Category Archive: 5) Global Macro

The Market Crash Nobody Thinks Is Possible Is Coming

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold. The ideal setup for a crash is a consensus that a crash is impossible--in other words, just like the present: sure, there are carefully measured murmurings about a "correction" but nobody with anything to lose in the way of public credibility is calling for an honest-to-goodness crash, a real crash, not a wimpy, limp-wristed dip that will...

Read More »

Read More »

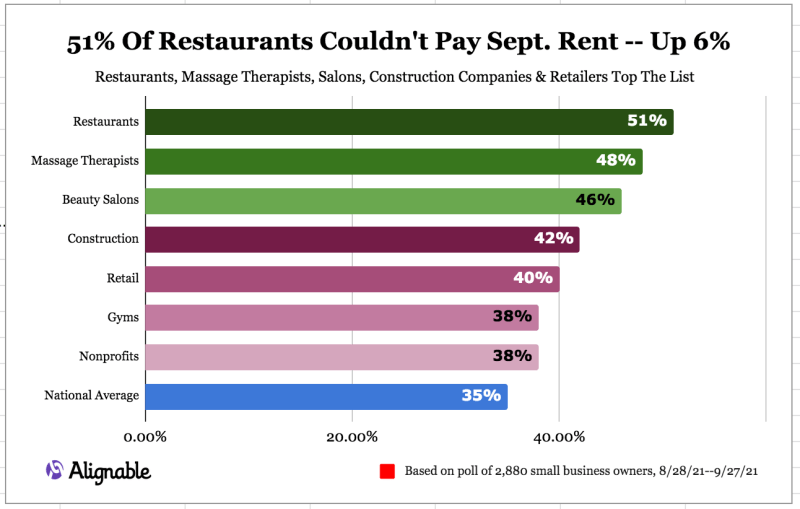

An Economy Dividing By Inventory And Labor

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too.

Read More »

Read More »

Revisiting The Last Overhang

One reason why I still believe the US most likely would have entered a recession at some point in 2020 even without COVID wasn’t just the yield curve inversion that popped up several months before then. In August of 2019, the small part of the Treasury curve most people pay attention to (2s10s) did send out that dreaded signal, suggesting already to expect contraction in the intermediate term ahead of then.

Read More »

Read More »

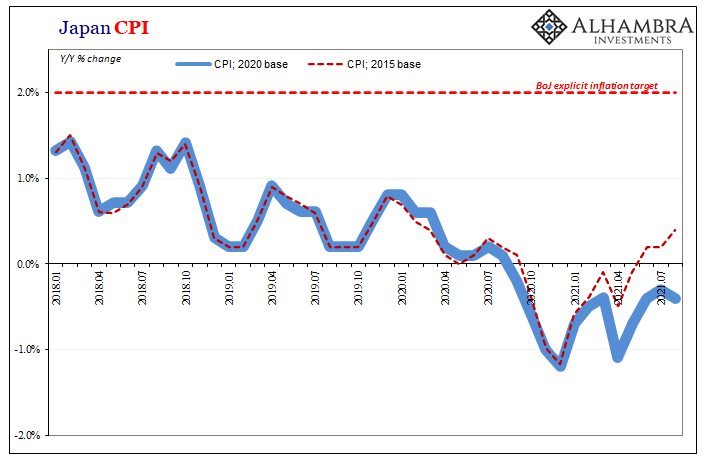

August Avoids Zero In JGB’s

Central banks and their staffs have long been accused of trying to hide inflation. This allegation had been a staple of their critics, those charging reckless monetary policies for creating “too much” money that had allegedly been causing price imbalances all over the financial map.

Read More »

Read More »

Are We Really So “Rich”? A New Way of Defining Wealth

What if our commoditized, financialized definition of wealth reflects a staggering poverty of culture, spirit, wisdom, practicality and common sense? The conventional definition of wealth is solely financial: ownership of money and assets.

The assumption is that money can buy anything the owner desires: power, access, land, shelter, energy, transport and if not love, then a facsimile of caring.

Read More »

Read More »

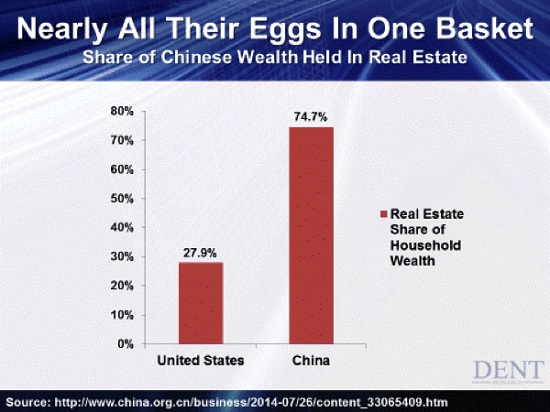

Weekly Market Pulse: Not So Evergrande

US stocks sold off last Monday due to fears over the potential – likely – failure of China Evergrande, a real estate developer that has suddenly discovered the perils of leverage. Well that and the perils of being in an industry not currently favored by Xi Jinping. He has declared that houses are for living in not speculating on and ordered the state controlled banks to lend accordingly.

Read More »

Read More »

To see Germany’s future, look at its cars | The Economist

As the election approaches, Germany's carmakers will face the same challenges as its new leaders: a need to innovate, tackle climate change and reassess its trade relationship with China. How this world-renowned motor industry navigates the road ahead could tell a lot about Germany’s future.

00:00 - Germany faces numerous challenges

00:49 - Can Germany’s cars reveal its future? (or whatever the title is) ...

Read More »

Read More »

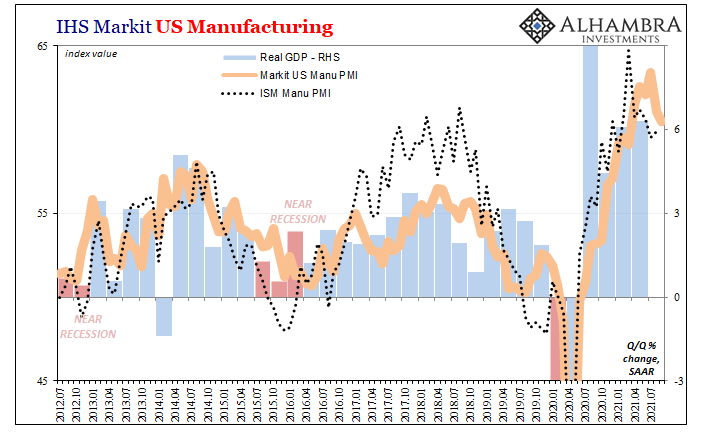

All Eyes On Inventory

You’ve heard of the virtuous circle in the economy. Risk taking leads to spending/investment/hiring, which then leads to more spending/investment/hiring. Recovery, in other words. In the old days of the 20th century, quite a lot of the circle was rounded out by the inventory cycle. Both recession and recovery would depend upon how much additional product floated up and down the supply chain.

Read More »

Read More »

What’s Really Going On in China

Losses will be taken and sacrifices enforced on those who don't understand the Chinese state will no longer absorb the losses of speculative excess. Let's start by stipulating that no one outside President Xi's inner circle really knows what's going on in China, and so my comments here are systemic observations, not claims of insider knowledge.

Read More »

Read More »

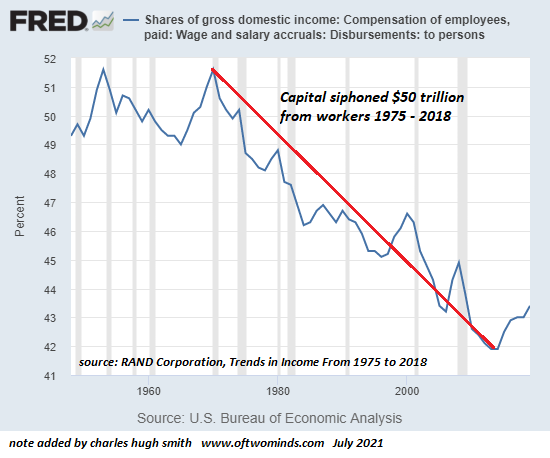

America 2021: Inequality is Now Baked In

This complete capture of all avenues of regulation and governance can only end one way, a kind of hyper-stagflation. Zeus Y. and I go way back, and he has always had a knack for summarizing just how insane,

disconnected from reality, manipulative and exploitive the status quo narrative has become.

Read More »

Read More »

Now That the American Dream Is Reserved for the Wealthy, The Smart Crowd Is Opting Out

The already-wealthy and their minions are unprepared for the Smart Crowd opting out. Clueless economists are wringing their hands about the labor shortage without looking at the underlying causes, one of which is painfully obvious: the American economy now only works for the top 10%; the American Dream of turning labor into capital is now reserved for the already-wealthy.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun discusses China’s Evergrand, this week’s Fed meeting, the overpriced stock market, and the latest CPI numbers and reports.

Read More »

Read More »

Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time.

Read More »

Read More »

Ministry of Manipulation: No Wonder Trust and Credibility Have Been Lost

Now that every financial game in America has been rigged to benefit the few at the expense of the many, trust and credibility has evaporated like an ice cube on a summer day in Death Valley.

Read More »

Read More »

Is America in decline? | The Economist

America is reeling from a failed war in Afghanistan, political polarisation and increasing social division. Could the superpower be in decline?

00:00 - America’s rising instability

00:45 - Is America in decline?

03:21 - America’s foreign policy failures

05:23 - Is this the end of American intervention?

07:02 - America’s domestic decline: what can be done?

09:09 - Will the infrastructure bill help?

10:40 - Is declinism inevitable?

Did America...

Read More »

Read More »

August Retail Sales Surprise To The Upside, Because They Were Down?

According to the movie The Princess Bride, the worst classic blunder anyone can make is to get involved in a land war in Asia. No kidding. The second is something about Sicilians and death. There is also, I’ve come to learn, an unspoken third which cautions against chasing down and then trying to break down seasonal adjustments in economic data.Some things are best left just as they are published.

Read More »

Read More »

The U.S. Consumer Is Fine: Picet Wealth Management

Sep.16 -- Thomas Costerg, senior U.S. economist at Pictet Wealth Management, says he ignores U.S. consumer surveys. He says the U.S. consumer is fine and can withstand headwinds like the Delta variant and the end of QE. He's on "Bloomberg Surveillance."

Read More »

Read More »

The Illusion of Getting Rich While Producing Nothing

By incentivizing speculation and corruption, reducing the rewards for productive work and sucking wages dry with inflation, America has greased the skids to collapse.

Read More »

Read More »

The U.S. Economy In a Nutshell: When Critical Parts Are On “Indefinite Back Order,” the Machine Grinds to a Halt

A great many essential components in America are on 'indefinite back order', including the lifestyle of endless globally sourced goodies at low, low prices. Setting aside the "transitory inflation" parlor game for a moment, let's look at what happens when critical parts are unavailable for whatever reason, for example, they're on back order or indefinite back order, i.e. the supplier has no visibility on when the parts will be available.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun responds to questions about a slowing economy, long-term economic impacts of COVID, stock prices and the business cycle.

Read More »

Read More »