Category Archive: 5) Global Macro

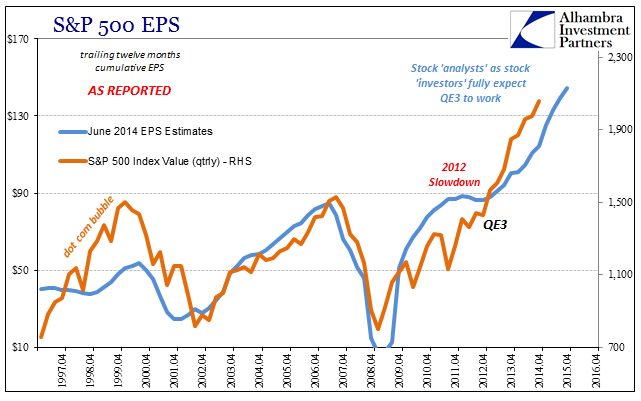

The Market Is Not The Economy, But Earnings Are (Closer)

My colleague Joe Calhoun likes to remind me that markets and fundamentals only sound like they should be related, an observation that is a correct one on so many different levels. Stock prices, in general, and GDP growth may seem to warrant some kind of expected correlation, but it has proven quite tenuous at times especially in a 21st century sense.

Read More »

Read More »

The Problem with Gold-Backed Currencies

Any currency is only truly "backed by gold" if it is convertible to gold. There is something intuitively appealing about the idea of a gold-backed currency --money backed by the tangible value of gold, i.e. "the gold standard." Instead of intrinsically worthless paper money (fiat currency), gold-backed money would have real, enduring value-it would be "hard currency", i.e. sound money, because it would be convertible to gold itself.

Read More »

Read More »

Corals: the largest organism on the planet

From providing much of the oxygen we breathe to hosting myriad forms of life, corals are a critical part of our planet’s eco-system. But they are dying. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and …

Read More »

Read More »

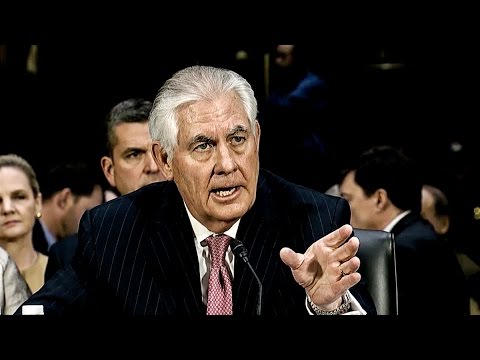

Rex Tillerson: America’s new chief emissary | The Economist

Rex Tillerson, America’s secretary of state, will need all his nimble diplomacy when he meets Mexico’s president Enrique Pena Nieto to discuss trade and security. But any calming reassurance could be undermined the next time President Trump tweets. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day …

Read More »

Read More »

The Criminalization of Financial Independence

Just as the "war on drugs" criminalized and destroyed large swaths of African-American and Latino communities, the "war on cash" will further criminalize the few remaining avenues to financial independence and freedom. The introduction of "entitlement" welfare in the 1960s generated a toxic dependency on the state that institutionalized worklessness, a one-two punch that undermined marriage and family in America's working class of all ethnicities.

Read More »

Read More »

Saving corals from the effects of climate change

With the world’s corals threatened with extinction, scientists are using cutting edge technology to help these planetary treasures make a comeback. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 It covers more than 70% of the earths surface. The ocean is the planet’s lifeblood but its being transformed by climate change. Colonies of …

Read More »

Read More »

The Stinking Politics of It All

It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one...

Read More »

Read More »

How Donald Trump plans to approach Iran | The Economist

How much tougher is Trump than Obama when it comes to Iran? Matthew Symonds, our defence and diplomatic editor, explains. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

No Acceleration In Industry, Either

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry.

Read More »

Read More »

How Robert Mugabe wrecked Zimbabwe

President Mugabe’s economic mismanagement of Zimbabwe has brought the country poverty and malnutrition. After 36 years in charge, he’s looking to extend his rule by 5 more years. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Robert Mugabe has ruled for 36 years, but this despot’s country is on its knees. Zimbabwe is …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy.

Read More »

Read More »

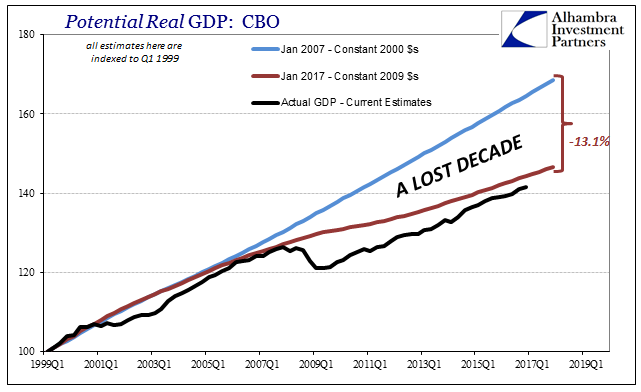

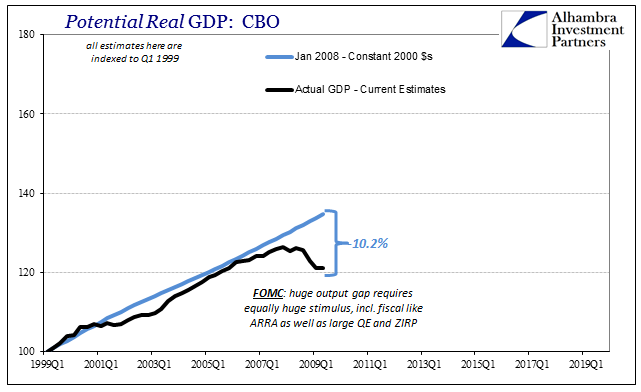

Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

Emerging Markets: What has Changed

Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans.

Read More »

Read More »

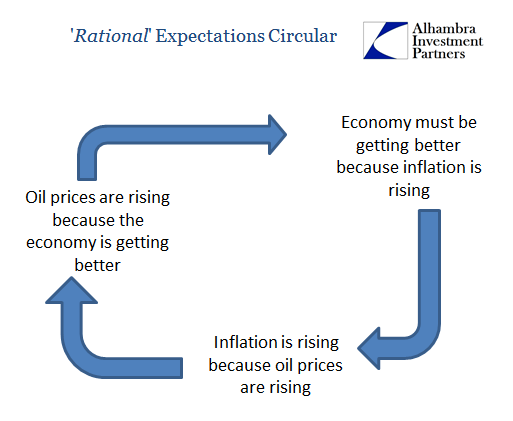

Why Aren’t Oil Prices $50 Ahead?

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even 2014, it may at times seem the...

Read More »

Read More »

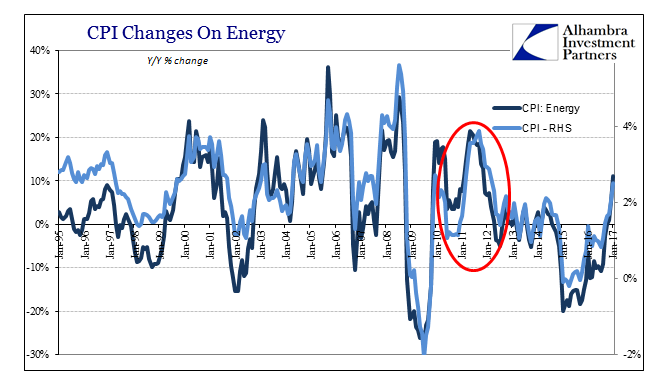

U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of...

Read More »

Read More »

This Is How the Status Quo Unravels: As the Pie Shrinks, Everybody Demands Their Piece Should Get Bigger

The politics of the past 70 years was all about horsetrading who got what share of the growing pie: the "pie" being cheap energy, government revenues and consumption, sales and profits. Horsetrading over a growing pie is basically fun. There's always a little increase left for the losers, so there is a reason for everyone to cooperate in a broad political consensus.

Read More »

Read More »

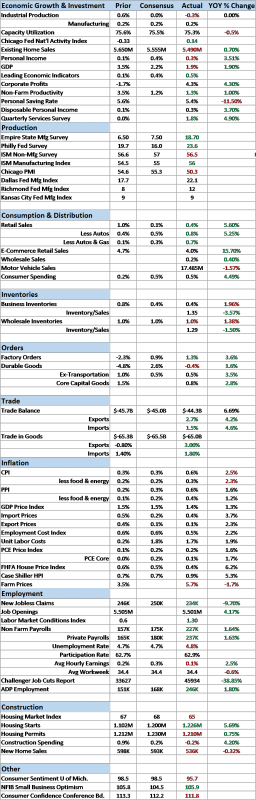

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

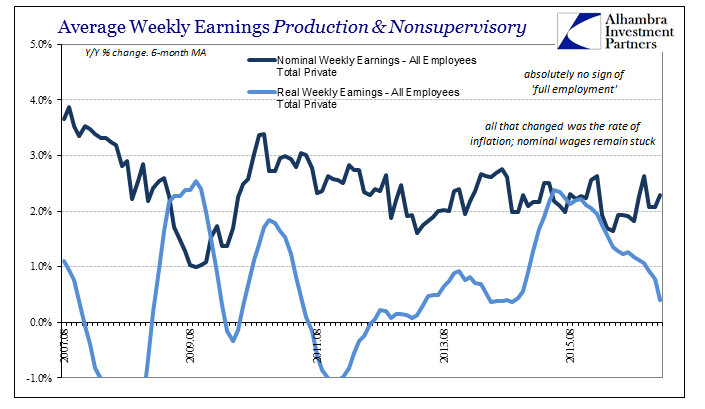

Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them.

Read More »

Read More »