Category Archive: 5) Global Macro

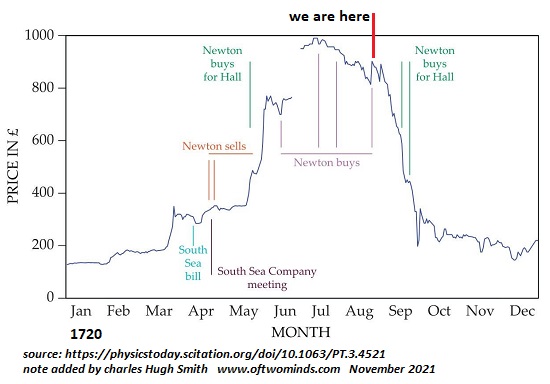

Paging Isaac Newton: Time to Buy the Top of This Bubble

Despite Newton's tremendous intelligence and experience, he fell victim to the bubble along with the vast herd of credulous greedy punters. One of the most famous examples of smart people being sucked into a bubble and losing a packet as a result is Isaac Newton's forays in and out of the 1720 South Seas Bubble that is estimated to have sucked in between 80% and 90% of the entire pool of investors in England.

Read More »

Read More »

Look Out Below: Why a Rug-Pull Flash Crash Makes Perfect Sense

It makes perfect financial sense to crash the market and no sense to reward the retail options marks by pushing it higher. An extraordinary opportunity to scoop up mega-millions in profits has arisen, and grabbing all this free money makes perfect financial sense. Now the question is: will those who have the means to grab the dough have the guts to do so?

Read More »

Read More »

The Contrarian Trade of the Decade: The Dollar Refuses to Die

Which is more valuable: Wall Street's debt/asset bubbles or the global empire? You can't have both, so choose wisely. The consensus makes sense: the U.S. dollar is doomed because the Federal Reserve and the Treasury will conjure trillions of new dollars out of thin air to prop up the status quo entitlements, monopolies, cartels and debt/asset bubbles, and since little of this issuance actually increases productivity, all it will accomplish is the...

Read More »

Read More »

How to cool a warming world | The Economist

The warmer it gets, the more people use air conditioning—but the more people use air conditioning, the warmer it gets. Is there any way out of this trap?

00:00: What’s the cooling conundrum?

01:05: The pros and cons of AC

03:28: How to reinvent air conditioning

05:02: Can buildings be redesigned to keep cool?

07:30: Scalable, affordable cooling solutions

10:24: Policy interventions for cooling

Like our video content? Take our survey to tell us...

Read More »

Read More »

Russia: how Putin is silencing his opponents | The Economist

In Russia, repression is on the rise as Vladimir Putin seeks to crush any form of dissent. From eliminating the opposition—including his main rival, Alexei Navalny—to controlling the courts and purging Russia of free speech, Putin is deploying a wider range of tactics than ever to tighten his grip on power.

00:00 - What is happening in Russia?

01:00 - Why is Putin afraid of Alexei Navanly?

02:33 - The role Russia’s economy plays in Putin’s power...

Read More »

Read More »

Eight Reasons Scarcities Will Increase Rather Than Evaporate

Who knew it would be so easy? All we have to do is collect urine and we'll be flying our electric air taxi tomorrow! While the private-jet crowd is busy selling a future of 1 billion electric vehicles, 1 billion windmills, 1 billion solar arrays, hundreds of thousands of electric aircraft, thousands of new nuclear power plants and trillions more in "wealth" accumulating in their bloated ledgers, reality is intruding on their technocratic...

Read More »

Read More »

One Solution to Soaring Food Prices: Start Your 2022 Garden Now

There is a great deal of joy and satisfaction in gardening; benefits include saving money, eating healthier, sharing the bounty with others and reducing the derealization / derangement of modern life.

Read More »

Read More »

Whistleblowers Torpedo Facebook and Pfizer: Who’s Next?

If America's total dependence on corporate profits and stock market/housing bubbles is

just fine because the bubbles just keep inflating, there's nothing left but rot.

Read More »

Read More »

Reading Jeff Snider: Nobody’s Looking, Economic Activity Revised Down [Ep. 147, Macropiece Theater]

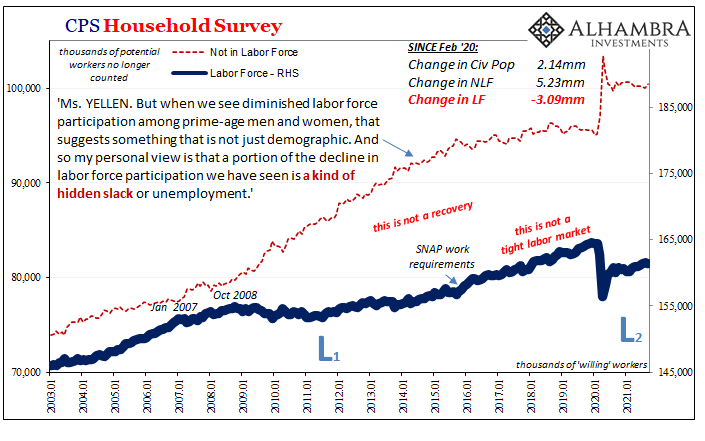

The September 2021 reading for America's new orders of durable goods shows stagnation / stalling. It is likely much worse but we won't know it for several years, not until the benchmark revisions are performed. We've seen this before, in 2018.

Read More »

Read More »

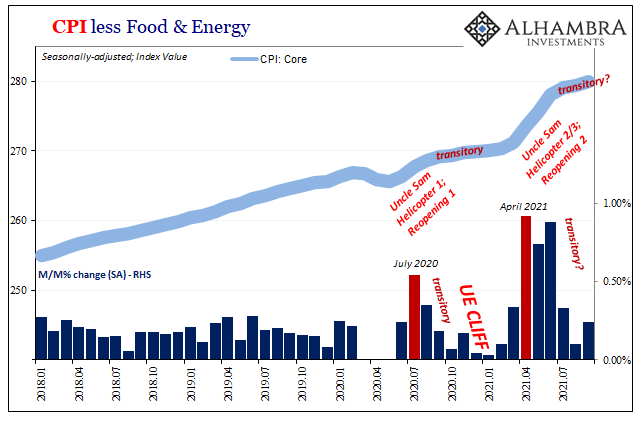

The Wile E. Powell Inflation: Are We Really Just Going To Ignore The Cliff?

Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed.

Read More »

Read More »

Brian Cox: Why Succession struck a chord | The Economist

Brian Cox of HBO’s “Succession” reveals what it’s like to play the tyrannical media mogul and patriarch Logan Roy, and why the show struck such a chord in Trump's America.

00:00 - The success of “Succession”

00:50 - Brian Cox’s career and playing Logan Roy

01:33 - How he finds humanity in Logan Roy

03:42 - Real-life comparisons to the Roys

04:36 - “Succession” in Trump’s America

05:44 - The politics of “Succession”

07:09 - Social mobility and...

Read More »

Read More »

What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace.

Read More »

Read More »

Revenge of the Real World

The status quo response would be amusing if the consequences weren't so dire. Rather than stare at empty shelves, you have two options for distraction: you can don a virtual-reality headset and cavort with dolphins in the metaverse, or you can trade various forms of phantom wealth that always go up (happy happy!) because the Fed.

Read More »

Read More »

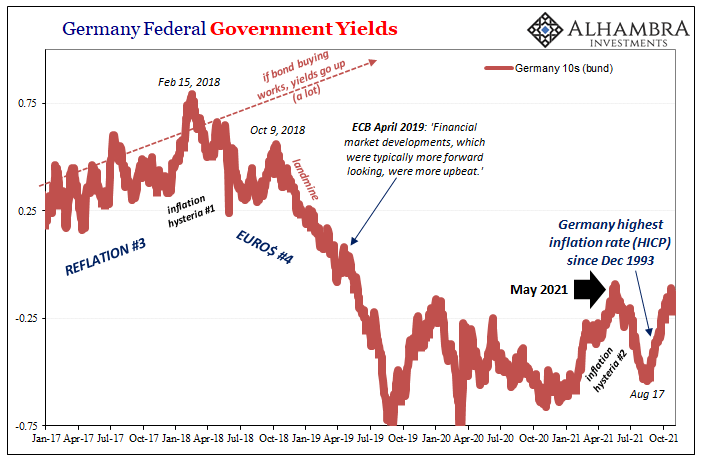

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »

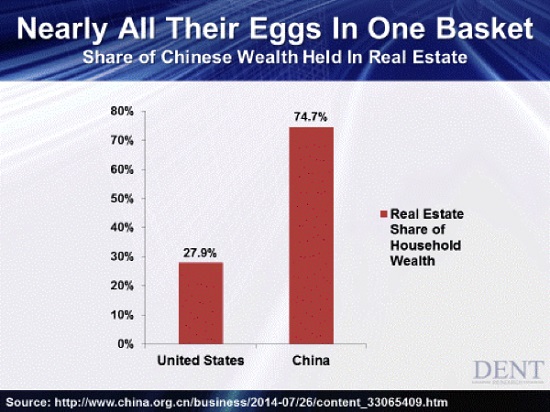

Will China Pop the Global Everything Bubble? Yes

The line of dominoes that is already toppling extends around the entire global economy and financial system. Plan accordingly. That China faces structural problems is well-recognized.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims.

Read More »

Read More »

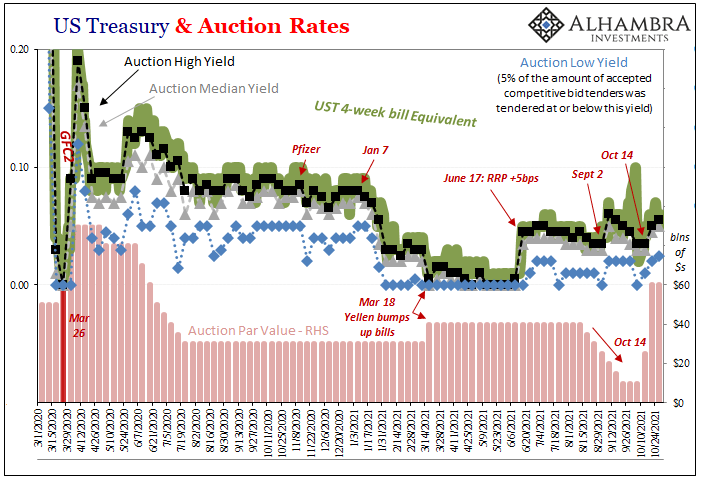

Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though.

Read More »

Read More »

Weekly Market Pulse: Growth Scare?

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved.

Read More »

Read More »

Reading Jeff Snider: Why Do We Think Inflation Expectations Matter? [Ep. 139, Macropiece Theater]

Federal Reserve economist Jeremy Rudd's paper savages the use of inflation expectations in monetary econometrics. He lambasts the profession for producing "minimal direct evidence" and the "next-to-no-examination of alternatives". A reading, by Emil Kalinowski.

Read More »

Read More »

GDP Red Flag

There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%.

Read More »

Read More »