Category Archive: 5) Global Macro

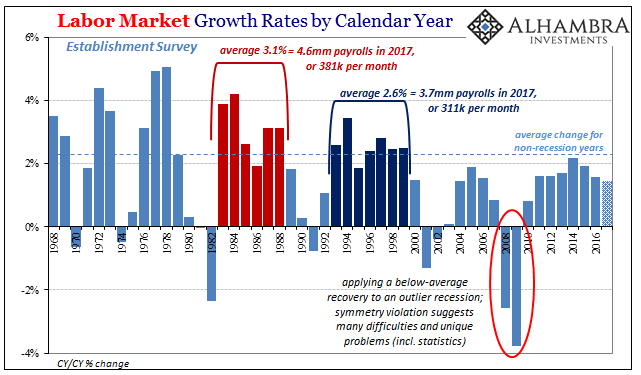

Defining The Economy Through Payrolls

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too.

Read More »

Read More »

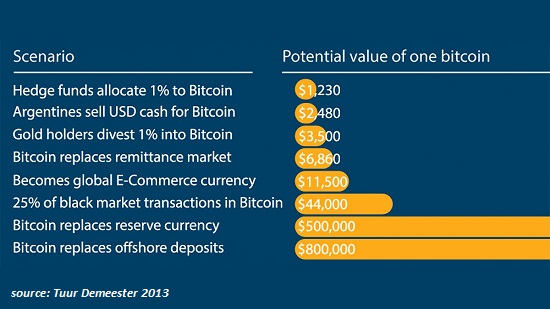

A Race To The Potential Behind Bitcoin

The timing just never seems to fall in our favor. If we had had this conversation ten years ago as would have been appropriate, then this evolution might have fell perfectly in our collective laps. Just as the global financial system, really the international, interbank monetary system of the eurodollar, was crashing all around us, the genesis block of the Bitcoin blockchain was hard coded.

Read More »

Read More »

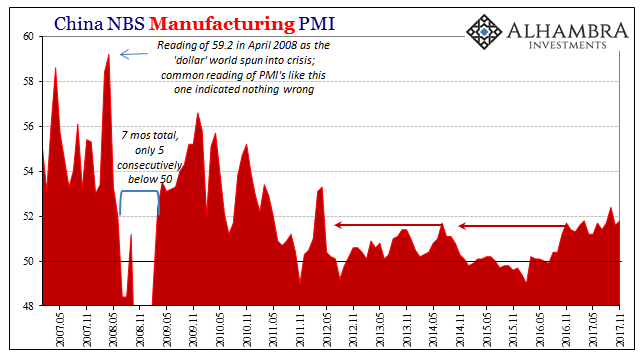

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

A Radical Critique of Universal Basic Income

This critique reveals the unintended consequences of UBI. Readers have been asking me what I thought of Universal Basic Income (UBI) as the solution to the systemic problem of jobs being replaced by automation.To answer this question, I realized I had to start by taking a fresh look at work and its role in human life and society. And since UBI is fundamentally a distribution of money, I also needed to take a fresh look at our system of money.

Read More »

Read More »

Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 - and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce competition in the industry has induced...

Read More »

Read More »

What Is Money? (Yes, We’re Talking About Bitcoin)

What is money? We all assume we know, because money is a commonplace feature of everyday life. Money is what we earn and exchange for goods and services. Everyone thinks the money they’re familiar with is the only possible system of money—until they run across an entirely different system of money.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM.

Read More »

Read More »

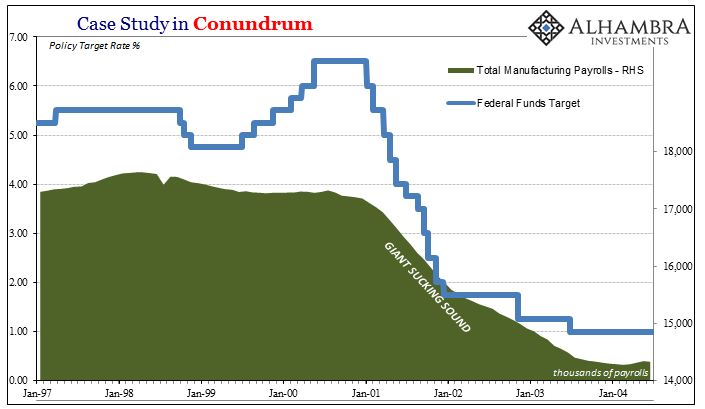

Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really are buying at a healthy pace,...

Read More »

Read More »

Reduced Trade Terms Salute The Flattened Curve

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year.

Read More »

Read More »

Emerging Markets: What Changed

China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation forecasts and shifted to a more dovish...

Read More »

Read More »

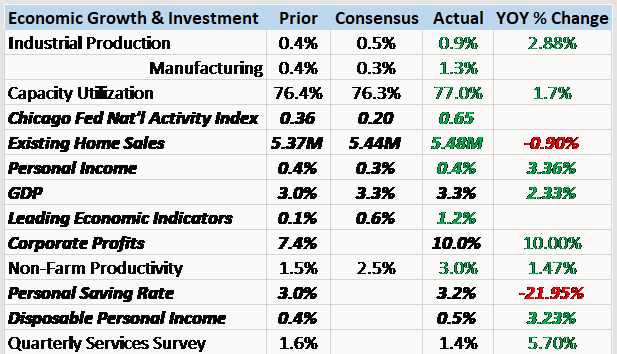

Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive.

Read More »

Read More »

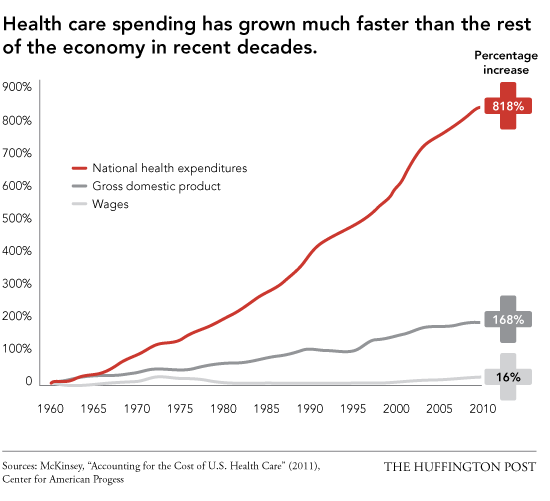

The Cost Basis of our Economy is Spiraling Out of Control

What will it take to radically reduce the cost basis of our economy? If we had to choose one "big picture" reason why the vast majority of households are losing ground, it would either be the stagnation of income or the spiraling out of control cost basis of our economy, that is, the essential foundational expenses of households, government and enterprise.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks.

Read More »

Read More »

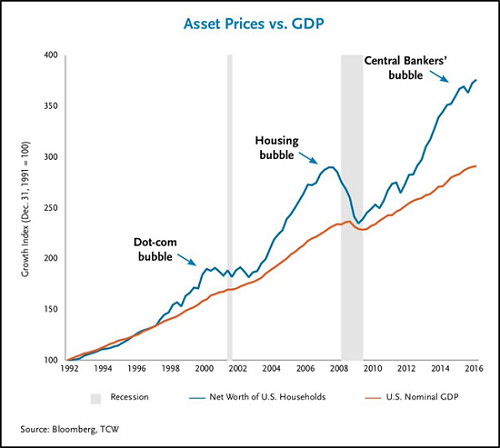

Stock Market 2018: The Tao vs. Central Banks

The central banks claim omnipotent financial powers, and their comeuppance is overdue. will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever.

Read More »

Read More »

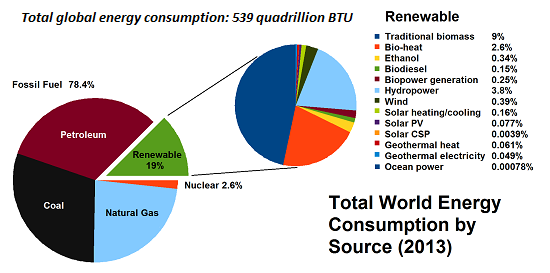

Did Anyone Do Even a Minimal Check on the Sensationalist Bitcoin Electrical Consumption Story?

Check the context before uncritically accepting sensationalist conclusions. Let's start with a primer on how to write a sensationalist story that can be passed off as "journalism:" 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as "fact" rather than data that requires verification by disinterested researchers.

Read More »

Read More »

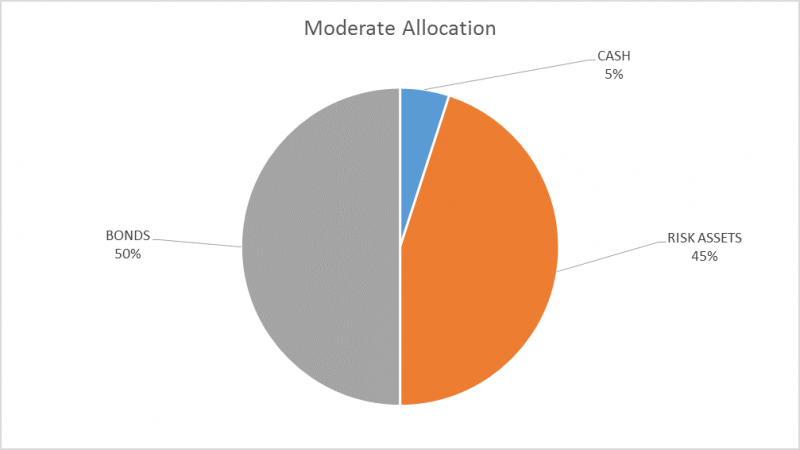

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

Emerging Markets: What Changed

Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook.

Read More »

Read More »

My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy

The basis of this admittedly crazy forecast was simple: capital flows. I think we can all agree that bitcoin (BTC) is "interesting." One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward. Unknowns and big swings up and down are characteristics of open markets.It's impossible to forecast bitcoin's future price because virtually all the future inputs are unknown.

Read More »

Read More »

The Asymmetry of Bubbles: the Status Quo and Bitcoin

Regardless of one's own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the electrical consumption of bitcoin is "shocking," "ridiculous," etc.

Read More »

Read More »

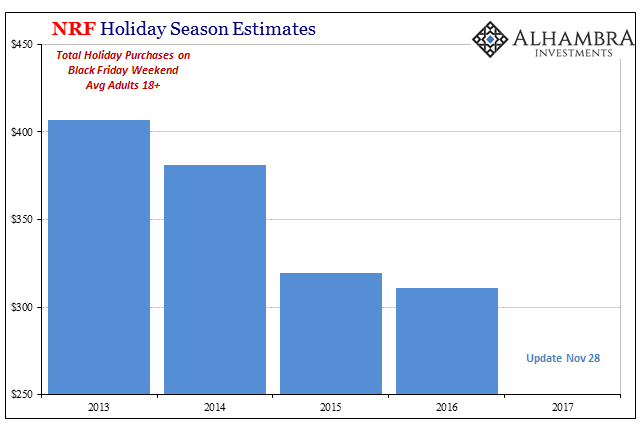

Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was.

Read More »

Read More »