Category Archive: 5) Global Macro

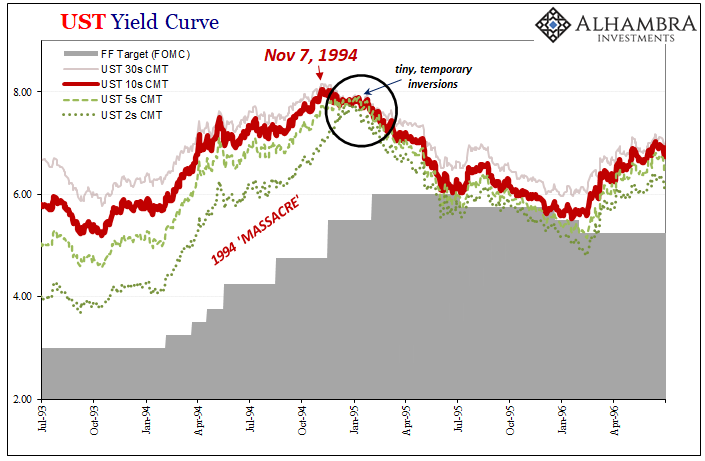

We Can Only Hope For Another (bond) Massacre

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them.I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995.

Read More »

Read More »

Cash from trash: could it clean up the world? | The Economist

The world is facing a growing waste problem, with 2bn tonnes produced last year alone. Is it possible to clean up this mess by turning trash into cash?

Read More »

Read More »

War in Ukraine: The Economist interviews President Zelensky | The Economist

Volodymyr Zelensky talks to The Economist’s editor-in-chief, Zanny Minton Beddoes, in his Kyiv complex dubbed “the fortress”. In a wide-ranging interview, the Ukrainian president discusses the state of the war, the international support he needs and what a Ukrainian victory would look like.

00:00 President Zelensky meets The Economist

00:44 Actor-turned-president: how did it happen?

03:53 Where was President Zelensky when the war started?

04:34...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 28 mars 2022, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

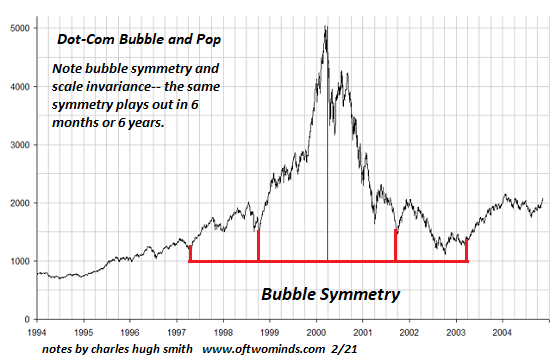

Calm Before the Storm?

Stocks don't vanish when sold; somebody owns the shares all the way to the bottom. These owners who refuse to sell because they have convinced themselves the next dip will be the hoped-for resumption of the bullish trend are called "bagholders."

Read More »

Read More »

War in Ukraine: is a peace deal possible? | The Economist

As negotiations between Russia and Ukraine continue, our experts discuss what conditions might encourage both sides to lay down their weapons—and how likely a peace deal really is.

00:00 - War in Ukraine: when will there be peace?

00:37 - What would a peace deal involve?

02:30 - What will happen to Ukrainian territory?

04:29 - What is the perspective from the Russian side?

08:04 - Is Putin’s legitimacy weakening?

Find all our coverage on the...

Read More »

Read More »

Autocracy’s Fatal Weakness

This desire for compliance and consensus dooms the autocracy to failure and collapse because dissent is the essence of evolutionary churn and adaptation. The various flavors of autocracy (theocracy, kleptocracy, dictatorship, etc.) look remarkably successful at first blush but they all share a fatal flaw.

Read More »

Read More »

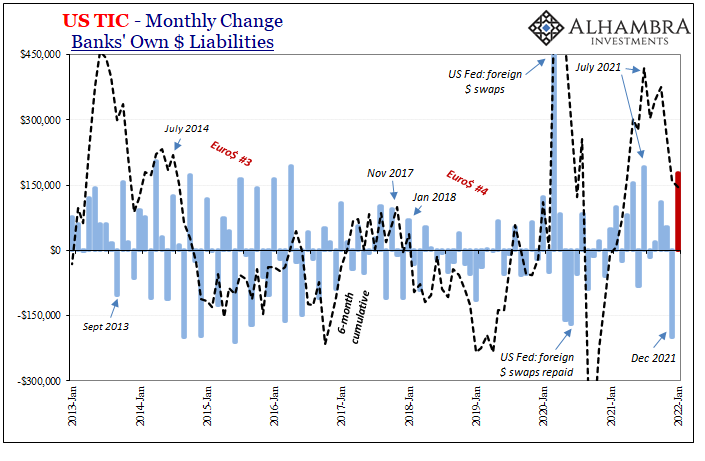

It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention.

Read More »

Read More »

Sustainable materials: is there a concrete solution? | The Economist

The construction industry is responsible for over a tenth of the world’s man-made carbon emissions, with concrete being the biggest culprit. How can we continue to build, without it costing the earth?

Film supported by @Infosys

00:00 - The trouble with rubble

00:55 - Construction is driving climate change

02:54 - The second most consumed resource on the planet: concrete

03:44 - Why concrete is so bad for the environment

04:40 - Cement...

Read More »

Read More »

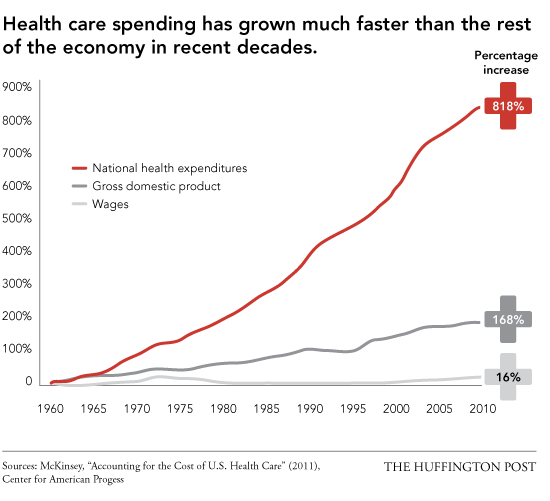

How Healthcare Became Sickcare

The financialization of healthcare started two generations ago and is now in a run-to-fail feedback loop of insolvency. Long-time readers know I have been critical of U.S. healthcare for over a decade. When I use the term sickcare this is not a reflection on the hard work of frontline caregivers--it is a reflection of the financialization incentives that have distorted the system's priorities and put it on a path to insolvency.

Read More »

Read More »

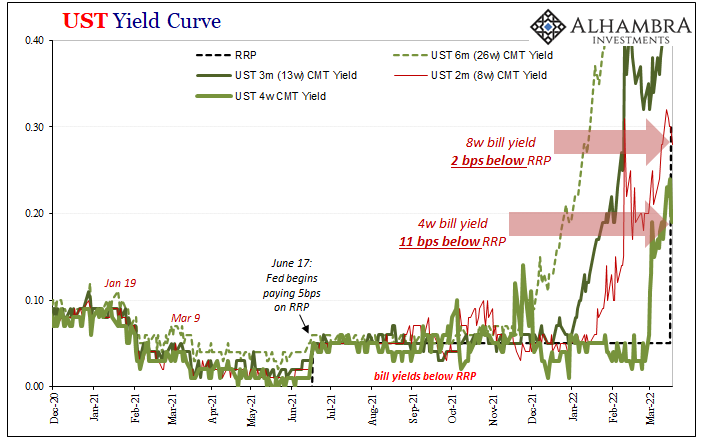

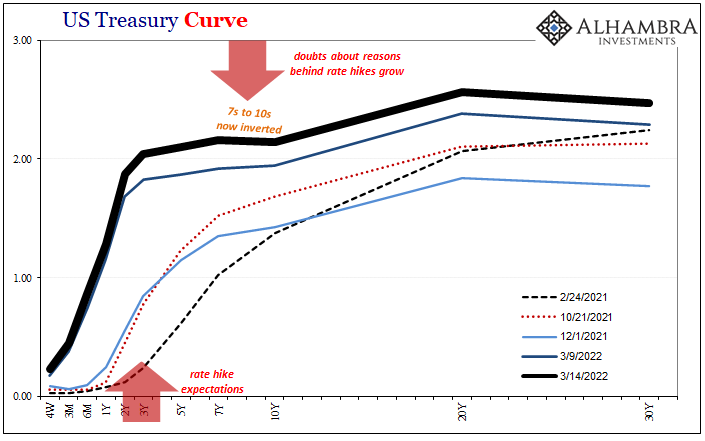

Inversion Is The Real March Madness, Just Don’t Take It Literally

With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets.

Read More »

Read More »

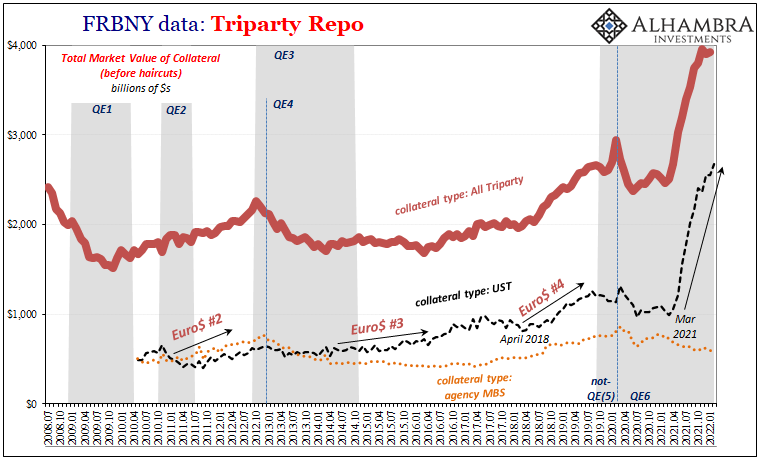

The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps.

Read More »

Read More »

Baby Boomer Retirement at Risk

The seven deadliest words in the English language—We’ve never done it this way before. And that certainly applies to Baby Boomers whose prospects for retirement are different than any preceding generation.

Read More »

Read More »

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy by: Charles Hugh Smith

National Security is not just military force. In an age of scarcity, security is a degrowth economy of energy independence, social cohesion and civic virtue.

All nations, including the United States, face systemic crises that are reinforcing each other at an explosive point in history.

Read More »

Read More »

Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end.We shouldn’t care much about the Fed.

Read More »

Read More »

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 2]

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking.

Read More »

Read More »

Gene editing: should you be worried? | The Economist

From combating climate change, to curing disease, to creating designer babies, gene-editing technologies have the potential to transform lives. What risks do they pose?

00:00 - Gene editing: risk v reward

01:06 - Cavendish bananas are under threat

03:47 - GM crops have a bad reputation

05:18 - GM mosquitoes could reduce transmissible viruses

07:50 - Ethical concerns around genetic interventions

09:30 - Editing genes with CRISPR

10:57 - CRISPR...

Read More »

Read More »

The Roundtable Insight with Charles Hugh Smith on The Great Awakening Vision

Http://financialrepressionauthority.com/2022/03/17/the-roundtable-insight-charles-hugh-smith-on-the-great-awakening-vision/

Link to the Article on the alternative Great Reset - http://financialrepressionauthority.com/2022/03/08/the-great-awakening-an-alternative-great-reset-based-on-the-principles-of-the-austrian-school-of-economics

Read More »

Read More »

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place.

Read More »

Read More »

Risk Accumulates Where No One Is Looking For It

All this decay is so incremental that nobody thinks it possible that it could ever accumulate into a risk that threatens the entire system. The funny thing about risk is the risk that everyone sees isn't the risk that blows up the system. The mere

fact that everyone is paying attention to the risk tends to defang it as everyone rushes to hedge or reduce the risk.

Read More »

Read More »