Category Archive: 5) Global Macro

Historic shift in Russian energy flows, becomes China’s 4th largest LNG supplier | Latest | WION

The coordinated sanctions imposed on Russian oil and gas by the US, Europe and their Pacific allies have led to a historic shift in the direction of the Russian energy flow.

Read More »

Read More »

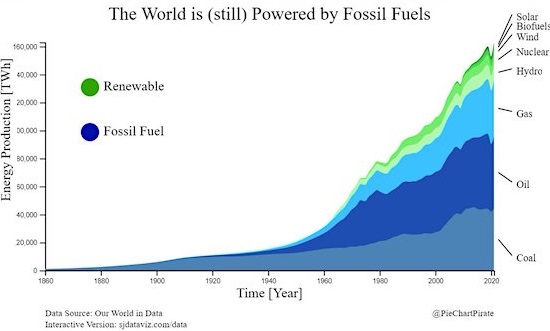

The Global Energy Crunch

If we insist on doing the transition the hard, slow, costly way rather than the easy, fast, cheap way, it's going to be a needlessly arduous, soul-crushing slog. Let's cover a few common-sense points and ask a few questions about the Global Energy Crunch.

Read More »

Read More »

Oil up nearly 3% as OPEC+ agrees to small oil output cut | WION Business News

Oil prices rose about 3% on Monday, as OPEC+ members agreed to a small production cut of 100,000 barrels per day to bolster prices.

Read More »

Read More »

How to Know When the Fed will Stop Rate Hikes [Ep. 283, Eurodollar University]

In 2000 and 2006 the inversion of future 2-year rates and current 2-year rates correctly predicted when the Fed would stop hiking rates. Of course, the Fed had no idea it would stop -- markets knew it though. Where is the future 2-year rate relative today? An eyelash from inversion.

Read More »

Read More »

Ukraine: IAEA Director General Rafael Grossi leads Zaporizhzhia inspection | World News | WION

International Atomic Energy Agency's team led by chief Rafael Grossi has visited the Zaporizhzhia nuclear plant to assess damages that occurred by consistent shelling. Grossi, the head of the UN nuclear watchdog says the physical integrity of the Russian-occupied nuclear plant in Ukraine had been violated several times.

Read More »

Read More »

The System Is Busy Cannibalizing Itself

As the word suggests, cannibalism won't end well for those consumed by the infinitely insatiable few. Cannibalize is an interesting word. It is a remarkably graphic way to describe the self-inflicted destruction of a system by stripping previously functional subsystems to sustain the illusion of system functionality. Here are some examples.

Read More »

Read More »

Russia kicks off ‘Vostok 2022’, India and China among the participants | International News | WION

For the next 7 days, Russia will undertake massive military drills along with troops of at least 12 countries including China and India. The drills mark increasingly close defense ties between Moscow and Beijing.

Read More »

Read More »

Gravitas: EU scraps VISA agreement with Russia

The European Union has cancelled a 2007 VISA agreement with Russia. Russian citizens will now have to pay more and wait longer to get VISAs from EU member states. Is Europe right in punishing civilians for Putin's war? Palki Sharma tells you.

Read More »

Read More »

WION Fineprint | NATO chief warns about Russia’s Arctic military build-up

NATO Secretary General Jens Stoltenberg has called for more investment in the Arctic as Moscow reopens hundreds of Soviet-era military sites.

Read More »

Read More »

Global Financial Crisis Jeff Snider | Indian Rupee

Global Financial Crisis Jeff Snider Indian ruppee. India #jeffsnider#treasurybills#economy#useconomy

Read More »

Read More »

Putin to not attend Mikhail Gorbachev’s funeral, skip due to ‘work schedule’ | Latest News | WION

Russian President Vladimir Putin will not be attending the funeral of Mikhail Gorbachev who was Soviet Union's last leader. The leader died at the age of 91.

Read More »

Read More »

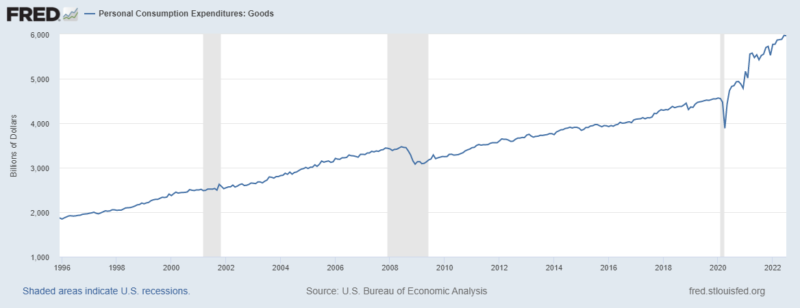

Goldilocks Calling

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now.

Read More »

Read More »

New artillery attack as IAEA heads to Ukraine’s Zaporizhzhia nuclear power plant | World News

Ahead of the IAEA visit to Ukraine's Zaporizhzhia nuclear power plant, a new set of latest satellite images have appeared which showed the damage from an artillery attack to the roof of a building right next to the nuclear reactors at Ukraine's Zaporizhzhia nuclear power plant.

Read More »

Read More »

World at War LIVE | Russia to unleash ‘General Winter’ on Europe to win the Ukraine war | WION News

This week on World At War with Mohammed Saleh:

- Turf war between the Taliban & ISIS Khorasan escalates

- Al-Shabab strikes again in the heart of Mogadishu

- Myanmar's military generals 'planned' the Rohingya genocide

#WorldAtWar #WIONLive #WorldNews

Read More »

Read More »

Ukrainian troops have attacked Russian positions along entire front of war, says Zelenksy| WION News

Ukrainian President Volodymyr Zelensky said that his country’s troops have launched attacks on Russian positions along the entire front of the war.

Read More »

Read More »

No gas supply though Nord Stream 1 pipeline, EU chief calls out Russia for ‘manipulation’ | WION

Europe is grappling with Russia's gas supply cuts adding further to its woes. Russian energy giant Gazprom has cut off its gas supplies to Germany while the North Stream one pipeline citing maintenance work.

Read More »

Read More »

How Working Longer Affects Your Social Security Benefits

Since 1935, Social Security has been synonymous with retirement. It was always intended to supplement retirement income, never be a person’s total retirement income. Unfortunately, according to the Center on Budget and Policy Priorities, about half of older Americans rely on Social Security for at least 50% of their income, and 25% of retirees rely on it for 90% of their income. That’s why more Americans are choosing to work longer.

Read More »

Read More »

Ukraine launches counter-offensive to recapture Kherson, Mykolaiv | World News | WION

Ukraine has announced the launch of a counter-offensive to recapture southern parts of the country and has advanced into the Kherson, Mykolaiv regions; however, Russia claimed to have repulsed the Ukrainian offensive.

Read More »

Read More »

Will Trump be president again?

Despite losing in 2020, Donald Trump has managed to strengthen his grip on the Republican Party. Will he run again for president—and if so, could he win?

Read More »

Read More »