Category Archive: 5.) The United States

America’s Nine Classes: The New Class Hierarchy

Eight of the nine classes are hidebound by conventions, neofeudal and neocolonial arrangements and a variety of false choices. There are many ways to slice and dice America's power/wealth hierarchy. The conventional class structure is divided along the lines of income, i.e. the wealthy, upper middle class, middle class, lower middle class and the poor.

Read More »

Read More »

What Does It Take To Be Middle Class?

By standards of previous generations, the middle class has been stripmined of income, assets and purchasing power. What does it take to be middle class nowadays? A recent paper, The Distribution of Household Income and the Middle Class, used Census data to discuss what sort of income it takes to qualify as middle class, but reached no firm conclusion: people tend to self-report that they belong to the middle class based on income, but income is not...

Read More »

Read More »

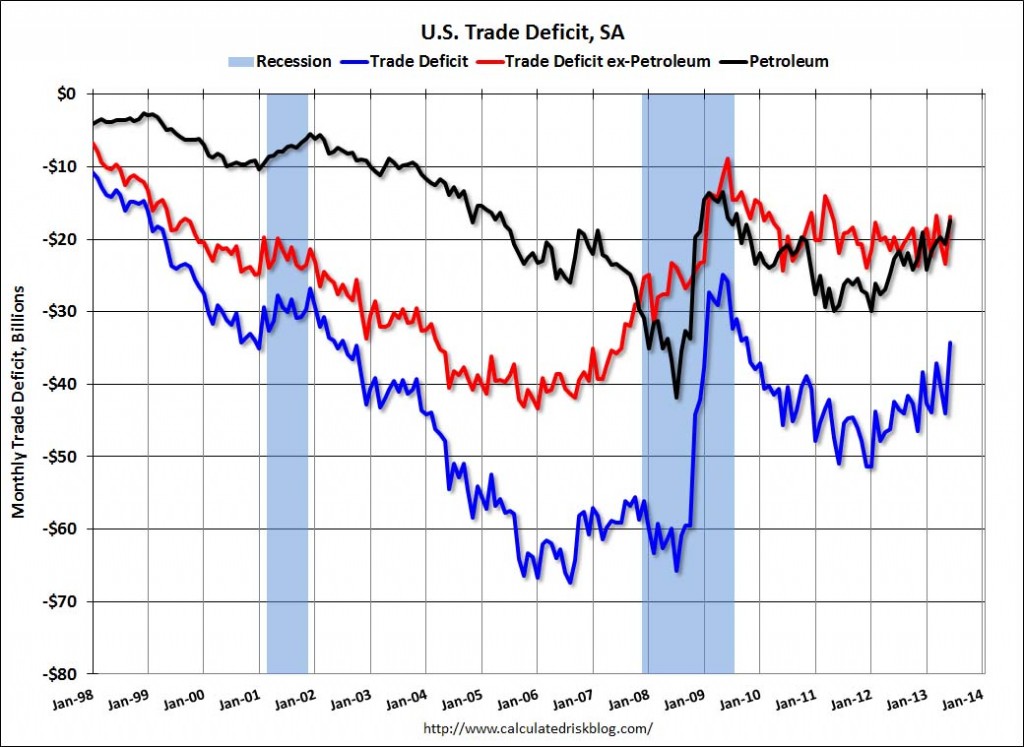

The U.S. “Oil Trade Deficit” Narrows

The United States trade balance has strengthened to a deficit of only -34.2 bln USD in June 2013. This is nearly half the record-high trade deficit of 62 bln. $ in August 2008 and not too far from record-lows of 26 bln. $ in July 2009, when oil was really cheap. In the first six … Continue reading »

Read More »

Read More »

Pictet Become “Secular Dollar Bulls” and Gold Bashers: Our Response

Precisely at the moment when the dollar undergoes a secular bashing with a 6% loss against the yen and 3% against the euro, Pictet publish their “secular dollar bull era” video and recommend investors to avoid gold. “Secular movements” in currency markets are mostly driven by current account (CA) surpluses or deficits, while housing …

Read More »

Read More »

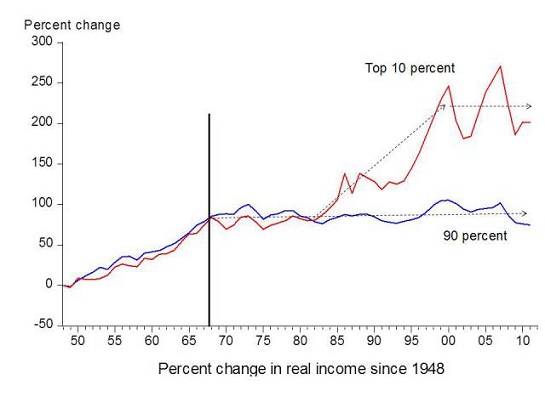

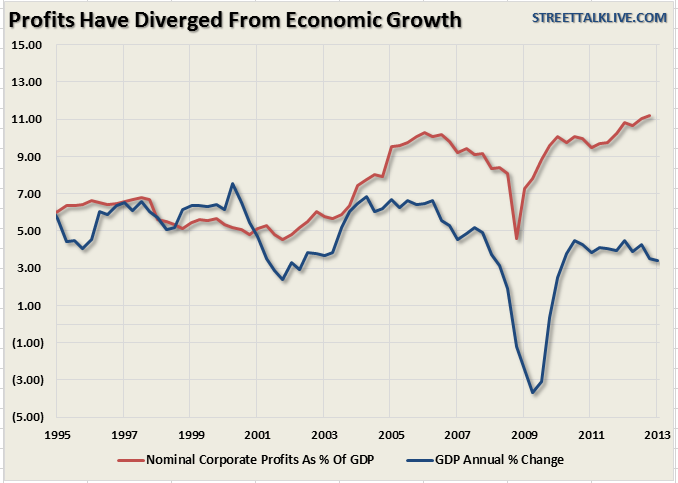

The Great “American” Divide

Disconnect between Wall Street and Main Street. While asset prices are inflated by continued Fed interventions, boosting profits widening the wealth gap between the top 20% of Americans and the rest.

Read More »

Read More »

The “Sell in May, Come Back in October” Effect and the 19 Fortune-Tellers of the FOMC

The U.S. economy regularly improves between October and April, this year additionally fueled by "unlimited" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies. Update 2013: The Case-Shiller index continued to climb in April 2013; it became clear that this year the "Sell in May" …

Read More »

Read More »

Is U.S. Housing Really Recovering? Pros and Cons

The U.S. housing market is the main driver for risk on/off movements and therewith implicitly of the gold price. We state charts, e.g. Shiller Home Price Index and U.S. New Home Sales statistics, arguments in favour of a housing recovery and the counter-arguments.

Read More »

Read More »

Is U.S. Housing Really Recovering? A Discussion

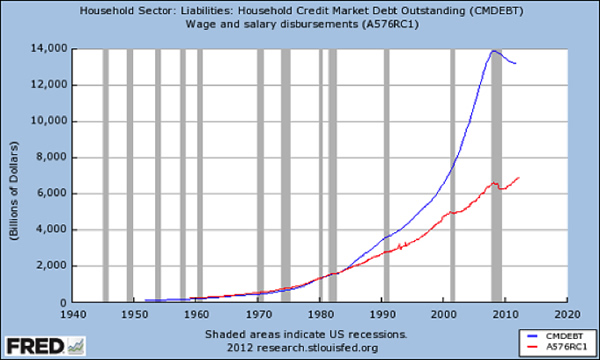

Collection of 6 sources showing: Housing Market Index,Home Inventory, S&P/C-Shiller, New Home Sales&Prices and Ratio to Population, MBS Purchases by the Fed, Household Liabilities and Dependency Ratio.

Read More »

Read More »

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »

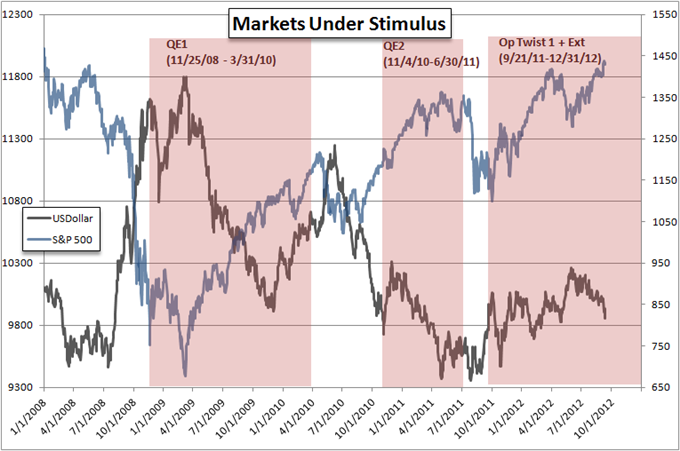

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

Main US Economic Indicators

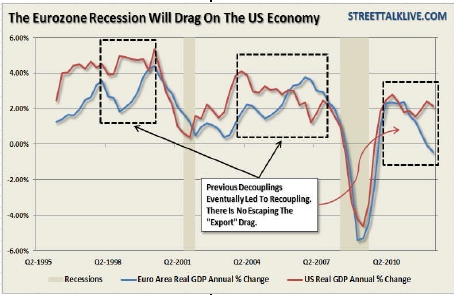

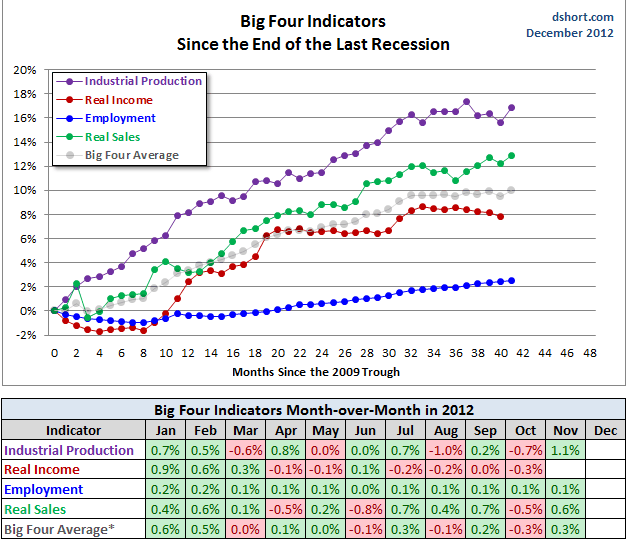

The four best “recession” indicators, in form of coincident economic indicators, can be seen at Doug Short/Advisor Perspectives Update September 2013 Update December 21th, 2012 We observe the following: US indicators point upwards, when the rest of the world is slowing. After capital left many emerging markets and Europe, this capital helps the United States …

Read More »

Read More »

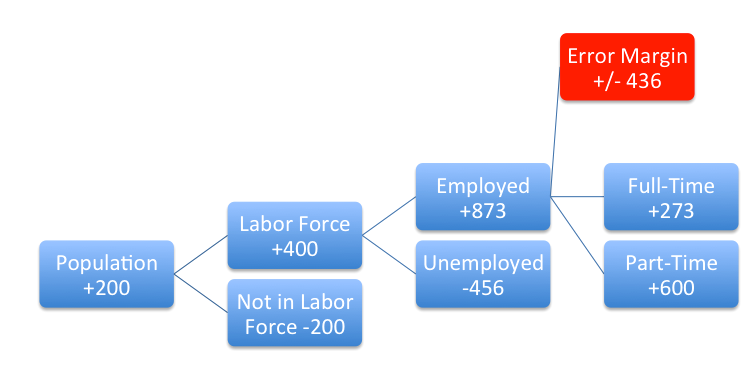

Again Flawed Data for Jobs

Some ten days ago, we examined in detail why the monthly job data was no conspiracy as Jack Welch maintained, but simply flawed. Similarly as David Rosenberg we said that the way the BLS obtains data for the household survey was error-prone. Gluskin Sheff’s David Rosenberg That the 7.8 percent jobless rate takes it to the …

Read More »

Read More »

Conspiracy? Why the Jobs Report Was not Cooked, but simply Flawed

Conspiracy ? Huge Differences Between the Payrolls Report and the Household Survey based on the extracts of Robert Oak, Noslaves.com and his blog on Economic Populist It’s a conspiracy! The BLS is trying to swing the election! They’re cookin’ de books! By now you’ve seen the claims, accusations and mumblings by the pundits, press, twitter and blogosphere. So …

Read More »

Read More »

It’s not simply QE3

Submitted by Mark Chandler, from marctomarkets.com The outcome of the FOMC meeting is not just a new round of quantitative easing, some might call it QE3. What the Fed announced represents a new chapter in its policy response. The first distinguishing aspect of its decision is the open-ended nature of it. While it has not indicated … Continue reading...

Read More »

Read More »

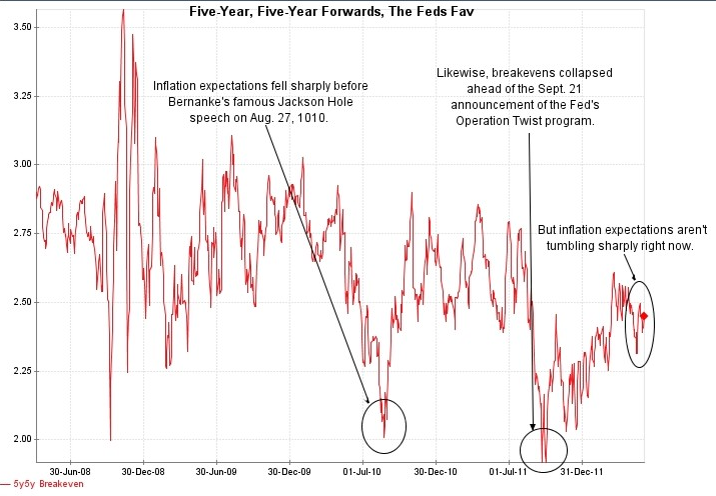

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »

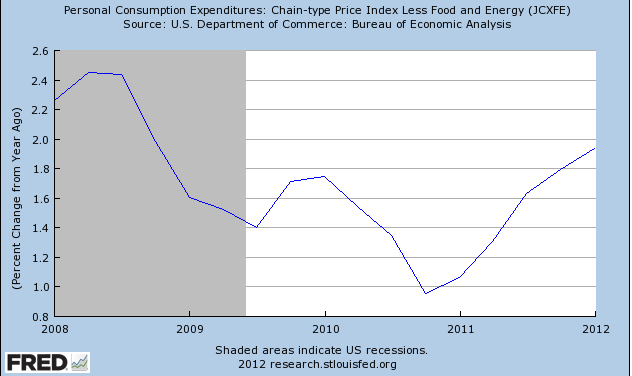

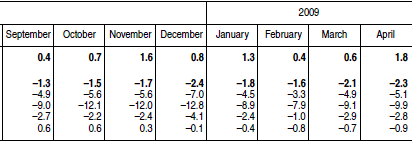

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

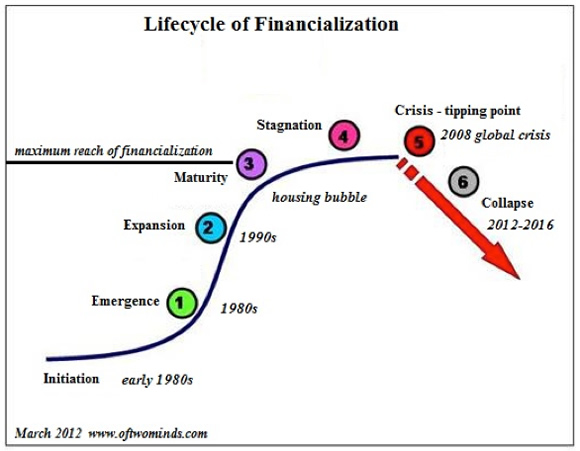

Financialization and Crony Capitalism Have Gutted the Middle Class

The neofeudal colonization of the "home market" has transformed the middle class into debt serfs. According to the conventional account, the Great American Middle Class has been eroded by rising energy costs, globalization, and the declining purchasing power of the U.S. dollar in the four decades since 1973.

Read More »

Read More »

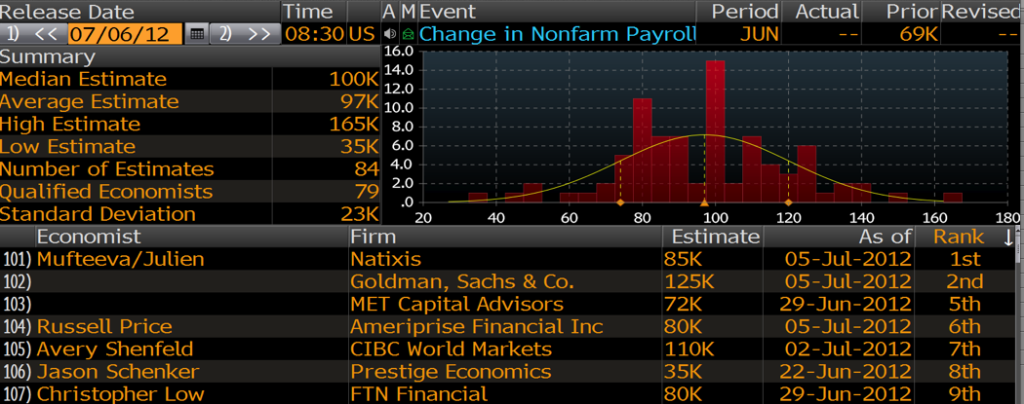

Non-Farm Payrolls: Today’s preview

A detailed comparison of Non-Farm Payroll estimators from six different sources, like Bloomberg, ISM, Department of Labor and ADP.

Read More »

Read More »

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »

Forget Non-Farm Payrolls, Take US Personal Disposable Income as Lead Economic Indicator

The unreliable Non-Farm Payrolls has far too much importance Interesting to see that markets needed two relatively bad NFPs to really believe that their main indicators, the “Non-Farm Payroll” reports were strongly biased in January and February by a positive weather effect. HFT algorithms that highly influence stock market prices, are not able to take …

Read More »

Read More »