Category Archive: 5) Global Macro

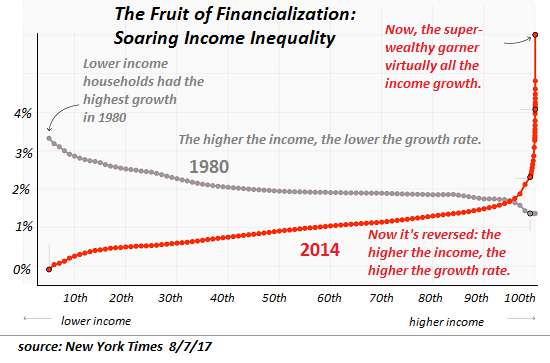

The Pie Is Shrinking for the 99 percent

The ensuing social disunity and disruption will be of the sort many alive today have never seen. Social movements arise to solve problems of inequality, injustice, exploitation and oppression. In other words, they are solutions to society-wide problems plaguing the many but not the few (i.e. the elites at the top of the wealth-power pyramid).

Read More »

Read More »

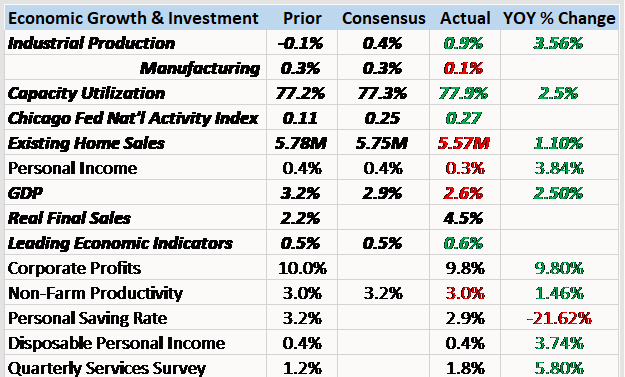

Bi-Weekly Economic Review: Markets At Extremes

Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on the price of oil but that is what we’ve become over the...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves.

Read More »

Read More »

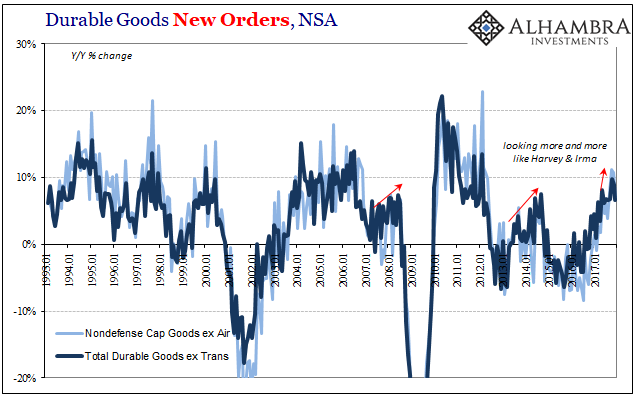

December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes.

Read More »

Read More »

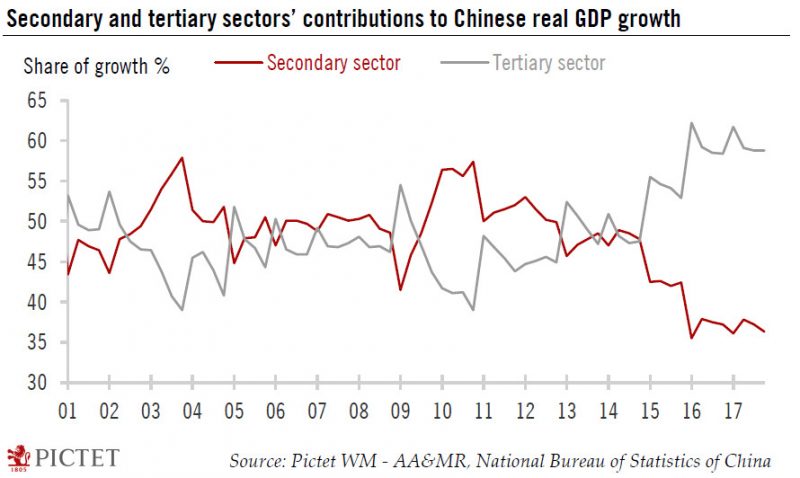

Forget It, China’s Not Booming

Jeffrey Snider, head of global investment research at Alhambra Investments, says China is in fact not growing rapidly, which sounds disheartening for commodity investors. He reckons a crucial investment metric has weakened, pointing to slower economic expansion.

Read More »

Read More »

Emerging Markets: What Changed

Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia's central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate cut.

Read More »

Read More »

China: 2018 GDP forecast revised up

The Chinese economy ended 2017 on a strong note. In Q4 2017, China’s GDP amounted to Rmb23.4 trillion (about USD3.7 trillion), rising 1.6% over the previous quarter and 6.8% year-over-year (y-o-y) in real terms. Full-year GDP came in at Rmb82.7 trillion (about USD12.9 trillion), growing by 6.9% in real terms and beating the consensus forecast as well as our own estimate (both at 6.8%).

Read More »

Read More »

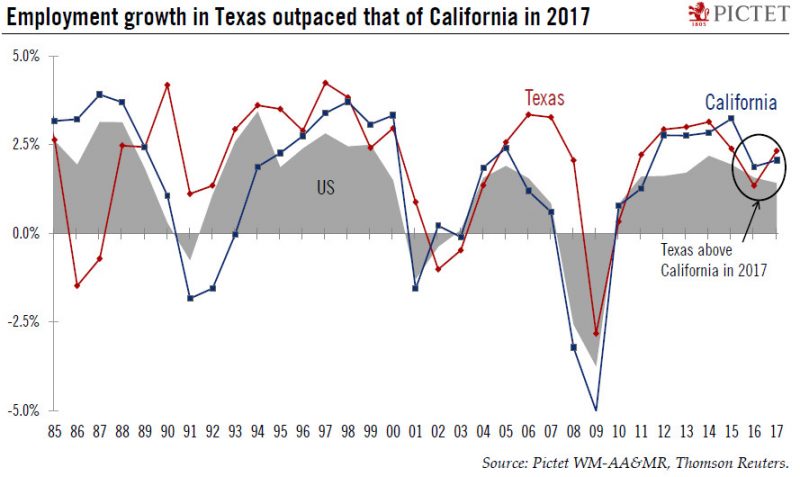

US chart of the week – Texas rebounds

One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth?

Read More »

Read More »

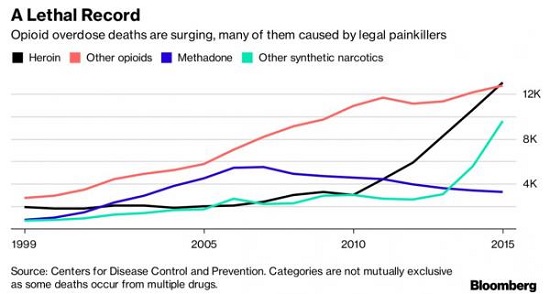

Can We Finally Have an Honest Discussion about the Opioid Crisis?

The economy no longer generates secure, purposeful jobs for the working class, and so millions of people live in a state of insecure despair. The opioid epidemic is generating a lot of media coverage and hand-wringing, but few if any solutions, and this is predictable: if you don't face up to the causes, then you can't solve the problem.

Read More »

Read More »

Bassem Youssef: Why we should laugh at leaders | The Economist

Bassem Youssef has been called “the Jon Stewart of the Middle East”. On the seventh anniversary of Egypt’s Arab Spring he talks to The Economist’s award-winning cartoonist, KAL, about political satire and what it means for democracy. Click here to subscribe to The Economist on YouTube: http://econ.st/2GgGB8d Dr Bassem Yousef is a television comedian. He …

Read More »

Read More »

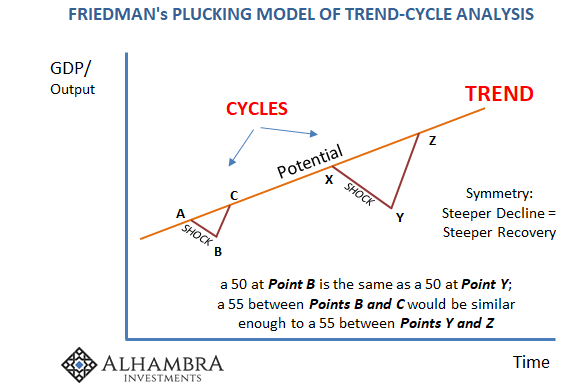

The Dismal Boom

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction.

Read More »

Read More »

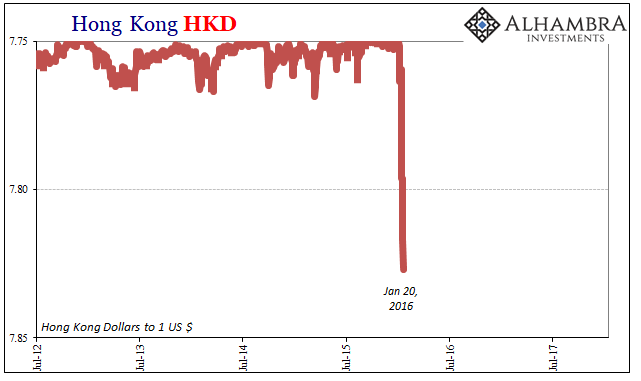

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed.

Read More »

Read More »

Charles Hugh Smith // What’s Your Job Worth / work, money and automation

Money & Work Unchainedm started when Charles asked himself: When we dream of the future of our society, are we hoping for the right things? The current conventional-wisdom. Money & Work Unchainedm started when Charles asked himself: When we dream of the future of our society, are we hoping for the right things? The current …

Read More »

Read More »

Obesity: not just a rich-world problem | The Economist

Obesity is a global problem, but more people are getting fatter in developing countries than anywhere else. If current trends continue, obese children will soon outnumber those who are undernourished. Click here to subscribe to The Economist on YouTube: http://econ.st/2rAAQPL People are fatter than ever. Obesity has more than doubled since 1980. But the biggest …

Read More »

Read More »

CHARLES HUGH SMITH What we want to do is make society rich

CHARLES HUGH SMITH What we want to do is make society rich ———————————- $ Help Finance News reach 1000 subscribers: $ ANDREW HOFFMAN: SUBSCRIBE for Latest on FINANCIAL CR / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH /. …

Read More »

Read More »

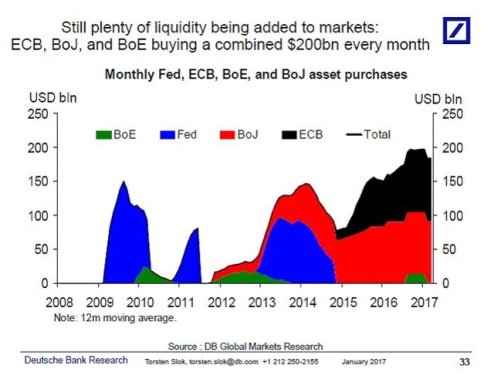

Central Banks: From Coordination to Competition

This is one reason why I anticipate "unexpected" disruptions in the global economy in 2018. The mere mention of "central banks" will likely turn off many readers who understandably have little interest in convoluted policies and arcane mumbo-jumbo, but bear with me for a few paragraphs while I make the case for something to happen in 2018 that will impact us all to some degree.

Read More »

Read More »

RMR: Special Guest – Charles Hugh Smith – Of Two Minds (01/22/2018)

“V” and Charles have a great discussion regarding cryptocurrencies, the future of money and the current broken banking model. We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please subscribe for the latest shows daily! http://www.roguemoney.net …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM.

Read More »

Read More »

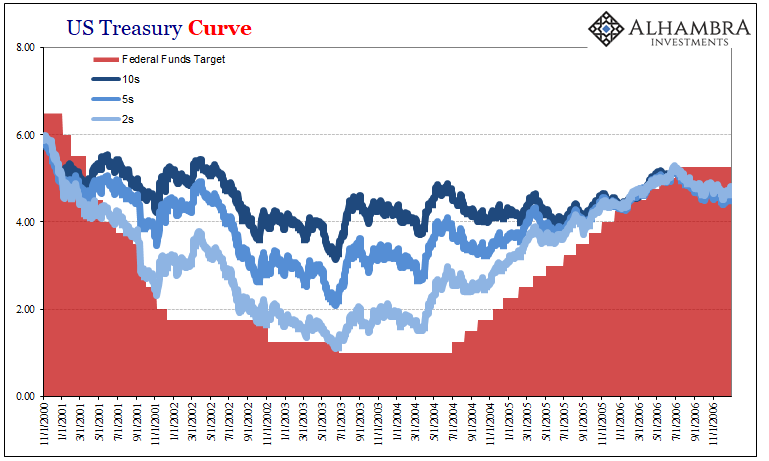

What About 2.62 percent?

There’s nothing especially special about 2.62%. It’s a level pretty much like any other, given significance by only one phrase: the highest since 2014. It sounds impressive, which is the point. But that only lasts until you remember the same thing was said not all that long ago.

Read More »

Read More »

It’s Time to Retire “Capitalism”

Our current socio-economic system is nothing but the application of force on the many to enforce the skims, scams and privileges of the self-serving few. I've placed the word capitalism in quotation marks to reflect the reality that this word now covers a wide spectrum of economic activities, very little of which is actually capitalism as classically defined.

Read More »

Read More »