Category Archive: 5) Global Macro

Quantum technology opens up a world of possibilities | The Economist

After a century confined to the laboratory, the quantum realm is turning its theoretical promise into practical opportunities. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like …

Read More »

Read More »

Interview Questions For Charles Hugh Smith Exclusive March 2017

Interview Questions For Charles Hugh Smith Exclusive March 2017, Interview Questions For Charles Hugh Smith Exclusive March 2017

Read More »

Read More »

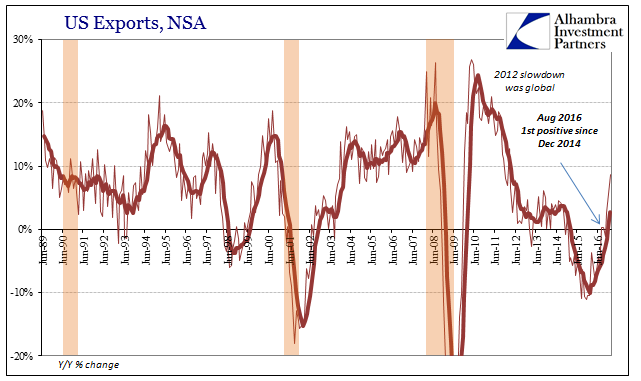

US Trade Skews

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it.

Read More »

Read More »

Why are people choosing smaller dogs? | The Economist

Small dogs are becoming increasingly popular around the world. Why are people choosing little pooches? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Smaller, cheaper, cuter. Why are our dogs shrinking? In Britain the average weight of a dog has fallen by 12% since 2006. In America, small dogs are the most popular …

Read More »

Read More »

Ocean: A 360-degree tour of the mysterious, magical corals of Palau | The Economist

Palau’s vibrant corals are thriving, despite some of the warmest and most acidic waters in the world. In this virtual reality experience, Lukas Isall from the Palau International Research Centre explains how unlocking the mystery of Palau’s corals might help in the fight against climate change. Click here to subscribe to The Economist on YouTube: …

Read More »

Read More »

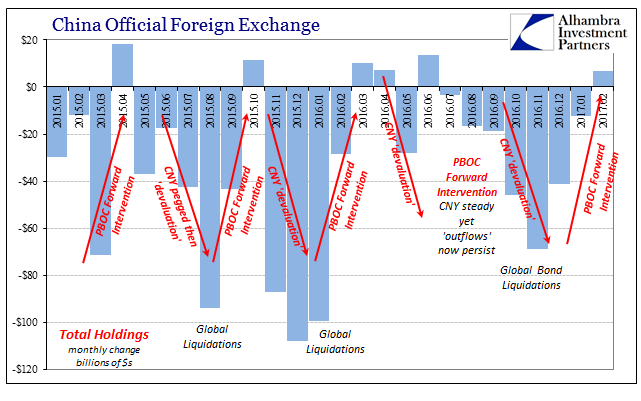

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

How to succeed as a woman in politics

Be confident and don’t succumb to “imposter syndrome”. Bangladeshi-born British member of Parliament Rushanara Ali offers her advice on International Women’s Day. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Rushanara Ali was first elected to Parliament in 2010. She is only of only three female Muslim members of Parliament in the United …

Read More »

Read More »

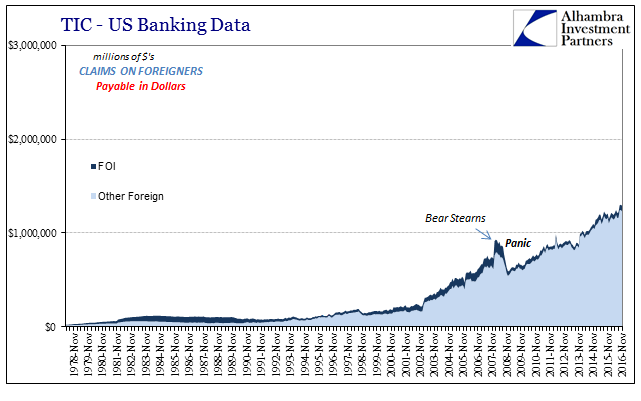

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

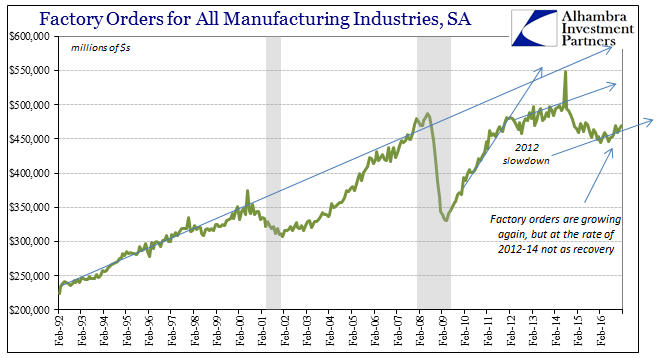

Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but.

Read More »

Read More »

The European Union is facing a threat to its very existence | The Economist

The Treaty of Rome was signed 60 years ago this month. But can European leaders make the EU appealing to a new generation of more sceptical voters? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM FX was mostly softer last week, though it ended the week firmer, buoyed by outsized MXN gains Friday. The Fed is sending very strong signals for a March hike, which should keep EM FX on its back foot. However, with the March 15 FOMC embargo coming into effect, there will be no Fed speakers after Kashkari on Monday. Jobs data on Friday will be the highlight, but given the Fed’s signals, we do not think a soft report will derail a hike next...

Read More »

Read More »

MACRO ANALYTICS – 03 03 17 – Is Retail CRE The Next Financial Implosion? – w/Charles Hugh Smith

ABSTRACT: https://matasii.com/is-retail-commercial-real-estate-the-next-financial-implosion/

Read More »

Read More »

Bi-Weekly Economic Review

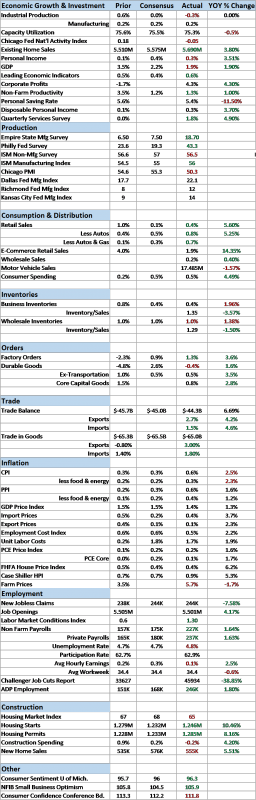

Economic Reports Scorecard. The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher.

Read More »

Read More »

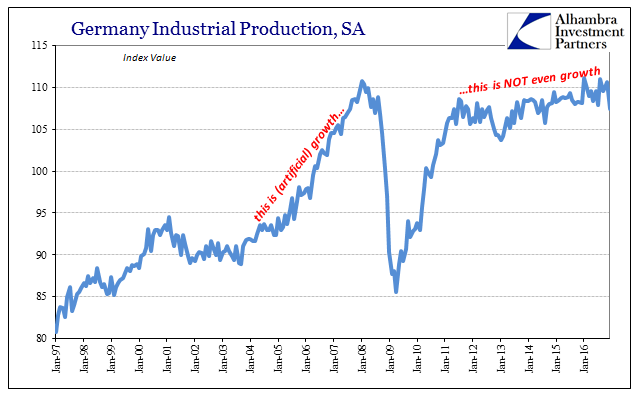

Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony.

Read More »

Read More »

Emerging Markets: What has Changed?

A Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. Bulgaria’s interim government said it may apply to join the eurozone within a month. South Africa’s main labor union Cosatu accepted a government-proposed minimum wage.

Read More »

Read More »

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

Real Disposable Income: Headwinds of the Negative

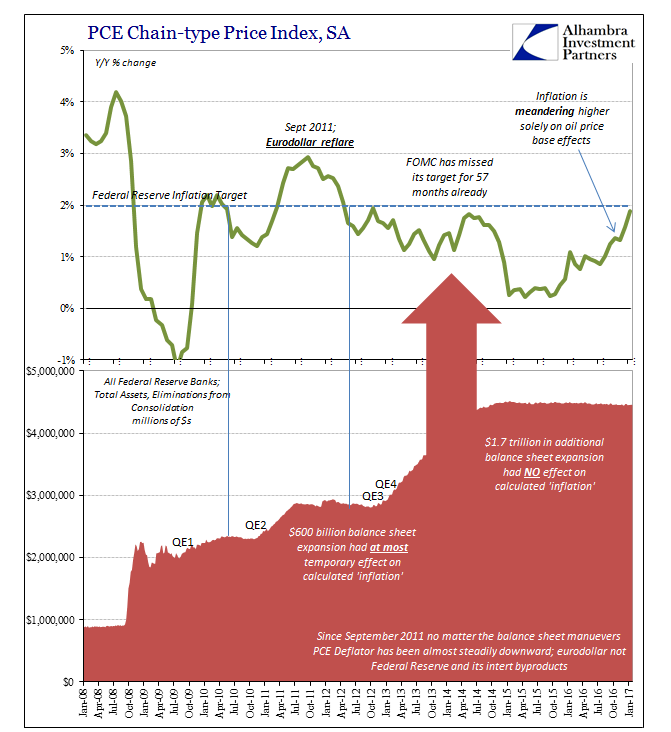

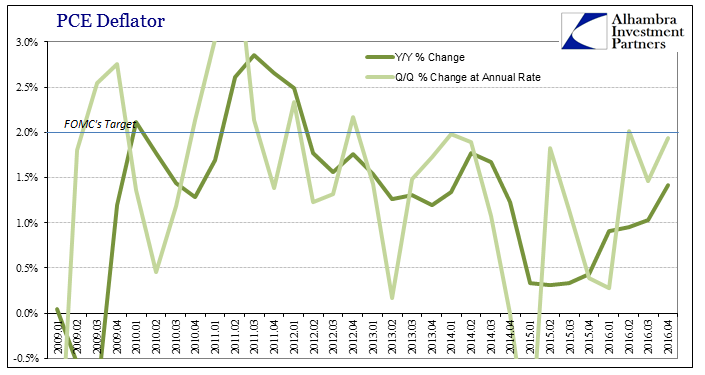

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability).

Read More »

Read More »

Why Is the Cost of Living so Unaffordable?

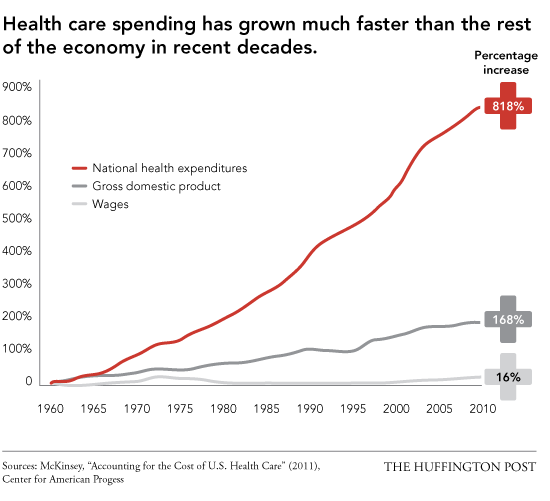

Strip away the centralized power that protects and funds cartels, and prices would plummet. The mainstream narrative is "the problem is low wages." Actually, the problem is the soaring cost of living. If essentials such as healthcare, housing, higher education and government services were as cheap as they once were, a wage of $10 or $12 an hour would be more than enough to maintain a decent everyday life.

Read More »

Read More »

How do animals change their colour? | The Economist

Take a look at the science behind the kaleidoscopic animals that can adopt new colours at will. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Chameleons aren’t the only animals that can change colour. Some primates can blush. How do animals change colour? 1. Brain signals: The colours of the environment, a rival, …

Read More »

Read More »

Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion.

Read More »

Read More »