Category Archive: 5) Global Macro

Climate change technology: is shading the earth too risky? | The Economist

If the world is getting too hot, why not give it some shade? Solar geoengineering could halt global warming, but there are risks to this controversial technology.

00:00 - Is solar geoengineering worth the risks?

00:41 - On the frontline of climate change

01:40 - What is solar geoengineering?

02:05 - Why the Saami Council stopped a research project

03:33 - Why we need more research

05:05 - The risk of global political tension

06:12 - The risk of...

Read More »

Read More »

Captured Britons put on Russian TV seeks Boris Johnson’s help to free them

In a dramatic escalation two British fighters captured in Ukraine by Russian forces were broadcast on Russian state TV, both men looking haggard appealed to British Prime Minister Boris Johnson to negotiate their release and asked to be exchanged for pro-Russian politician and Putin ally Viktor Medvedchuk.

Read More »

Read More »

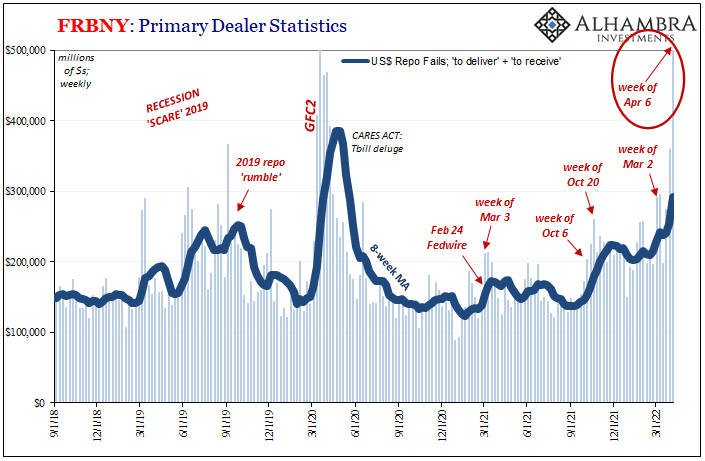

I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape.

Read More »

Read More »

Ukraine says ‘Russia has begun it’s eastern offensive,’ explosions reported across Donbas | WION

It is week nine of the Russian invasion of Ukraine and Kyiv says that the second phase of the war has now begun. Russia has launched its much anticipated offensive with explosions reported all along the eastern front, Ukraine's President Zelensky vowed to fight on, listen in.

Read More »

Read More »

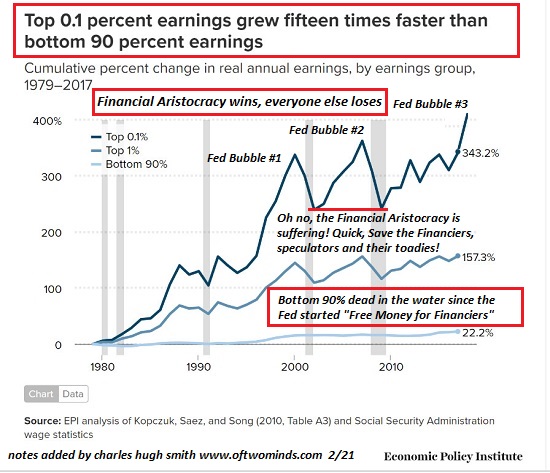

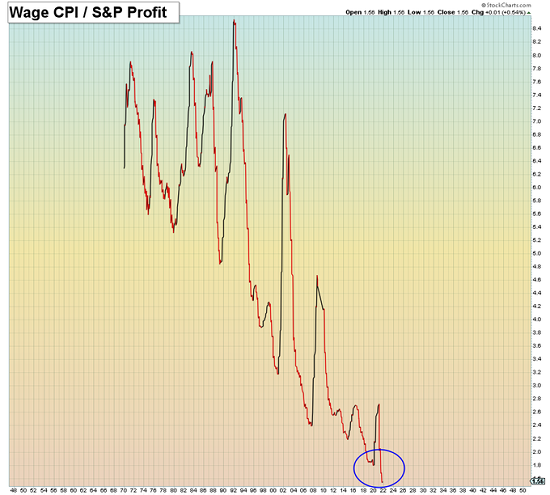

A Couple of Thoughts on Big Numbers

Let's ask "cui bono" of the $33 trillion in added debt and the $9 trillion added to GDP: to whose

benefit?

I've been thinking about how hard it is to get our heads around big numbers.

Read More »

Read More »

Crypto: a beginner’s guide | The Economist

Cryptocurrencies, decentralised finance and blockchain technology—what do these terms really mean? The Economist’s finance correspondents guide us through the key concepts of crypto.

00:00 - Crypto can be confusing

00:19 - What is crypto?

01:08 - What is a blockchain?

02:05 - What is mining?

03:15 - What is Bitcoin?

04:00 - What is Ethereum?

04:44 - What is an NFT?

05:41 - How to understand crypto

Watch the full discussion here:...

Read More »

Read More »

Debt Saturation: Off the Cliff We Go

When the system can't borrow more and distribute the insolvency, it implodes. I started writing about debt saturation back in 2011. The basic idea is we can continue to borrow and spend as long as one of two conditions hold: 1) real (inflation-adjusted) income is rising, so there's more income to service additional debt, or 2) the cost of borrowing declines so the same income can support more debt.

Read More »

Read More »

Ukraine-Russia conflict: Russian missile attack kills 5 In Ukraine’s Kharkiv | World News | WION

The assault on major Ukrainian cities is only intensifying. In a series of strikes, Russia has attacked Ukraine's second-largest city of Kharkiv killing at least five people and injuring 13.

Read More »

Read More »

Ukraine under attack: Zelensky calls situation in Mariupol ‘Inhuman’

Russia-Ukraine conflict shows no signs of abating. Ukrainian president Zelensky said that Kyiv will stall all negotiation talks with Moscow if the last Ukrainian troops in the besieged city of Mariupol are harmed.

Read More »

Read More »

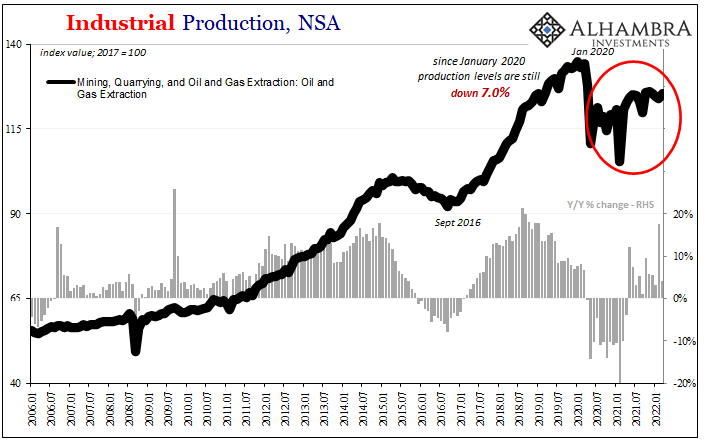

Yield Curve Inversion Was/Is Absolutely All About Collateral

If there was a compelling collateral case for bending the Treasury yield curve toward inversion beginning last October, what follows is the update for the twist itself. As collateral scarcity became shortage then a pretty substantial run, that was the very moment yield curve flattening became inverted.Just like October, you can actually see it all unfold.

Read More »

Read More »

Gravitas: Finland prepares for a potential war with Russia

Russia's Ukraine invasion has sparked concerns in Finland. The Nordic country is preparing for a possible conflict with Russia. Its citizens are learning how to use a gun. the government is stockpiling essentials. Palki Sharma tells you more.

Read More »

Read More »

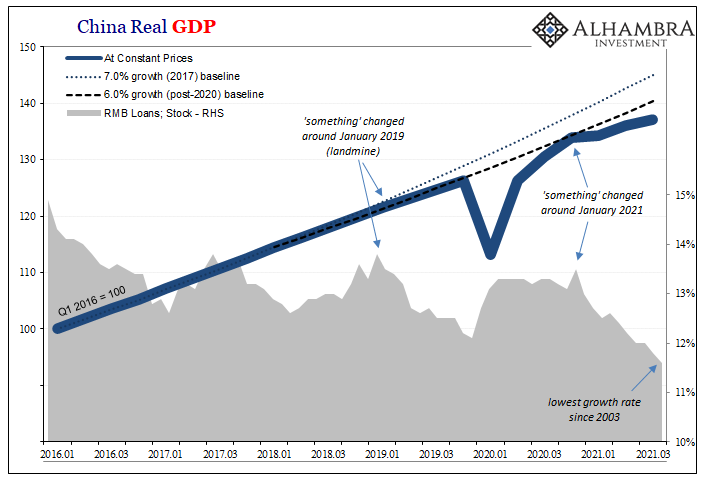

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

China’s Imports Outright Declined In March, And COVID Was The Reason Why But Not Really

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics.

Read More »

Read More »

India’s software giant Infosys announces withdrawal from Russia

The Indian software giant Infosys has finally joined the corporate boycott of Russia over its invasion of Ukraine. Speaking to media at its headquarters in India's Bengaluru Infosys said it would move its business out of the country and pursue alternate options.

Read More »

Read More »

US gives Ukraine $800 million more in military aid | Latest English News | WION

US President Joe Biden announced an additional $800 million in military assistance to Ukraine, expanding the scope of the systems provided to include heavy artillery ahead of a wider Russian assault expected in eastern Ukraine.

Read More »

Read More »

Yes, It Is Different This Time

Most people would be horrified by a 40% decline in their "investments." When bubbles pop, speculative assets don't drop 40%, they drop 90% or even 98%.

Read More »

Read More »

Gravitas: Japan says Russia has “illegally occupied” disputed islands

A decades-long territorial dispute between Japan and Russia has been reignited. Tokyo claims Russia has "illegally occupied" four disputed islands. Molly Gambhir tells you more.

#Gravitas #Japan #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring...

Read More »

Read More »

French election 2022: Marine Le Pen wants France out of NATO | World News | WION

The presidential challenger and far-right candidate Marine Le Pen pitches her foreign policy agenda. Le Pen wants closer NATO-Russia ties. To get more details, we're joined by William Courtney of RAND corporation.

#France #MarineLePen #Elections

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With...

Read More »

Read More »

Brexit: What will happen to Ireland? | The Economist

The border between Northern Ireland and the Republic is one of the most contentious in the world. But what really divides Ireland? And after Brexit, is Irish unification a real possibility?

00:00 Ireland’s irregular border

00:45 Ireland’s history divided

02:31 Caught on the wrong side

04:36 The Troubles

06:30 Working towards peace

07:44 New divisions, old tensions

Sign up to The Economist’s daily newsletter to keep up to date with our latest...

Read More »

Read More »

Russian Warship ‘Seriously Damaged,’ Ukraine claims responsibility

While Ukraine and Russia continue to hold ceasefire talks the fighting on ground has only intensified. With Moscow now reporting attack on warship, a Russian flagship was reportedly damaged due to attack at the Black Sea. Russian navy's flagship sea fleet the Moskva missile cruiser was damaged heavily.

Read More »

Read More »