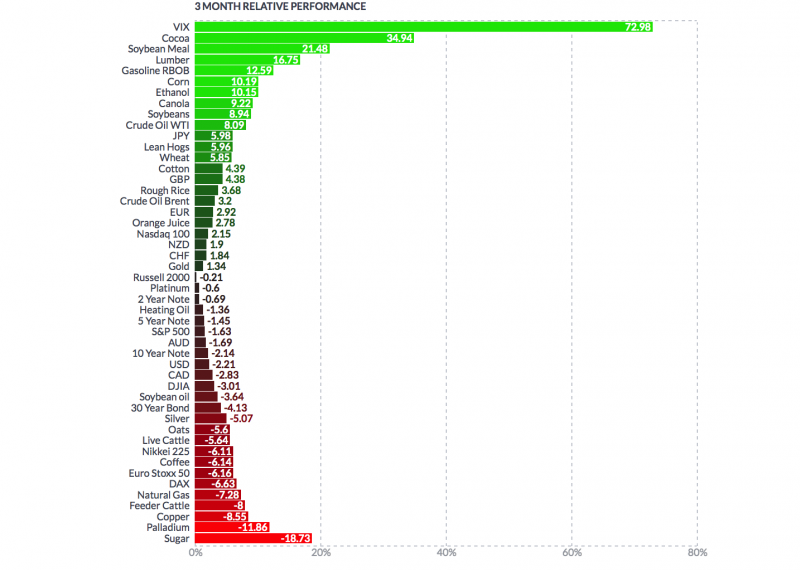

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in April (see table below).

Read More »

Read More »

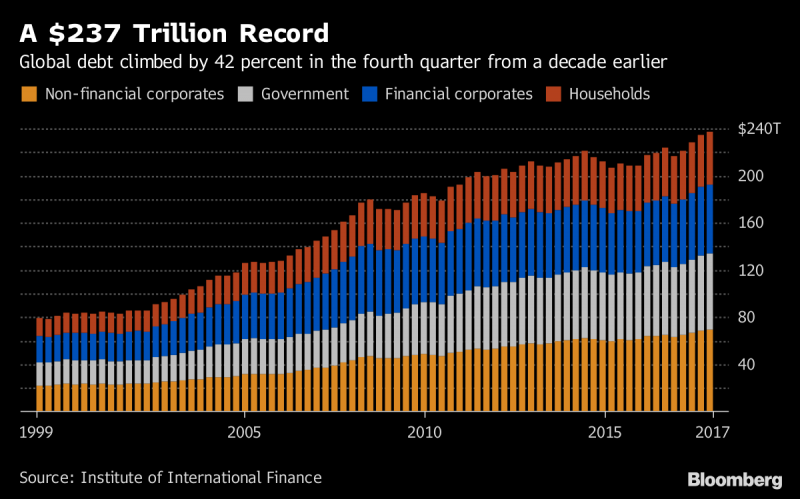

Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

Global debt bubble hits new all time high – over $237 trillion. Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD. Increase in debt equivalent to United States’ ballooning national debt. Global debt up $50 trillion in decade & over 327% of global GDP. $750 trillion of bank derivatives means global debt over $1 quadrillion. Gold will be ‘store of value’ in coming economic contraction. Global debt is the mother of all...

Read More »

Read More »

Volatile Week Sees Oil and Palladium Surge Over 8percent, Gold and Silver Marginally Higher and Stocks Gain

Gold & silver eke out small gains; palladium surges 8% and platinum 2%. Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk. U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns. Stocks rally and shrug off trade war, macro and geo-political risks. Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply. Russia-US tensions high: Trump warns attack ‘could be very soon or not so soon at all’.

Read More »

Read More »

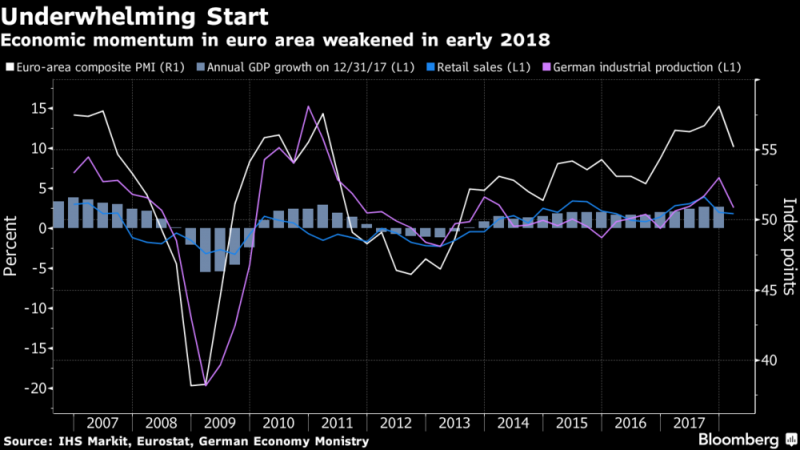

EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East. – Middle East war involving Russia may badly impact energy dependent & fragile EU. – Trade and actual wars on European doorstep show the strategic weakness of the EU. – Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations.

Read More »

Read More »

Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

Dow set to drop 300 points at open after Trump tweet today. Stocks see sell off and gold pops to test resistance at $1,350/oz. US stock futures suggest over 1% losses at New York open. Oil surged to a two-week high and has surged nearly 7% this week. U.S. bombing Syria may provoke escalation of conflict with Russia and wider conflict in volatile Middle East.

Read More »

Read More »

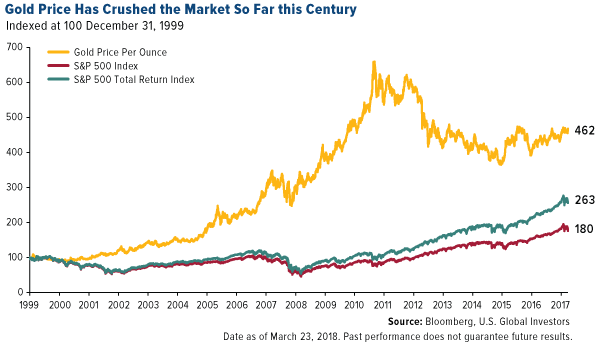

Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Read More »

Read More »

Jamie Dimon Warns Of Potential ‘Market Panic’

Jamie Dimon Warns Of Potential ‘Market Panic’. JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’. In annual letter to shareholders Dimon warns of increased inflation and interest rates. Concerned QE unwinding could cause chaos as ‘markets will get more volatile’.

Read More »

Read More »

Silver Bullion: Should We Be Worried About Silver?

Silver Bullion: Should We Be Worried About Silver? Bloomberg’s Mike McGlone silver “set to test the $18 an ounce resistance level”. LBMA report: volume of silver ounces transferred in February fell by 24%. Standard Chartered: gold-silver ratio and supply/demand fundamentals favour silver. Gold/silver ratio at near two-year high on silver’s underperformance. Silver COT reports remain more bullish than at any time in history.

Read More »

Read More »

Brexit, Stagflation Pressures UK High Street

Brexit, Stagflation Pressures UK High Street. UK high street and wider consumer market feeling effects of financial crisis, Brexit and inflation. 350,000 retails jobs expected to disappear between 2016 and 2020. Centre for Retail Research predicts 9,500 shops to close this year and 10,200 in 2019. UK is ‘worst performing’ European market for new car registrations – Moody’s. UK’s growth outlook is the ‘worst in the G20’ – Institute of Fiscal...

Read More »

Read More »

Gold Is Money While Currencies Today Are “IOU Nothings”

Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. What is money anyway? First, it is a means of payment or medium of exchange. I prefer that first phrase. It is simpler. We all use money to pay our bills, to buy goods and services. We also accept money when we sell.

Read More »

Read More »

Gold Outperforms Stocks In Q1, 2018

Gold Outperforms Stocks In Q1, 2018. Gold signs off Q1 2018 with best run since 2011. Gold price supported by safe haven demand, interest-rate concerns and inflation. Trade wars and concerns over equity market have sent investors towards gold. ETF holdings highest in nearly a decade. Goldman Sachs: ‘The dislocation between the gold prices and U.S. rates is here to stay’.

Read More »

Read More »

“Stars Are Slowly Aligning For Gold” – Frisby

“Stars Are Slowly Aligning For Gold” – Frisby. Gold ends March with a third-quarterly gain, a feat not seen since 2011. Impressive gains seen despite tightening of monetary policy from Federal Reserve. Frisby – gold is set to break through technical resistance of $1,360. Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions. Now is opportune time for investors to buy gold, ahead of next quarter.

Read More »

Read More »

Uncle Sam Issuing $300 Billion In New Debt This Week Alone

US needs to borrow almost $300 billion this week alone. This is the largest debt issuance since 2008 financial crisis. Trump threatens trade war with its biggest creditor – China. Bond auctions have seen weak demand due to large supply and trade war concerns. $20 trillion mark reached in early September 2017; $1 trillion added in just 6 months. US total national debt level now exceeds $21.05 trillion and is accelerating higher.

Read More »

Read More »