Category Archive: 5) Global Macro

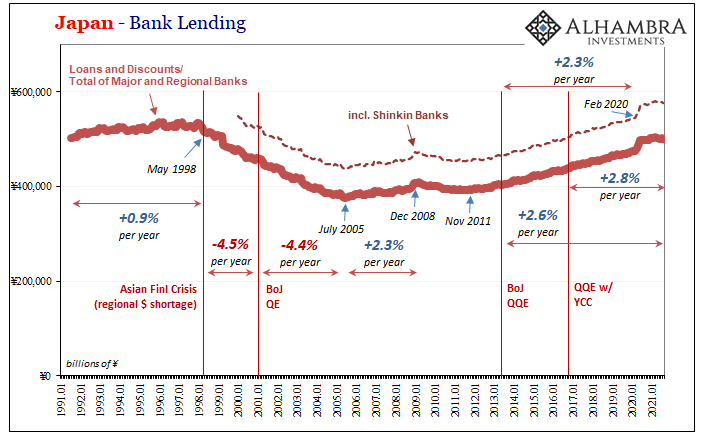

You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s.

Read More »

Read More »

The hidden cost of black hair | The Economist

Hair is an important part of black women’s identity, but throughout history it has also been a target of oppression. What is the true cost of having black hair?

00:00 - What does your hair mean to you?

01:17 - Current attitudes towards textured hair

02:37 - How has black hair been viewed historically?

05:12 - Adhering to white expectations

06:14 - Why is black hair so expensive?

07:30 - The economics of the black hair care industry

09:16 - The...

Read More »

Read More »

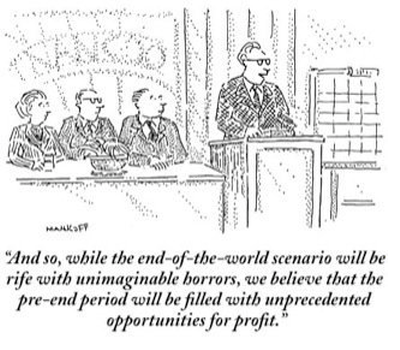

America Is Now a Kleptocrapocracy

I hope everyone here is hungry because the banquet of consequences is being served. I've coined a new portmanteau word to describe America's descent: kleptocrapocracy, a union of kleptocracy (a nation ruled by kleptocrats) and crapocracy, a nation drowning in a moral sewer of rampant self-interest in which the focus is cloaking all the skims, scams, rackets and bezzles in some virtuous-sounding garb, a nation choking on low-quality junk ceaselessly...

Read More »

Read More »

Business: go woke or go broke? | The Economist

Today consumers want to buy more sustainable products, employees want to work for firms that share their values, and in the investment world, ESG funds are all the rage. How are companies responding to these shifting demands and can businesses really do well by doing good?

00:00 - Can companies do well by doing good?

00:50 - Environment and climate change

06:50 - Employee wellbeing

09:51 - Workforce diversity

15:50 - Ethical supply chains

19:26 -...

Read More »

Read More »

Ask Bob – What Do I Do If I Choose The Wrong Medicare Plan?

Alhambra’s Bob Williams answers the question, “What do I do if I choose the wrong Medicare Plan?”.

Read More »

Read More »

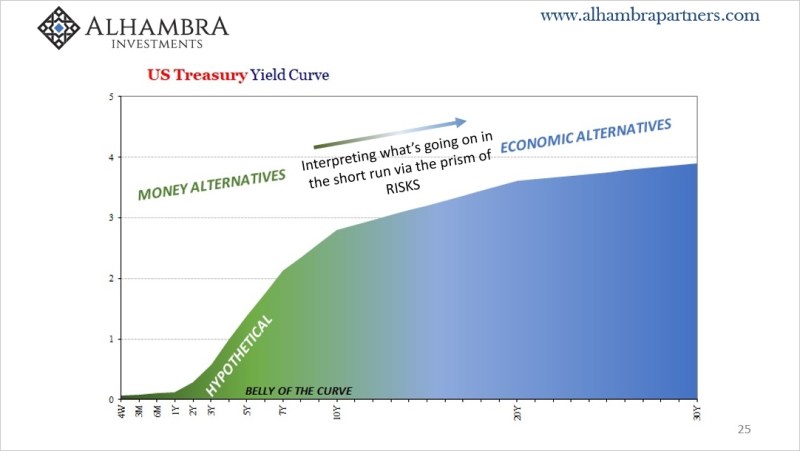

The Curve Is Missing Something Big

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below).

Read More »

Read More »

Far Longer And Deeper Than Just The Past Few Months

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States.

Read More »

Read More »

Software Ate the World and Now Has Indigestion

As for all those automated systems we have to navigate--do any of them work so well that those profiting from them actually use them? Of course not.

Read More »

Read More »

Reading Jeff Snider: US Bank Loans Shrinking in 2021 [Ep. 128, Macropiece Theater]

Bank balance sheets are expanding in 2021, which is great news if you believe credit is modern money. But a closer look reveals banks are PILING into the SAFEST assets while beating a RETREAT from loans (real economy money).

Read More »

Read More »

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »

Jeffrey Snider, Head of Global Research at Alhambra Investments demystifies global monetary system.

Special guest Jeffrey Snider is Head of Global Research at Alhambra Investments. He is not an economist, which is probably why he's been able to develop a working model of the global monetary system.

Read More »

Read More »

Everything Solid Melts into Air

That the neofeudal lords and their lackeys offer the debt-serfs "choices" of forced labor would be comic if the results weren't so tragic. We know we're close to the moment when Everything Solid Melts into Air when extraordinary breakdowns are treated as ordinary and the "news" quickly reverts to gossip.

Read More »

Read More »

Who should fix climate change? | The Economist

This is an excerpt from a longer event, exclusive to Economist subscribers. To watch this event in full or join a live discussion, go to the subscriber-events hub—you'll just have to subscribe to The Economist if you haven't already.

00:00 - Who should fix climate change?

00:55 - Hard problems are why we elect governments

01:29 - Which countries are leading?

03:00 - What is the role of companies?

03:57 - Companies innovate better than countries...

Read More »

Read More »

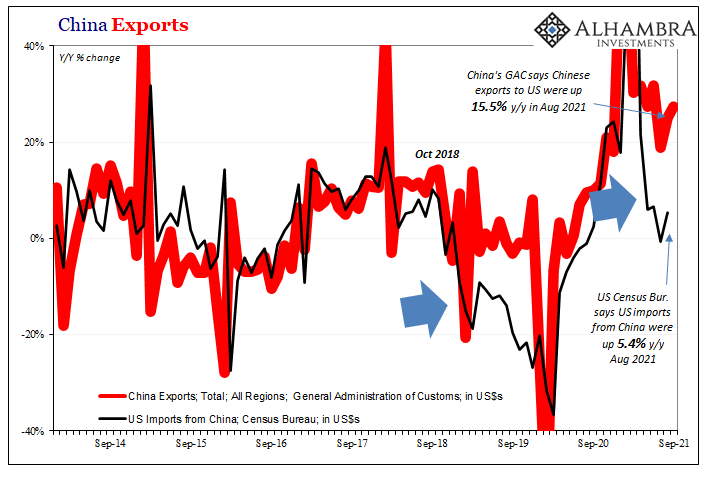

Inflating Chinese Trade

There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not like anyone asked Xi Jinping to weigh in; they report what numbers they have and consider them authoritative.

Read More »

Read More »

America’s Bottom 50 percent Have Nowhere To Go But Down

One might anticipate that the bottom 50%'s meager share of the nation's exploding wealth would have increased as smartly as the wealth of the billionaires, but alas, no.

Read More »

Read More »

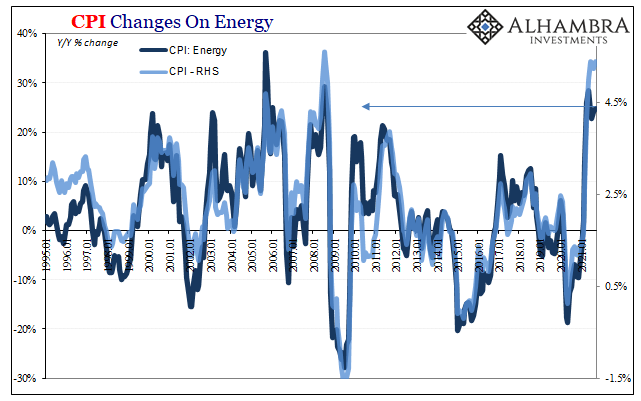

Perfect Time To Review What Is, And What Is Not, Inflation (and why it matters so much)

It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE.

Read More »

Read More »

The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.”

Read More »

Read More »

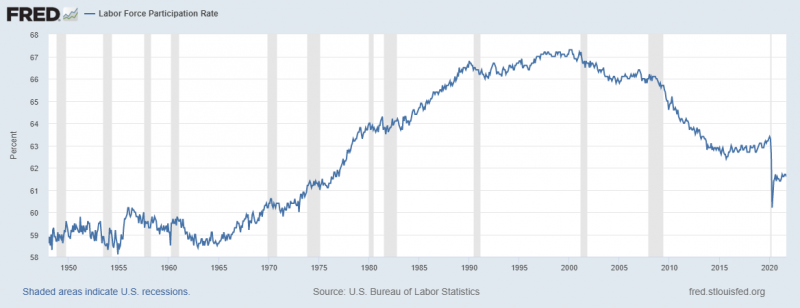

For The Love Of Unemployment Rates

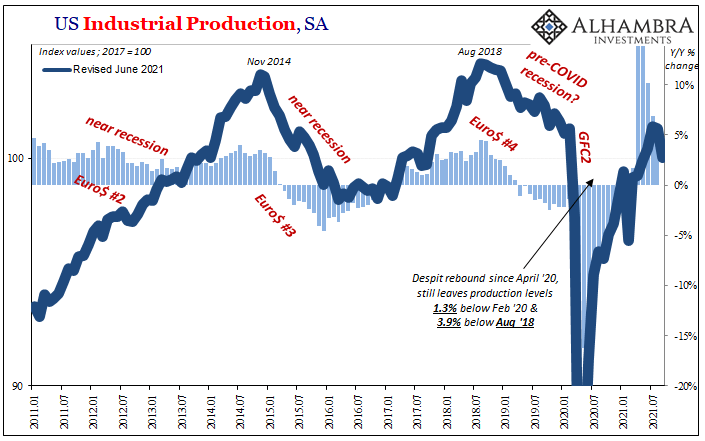

Here we are again. The labor force. The numbers from the BLS are simply staggering. During September 2021, the government believes it shrank for another month, down by 183,000 when compared to August. This means that the Labor Force Participation rate declined slightly to 61.6%, practically the same level in this key metric going back to June.

Read More »

Read More »

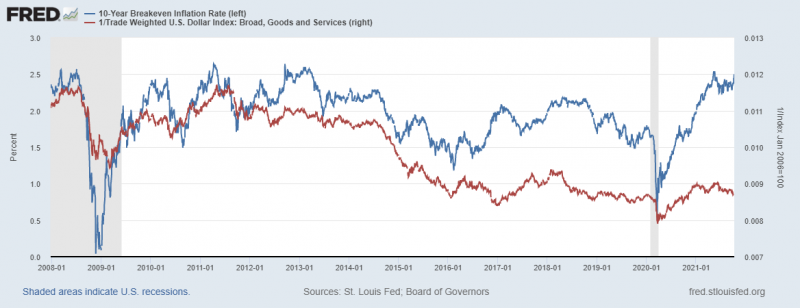

Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it.

Read More »

Read More »

The challenges facing Germany’s new leader | The Economist

Germany’s election marks the end of an era of stability and stagnation. What international challenges will Angela Merkel's successor face?

00:00 The coalition negotiations

01:00 Who are the kingmakers?

02:09: Who is Olaf Scholz?

03:09 Germany’s future global role

04:57 Germany’s relationship with Russia & China

Like our video content? Take our survey to tell us why: https://econ.st/3oYeC61

Find The Economist’s most recent coverage on the...

Read More »

Read More »