Category Archive: 6a.) GoldCore

Is the US Election the “Cork in the Bottle” for Gold and Silver?

Today we are taking our weekly look at the charts for gold and silver.

Republicans and Democrats continue to play the “will they, won’t they?” game over another stimulus package in a Covid19 ravaged US economy. An agreement on a package will ultimately be seen as positive for the markets but, with the US Election just weeks away this may prove to prolong negotiations or postpone decisions until the results of the election are clear and...

Read More »

Read More »

Gold and Silver Set for a Breakout?

Today we are taking our weekly look at the charts for gold and silver. Corvid 19, the US Election and US Financial Stimulus talks have given gold plenty to digest over the last week. On a short term basis gold has been taking a lot of signal from the fortunes of the stock markets and increased hopes of agreement of a financial stimulus package gave a boost to both stock markets and the gold price.

Read More »

Read More »

Precious Metals Nowhere Near Cycle Highs – Brace for Gains!

In today’s video GoldCore’s Mark O’Byrne is interviewed by the Wealth Research Group, discussing the start of a new bull run for gold and silver and what we can expect.

Read More »

Read More »

Is Silver about to “Pop” or “Drop”

The chart of silver at the moment shows that it is poised for a breakout move. It has failed on a number of occasions recently to close above resistance at $24.40.

Read More »

Read More »

Where Next for Gold & Silver

Markets have struggled to find a clear direction as they attempt to digest US election news, debate performance, the impact of increased Covid-19 restrictions in many countries and vaccine news.

Read More »

Read More »

Heavy Metal Selling

Anxiety about an increase in Covid19 cases and fears of a second wave coupled with revelations of historic money laundering practices of major global banks weighed heavily on financial markets yesterday.

Read More »

Read More »

Gold is Looking Strong as it Tests Resistance

Since it’s sell-off from it’s early August high, gold has been stuck in an ever decreasing range. Having had a remarkable rally to an intra-day high of $2,078 on the 7th of August Gold has traded sideways and consolidated. This has been viewed by many market commentators as a healthy pause in gold’s bull rally as when markets go parabolic they tend to retrace just as fast.

Read More »

Read More »

MARK O’BYRNE: GET READY FOR TRIPLE-DIGIT SILVER!

One of The World's Top Precious Metals Experts, MARK O'BYRNE of GOLD CORE LTD, Joins Michelle To Breakdown The Future Of Silver & Gold!

Read More »

Read More »

Gold, Silver Jump After Swings Amid Weak Dollar and Economic Woe

Spot gold headed for back-to-back gains as investors weighed the outlook for the metal’s record-setting rally after this week’s dramatic price swings. Silver climbed the most in more than five years.

Read More »

Read More »

Value of gold stored by Irish metals broker GoldCore surges past €100m

Investment in gold has risen during pandemic. The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

Gold prices last week topped the $2,000-per-ounce level for the first time as investors seek havens...

Read More »

Read More »

Perfect Storm for Precious Metals Leads to Price Correction

Gold fell by nearly 6% yesterday and silver by a whopping 15%, the largest one day loss in over 7 years. The futures market saw massive volumes of selling with over 1.6 bn ounces of silver contracts sold yesterday. That’s a value of over $40 billion.

Read More »

Read More »

MARK O’BYRNE on the greatest ponzi scheme in mankind

An experiment, which was only supposed to buy us some time, has become the norm - and has led to massive monetary debasement. Mark O’Byrne @MarkTOByrne explains how and why we got here.

Full episode available here: https://www.youtube.com/watch?v=N_l2a3qCItY

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Renegade Inc. provides its members with the content and connections that help navigate the ‘new normal’. Finding the people who are thinking differently...

Read More »

Read More »

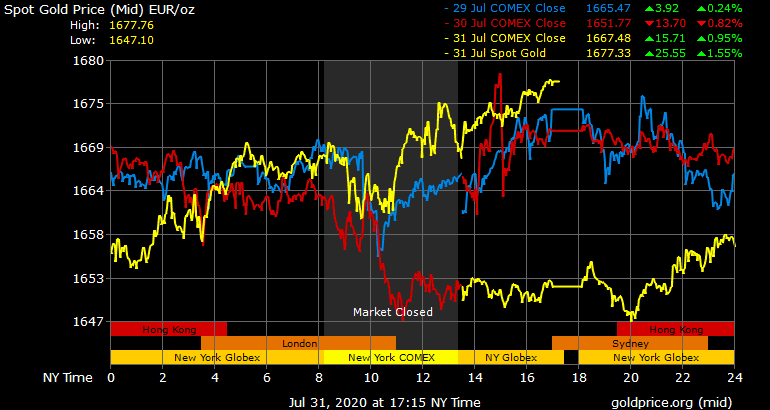

Short Term Weakness Likely Prior To A “Massive Short Squeeze Propels” Gold and Silver “To Much Higher Levels” – GoldCore

Gold and silver are set for a 5% and 6% gain this week and a significant 11% and 30% gain in the month of July.

Read More »

Read More »

Gold Reaches $2,000/oz Prior to Two “Concerted Attacks” In Futures Market

The King Report“Anyone that’s been around the block a few times with gold knows that at some point ‘they’ will stage a concerted effort to drive gold lower.” December gold hit $2,000 at 21:19 ET Monday. It then retreated and traded sideways until 22:50 ET. Then someone slammed gold down to $1,955 in 20 minutes. This is obvious “impact trading.” Gold then traded sideways for over four hours.

Read More »

Read More »

Gold futures end a stone’s throw away from a record

Gold futures ended higher for a fifth straight session Thursday, with the most-active contract just short of notching a settlement record, highlighting feverish demand for bullion amid the worst pandemic in over a century.

Read More »

Read More »

Silver Breaks Out!

The price of an ounce of silver broke through the resistance level at $21 and continued to rise to $22.75, a level not seen since 2013! Over the last few weeks investors have been taking advantage of any pullback in the price of silver to add to their positions, which has continued to underpin this run higher.

Read More »

Read More »

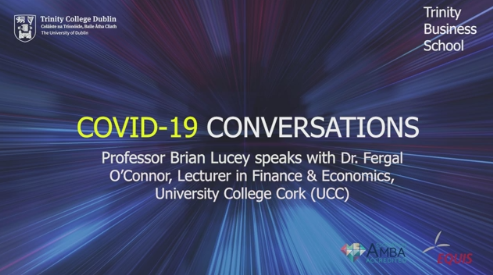

Gold Protects from Financial Crisis and Crashes Throughout History – Lucey and O’Connor

This is an interesting interview between Professor Brian Lucey and Dr. Fergal O’Connor, lecturer in finance and economics at University College Cork (UCC) on gold’s performance as a safe haven asset in the last 200 hundred years and in recent history including the 2008-2012 global financial crisis.

Read More »

Read More »

‘Death Cross’ Strikes U.S. Dollar As Virus Cases Grow

A resurgent coronavirus pandemic in the United States and the prospect of improving growth abroad are souring some investors on the dollar, threatening a years-long rally in the currency.

Read More »

Read More »

Gold Will “Trend Toward $10,000 Per Ounce Or Higher” Over The Next Four Years

You’re likely aware of the price action in gold lately. Gold has rallied from $1,591 per ounce on April 1 to $1,782 per ounce as of today. That’s a 12% gain in less than three months.

Read More »

Read More »

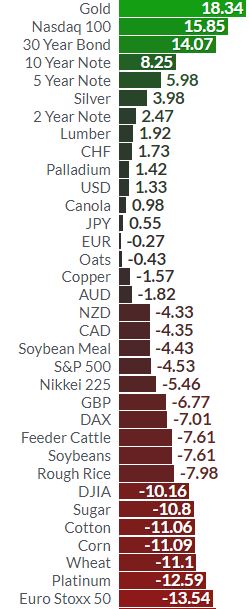

Gold Outperforms All Assets In 2020 YTD as Enters Seasonal Sweet Spot of July, August and September

Source: Finiz.com

◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above).Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained...

Read More »

Read More »