The unreliable Non-Farm Payrolls has far too much importance

Interesting to see that markets needed two relatively bad NFPs to really believe that their main indicators, the “Non-Farm Payroll” reports were strongly biased in January and February by a positive weather effect.

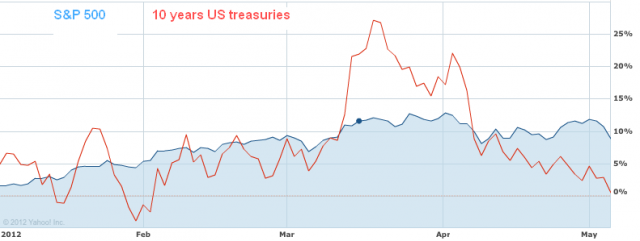

HFT algorithms that highly influence stock market prices, are not able to take the weather effect as input variable to their calculations, whereas these algos have difficulties manipulating the 10 year US bond yields, because volumes in treasuries are that big so that they are driven are rather by private (human) demand. Bond yields are falling since the first NFP deception one month ago and are back to their 2012 start values. Human beats machine !

Another reason not overvalue the NFP numbers is that the report is very vulnerable to statistical failures, especially due to the small sample size (see details in the FT). Last but not least, everybody (including the Fed) knows that it will take years and years to come back to full employment. Why a number of 100K lets the stock markets fall so much and a number of 200K let it rise so much, is for us a miracle, given that 125K barely covers population growth and that even with a 200K jobs figure it will take 7 years to come back to full employment to cover the 6.3 million jobs lost in the big depression (calculus: 75K x 12 months x 7 years = 6.3 million).

One explanation of the NFP importance is that the foremost leading indicator, the US Purchasing Manager Index, seem to be strongly influenced by the NFP numbers, even if the economic theory tells us that a reduction of unemployment should be rather a coincident or even a lagging indicator and therefore a better PMI should come before the unemployment goes down.

Despite a better and better economic sentiment with consumers and companies, US companies did not hire more than they did last year April or in September or October 2011 during the looming recession.

Especially in the era of Quantitative Easing investments are that volatile so that they cannot really be counted as part of the GDP. Massive inflows into the Emerging Markets between 2009 and summer 2011 were followed by strong investments into the US, when the hot money fled back. Interpreting the strong investments in the US, the rise of car purchases in Q3, 2011 after the Q2 disruptions and the resilience of the US economy thanks to cheaper gas prices in Q4/2011 and warm winter as an “upcoming recovery” is completely premature.

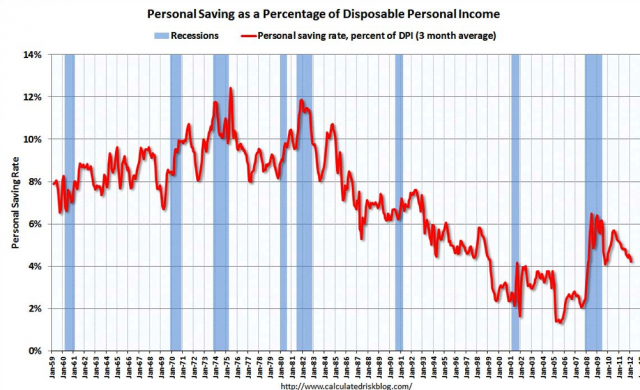

Simple macroeconomic theory tells us that only after unemployment has been significantly reduced, full employment is reached and after resources have become rare on the labor market, companies will start hiking wages. Only with the income increase people will be able to spend again.

Deficit spending

Deficit spending and high company profits thanks to suppressed salaries and demand from Emerging Markets will not be able to save the American economy.

The real data we take for our analysis especially in the bond area for the US economy are Personal Spending and Personal Income.

Personal Disposable Income

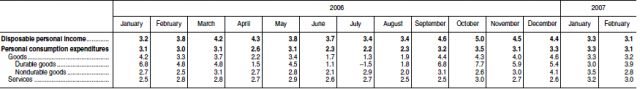

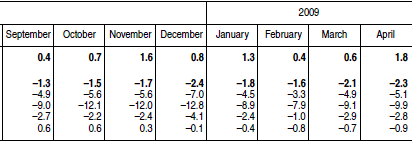

The following data from the BEA is the real YoY disposable personal income and real personal expenditures for the US economy in expansion:

For sustained growth a healthy 3% rise in both Disposable Personal income, and Personal Expenditures in each month is required.

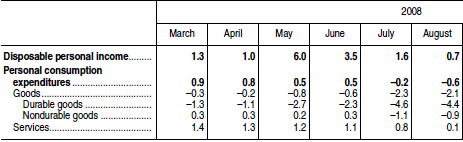

The same indicators in 2007/2008 show a slowing economy:

Consumers cut their expenditures and increase saving, the Marginal Propensity of Consume (MPC) decreases. Due to full employment and increasing inflation companies must raise salaries.

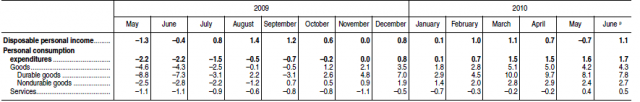

Consumers cut spending even more during the recession; thanks to falling prices the disposable incomes remain stable, but the unemployment rises:

Fallen prices especially for fuel products help increase consumer spending again. A first recovery begins (here from December 2009 on):

Due to the high unemployment, salaries do not need to rise with the spending. The US consumer is essentially deficit-spending and pushes up growth in foreign economies, like the BRICS and Australia and similarly the oil price.

Are you the author? Previous post See more for Next post

Tags: consumer spending,deficit,Federal Reserve,Non-Farm,PMI,Purchasing Manager,Quantitative Easing,Swiss National Bank,U.S. Nonfarm Payrolls,United States