Category Archive: 5) Global Macro

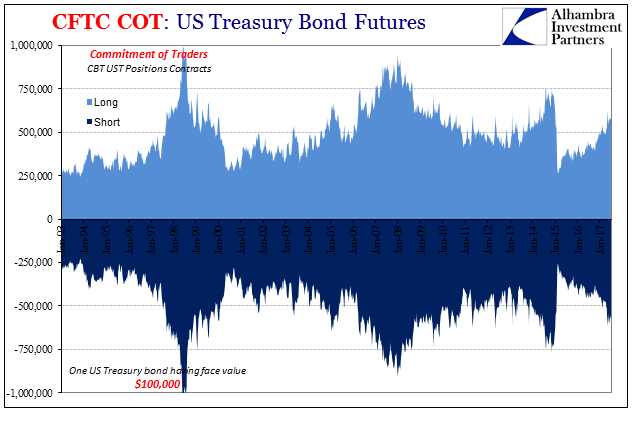

U.S. Treasuries: Not Really Wrong On Bonds

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014.

Read More »

Read More »

Emerging Markets: What has Changed

The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates.

Read More »

Read More »

Why We’re So Risk-Averse: “We Can’t Take That Chance”

If our faith in the future and our resilience is near-zero, then we can't take any chances. You've probably noticed how risk-averse Hollywood has become: the big summer movies are all extensions of existing franchises--mixing up the superheroes in new combinations, or remaking hit films from the past--all safe bets.

Read More »

Read More »

The folly of Venezuelan president Nicolás Maduro’s policies, as seen by Kal | The Economist

In Venezuela, a rigged election, months of violent protests and a power hungry leader created a dangerous cocktail. KAL’s cartoon commentary Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk …

Read More »

Read More »

Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook.

Read More »

Read More »

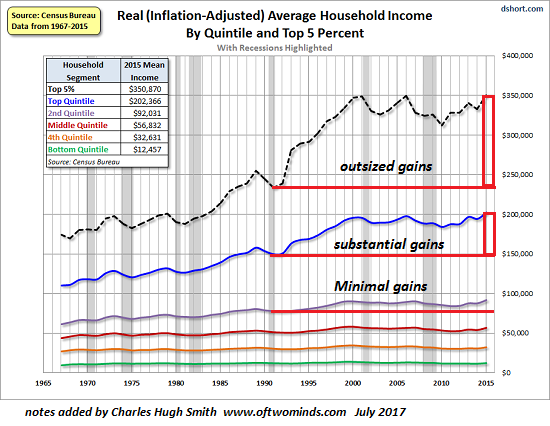

13 April 2017 Charles Hugh Smith sheds interesting light upon cause of the retail apocalyp

While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has …

Read More »

Read More »

Charles Hugh Smith On Where The Jobs Are

Click here for the full summary and slides: http://financialrepressionauthority.com/2017/08/02/the-roundtable-insight-charles-hugh-smith-on-where-the-jobs-are/

Read More »

Read More »

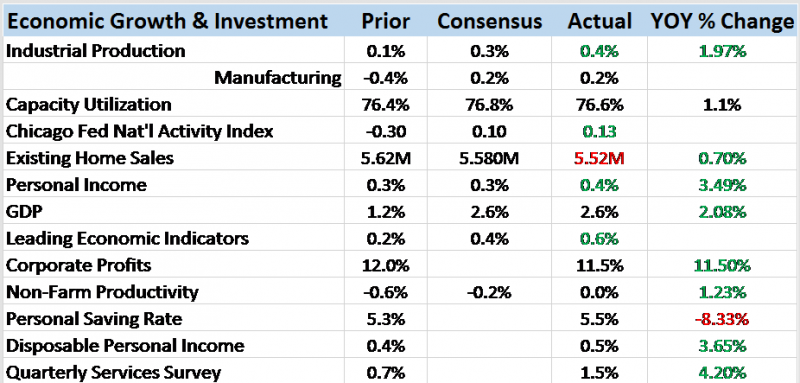

Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

Rwanda’s eternal president, Paul Kagame | The Economist

Under President Paul Kagame Rwanda has gone from carnage to calm. So why are his people terrified of him? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed last week, as markets await fresh drivers. Jobs report this Friday could provide greater clarity with regards to Fed policy. BOE and RBA meet but aren’t expected to change policy. Data is likely to reinforce the notion that inflation remains low in EM, allowing those central banks to remain dovish. Czech National Bank is the main exception, as it may start the tightening cycle this week.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party.

Read More »

Read More »

Sergei Shnurov: Rocking the Kremlin | The Economist

Sergei Shnurov, described as Russia’s most popular rock star, with a fanbase to match Putin. Meet Sergei Shnurov Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist …

Read More »

Read More »

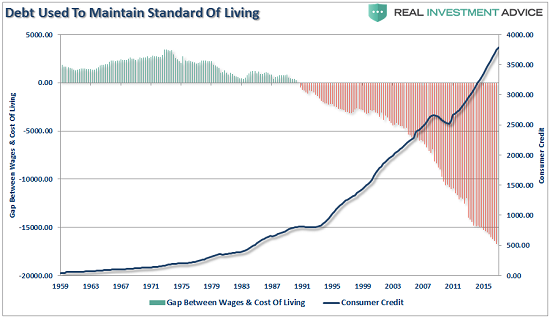

The Two Charts That Dictate the Future of the Economy

The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable household income, i.e. the real income remaining after debt service (interest and principal), rent, healthcare co-payments and insurance and other essential living expenses.

Read More »

Read More »

U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing what is just one quarter shy of...

Read More »

Read More »

Commercial Property Market Is Inflated and May Burst Again – McWilliams

Dublin property investors had better hope that Brexit happens soon. They should also hope that it’s not just a ‘hard’ Brexit, but a granite Brexit — a Brexit that’s as hard as possible. They should be betting on the buffoonery of Boris Johnson, down on both knees praying for a massive barney between Davis and Barnier.

Read More »

Read More »

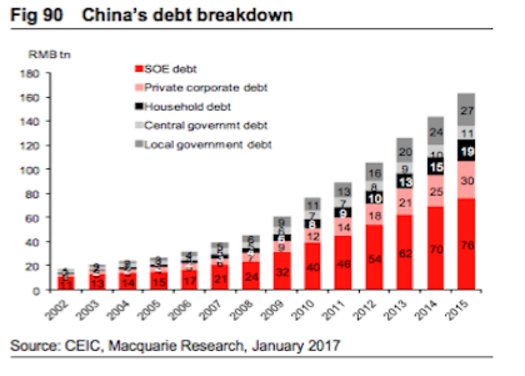

There Is Only One Empire: Finance

There's an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the "global empire" / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously misleading, in my view, for this reason:

Read More »

Read More »

Osaka: An Insiders Guide | The Economist

Osaka is the fastest-growing destination city in the world. Three locals give us their top tips for experiencing Japan’s second largest city. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday, but largely firmer over the entire week. Top performers were BRL, KRW, and ZAR, while the worst were ARS, MXN, and RUB. FOMC meeting this week poses some potential risks to the global liquidity story that’s supporting EM. Within EM, the low inflation/easy monetary policy narrative should continue with data and events this week.

Read More »

Read More »

Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why...

Read More »

Read More »

Emerging Markets: What has Changed

South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with a 25 bp cut to 7.0%.

Read More »

Read More »