Category Archive: 5) Global Macro

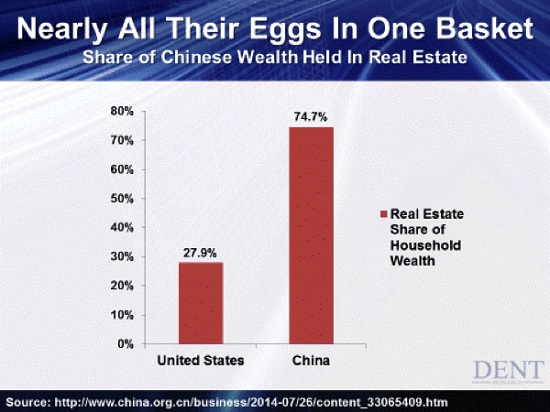

What’s Really Going On in China

Losses will be taken and sacrifices enforced on those who don't understand the Chinese state will no longer absorb the losses of speculative excess. Let's start by stipulating that no one outside President Xi's inner circle really knows what's going on in China, and so my comments here are systemic observations, not claims of insider knowledge.

Read More »

Read More »

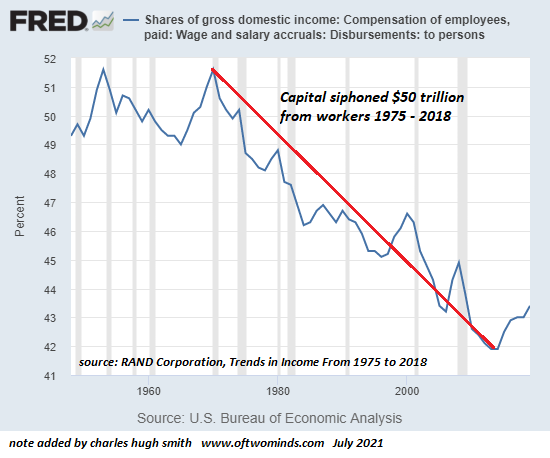

America 2021: Inequality is Now Baked In

This complete capture of all avenues of regulation and governance can only end one way, a kind of hyper-stagflation. Zeus Y. and I go way back, and he has always had a knack for summarizing just how insane,

disconnected from reality, manipulative and exploitive the status quo narrative has become.

Read More »

Read More »

Now That the American Dream Is Reserved for the Wealthy, The Smart Crowd Is Opting Out

The already-wealthy and their minions are unprepared for the Smart Crowd opting out. Clueless economists are wringing their hands about the labor shortage without looking at the underlying causes, one of which is painfully obvious: the American economy now only works for the top 10%; the American Dream of turning labor into capital is now reserved for the already-wealthy.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun discusses China’s Evergrand, this week’s Fed meeting, the overpriced stock market, and the latest CPI numbers and reports.

Read More »

Read More »

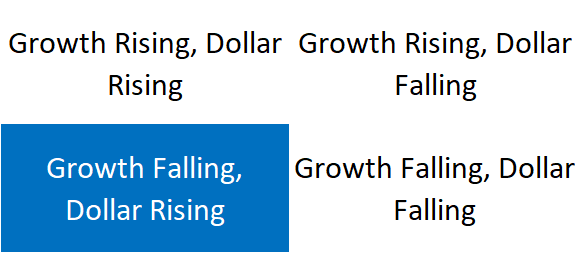

Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time.

Read More »

Read More »

Ministry of Manipulation: No Wonder Trust and Credibility Have Been Lost

Now that every financial game in America has been rigged to benefit the few at the expense of the many, trust and credibility has evaporated like an ice cube on a summer day in Death Valley.

Read More »

Read More »

Is America in decline? | The Economist

America is reeling from a failed war in Afghanistan, political polarisation and increasing social division. Could the superpower be in decline?

00:00 - America’s rising instability

00:45 - Is America in decline?

03:21 - America’s foreign policy failures

05:23 - Is this the end of American intervention?

07:02 - America’s domestic decline: what can be done?

09:09 - Will the infrastructure bill help?

10:40 - Is declinism inevitable?

Did America...

Read More »

Read More »

August Retail Sales Surprise To The Upside, Because They Were Down?

According to the movie The Princess Bride, the worst classic blunder anyone can make is to get involved in a land war in Asia. No kidding. The second is something about Sicilians and death. There is also, I’ve come to learn, an unspoken third which cautions against chasing down and then trying to break down seasonal adjustments in economic data.Some things are best left just as they are published.

Read More »

Read More »

The U.S. Consumer Is Fine: Picet Wealth Management

Sep.16 -- Thomas Costerg, senior U.S. economist at Pictet Wealth Management, says he ignores U.S. consumer surveys. He says the U.S. consumer is fine and can withstand headwinds like the Delta variant and the end of QE. He's on "Bloomberg Surveillance."

Read More »

Read More »

The Illusion of Getting Rich While Producing Nothing

By incentivizing speculation and corruption, reducing the rewards for productive work and sucking wages dry with inflation, America has greased the skids to collapse.

Read More »

Read More »

The U.S. Economy In a Nutshell: When Critical Parts Are On “Indefinite Back Order,” the Machine Grinds to a Halt

A great many essential components in America are on 'indefinite back order', including the lifestyle of endless globally sourced goodies at low, low prices. Setting aside the "transitory inflation" parlor game for a moment, let's look at what happens when critical parts are unavailable for whatever reason, for example, they're on back order or indefinite back order, i.e. the supplier has no visibility on when the parts will be available.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun responds to questions about a slowing economy, long-term economic impacts of COVID, stock prices and the business cycle.

Read More »

Read More »

The Banality of (Financial) Evil

The financialized American economy and State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a putrid heap.

Read More »

Read More »

From 9/11 to covid-19: can New York recover? | The Economist

As New Yorkers commemorate the 20th anniversary of 9/11, they are also contemplating how to recover from covid-19. After 9/11, New York came back stronger—so what lessons can the city's leaders learn from that success to help the city bounce back today?

00:00 Can New York learn from 9/11?

00:33 Remembering 9/11 with Jon Fasman

02:45 Rebuilding after 9/11

06:48 Supporting small businesses during the pandemic

09:28 The age-old problem of racism...

Read More »

Read More »

Please Don’t Pop Our Precious Bubble!

It's a peculiarity of the human psyche that it's remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble's inevitable collapse.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market.

Read More »

Read More »

What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out.

Read More »

Read More »

Covid-19: how tech will transform your kids’ education | The Economist

The pandemic not only disrupted education—it also thrust technology onto a sector which historically has been slow to adopt it. Will classrooms ever be the same again?

00:00 How the pandemic has affected education.

03:08 Why the education sector has been slow to adopt technology.

05:02 Technology helps children have a personalised learning experience.

07:50 How technology can help teachers

09:08 Could remote learning be here to stay?

Read more...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 30 août 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Covid-19: Can vaccines keep up with variants? | The Economist

The race between covid-19 vaccines and variants is on. Alok Jha, The Economist’s science correspondent, and Natasha Loder, health policy editor, discuss what this means for the future

Read more of our coverage on coronavirus: https://econ.st/3t1L6wx

Listen to our daily podcast, Gamechangers, on mRNA technology: https://econ.st/38cSewe

Listen to “The Jab” podcast from Economist Radio: https://econ.st/3yuETKF

Watch our film about mandatory...

Read More »

Read More »