Category Archive: 5) Global Macro

Ukraine hits Russian base in South, blasts kill 3 in Russian city of Belgorod | World News

As per the reports, at least 3 people were killed and dozens of buildings damaged in the Russian city of Belgorod. Russia claimed that Ukraine has targeted citizens in Belgorod.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 4 juillet 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

Russia claims ‘full control’ over Luhansk region | Latest International News

In a latest update on Russia-Ukraine conflict, Russia has claimed that it has taken control of Ukraine's eastern Luhansk region. However, Ukraine did not confirm Russia's control over Luhansk.

Read More »

Read More »

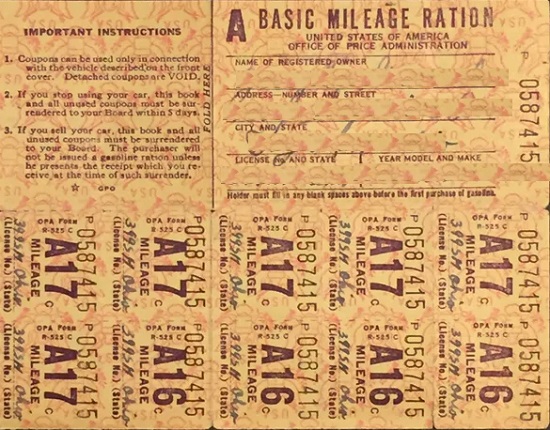

The Most Valuable Form of Money Nobody’s Seen–Yet

What is "money"? "Money" is a claim on the essentials of life. Ration cards are claims on essentials.Many people expect "money" will soon be tied to commodities. Agreed. It's called a ration cardthat grants the holder the right to buy a specific quantity of essential goods at a specified price.

Read More »

Read More »

Global Leadership Series: ‘Russia & Ukraine must negotiate and not fight,’ says Ugandan Prez

In an exclusive conversation with Ugandan President Yoweri Museveni with Eric Njoka on WION's Global Leadership, he said, we did not support motions against Russia at United Nations. He added, Russia & Ukraine must negotiate and not fight.

Read More »

Read More »

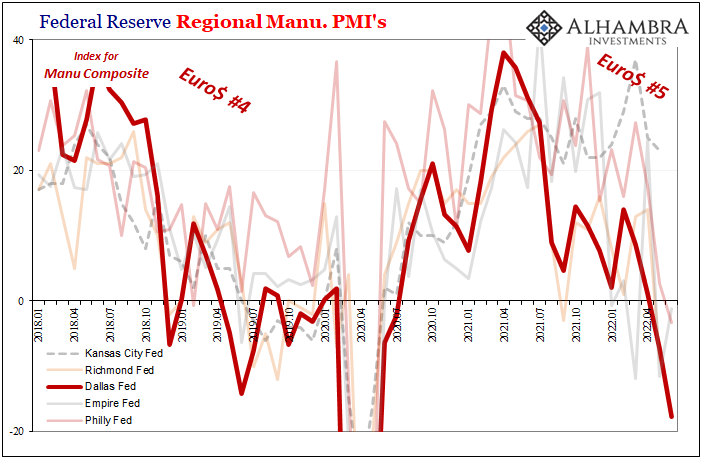

Demand Down, Supply Down, Ugly Up

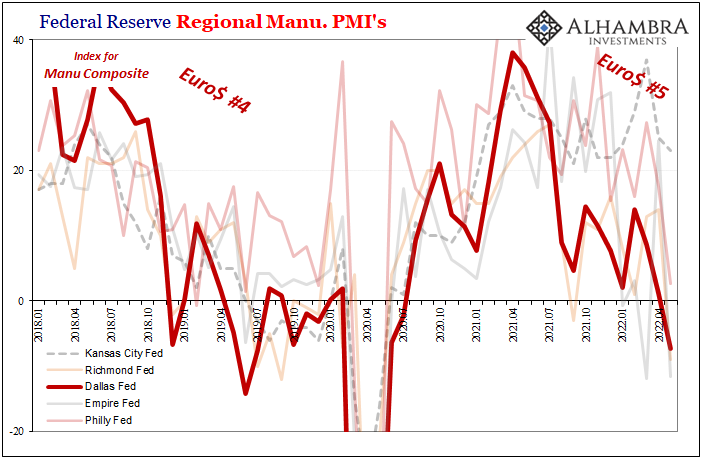

Well, that was a mess. The Richmond Fed’s Manufacturing Survey was at first released before being taken back. Initially reported as a plunge in the headline number, it was quickly scrapped once the statisticians remembered they had just discontinued their average workweek component – but had kept a zero in its place when tallying the overall PMI.

Read More »

Read More »

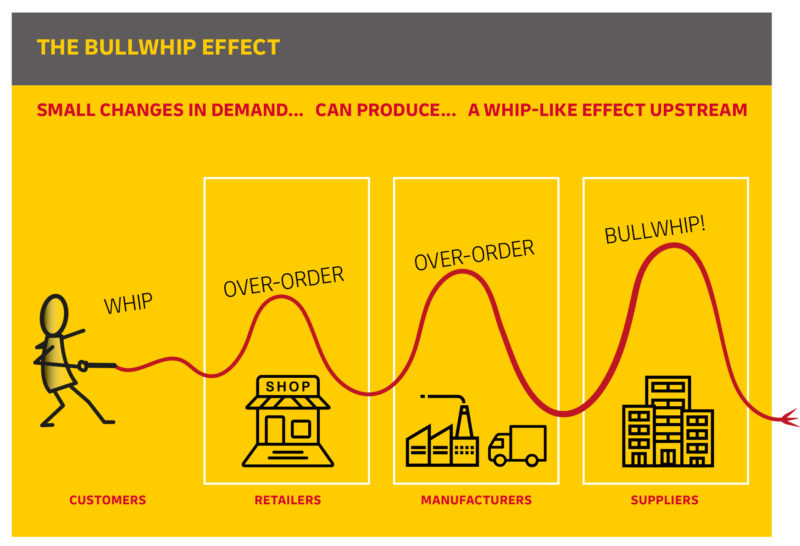

Getting Whipped Will Really Hurt

The Federal Reserve’s various branches don’t just do manufacturing surveys anymore. This is a modern economy, after all, meaning industry isn’t the same top dog as what it used to be. While still important, and still able to tear down even the global-iest synchronized of growth-y, services are the big macro enchilada.

Read More »

Read More »

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

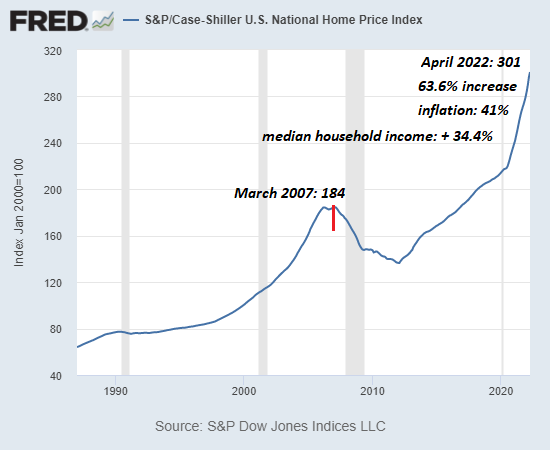

Why the Housing Bubble Bust Is Baked In

Putting this all together, it's clear that the source of the current housing bubble is the explosion of financial speculation fueled by central bank policies. Those benefiting from speculative bubbles have powerful incentives to deny the bubble can bust.

Read More »

Read More »

Eurodollar Futures Interpretation Is Everywhere

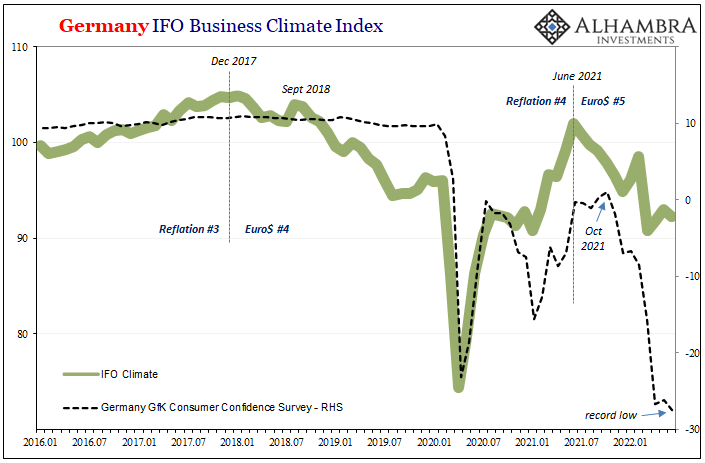

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation.

Read More »

Read More »

How China crushed Hong Kong

In 1997 China promised to protect Hong Kong's freedoms for the next five decades—but just 25 years after the handover, Hong Kong is now a police state. So how did China crush Hong Kong?

00:00 - How China crushed Hong Kong

00:44 - Tiananmen square massacre vigil banned

02:37 - China’s ambition since 1842: reclaim Hong Kong

04:16 - How China needed Hong Kong’s booming business

05:30 - President Xi’s aim to crush Hong Kong

07:30 - How China...

Read More »

Read More »

It’s Inventory PLUS Demand

It’s not just the flood of never-ending inventory. That’s a huge and growing problem, sure, as the chickens of last year’s short-termism overordering finally come home to their retailer roost. Being stuck with too many goods isn’t necessarily fatal to the global and domestic manufacturing sectors.

Read More »

Read More »

Letting Retirees Save for Healthcare Tax-Free

Health Savings Accounts (HSA) for retired folks. Isn’t that a novel idea? But it’s being considered in Congress—The Health Savings for Seniors Act, H.R. 3796.

Read More »

Read More »

Weekly Market Pulse: Expand Your Horizons

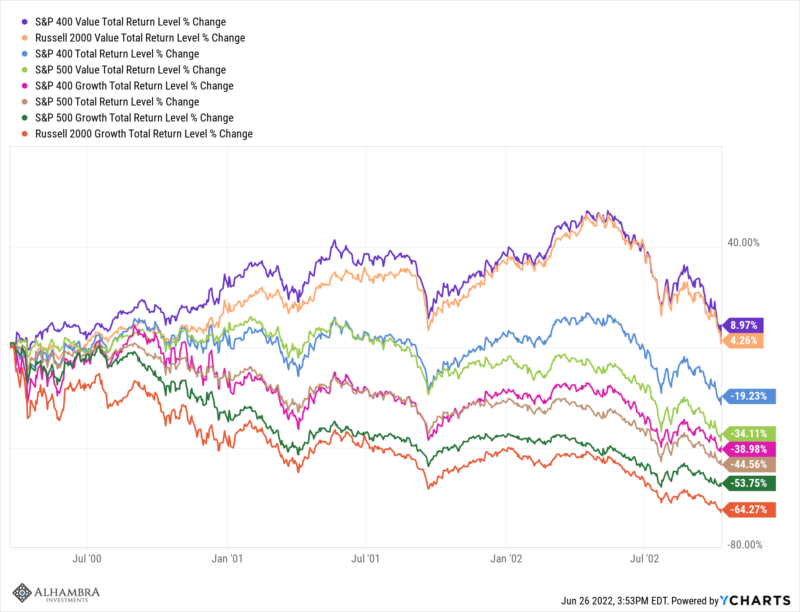

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

The Biggest Risk, No Surprise, Collateral

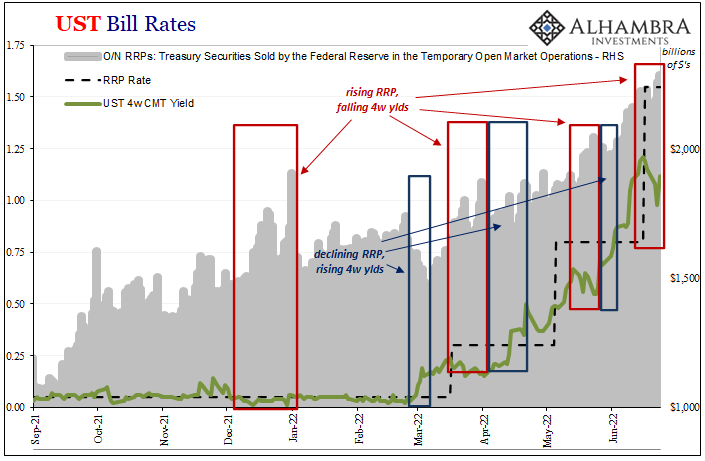

It’s not just the 4-week T-bill rate which is defying the Fed’s illusion of control, though that’s where the incidents are most evident. The front bill is nowhere close to the official RRP “floor” which can only mean one thing: collateral shortage, a large and persistent liquidity premium.

Read More »

Read More »

The Age of Discord

It's very difficult to find common ground that supports cooperation in the disintegrative stage of scarcities, rising prices, catastrophically centralized power and social discord. Today's topic echoes Peter Turchin's 2016 book, Ages of Discord, which I have often referenced in blog posts.

Read More »

Read More »

Nasty Number Five, Not Hawk Hiking CBs

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide.

Read More »

Read More »

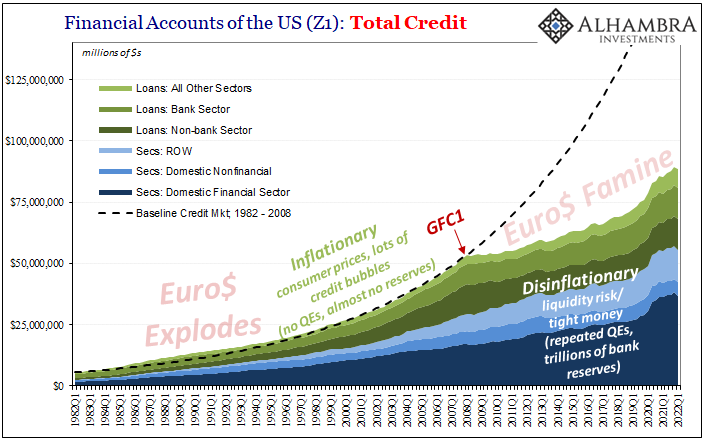

The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was.What data?

Read More »

Read More »

G7 summit: Germany gears up for 48th G7 meeting | Ukraine-Russia war to dominate talks | WION

The stage is set in Germany for the 48th G7 Summit. World leaders have started arriving and like most high-stakes meetings, Russia-Ukraine War going to dominate the talks. US President Joe Biden has reached Germany. Watch this report by Siddhant Sibbal from G7 media centre, Garmisch, Germany.

#g7summit #ukrainerussiawar #WION

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the...

Read More »

Read More »

World at War | Episode 8: Russia captures Severodonetsk from Ukraine

World at War | Episode 8: Russia captures Severodonetsk from Ukraine

Moscow deploys missiles in the Arctic for world domination

Taiwanese student Joseph Wen releases maps of Chinese PLA's military assets

Why is Tanzania evicting thousands of Maasai people from Ngorongoro?

& Islamic State Khorasan attacks gurudwara in Kabul

Mohammed Saleh gets you an indepth report on the world's biggest conflict zones of the week in World At War

#WorldAtWar...

Read More »

Read More »