Category Archive: 5) Global Macro

Life after Trump: what’s the future of the Republican Party? | The Economist

Donald Trump has finally accepted that a presidential transition from his administration to Joe Biden’s should begin. We answer your questions on what the Republican Party could look like in a post-Trump world.

Chapters:

00:00 Trump’s impact on the Republican Party

00:35 Party support for Trump

02:16 Trumpism after Trump

05:37 The era of “alternative facts”

06:56 The GOP in a more diverse America

08:40 The outlook for 2024

Find The Economist’s...

Read More »

Read More »

There Have Actually Been Some Jobs Saved, Only In Place of Recovery

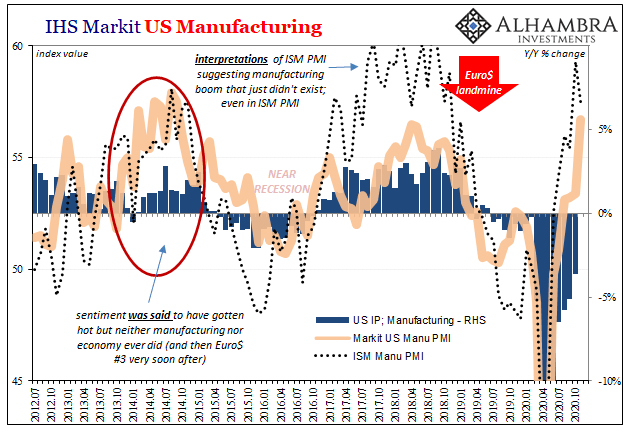

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5.

Read More »

Read More »

Dollar Plumbs New Depths With No Relief In Sight

Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields. ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat.

Read More »

Read More »

Tesla Isn’t A Car Company

We have the luxury, the honor, of speaking to a lot of individual investors here at Alhambra. Whether they are clients or future clients (optimism is my default condition), the most common view of stocks is that they are overvalued and a fall – a large fall – is inevitable. And there is no stock that embodies that view more than Elon Musk’s Tesla Incorporated. It was once known as Tesla Motors but Musk changed the name in early 2017. There may...

Read More »

Read More »

2021 is Already Optimized for Failure

One sure way to identify a system "optimized for failure" is if all the insiders are absolutely confident the system is "optimized for my success". I often discuss optimization here because it offers an insightful window into how systems become fragile and break down.

Read More »

Read More »

Drivers for the Week Ahead

Dollar weakness has resumed. This will be a very important data week for the US and the highlight will be November jobs data Friday; we will also get some important manufacturing readings for November; the Fed releases its Beige Book report for the December FOMC meeting Wednesday; Canada also has a busy week.

Read More »

Read More »

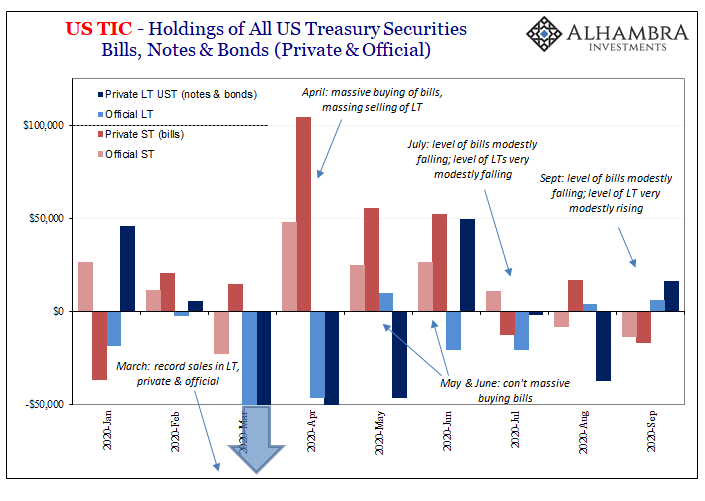

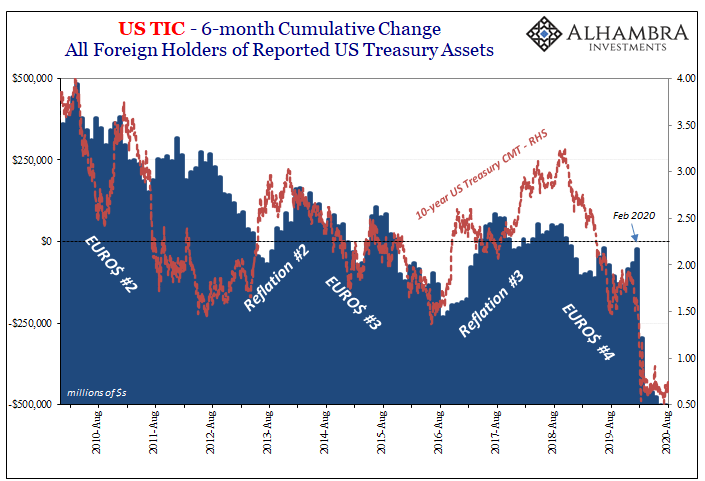

Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »

Care after covid: the future of elderly health-care | The Economist

Across the rich world around half of covid-19 deaths have been in care homes. Countries need to radically rethink how they care for their elderly—and some innovative solutions are on offer.

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/3m212Kj

Read our special report on the challenges of caring for an ageing population: https://econ.st/2UW40EB

Why we need to urgently reform our elderly care systems:...

Read More »

Read More »

A Dimly Lit Thanksgiving

Our overweening faith and confidence in our wealth and power make this a dimly lit Thanksgiving. A public expression of gratitude by victorious sports stars, lottery winners, etc. is now the convention in America: coaches, teammates, family and mentors (or agents) are recognized as an expression of the winners' humility and gratitude for everyone that contributed to the success.

Read More »

Read More »

In The World Change Process

The world is in the process of change. Especially in terms of health and economy, the world has experienced the biggest chaos of recent times. We are seeing signs of transition to the new economic order. What are the plans?

Read More »

Read More »

Making Sense Eurodollar University Episode 32 Part 3

The Chinese currency is gaining against the dollar. That SHOULD be an 'all-clear' signal that reflation, global trade, and positive momentum are in place. But we DO NOT see corroborating evidence on the People's Bank of China balance sheet. Maybe the move is an engineered feint?

Read More »

Read More »

Dollar Weakness Resumes as Short-Covering Fades

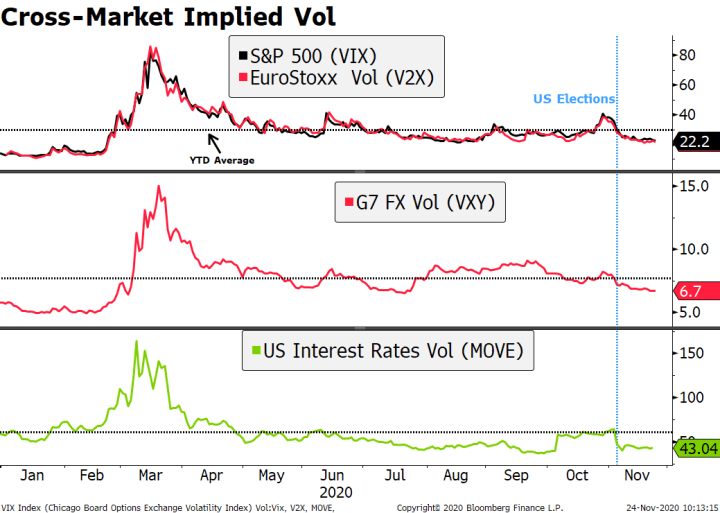

Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed. President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings.

Read More »

Read More »

Dollar Weakness Resumes as Markets Start Another Week in Risk-On Mode

Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar. Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising.

Read More »

Read More »

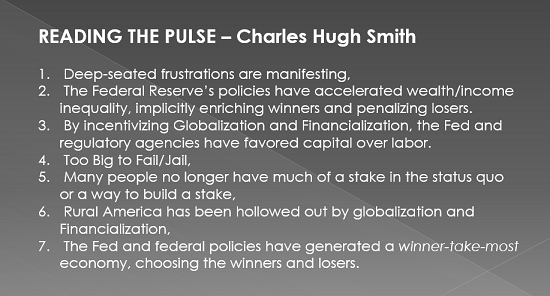

Our Frustrations Run Far Deeper Than Covid Lockdowns

The reality is the roulette wheel is rigged and only chumps believe it's a fair game. It's easy to lay America's visible frustrations at the feet of Covid lockdowns or political polarization, but this conveniently ignores the real driver: systemic unfairness.

Read More »

Read More »

Why I’m Hopeful About 2021

What we need is not a return to the corrupt, tottering kleptocracy of 2019, but a re-democratization of capital, agency and money. I'm hopeful about 2021, and no, it's not because of the vaccines or the end of lockdowns or anything related to Covid. The status quo is cheering the fantasy that we'll soon return to the debt-soaked glory days of 2019 when everything was peachy.

Read More »

Read More »

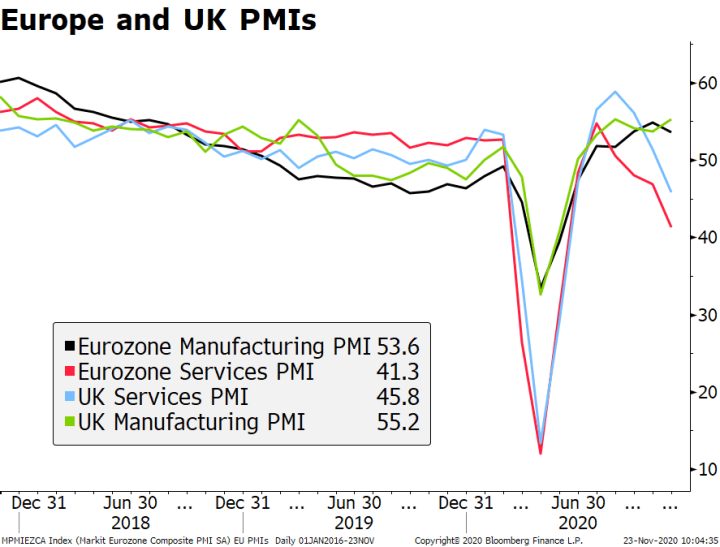

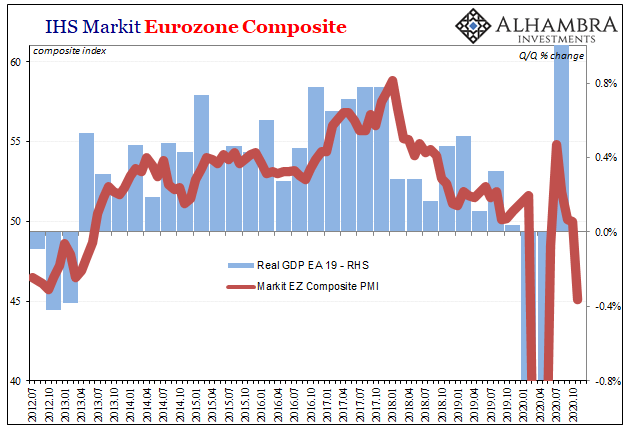

A Lesson In PMIs: Relative vs. Absolute

The bid for “decoupling” has never been stronger, and, unfortunately, this time actually represents the weakest case yet for it. According to the mainstream interpretations of the most recent sentiment indicators, the US and European economies appear to be going in the complete opposite directions.

Read More »

Read More »

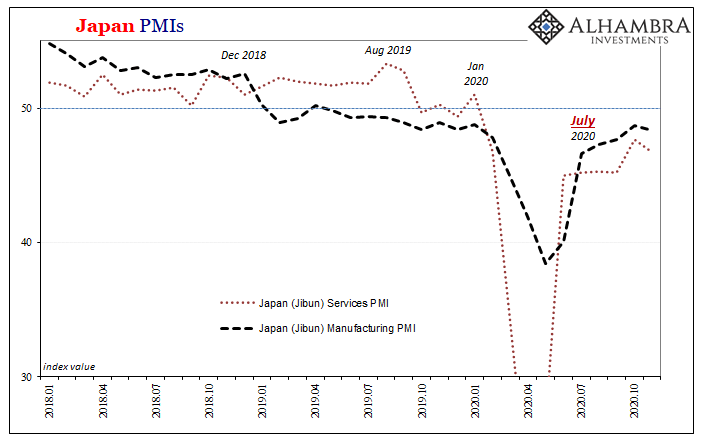

Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic.

Read More »

Read More »

EM Preview for the Week Ahead

Most EM currencies were up last week, once again taking advantage of broad dollar weakness. In addition, EM equities also performed well, with MSCI EM up for the third week in a row and for seven of the past eight. We expect EM assets to continue benefiting from the global liquidity story as well as the weak dollar trend.

Read More »

Read More »

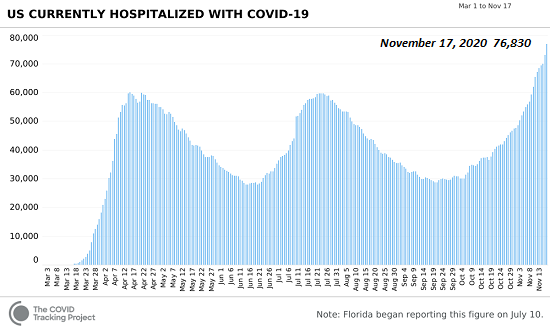

Vaccines–Too Little, Too Late?

Trust in institutions, authorities and Big Pharma is scraping the bottom of the barrel, and rushing these vaccines into mass use with extremely high expectations of efficacy is setting up the potential for a devastating loss of trust in the vaccines should they fail to live up to the claims of 100% safety and 95% effectiveness.

Read More »

Read More »