Category Archive: 5) Global Macro

Donald Trump’s controversial pick for US ambassador to Israel | The Economist

David Friedman, President Trump’s nominee for US ambassador to Israel has no diplomatic experience and is known for making inflammatory comments. His right-wing views are out of step with years of American diplomacy. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For …

Read More »

Read More »

A New Frame Of Reference Is Really All That Is Necessary To Start With

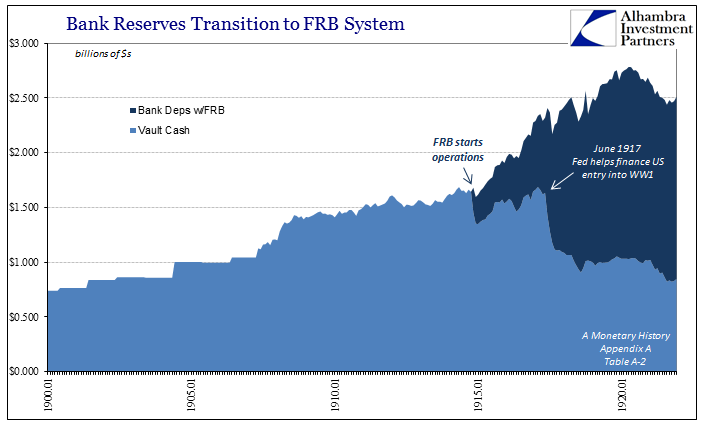

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

The world if robots take our jobs | The Economist

Computers are taking on increasingly sophisticated tasks, a trend which will cost many people their jobs. With so much automation to come, how many humans will still be needed? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films …

Read More »

Read More »

Want to Bring Back Jobs? It’s Impossible Unless We Fix these Four Things

It's your choice, America--you can keep your cartels and the captured government that enables and protects them, or you can fix what's broken and unaffordable. If there is any goal that might attract support from across the political spectrum, it's creating more fulltime jobs in the U.S. But this laudable goal is dead-on-arrival (DOA) unless we first fix these four things. Why is job growth stagnating? Many point to automation, and yes, that is a...

Read More »

Read More »

How South Korea should deal with Kim Jong Un | The Economist

North Korea and its leader Kim Jong Un continue to unsettle world leaders by testing nuclear weapons and long-range rockets. South Korea—with a new caretaker president after an impeachment scandal—could use some tips on how to handle its northern neighbour from hell. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching …

Read More »

Read More »

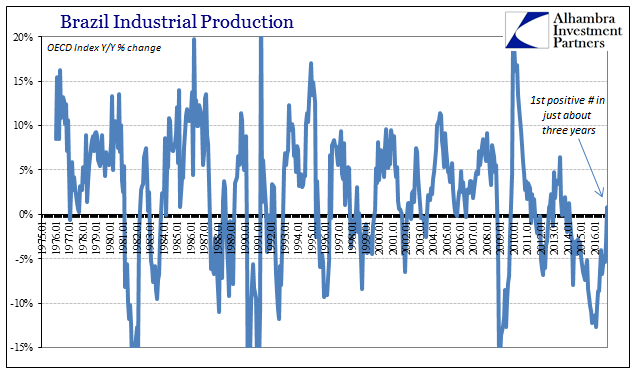

Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

What makes financial bubbles burst? | The Economist

Financial bubbles have popped up throughout modern history—from Dutch tulip mania to the more recent sub prime lending boom. Our cartoonist Kal illustrates what makes them burst. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 When the price of an asset rises faster than can be explained by economic fundamentals it creates a …

Read More »

Read More »

Emerging Market Preview of the Week Ahead

EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday.

Read More »

Read More »

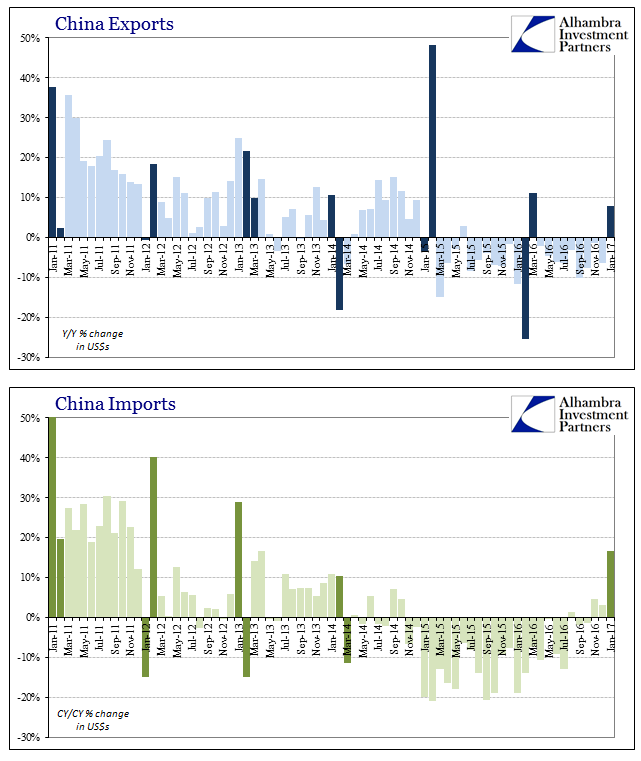

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »

Emerging Markets: What Has Changed

Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%.

Read More »

Read More »

How Iranians use music to protest against the regime | The Economist

This week in 1979 the world ’s first Islamic Revolution toppled the ruling dynasty of Shah Reza Pahlavi in Iran. The intertwining of religion and state has been tough for some Iranians, but they are increasingly using culture as a means to protest against the regime. Click here to subscribe to The Economist on YouTube: …

Read More »

Read More »

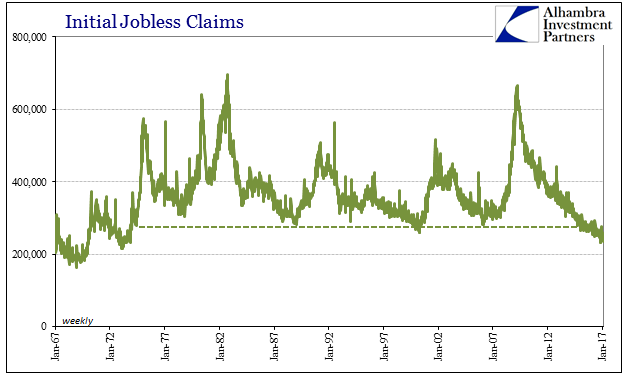

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

The Colonization of Local-Business Main Street by Corporate America

This is what our mode of production optimizes: ugliness, debt-serfdom, and servitude to politically dominant corporations.

Read More »

Read More »

The Central Banks Pull Back: Now It’s Up to Fiscal Policy to “Save the World”

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank "save" has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy?

Read More »

Read More »

Expropriation and Impoverishment: “Capitalist” Greece and “Socialist” Venezuela

Yesterday I noted that not all assets will make it through the inevitable financial re-set. ( Which Assets Are Most Likely to Survive the Inevitable "System Re-Set"?) Those that are easy to expropriate will be expropriated, and those assets vulnerable to soaring taxes, inflation and currency devaluation will also be hollowed out.

Read More »

Read More »

KAL draws… predatory pricing in business competition

Dumping: when a firm floods a market with cheap goods to undercut the competition. Illustrated by our cartoonist KAL. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk …

Read More »

Read More »

Which Assets Are Most Likely to Survive the Inevitable “System Re-Set”?

Your skills, knowledge and and social capital will emerge unscathed on the other side of the re-set wormhole. Your financial assets held in centrally controlled institutions will not. Longtime correspondent C.A. recently asked a question every American household should be asking: which assets are most likely to survive the "system re-set" that is now inevitable?

Read More »

Read More »

America’s embargo against Cuba | The Economist

America imposed a full trade embargo against Cuba 55 years ago, in an attempt to crack Fidel Castro’s Communist regime. Antonio José Ponte, an exiled Cuban writer, and Aleida Guevara, the daughter of Che Guevara, reveal how the embargo shaped Havana’s revolutionary story. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Fifty-five years …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the week on a firm note, with markets digesting what they perceived as a dovish Fed bias. We disagree, and continue to believe that markets are underestimating the Fed’s capacity to tighten this year. EM FX could continue gaining some traction if the dollar correction continues, but we think US interest rates will ultimately move higher and put pressure on EM once again.

Read More »

Read More »

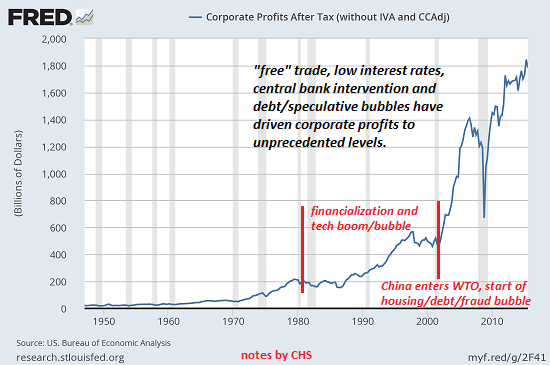

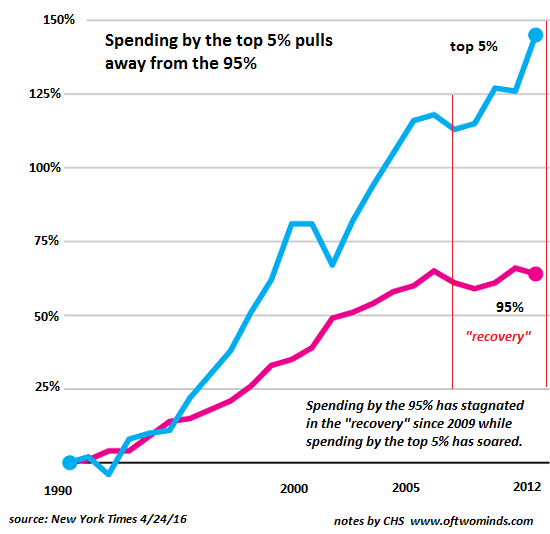

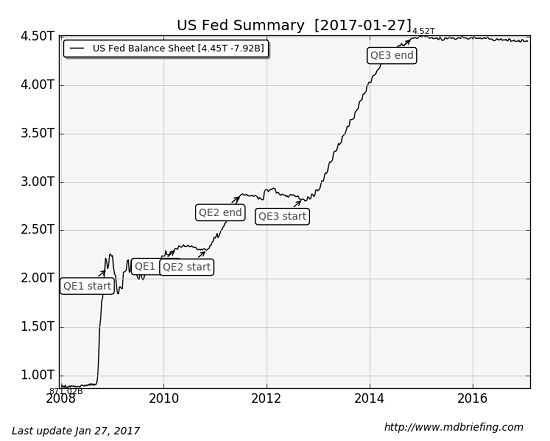

The Central Banks Face Unwelcome Realities: Their Policies Boosted Wealth Inequality, Failed to Generate “Growth”

Rather than be seen to be further enriching the rich, I think central banks will start closing the "free money for financiers" spigots. Take a quick glance at these charts of the Federal Reserve balance sheet and bank credit in the U.S.

Read More »

Read More »