Category Archive: 5) Global Macro

How vegan burgers can help save the planet | The Economist

When people cook steak, they’re also cooking the planet. As meat consumption continues to rise, what role can meat alternatives play in a more sustainable food system? Read more: https://econ.st/3rvlWHC

Film supported by @Infosys

00:00 - What you put on your plate impacts the planet

01:03 - Britain’s meat-eating habits

03:06 - The environmental impact of meat and dairy

05:43 - Plant-based food is better for the environment

07:03 - The rise of...

Read More »

Read More »

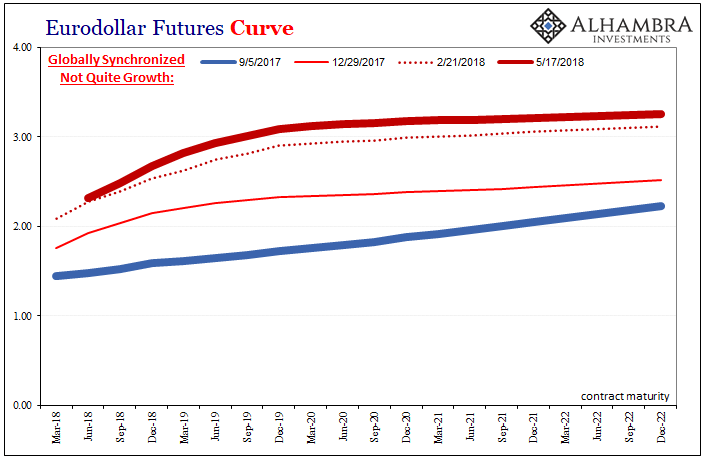

This Is A Big One (no, it’s not clickbait)

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two.

Read More »

Read More »

Covid-19: How dangerous is Omicron? | The Economist

The new variant of covid-19, Omicron, is spreading around the world. Just how infectious is the strain, and will current vaccines prove effective against it? Our experts answer your questions.

00:00 What is Omicron?

01:30 How dangerous is Omicron?

02:39 Will new vaccines be needed?

03:15 What are governments doing?

04:17 Is this new variant a setback in the fight against covid-10?

Keep up to date with The Economist’s coverage of the...

Read More »

Read More »

Medicare Eats Up Most of the 2022 Social Security Raise

There was dancing in the streets when Social Security announced that 2022 checks will go up by 5.9%, the biggest Cost of Living Adjustment (COLA) in 40 years. But now, the streets are empty and the cheering is gone. Most of that Social Security COLA will be eaten up by increases in Medicare.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 29 novembre 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Why Inflation Is a Runaway Freight Train

The value of these super-abundant follies will trend rapidly to zero once margin calls and other bits of reality drastically reduce demand. Inflation, deflation, stagflation--they've all got proponents. But who's going to be right?

Read More »

Read More »

Economic Growth Scare: Are Markets Rightly Scared? [Eurodollar University, Ep. 168c]

The nominal value of Chinese imports of iron ore, German exports and Japanese exports all look pretty, pretty good. But the unit volume is pretty, pretty awful.

Read More »

Read More »

The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID.

Read More »

Read More »

Why it’s harder to earn more than your parents | The Economist

In the 21st century it's got harder to earn more than your parents and to climb the social ladder. What's gone wrong, and what can be done to change this? Film supported by @Mishcon de Reya LLP

00:00 - Why it's harder to get rich if you're born poor

03:29 - Social divisions are increasing within society

04:11 - Changing patterns of social mobility over time

05:41 - Education as a determinant of social mobility

09:16 - Class barriers to further...

Read More »

Read More »

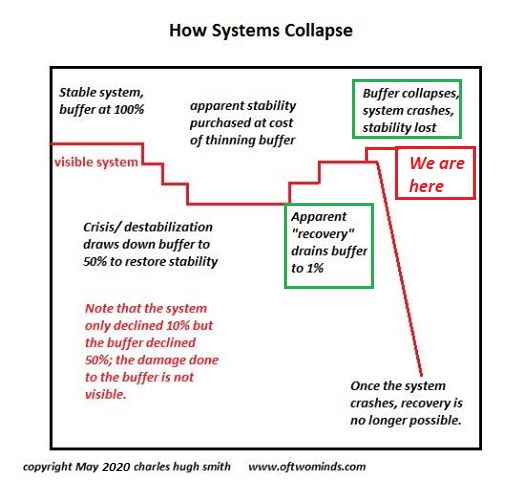

When Risk and Opportunity Become Personal

The opportunity to lower our exposure to risk is always present in some fashion, but embracing this opportunity becomes critical when precarity and change-points rise like restless seas.

Read More »

Read More »

Jeff Snider: Inflation Vs Deflation. Part 2

As the reflation trades cools down and the economic data begins to roll over, Jeff Snider, head of global research at Alhambra Investments, anticipates an ugly, near-term outcome for growth.

Read More »

Read More »

How to manage a megacity | The Economist

By 2050, 6 billion people could be living in cities. How should the challenges caused by rapid urbanization be handled in the world ahead? Film supported by @Mission Winnow

00:00 - What are megacities?

01:01 - The problem with megacities

03:07 - How is Ahmedabad tackling rapid urbanisation?

04:45 - How can cities manage traffic?

07:04 - The problem with waste

08:00 - How is Recycle Central revolutionizing trash?

10:58 - What are the most urgent...

Read More »

Read More »

When Everything Is Artifice and PR, Collapse Beckons

The notion that consequence can be as easily managed as PR is the ultimate artifice and the ultimate delusion. The consequences of the drip-drip-drip of moral decay is difficult to discern in day-to-day life. It's easy to dismiss the ubiquity of artifice, PR, spin, corruption, racketeering, fraud, collusion and narrative manipulation (a.k.a. propaganda) as nothing more than human nature, but this dismissal of moral decay is nothing more than...

Read More »

Read More »

Jeff Snider: Inflation Vs Deflation.

As the reflation trades cools down and the economic data begins to roll over, Jeff Snider, head of global research at Alhambra Investments, anticipates an ugly, near-term outcome for growth.

Read More »

Read More »

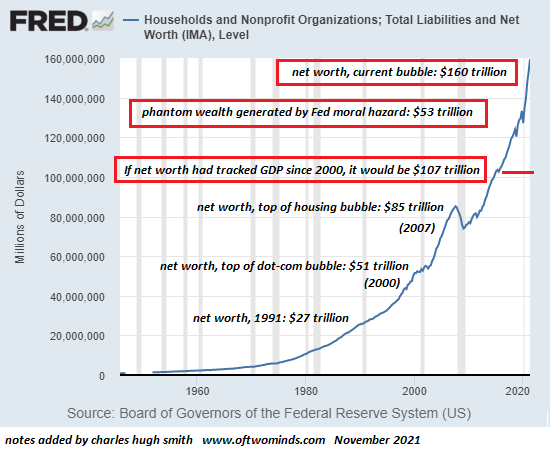

The Fed’s Moral Hazard Monster Is About to Lay Waste to “Wealth”

If the Fed set out to destroy the financial system, they're very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad.

Read More »

Read More »

Is it time to go back to the office? | The Economist

Has the working-from-home revolution been good for productivity? Or is it time for office workers to go back to the office?

00:00 - How have our panellists’ working lives changed?

01:54 - Do employees and employers have different opinions?

03:40 - The impact of race on remote working

04:14 - Do you need to be in the office to be productive?

05:05 - Should teams choose their days in the office?

05:48 - The presenteeism bonus

Like our video...

Read More »

Read More »

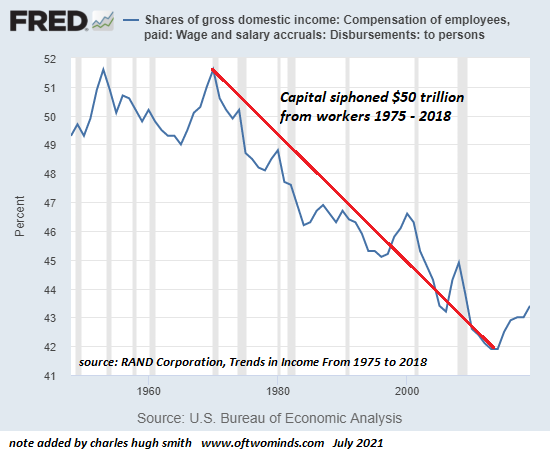

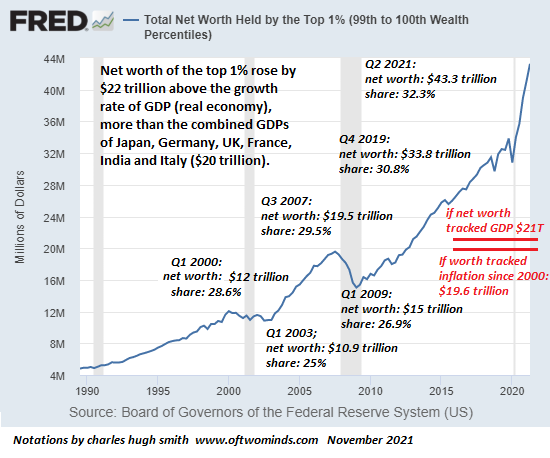

Top 1% Gains More Wealth Than the Combined GDPs of Japan, Germany, UK, France, India and Italy, Bottom 50%–You Get Nothing

Given that political power in America is a pay-to-play auction in which the highest bidder wins, how this incomprehensibly lopsided ownership of wealth plays out is an open question.

Read More »

Read More »

Why QE Is NOT Money Printing | Jeff Snider & Emil Kalinowski

In this episode of On The Margin Mike is joined by Jeff Snider of Alhambra Investments & Emil Kalinowski, Mining & Metals Researcher. Jeff & Emil are hosts of Eurodollar University, a podcast dedicated to analyzing the 2007 malfunction of the monetary system - and how its continuing disorder - affects finance, politics and society.

Read More »

Read More »

How economic policy can help the world recover | The Economist

Economic recovery from covid-19 is deeply uneven around the world. Our experts answer your questions about the problems facing the world economy and the actions governments could take.

00:00 - The problems with the global economy

00:34 - Will there be hyperinflation?

02:26 - What’s behind labour shortages?

04:12 - Disrupted supply and demand

05:20 - Economic policies to tackle climate change

06:00 - Uneven global recovery from the pandemic

07:05 -...

Read More »

Read More »