Category Archive: 5) Global Macro

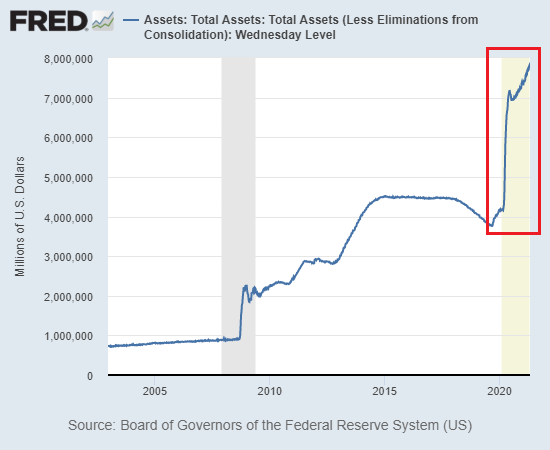

Hey Fed, Explain Again How Making Billionaires Richer Creates Jobs

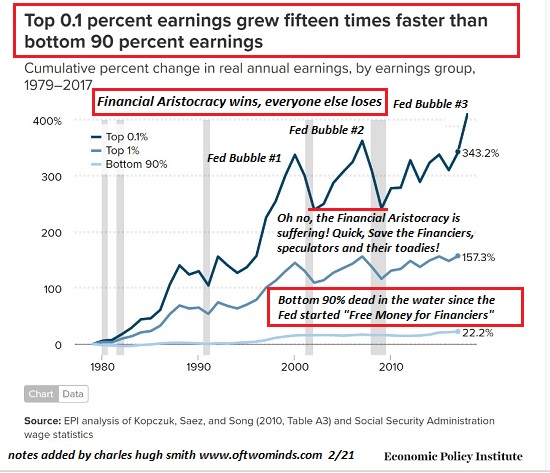

Despite their hollow bleatings about 'doing all we can to achieve full employment',

the Fed's policies has been Kryptonite to employment, labor and the bottom 90%--and most especially

to the bottom 50%, the working poor that one might imagine most deserve a leg up.

As wealth and income inequality soar to new heights thanks to the Federal Reserve's policies

of zero interest rates, money-printing and financial stimulus, the Fed says its goal...

Read More »

Read More »

Is Taiwan part of China? | The Economist

Taiwan’s sovereignty has been a disputed issue for centuries. Though the island sees itself as independent, China insists it is part of the People’s Republic and has not ruled out taking Taiwan by force. That could ignite an all-out war between American and China.

Sign up to our newsletter to keep up to date: https://econ.st/3a6aZmv

Read all of our Asia coverage: https://econ.st/2QDDDEJ

Listen to Intelligence’s daily podcast “Scared strait:...

Read More »

Read More »

What’s Yours Is Now Mine: America’s Era of Accelerating Expropriation

The takeaway here is obvious: earn as little money as possible and invest your surplus labor in assets that can't be expropriated. Expropriation: dispossessing the populace of property and property rights, via the legal and financial over-reach of monetary and political authorities.

Read More »

Read More »

Alexei Navalny: will the West stand up to Russia? | The Economist

Alexei Navalny’s hunger strike has prompted widespread international support. Vladimir Putin has warned that any country meddling in Russia’s affairs will “regret their actions”. How should the West respond to a tyrant like Putin?

Chapters

00:00 - What’s happening in Russia?

00:54 - What does Navalny represent for Russia?

01:36 - How should America respond?

03:08 - Do sanctions work?

05:30 - Why were troops sent to the Ukranian border?

07:20 -...

Read More »

Read More »

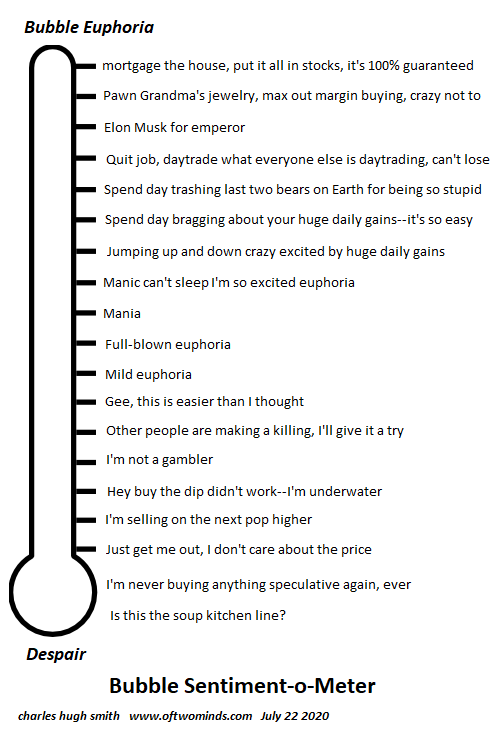

The Only Way to Get Ahead Now Is Crazy-Risky Speculation

It's all so pathetic, isn't it? The only way left to get ahead in America is to leverage up the riskiest gambles. It's painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin?

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 22 avril 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Charles Hugh Smith on the Terminally Ill Economy

Http://financialrepressionauthority.com/2021/04/22/the-roundtable-insight-charles-hugh-smith-on-the-terminally-ill-economy/

Read More »

Read More »

If You Don’t See Any Risk, Ask Who Will “Buy the Dip” in a Freefall?

Nobody thinks a euphoric rally could ever go bidless, but as Greenspan belatedly admitted, liquidity is not guaranteed. The current market melt-up is taken as nearly risk-free because the Fed has our back, i.e. the Federal Reserve will intervene long before any market decline does any damage.

Read More »

Read More »

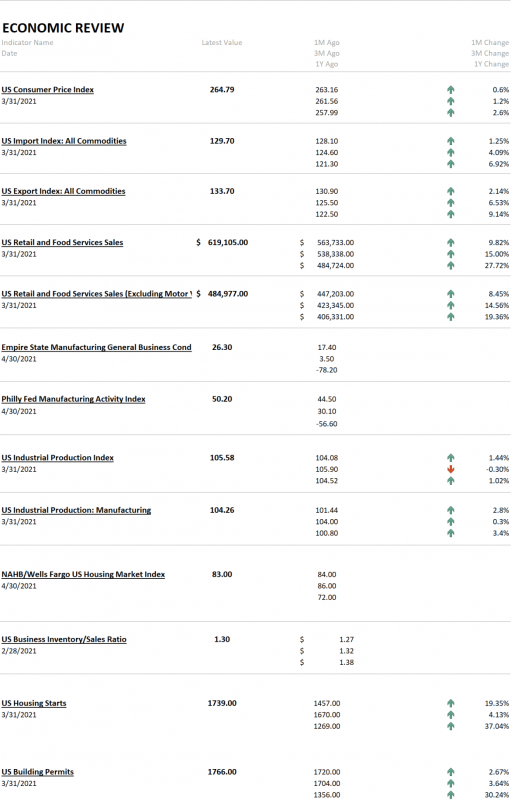

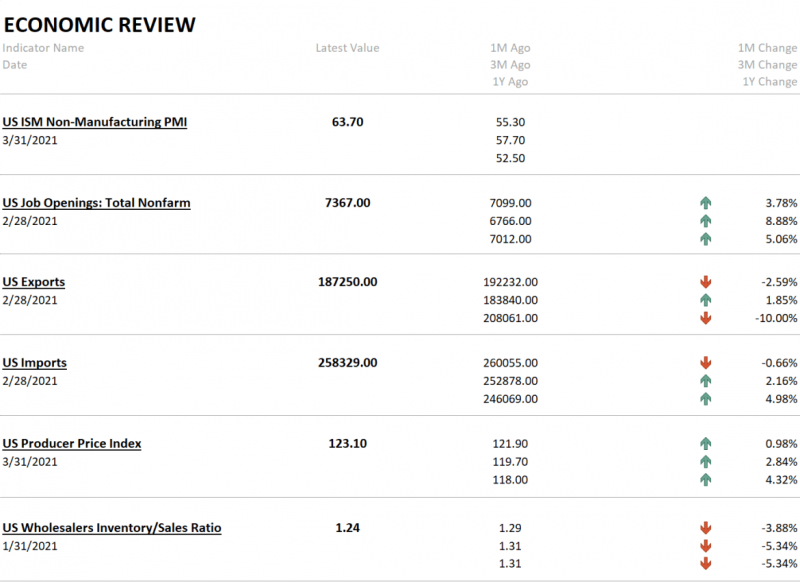

Weekly Market Pulse: The Market Did What??!!

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the current economic data would seem to dictate. I’ve been in this business for 30 years and I think I first heard that in year one. Or maybe even before I decided to lose my mind and start managing other people’s money. Because, of course, it has always been this way.

Read More »

Read More »

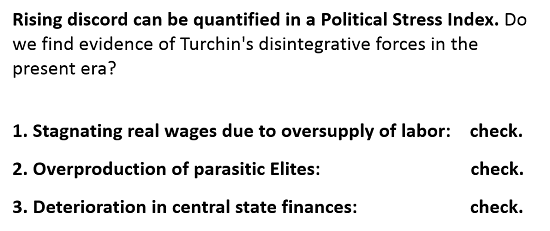

America’s Fatal Synergies

America's financial system and state are themselves the problems, yet neither system is capable of recognizing this or unwinding their fatal synergies. why do some systems/states emerge from crises stronger while similar

systems/states collapse?

Read More »

Read More »

Scottish independence: could Britain break up? | The Economist

The union between the nations of the United Kingdom is looking increasingly fragile, thanks to Brexit. If Scotland were to break away from Britain it would face an uncertain future—as would the rest of the union.

Sign up to our newsletter to keep up to date: https://econ.st/3a6aZmv

See all of our Britain coverage: https://econ.st/3e1cN15

How the pandemic has strengthened calls for Scottish independence: https://econ.st/3tqDZwL

Scottish...

Read More »

Read More »

What’s Taboo? Everything Except Greed

OK, now I get it. Take a couple tabs of Euphorestra and Hopium, and stick to talking about making money in the market. Greed won't offend anyone. So I started to tell my buddy about my new screenplay idea: "There's a global pandemic, and when they rush a bunch of vaccines to market, then...."

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 15 avril 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

The Middle Class Has Finally Been Suckered into the Casino

The Fed's casino isn't just rigged; it's criminally unstable. The decay of America's middle class has been well documented and many commentators have explored the causal factors. The bottom line is that this decay isn't random; the income of the middle class isn't going to suddenly increase at 15 times the growth rate of the income of the top 0.1%. (see chart below) The income of the top 0.1% grew 15 times faster than the incomes of the bottom 90%...

Read More »

Read More »

The “Helicopter Parent” Fed and the Fatal Crash of Risk

All the risks generated by gambling with trillions of borrowed and leveraged dollars didn't actually vanish; they were transferred by the Fed to the entire system. The Federal Reserve is the nation's Helicopter Parent, saving everyone from the

consequences of their actions.

Read More »

Read More »

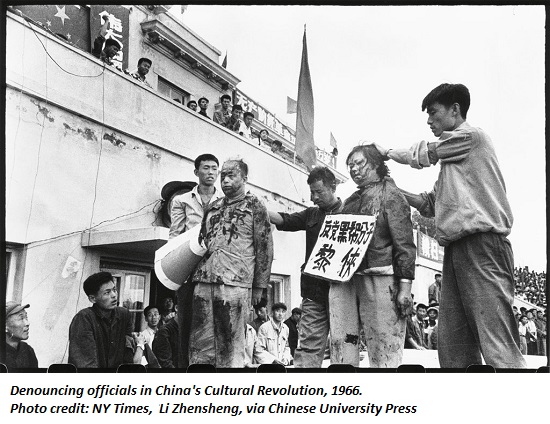

Is a Cultural Revolution Brewing in America?

The lesson of China's Cultural Revolution in my view is that once the lid blows off, everything that was linear (predictable) goes non-linear (unpredictable). There is a whiff of unease in the air as beneath the cheery veneer of free money for

almost everyone, inequality and polarization are rapidly consuming what's left of common ground in America.

Read More »

Read More »

Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things.

Read More »

Read More »

The Trial of the Chicago 7: fact v drama | The Economist

“The Trial of the Chicago 7” has been nominated for six Oscars. Aaron Sorkin, the film’s screenwriter and director, speaks to The Economist about the tension between historical accuracy and compelling drama.

00:00 - The Trial of the Chicago 7

00:51 - Why is the story still so relevant?

01:34 - How to adapt real events into drama

02:40 - Why the film deviates from historical fact

04:41 - Historical accuracy v artistic truth

05:41 - Altering events...

Read More »

Read More »