Contributed by Lance Roberts of Streettalk Live

original URL

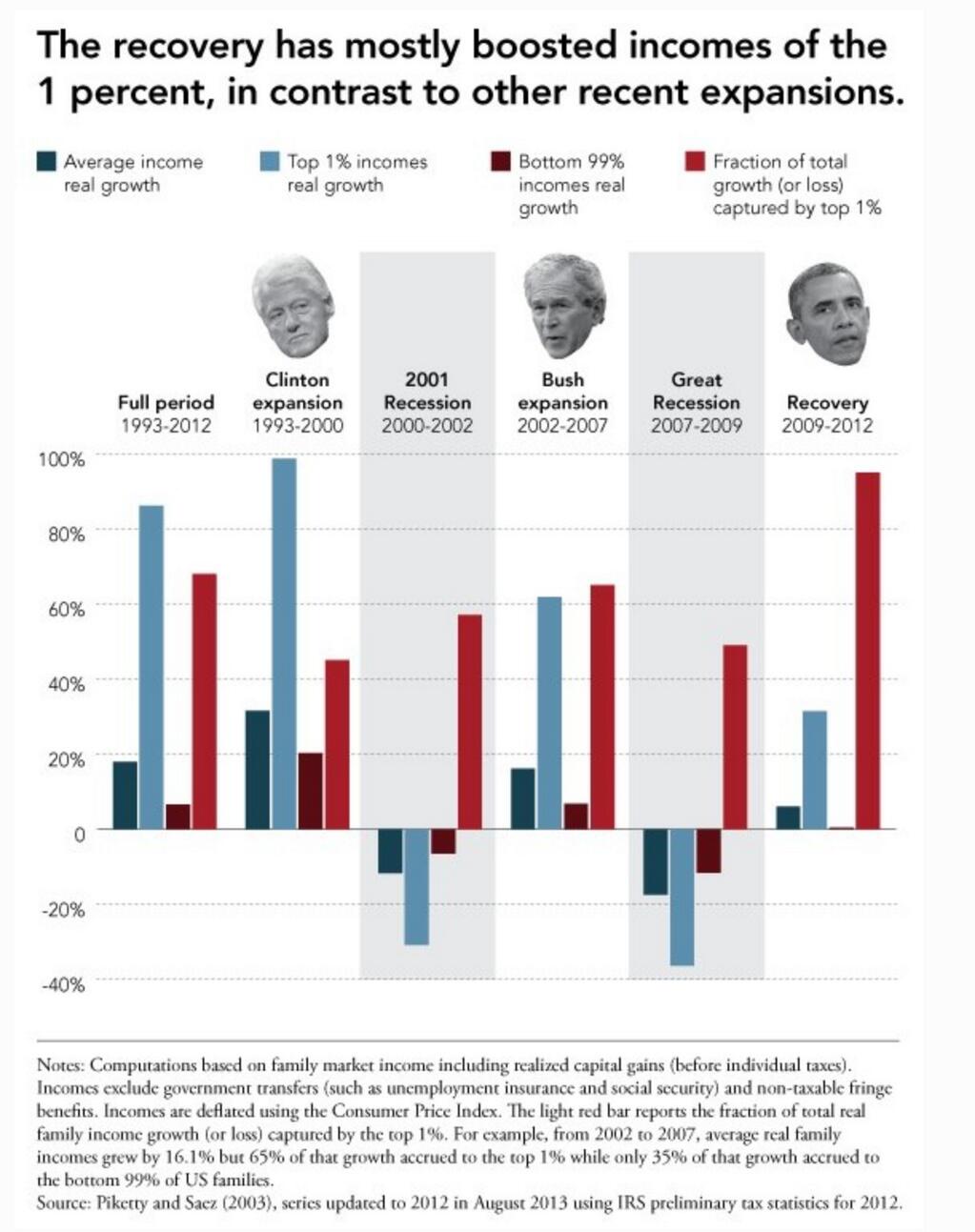

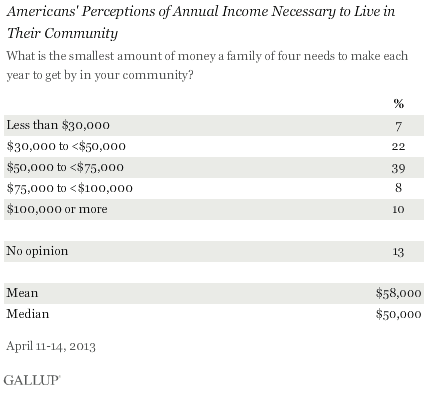

I have often spoken of the disconnect between Wall Street and Main Street. While asset prices are inflated by continued interventions of monetary policy from the Federal Reserve, boosting Wall Street profits and widening the wealth gap between the top 20% of Americans and the rest, “Main Street” continues to suffer a from a rising cost of living and falling wage growth. Just recently Gallup released the following survey:

“The federal poverty threshold for a family of four is just under $24,000; however, Americans believe such a family unit living in their community needs more than double that — $58,000, on average — just to ‘get by.’ That estimate reflects 29% of Americans saying these families need up to $50,000 in annual income, 47% saying they need between $50,000 and $99,999, and 10% saying they need $100,000 or more.”

The problem is that as the cost of living rises over time due to the effects of inflation – median household incomes have fallen. The following chart shows the seasonally adjusted median household income through March of 2013 as compared to Gallup’s poll of family living needs.

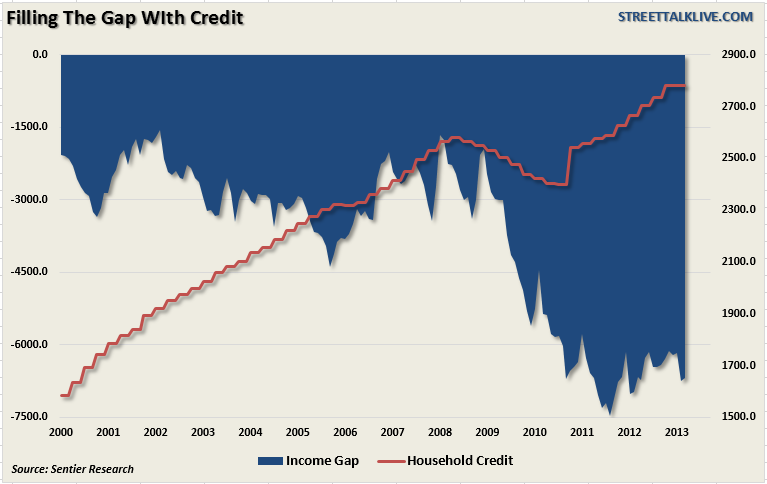

The shortfall is quite evident. The obvious question that follows is:

“Where does the money come from to fill the gap between living standards and incomes?”

The chart below answers that question. The chart shows the difference between the $58,000 need for a family unit and median incomes, defined as the “income gap,” and then compared to household credit.

Besides the very brief forced deleveraging of balance sheets during the financial crisis, as households defaulted on debt and financial institutions cut credit lines, consumers have returned to credit to supplement incomes with a vengeance since 2011.

Ample Evidence

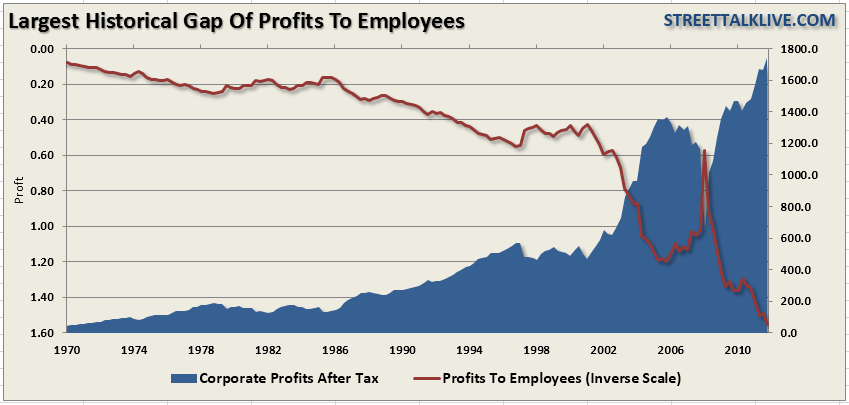

There is considerable evidence behind the current dislocation between Corporate America and Main Street. Real unemployment remains extremely elevated as witnessed by the labor force participation rate and employment-to-population ratio at levels not seen since the early 1980’s.

I recently published a piece on the “5 Questions That Every Market Bull Should Answer” discussing the disconnect between the “have’s” and the “have not’s” stating:

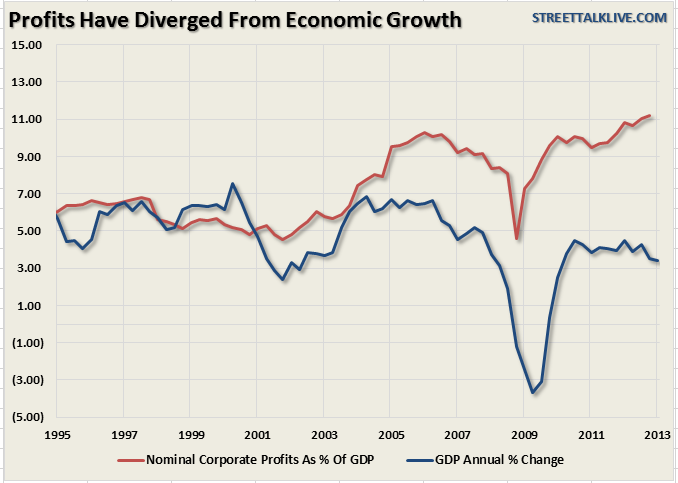

“Suppressed wage growth, layoffs, cost-cutting, productivity increases, accounting gimmickry and stock buybacks have been the primary factors in surging profitability. However, these actions are finite in nature and inevitably it will come down to topline revenue growth. However, since consumer incomes have been cannibalized by suppressed wages and interest rates – there is nowhere left to generate further sales gains from in excess of population growth.”

This is why the gap between corporate profits and the number of working employees is the highest level on record. Fewer workers, higher productivity and longer hours for the same pay, or less, equals higher corporate profits. This is great for executives, primarily the top 10% of wage of earners, who are compenstated from rising share prices, bonuses and other performance related compensation. However, for the “working stiff,” there is little reward for their labor.

“Welfaring Of America”

At $58,000, Americans’ perceptions of the amount it takes just to get by in their community is substantially higher that the national median household income. This level is also well out of reach for a bulk of the lower 30% of American households.

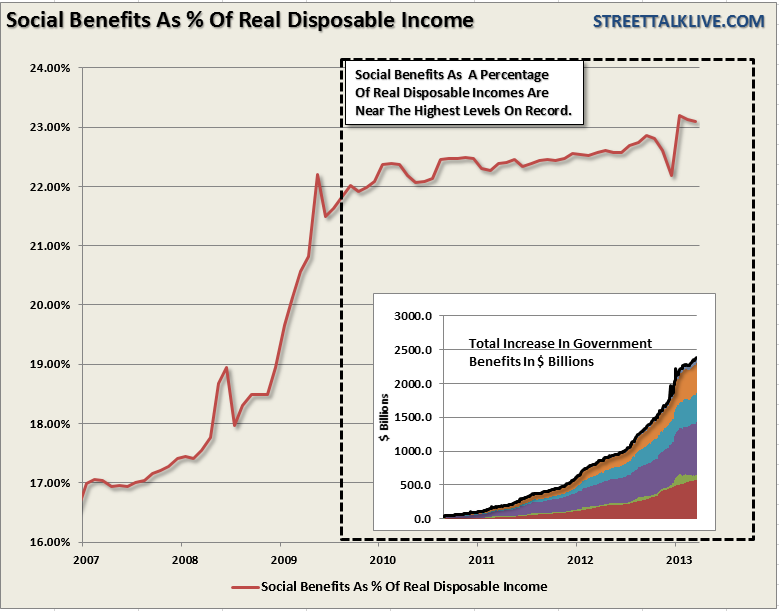

However, this gap between incomes and living standards goes a long way to explaining the “welfaring” of America. As incomes have waned against a rising cost of living – it is not surprising to see more individuals receiving income supplements in the mail either from “food stamps”, social security benefits or disability claims. All of which are currently at record levels. The chart below shows the level of social security benefits as a percentage of disposable personal incomes which is currently near the highest level on record.

“How long can the disconnect last between Wall Street and Main Street? “

There is no clear answer for that as consumers have shown a willingness to draw down savings rates to historically low levels while quickly returning to cheap credit forgetting the disaster that it caused them not so long ago. However, in reality, when you have a family to feed, clothe and house – it really doesn’t matter what is logical, but what is necessary, regardless of the consequences down the road. Of course, for many American’s today, the only real difference between now and the “bread lines” of the 30’s is that the “bread” is delivered in the mail rather than at the “soup kitchen” on the corner.