Category Archive: 6a.) GoldCore

“Smart Move” By Prudent Investors Is To Diversify Into Gold

With no opportunity cost to holding a zero-yield asset such as gold, investors increasingly are adding it to their portfolios as a hedge. ◆ Gold retains its intrinsic value, something no paper currency has managed to do over history. ◆ Gold is insurance. Insurance isn’t supposed to make you rich; it’s supposed to keep you from being poor.

Read More »

Read More »

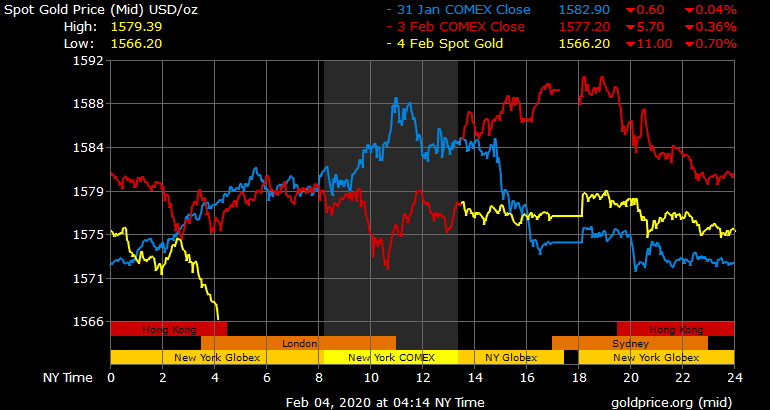

Gold Falls 0.6percent After Having A Seven Year Weekly High Close and 4percent Gain In January

Gold falls from seven year high weekly close ◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb.

Read More »

Read More »

Gold May Top $2,000 As “Prices Surge On Global Fear”

Gold was one of the few investments heading higher Monday as worries about the coronavirus outbreak led to a steep market slide. Gold is now up more than 20% in the past year, and trading near $1,600 an ounce, its highest level since 2013. Other precious metals, such as silver and platinum, have rallied too. Meanwhile, the Dow was down nearly 350 points in midday trading.

Read More »

Read More »

“All You Need To Do Is Own Gold and Silver” To Make Money In 2020

If you want to make money from investing, it’s simple: find a bull market and go long. And in 2020 gold and silver are in a bull market. by Dominic Frisby via the UK’s best-selling financial magazine Money Week

I ran into Jim Mellon at a party at the weekend, and we soon got talking about markets. One of his comments – stated with surety and simplicity – has stuck in my mind.

Read More »

Read More »

Why Do Prudent Indians Diversify Into Gold?

◆ Indians diversify into gold coins, bars and jewellery because it never fails them in an emergency◆ Indians are simply very prudent and practical and believe in channeling some of their wealth and saving into physical gold ◆ “A woman’s gold is both her personal treasure and plays a functional role as the family’s financial buffer” – Richard Davies

Read More »

Read More »

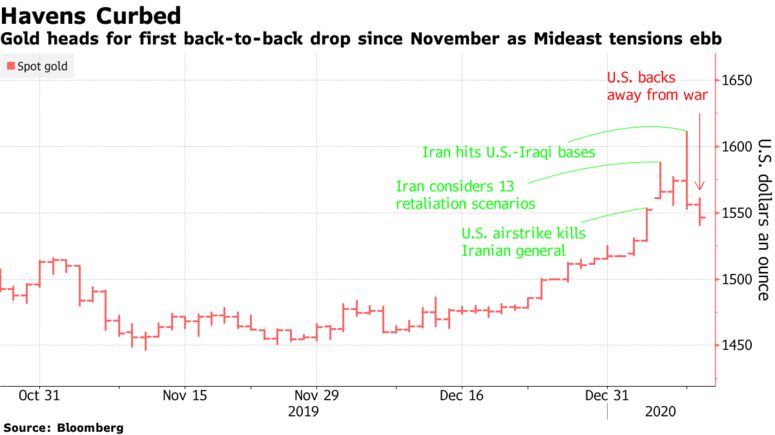

Gold Steadies After Falls As U.S., Iran Stepping Back From the Brink

◆ Haven demand ebbs as stocks climb with easing Mideast tensions◆ Palladium retreats from fresh record but holds near $2,100. ◆ There’s still very strong demand for gold “due to a host of financial, geopolitical and monetary risks,” said Mark O’Byrne, research director at GoldCore

Read More »

Read More »

Gold’s New Bull Market and Why $7,000 Per Ounce Is “Logical” (Part I)

◆ Gold could rise to more than $7,000 an ounce according to respected MoneyWeek contributor and fund manager Charlie Morris (Part I today and Part II tomorrow). A year ago, in my occasional free newsletter, Atlas Pulse, I upgraded gold – which was trading at $1,239 an ounce at that point – to “bull market” status for the first time since 2012.

Read More »

Read More »

Gold Surges To Test $1,600/oz, Oil Over $70, Stocks Fall on Risks of World War In Middle East

◆ Gold has surged to test $1,600 per ounce, up 4% so far in 2020 and building on the stellar near 18.9% gain in 2019 ◆ Gold is testing it’s highest levels since 2013 as investors diversify into gold; Goldman, Citi and other gold analysts are advocating gold bullion as important hedge in crisis ◆ Oil prices have surged with Brent crude reaching $70 per barrel; concern over oil supplies from Iran, Iraq and other nations as U.S. State Department warns...

Read More »

Read More »

Outlook 2020 | Buy Gold and Silver To Hedge Massive Risks including U.S. ‘Insolvency’

Buy gold and silver to hedge risks in 2020. IG interview Mark O’Byrne of GoldCore

With late cycle risks and concerns about global growth, many Wall Street analysts are increasingly bullish on gold. Mark O’Byrne, founder at GoldCore spoke to IGTV’s Victoria Scholar about the outlook for gold in 2020.He explained why most analysts including GoldCore are optimistic on both gold and silver.

Read More »

Read More »

Fed Is Monetizing 90 percent of U.S. Deficit to Keep Interest Rates from Rising and Crashing Markets

By Daniel R. Amerman, CFAAs can be seen in the graph above, for the last 12 weeks there has been a stunning visual correlation between the yellow bars of the total weekly funding of deficits by the Federal Reserve, and the green bars of the weekly deficit spending by the United States government.

Read More »

Read More »

Gold Coins Worth Thousands Generously Donated To Salvation Army

◆ Gold coins worth thousands generously gifted to the charity again this year ◆ It just means so much … because it means that they went out of their way to do something extra special…” ◆ Salvation Army gold donors keep giving gold coins including Gold Krugerrands anonymously every year◆ At least three gold coins worth some $4,500 have again been generously gifted to charity this year (that we know of)

Read More »

Read More »

The Most Important UK Election of the Century So Far

There’s only one story in the UK this morning – it’s the day Britain goes to the polls. It’s no exaggeration to say that this election is probably the most important of the century so far. If the ruling Conservative party wins a clear majority, then some form of Brexit is almost certain to go ahead.

Read More »

Read More »

Gold $1600 In 2020 as Case for Diversifying into Gold ‘as Strong as Ever’ – Goldman

Gold will climb to $1,600 over the next year – Goldman. ◆ Goldman is still forecasting that gold will climb to $1,600 over the next year due to investment demand. ◆ Investors should diversify their long-term bond holdings with gold, citing “fear-driven demand” for the precious metal – Goldman Sachs Group Inc.

Read More »

Read More »

Largest Gold Nugget in Britain Found in River in Scotland – “Experts” Concerned About a Scottish Gold Rush

The largest gold nugget in Britain has been found in a Scottish river, as experts reveal that members of the public are taking up hunting after watching YouTube clips. The diver, who wishes to remain anonymous, discovered the £80,000 “doughnut-shaped” nugget using a method called “sniping”, in which a prospector uses a snorkel and hand tools to scan the riverbed for treasures.

Read More »

Read More »

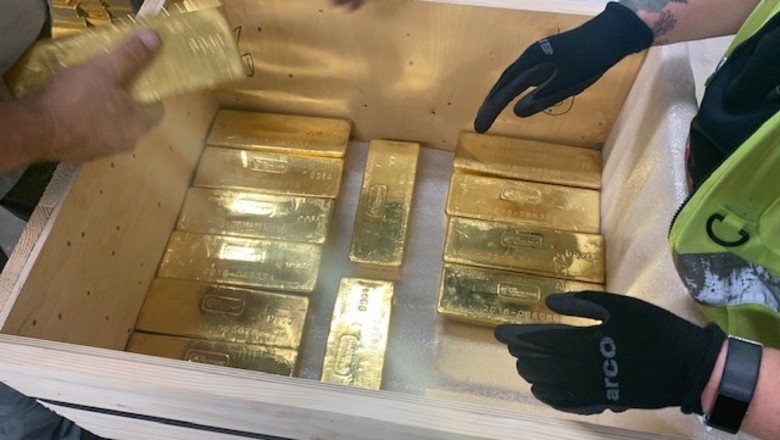

Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold

◆ Gold is flowing to strong hands in safer forms of gold ownership, in safer jurisdictions. ◆ Gold and silver bullion coins and bars owned by GoldCore’s clients have been moved from Hong Kong to Singapore. ◆ Central bank and institutional gold rush is beginning as prudent money diversifies fx reserves by buying gold & repatriates their gold from London and New York.

Read More »

Read More »

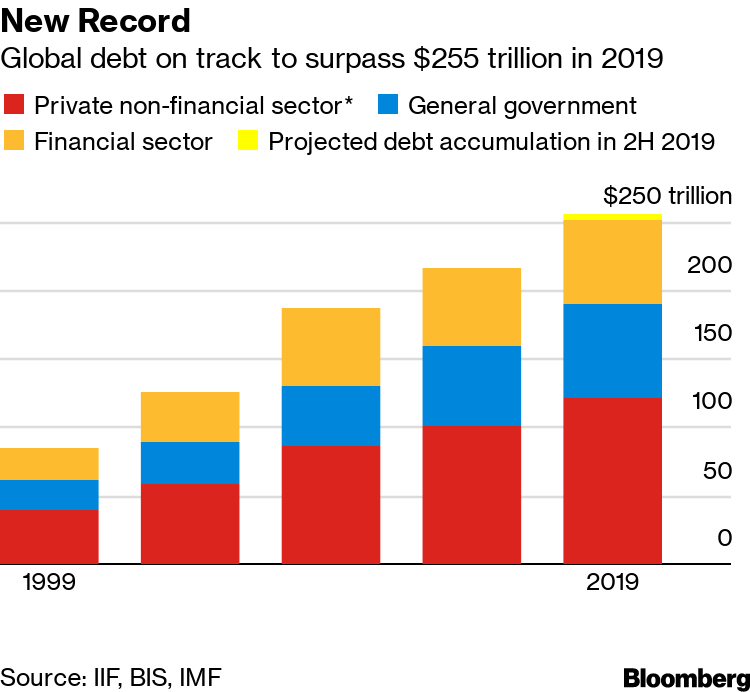

$255 Trillion Global Debt Bubble May Burst In 2020 – Prepare Now

◆ Global debt has risen to another record at $255 trillion due to cheap borrowing costs. ◆ A decade of easy money has left the world with a record $250 trillion of government, corporate and household debt. ◆ This is almost three times global economic output and equates to about $32,500 for every man, woman and child on earth.

Read More »

Read More »

Eastern European Nations Buy and Repatriate Gold Due To Growing Risks To Euro and Dollar

◆ Prudent leaders in Eastern European countries are repatriating their national gold reserves and diversifying into gold due to geopolitical risks and monetary risks posed to the dollar, euro and pound◆ Slovakia has joined China, Russia and a host of countries buying gold or seeking to repatriate their gold from the Bank of England and the New York Federal Reserve◆ “Brexit and the risk of a global economic crisis put Slovak gold stored in Britain...

Read More »

Read More »

Global Gold Buyers Are ‘Confident’ in Gold

‘Retail Gold Insights 2019’ has just been published by the World Gold Council. It is a thematic analysis of their new consumer research survey. With a base of 18,000 participants across India, China, Russia, Germany, the US and Canada, we believe it is the largest ever consumer survey on the global gold market.

Read More »

Read More »

CNBC is careful to admit that owning GLD is not owning gold

Chris Powell of GATA writes today about how he finds it interesting that CNBC are careful to admit that owning the GLD ETF is not the same thing as owning physical gold, a theme that has run strongly throughout our market commentaries for many years.

Read More »

Read More »

True US Economy About To Be ‘Revealed’ – Stockman Interview

David Stockman is the former budget director for President Ronald Reagan and author of “Peak Trump: The Undrainable Swamp and the Fantasy of MAGA”. He believes that the market “can’t digest” all the money flooding into Wall Street and that the Federal Reserve responded with panic.

Read More »

Read More »