Category Archive: 5) Global Macro

How Much Longer Can We Get Away With It?

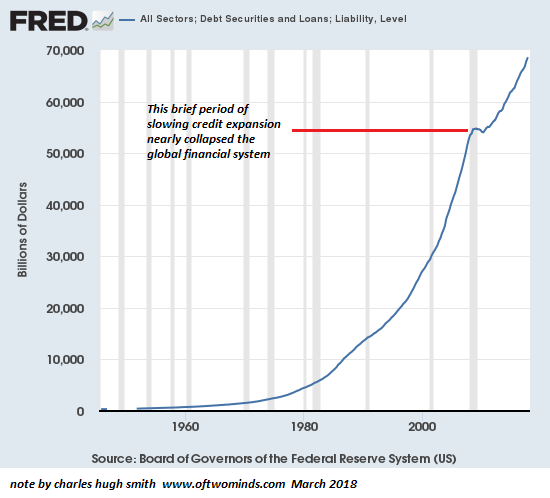

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

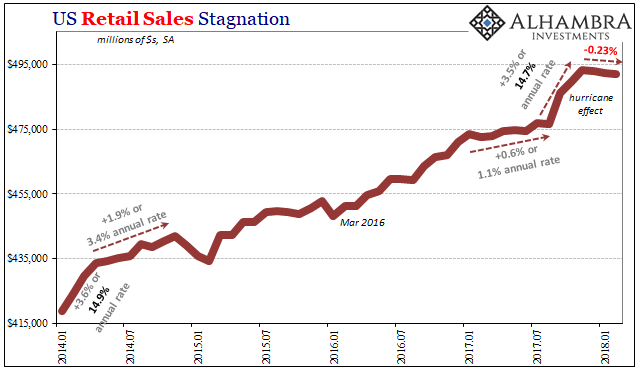

Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow tracking model was moved up to...

Read More »

Read More »

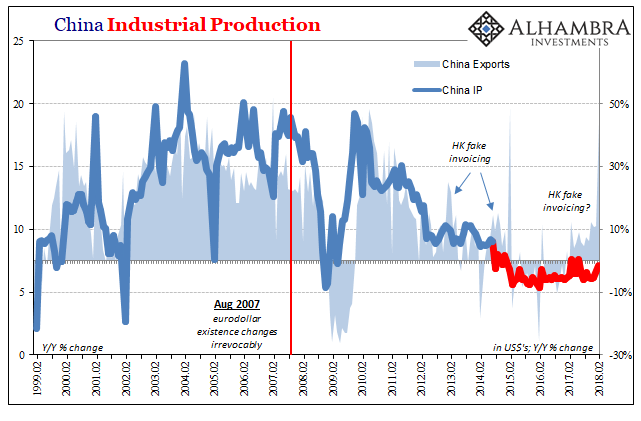

China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

Les banques centrales financées par les banques commerciales

Vincent Held continue à présenter des extraits dans cette 3ème et dernière vidéo. Les 3 vidéos se trouvent sur le site de Planètes 360. Cette vidéo fait suite à celle sur le marché REPO.

Read More »

Read More »

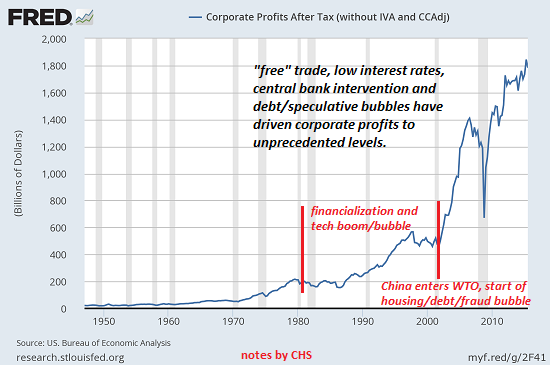

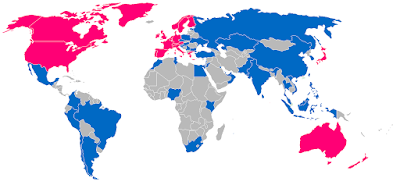

There is No “Free Trade”–There Is Only the Darwinian Game of Trade

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows. Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals: 1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped. 2. Extract foreign resources at low prices. 3. Deny geopolitical rivals access to these resources.

Read More »

Read More »

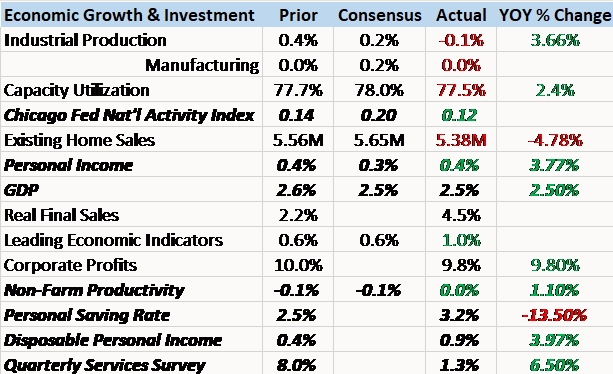

Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing.

Read More »

Read More »

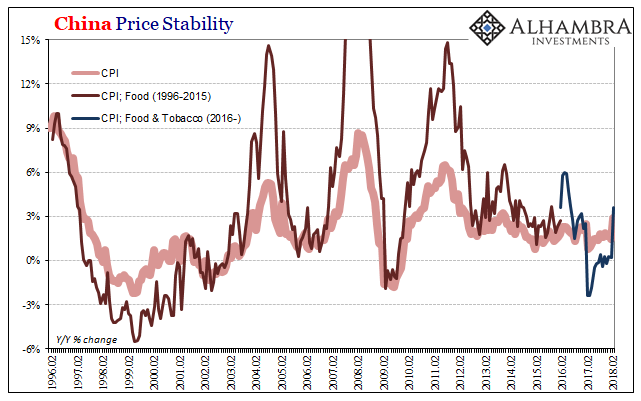

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »

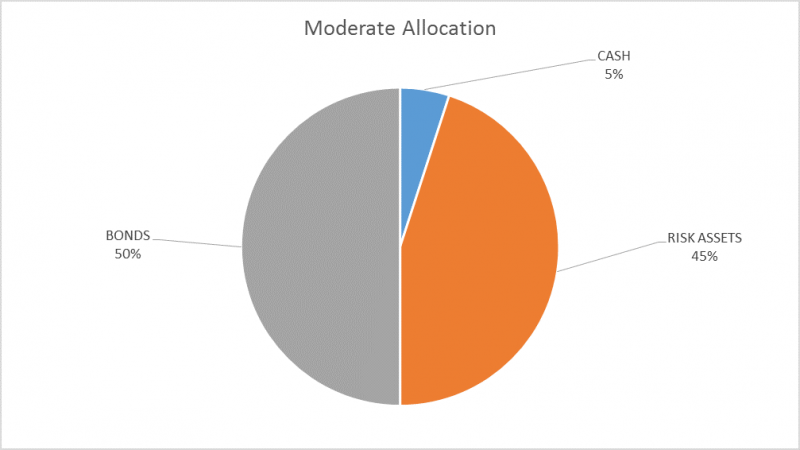

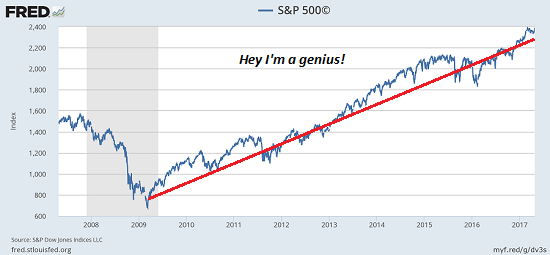

Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

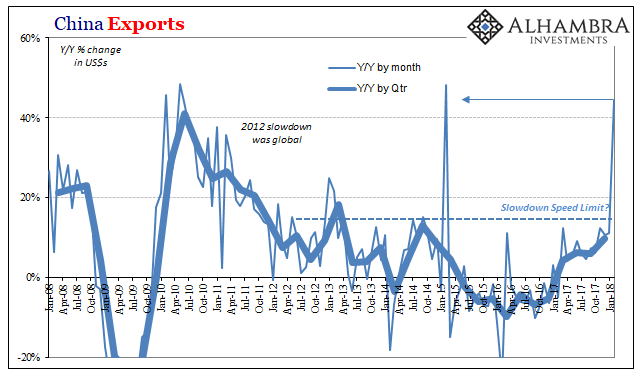

China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative.

Read More »

Read More »

Forget “Free Trade”–It’s All About Capital Flows

Defenders and critics of "free trade" and globalization tend to present the issue as either/or: it's inherently good or bad. In the real world, it's not that simple. The confusion starts with defining free trade (and by extension, globalization).

Read More »

Read More »

Emerging Markets: What Changed

Indonesia will freeze prices for electricity, gasoline, and diesel fuel until next year. US President Trump and North Korean President Kim Jong Un will hold a summit meeting this spring. National Bank of Poland has tilted even more dovish. Moody’s downgraded Turkey a notch to Ba2 with a stable outlook. Saudi Arabian Energy Minister hinted that the Aramco IPO could be delayed until 2019. Tanzania finally obtained a sovereign rating after years of...

Read More »

Read More »

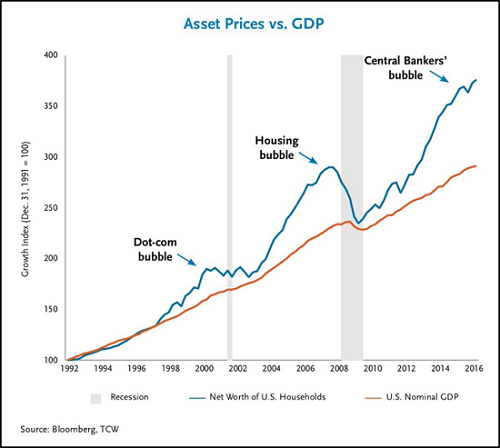

The Death of Buy and Hold: We’re All Traders Now

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses. The conventional wisdom of financial advisors--to save money and invest it in stocks and bonds "for the long haul"--a "buy and hold" strategy that has functioned as the default setting of financial planning for the past 60 years--may well be disastrously wrong for the next decade.

Read More »

Read More »

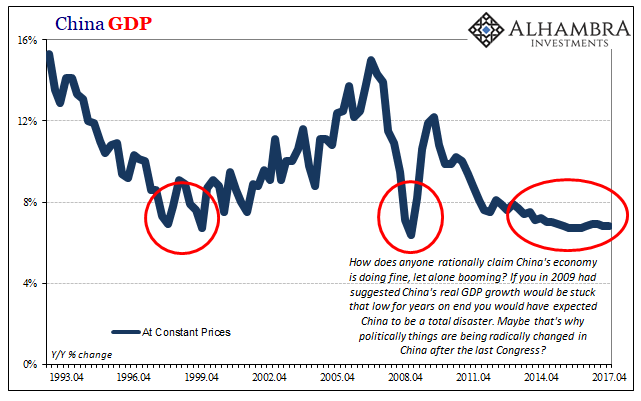

China Going Boom

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more easily accomplished in a place...

Read More »

Read More »

Never Mind Volatility: Systemic Risk Is Rising

So who's holding the hot potato of systemic risk now? Everyone. One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

Read More »

Read More »

China: February PMIs point to deceleration in industrial activity

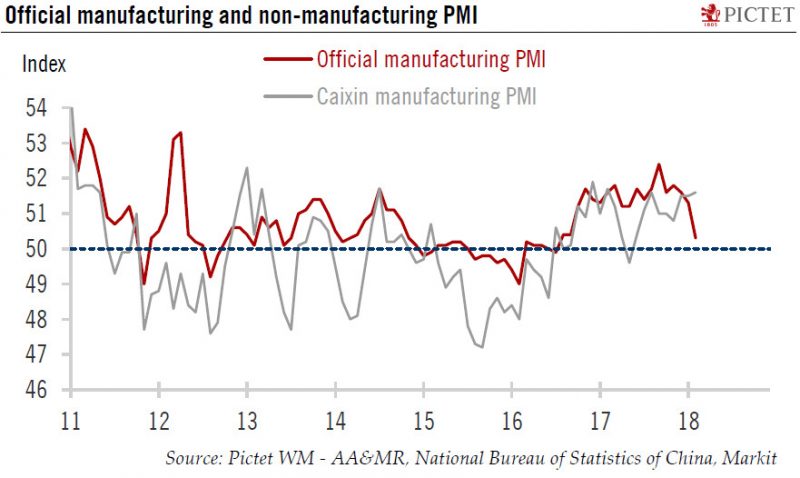

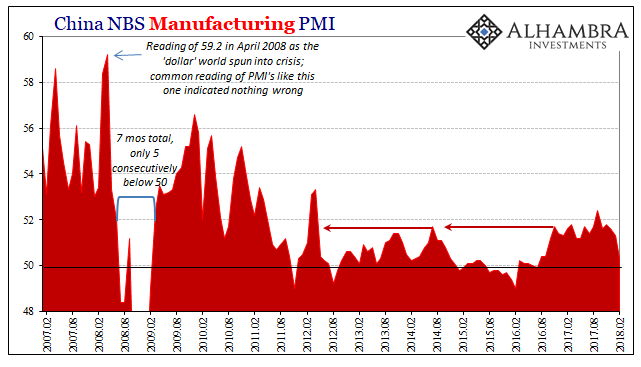

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

Data Distortions One Way Or Another

Back in October, we noted the likely coming of two important distortions in global economic data. The first was here at home in the form of Mother Nature. The other was over in China where Communist officials were gathering as they always do in their five-year intervals. That meant, potentially. In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes.

Read More »

Read More »

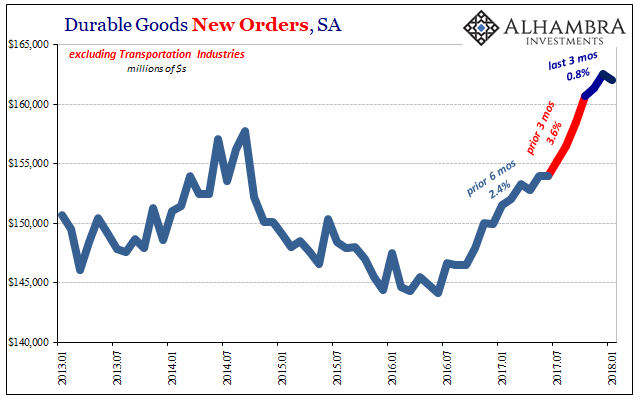

Durable and Capital Goods, Distortions Big And Small

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading.

Read More »

Read More »

Emerging Markets: What Changed

China plans to change its constitution to eliminate term limits for President Xi Jinping. Bank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Bank of Korea Governor Lee was reappointed by President Moon for a second term. Hungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. S&P upgraded Russia to BBB- with stable outlook.

Read More »

Read More »