Category Archive: 5) Global Macro

Bi-Weekly Economic Review

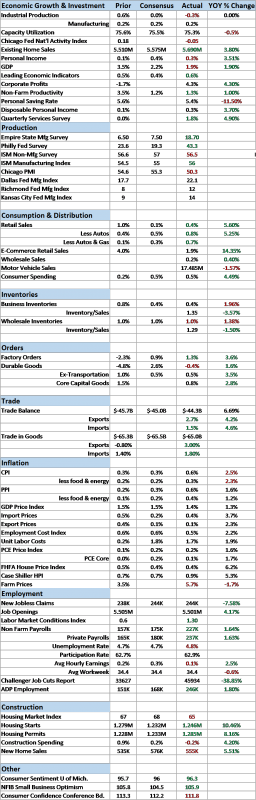

Economic Reports Scorecard. The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher.

Read More »

Read More »

Economic Dissonance, Too

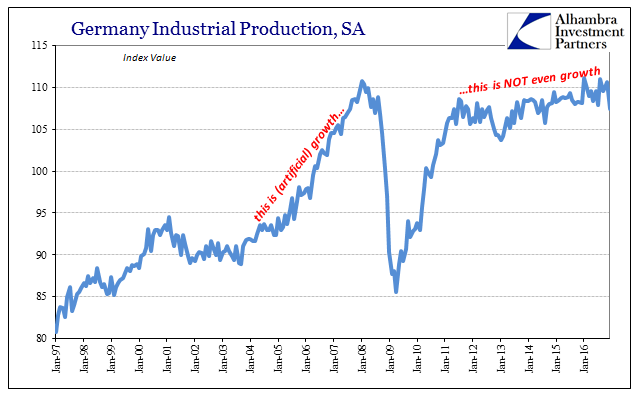

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony.

Read More »

Read More »

Emerging Markets: What has Changed?

A Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. Bulgaria’s interim government said it may apply to join the eurozone within a month. South Africa’s main labor union Cosatu accepted a government-proposed minimum wage.

Read More »

Read More »

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

Real Disposable Income: Headwinds of the Negative

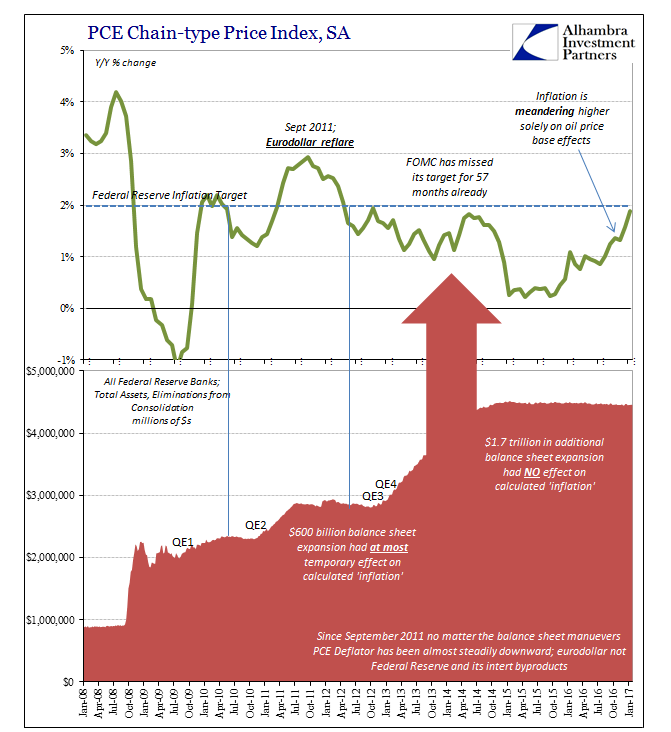

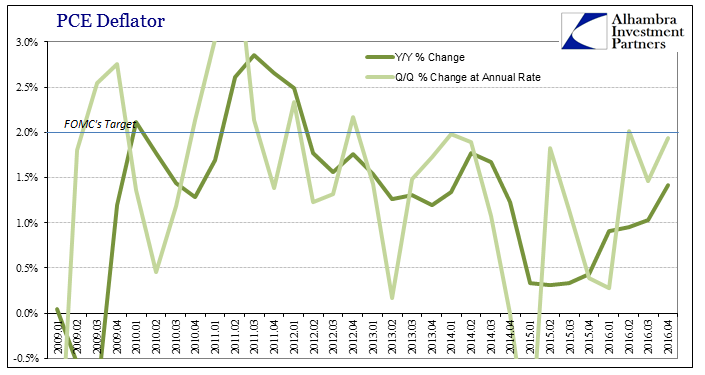

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability).

Read More »

Read More »

Why Is the Cost of Living so Unaffordable?

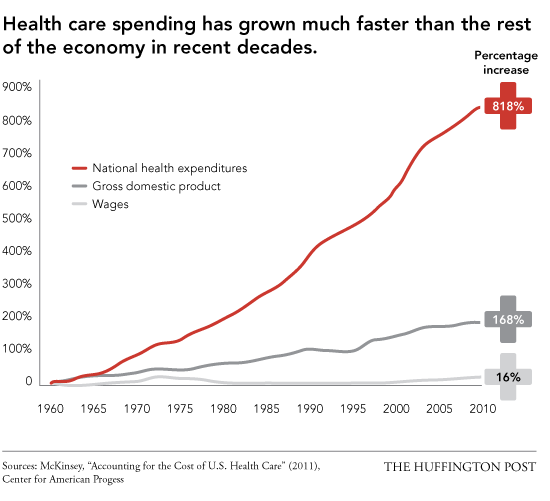

Strip away the centralized power that protects and funds cartels, and prices would plummet. The mainstream narrative is "the problem is low wages." Actually, the problem is the soaring cost of living. If essentials such as healthcare, housing, higher education and government services were as cheap as they once were, a wage of $10 or $12 an hour would be more than enough to maintain a decent everyday life.

Read More »

Read More »

How do animals change their colour? | The Economist

Take a look at the science behind the kaleidoscopic animals that can adopt new colours at will. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Chameleons aren’t the only animals that can change colour. Some primates can blush. How do animals change colour? 1. Brain signals: The colours of the environment, a rival, …

Read More »

Read More »

Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion.

Read More »

Read More »

What to expect from Donald Trump’s address to Congress

The White House press secretary, Sean Spicer, says the theme of Donald Trump’s address to Congress will be “the renewal of the American spirit”. What are the chances the president will turn the rhetoric into reality? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the …

Read More »

Read More »

Durable Goods Groundhog

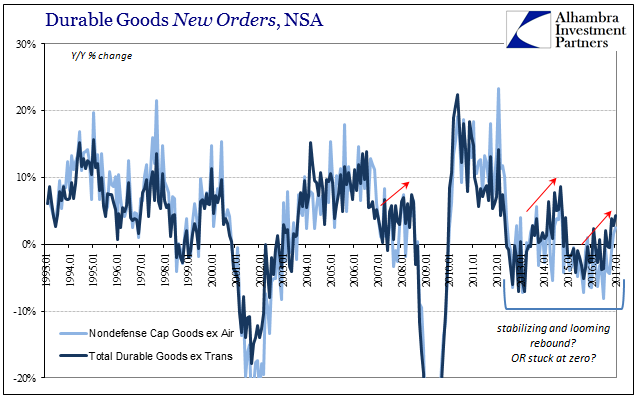

If the economy is repeating the after-effects of the latest “dollar” events, and it does seem more and more to be that case, then analysis starts with identifying a range for where it might be in the repetition. New orders for durable goods (ex transportation) rose 4.3% year-over-year in January 2017 (NSA, only 2.4% SA), the highest growth rate since September 2014 (though not meaningfully faster than the 3.9% rate in November 2016).

Read More »

Read More »

Virtue-Signaling the Decline of the Empire

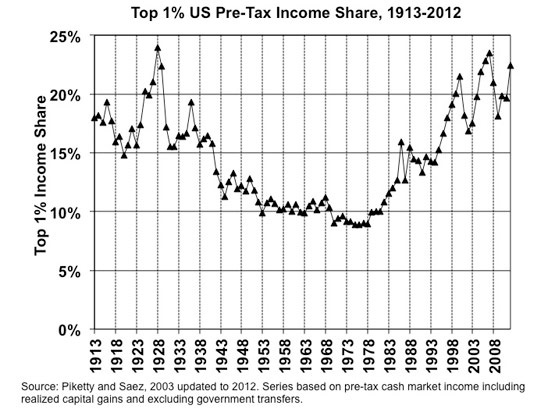

Virtue-signaling doesn't signal virtue--it signals decline and collapse. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, the status quo seeks to mask its self-serving rot behind high-minded "virtue-signaling" appeals to past glories and cost-free...

Read More »

Read More »

It Was ‘Dollars’ All Along

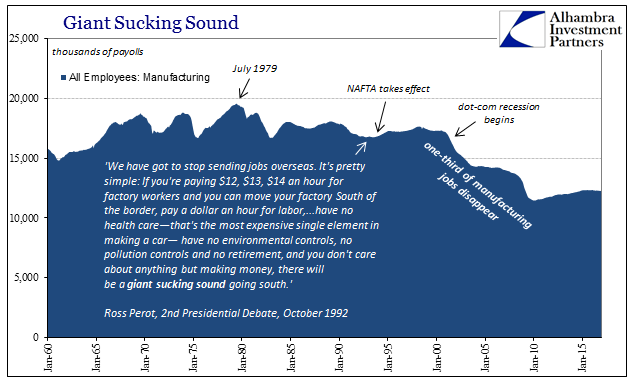

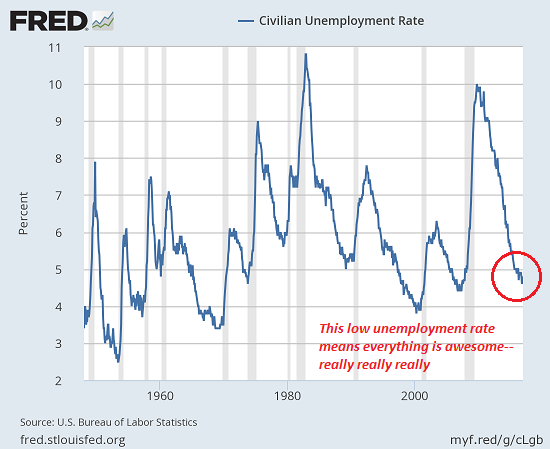

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot.

Read More »

Read More »

The coral Noah’s Ark

In Hawaii, a group of scientists is creating the world’s only bank of coral sperm. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and yet are relatively unknown. Dive down to their deepest depths to discover …

Read More »

Read More »

Corals are fighting back

In Palau, corals are thriving despite climate change. What’s their secret? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and yet are relatively unknown. Dive down to their deepest depths to discover how scientists are using …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC meeting.

Read More »

Read More »

Emerging Markets: What has Changed

PBOC tweaked its process for determining the yuan reference rate. Singapore is reportedly studying measures to boost revenue, including higher taxes. Moody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. Nigerian President Buhari extended his stay abroad. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. Brazil political risk is back on the table. Brazil’s central bank hinted at a faster pace...

Read More »

Read More »

There’s a Difference: Fake News and Junk News

The mainstream media continues peddling its "fake news" narrative like a desperate pusher whose junkies are dying from his toxic dope. It's slowly dawning on the media-consuming public that the MSM is the primary purveyor of "fake news"-- self-referential narratives that support a blatantly slanted agenda with unsupported accusations and suitably anonymous sources.

Read More »

Read More »

Not Recession, Systemic Rupture – Again

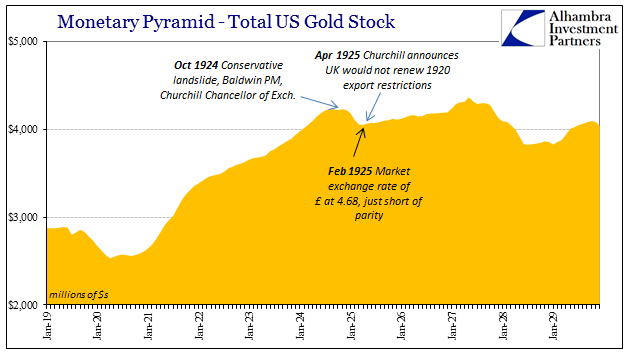

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed.

Read More »

Read More »

Where have all the fish gone?

The death of corals is already affecting the human communities that depend on the ocean for survival. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and yet are relatively unknown. Dive down to their deepest depths …

Read More »

Read More »

The dirty secret of clean energy | The Economist

The road to a future with an unlimited supply of clean energy is a rocky one. Ed Carr, our deputy editor, explains why energy features on the cover of this week’s The Economist. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For …

Read More »

Read More »