Category Archive: 5) Global Macro

Brian Cox: Why Succession struck a chord | The Economist

Brian Cox of HBO’s “Succession” reveals what it’s like to play the tyrannical media mogul and patriarch Logan Roy, and why the show struck such a chord in Trump's America.

00:00 - The success of “Succession”

00:50 - Brian Cox’s career and playing Logan Roy

01:33 - How he finds humanity in Logan Roy

03:42 - Real-life comparisons to the Roys

04:36 - “Succession” in Trump’s America

05:44 - The politics of “Succession”

07:09 - Social mobility and...

Read More »

Read More »

What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace.

Read More »

Read More »

Revenge of the Real World

The status quo response would be amusing if the consequences weren't so dire. Rather than stare at empty shelves, you have two options for distraction: you can don a virtual-reality headset and cavort with dolphins in the metaverse, or you can trade various forms of phantom wealth that always go up (happy happy!) because the Fed.

Read More »

Read More »

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »

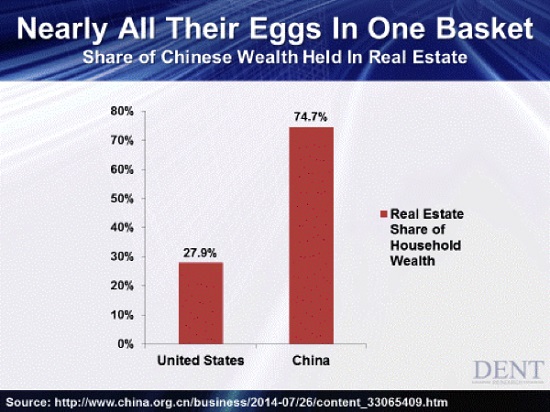

Will China Pop the Global Everything Bubble? Yes

The line of dominoes that is already toppling extends around the entire global economy and financial system. Plan accordingly. That China faces structural problems is well-recognized.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims.

Read More »

Read More »

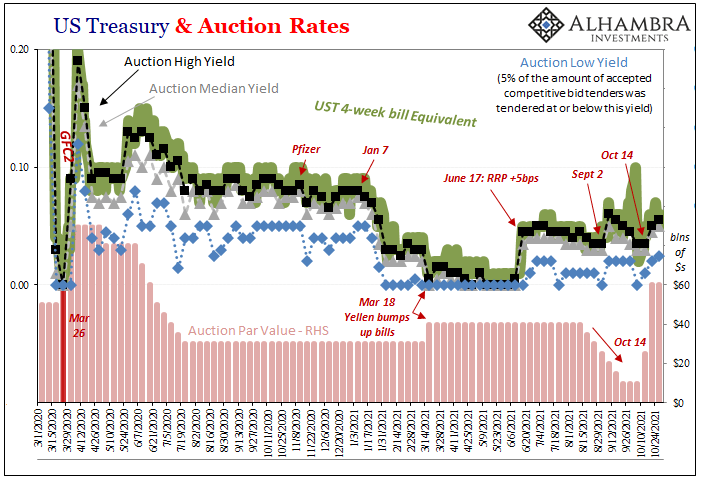

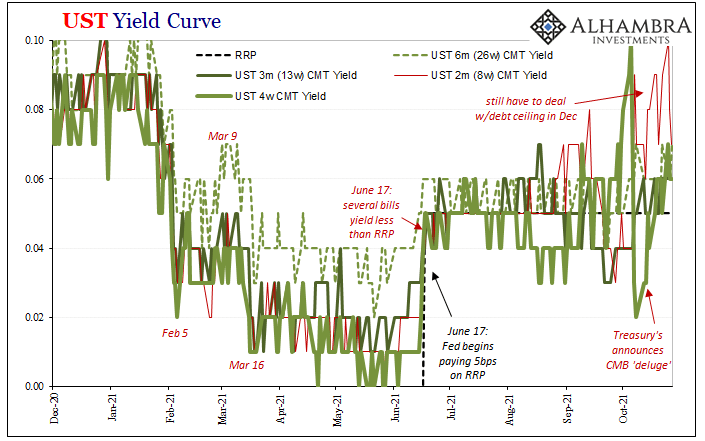

Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though.

Read More »

Read More »

Weekly Market Pulse: Growth Scare?

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved.

Read More »

Read More »

Reading Jeff Snider: Why Do We Think Inflation Expectations Matter? [Ep. 139, Macropiece Theater]

Federal Reserve economist Jeremy Rudd's paper savages the use of inflation expectations in monetary econometrics. He lambasts the profession for producing "minimal direct evidence" and the "next-to-no-examination of alternatives". A reading, by Emil Kalinowski.

Read More »

Read More »

GDP Red Flag

There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%.

Read More »

Read More »

See what three degrees of global warming looks like | The Economist

If global temperatures rise three degrees Celsius above pre-industrial levels, the results would be catastrophic. It’s an entirely plausible scenario, and this film shows you what it would look like.

00:00 - What will a 3°C world look like?

00:57 - Climate change is already having devastating effects

02:58 - How climate modelling works

04:06 - Nowhere is safe from global warming

05:20 - The impact of prolonged droughts

08:24 - Rising sea levels,...

Read More »

Read More »

Santa’s Revenge: Everyone Front-Running My Rally, You Get Nothing

Santa is generally a jolly fellow, but that doesn't mean he doesn't take pleasure in meting our well-deserved punishment to the greedy.

Read More »

Read More »

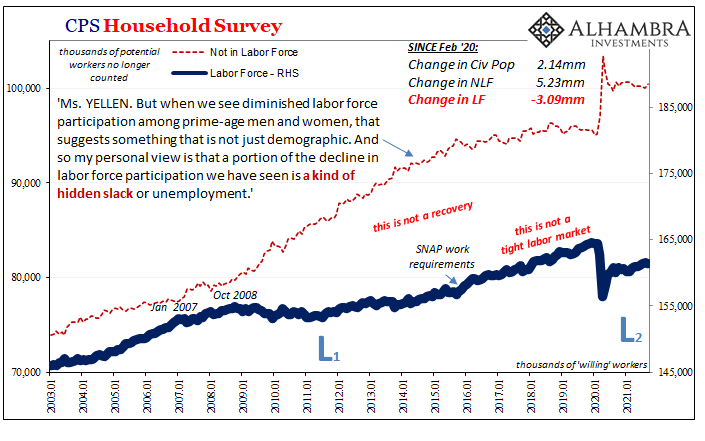

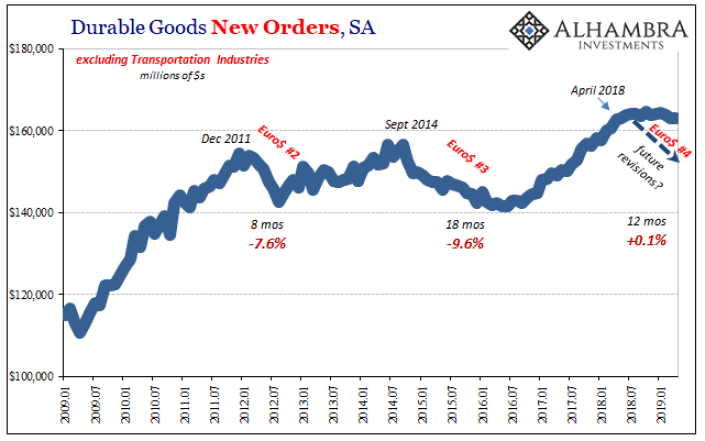

The Enormously Important Reasons To Revisit The Revisions Already Several Times Revisited

Extraordinary times call for extraordinary commitment. I never set out nor imagined that a quarter century after embarking on what I thought would be a career managing portfolios, researching markets, and picking investments, I’d instead have to spend a good amount of my time in the future taking apart how raw economic data is collected, tabulated, and then disseminated.

Read More »

Read More »

Short Run TIPS, LT Flat, Basically Awful Real(ity)

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

What’s the future of food? | The Economist

Over one-third of greenhouse-gas emissions come from food production. For a greener future, this urgently needs to change. What’s the future of food in a more sustainable world? Our experts answer your questions.

This film is supported by @Infosys - https://impact.economist.com/sustainability

00:00 - Food’s environmental impact

00:44 - Why it’s important to make food sustainable

01:34 - Will everyone have to give up meat?

02:13 - Can...

Read More »

Read More »

What *Seems* Inflation Now Is Something Else Entirely

This is yet another one of those crucial recent developments which should contribute much clarity about the economic situation, yet is exploited in other ways (political) adding only more to the general state of economic confusion. The shelves may be empty in a lot of places around the country, leaving anyone with the impression there just aren’t enough goods.

Read More »

Read More »

1970s Inflation vs. 2020s Price Increases [Ep. 130, Macropiece Theater]

Time travel to the early 1970s where we hear the Nixon Tapes, read memorandums, and study Congressional testimony to understand what the Federal Reserve knew, and when they knew it. Turns out they didn't know "money" then and they still don't today. A reading, by Emil Kalinowski.

Read More »

Read More »

Doing 90 MPH on Deadman’s Curve: A Few Thoughts on Risk

When the wreck is recovered, witnesses will wonder why they took such heedless, foolish risks. You're in the back seat wedged between tipsy revelers, the driver is drunk and heading into Deadman's Curve at 90 miles per hour. Nobody's worried because the driver has never crashed.

Read More »

Read More »

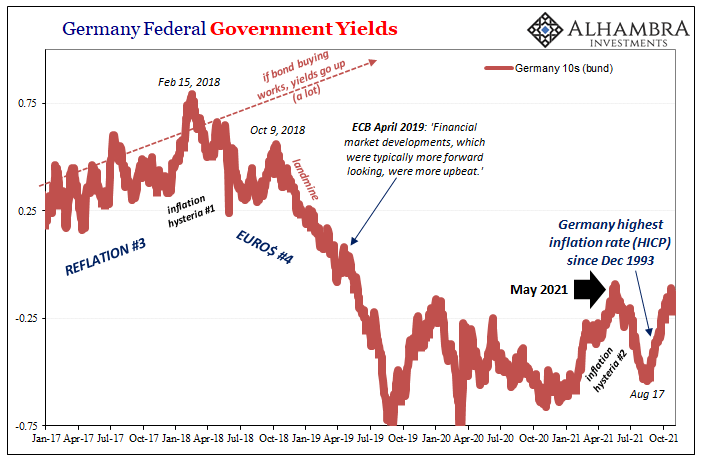

An Anti-Inflation Trio From Three Years Ago

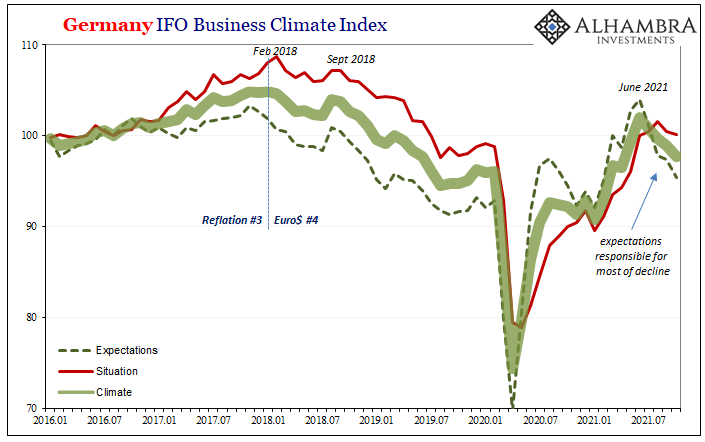

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »