Category Archive: 5) Global Macro

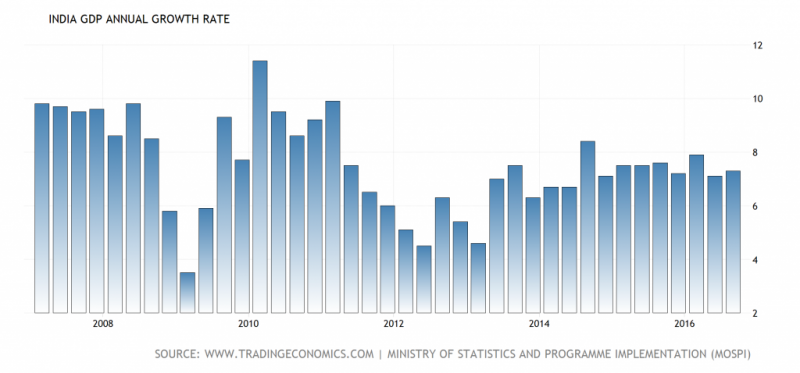

India: The World’s Fastest Growing Large Economy?

India has been the world’s favorite country for the last three years. It is believed to have superseded China as the world’s fastest growing large economy. India is expected to grow at 7.5%. Compare that to the mere 6.3% growth that China has “fallen” to.

Read More »

Read More »

GoldSeek Radio – Feb 3, 2017 [CHARLES HUGH SMITH & JIM ROGERS] weekly

GoldSeek Radio’s Chris Waltzek talks to Charles Hugh Smith from Of Two Minds http://www.oftwominds.com/blog.html and to Famed investor Jim Rogers http://www.jimrogers.com/ http://www.goldseek.com/ http://radio.goldseek.com/

Read More »

Read More »

Emerging Markets: What has Changed

Philippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. The Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Allies of Brazil President Michel Temer now head up both houses of congress. Press...

Read More »

Read More »

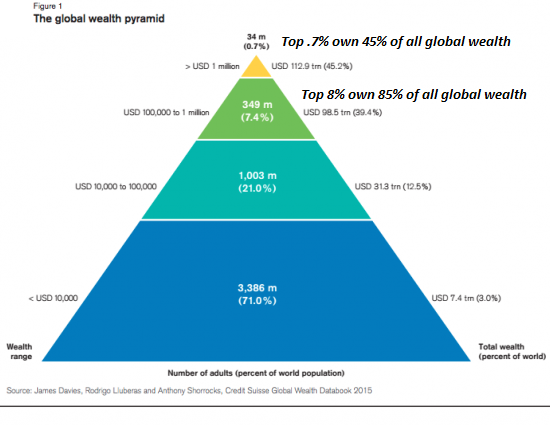

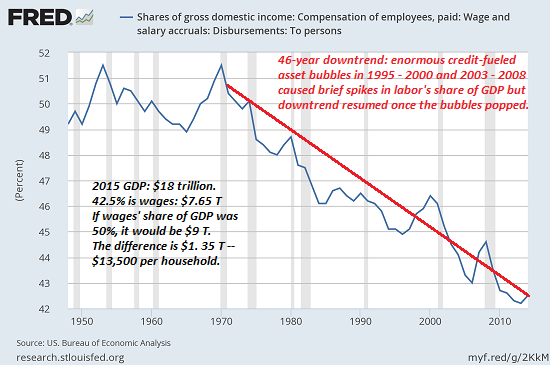

What Would a Labor-Centered Economy Look Like?

How about moving the power to create money from the apex of the pyramid down to its lowest level? Let's spend a moment deconstructing the word "capitalism." Note it contains the word Capital. So far so good. Obviously the key concept here is capital. So what is "capital"? It turns out there are multiple kinds of capital. The most familiar kinds are tangible: cash, orchards, factories, water rights, tools, and so on.

Read More »

Read More »

Donald Trump’s tough phone call, as drawn by our cartoonist KAL

America’s president Donald Trump and Australian Prime Minister Malcolm Turnbull have been facing questions about their “frank and forthright” phone call at the weekend. Our cartoonist, Kal, listens in to the next call on the president’s list. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of …

Read More »

Read More »

GSR interviews CHARLES HUGH SMITH – Feb 2, 2017 Nugget

GoldSeek Radio’s Chris Waltzek talks to Charles Hugh Smith from Of Two Minds http://www.oftwominds.com/blog.html http://www.goldseek.com/ http://radio.goldseek.com/

Read More »

Read More »

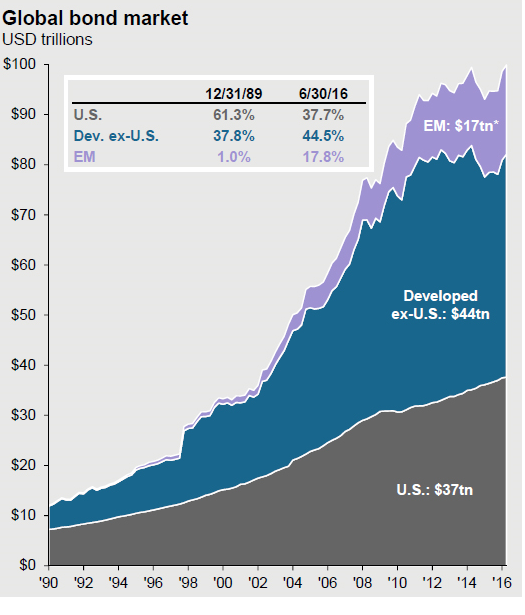

Why Our System Is Broken: Cheap Credit Is King

You want to fix the economic system, reduce political bribery and reduce rising income inequality? Shut off the cheap unlimited credit spigot to banks, financiers and corporations. Cheap credit--newly issued money that can be borrowed at low rates of interest--is presented as the savior of our economic system, but in reality, it's why our system is broken.

Read More »

Read More »

A new environmental idea to do away with waste | The Economist

A project in the Philippines is turning decayed fishing nets into the raw materials for a carpet tile manufacturer in Britain, reusing rather than disposing of what was once thought of as rubbish. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 This is ground zero for new thinking on waste – beyond recycling …

Read More »

Read More »

The Earth Circle: making environmentalism pay its way | The Economist

Making waste a thing of the past, new ideas on the environment are reusing or regenerating raw materials so that they pay dividends for business as well as the planet. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 In one of the poorest areas of the world, a revolutionary project taking waste, the …

Read More »

Read More »

A Supreme Court schism | The Economist

Tonight America’s president Donald Trump will announce on primetime television his first nominee to the Supreme Court. Our word of the day presages the clashes that are set to follow. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist …

Read More »

Read More »

Why are the Baltic states so rattled?

This week, soldiers from Germany and Belgium are settling into a new posting in Lithuania as part of the latest NATO troop deployment. Will their hosts—and the region—feel more secure as a result of their presence? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 NATO member countries Estonia, Latvia and Lithuania are feeling …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling.

Read More »

Read More »

Emerging Markets: What has Changed

Press reports suggest that China’s central bank has ordered banks to limit new loans in Q1. Fitch revised the outlook on Nigeria’s B+ rating from stable to negative. Russia announced details of the FX purchase plan. Brazil’s central bank confirmed it will simplify the reserve requirement system for banks. S&P cut the outlook on Chile’s AA- rating from stable to negative.

Read More »

Read More »

Ein Macher im Weißen Haus

Donald Trump sagt den alten Eliten den Kampf an. Europas Bürokraten müssen sich warm anziehen. Kürzlich stellte der Hedgefonds-Mogul Ray Dalio eine Analyse des Führungsteams von Donald Trump ins Netz („Reflections on the Trump Presidency, One Month after the Election“).

Read More »

Read More »

Arab Spring revisited—the battle for democracy in Egypt | The Economist

Six years ago the biggest revolution of the Arab Spring sent shockwaves across the Arab world. The Egyptian revolution was a demand by its people for “bread, freedom and social justice”—but the country has a long way to go to achieve those objectives. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 This week …

Read More »

Read More »

The Agenda: Margrethe Vestager on Europe | The Economist

Margrethe Vestager, European Commissioner for Competition, shares her views on an isolated Brussels at the centre of a Europe in the midst of upheaval. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 THE AGENDA explores the defining questions of our time and seeks out the stories, solutions and the personalities who might just …

Read More »

Read More »

China Says It Is Ready To Assume “World Leadership”, Slams Western Democracy As “Flawed”

Over the weekend China used the Trump inauguration to warn about the perils of democracy, touting the relative stability of the Communist system as President Xi Jinping heads toward a twice-a-decade reshuffle of senior leadership posts.

Read More »

Read More »

The Collapse of the Left

The Left is not just in disarray--it is in complete collapse because the working class has awakened to the Left's betrayal and abandonment of the working class in favor of building personal wealth and power. The source of the angry angst rippling through the Democratic Party's progressive camp is not President Trump--it's the complete collapse of the Left globally. To understand this collapse, we turn (once again) to Marx's profound understanding...

Read More »

Read More »

The evolution of taxation by our cartoonist KAL

It wasn’t always cold hard cash that the taxman was after. Our cartoonist looks at how tax has evolved through the ages. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Most modern societies employ some sort of taxation, but taxes have not always involved money. The ancient Chinese paid their taxes with pressed …

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended last week on a firm not, led by a huge MXN rally on Inauguration Day. We believe that the peso rally was largely driven by positioning and technicals, and so we view Friday’s gains as a correction since the fundamental outlook remains unchanged. Indeed, we think the broader EM rally will be short-lived too, as US interest rates remain elevated. The 10-year yield flirted with the 2.5% level, and we believe it will eventually head even...

Read More »

Read More »