Category Archive: 5) Global Macro

Global PMI’s Hang In There And That’s The Bad News

At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

Read More »

Read More »

Trump corruption: the creatures that live in the Washington swamp | The Economist

President Trump has been caught up in a corruption scandal involving two of his associates, Michael Cohen and Paul Manafort. The White House is sinking further into the Washington swamp. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

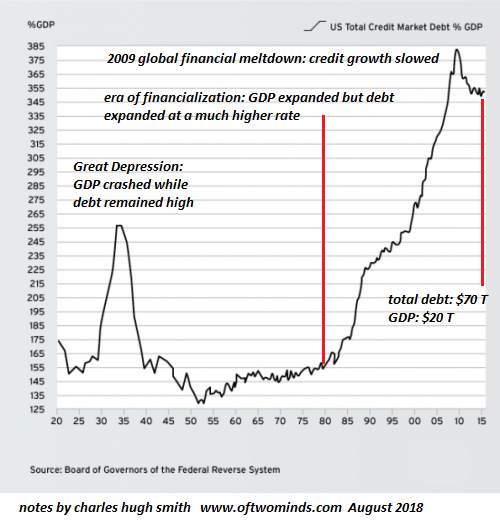

How “Wealthy” Would We Be If We Stopped Borrowing Trillions Every Year?

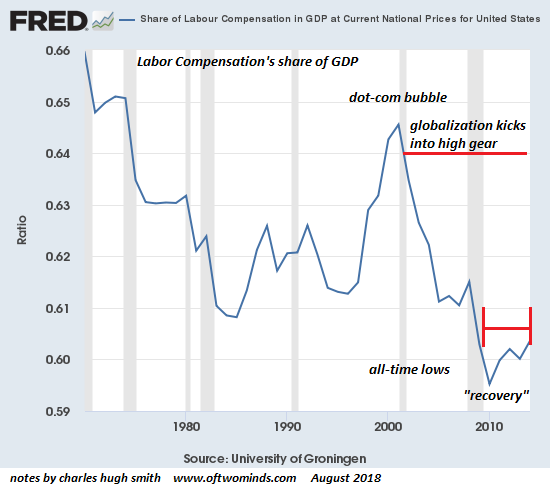

These charts reflect a linear system that is wobbling into the first stages of non-linear destabilization.

The widespread presumption is the U.S. is wealthy beyond words, and will remain so as far as the eye can see: wealthy enough to fund trillion-dollar weapons systems, trillion-dollar endless wars, multi-trillion dollar Medicare for all, multi-trillion dollar Universal Basic Income, and so on, in an endless profusion of endless trillions....

Read More »

Read More »

Cocaine: why the cartels are winning | The Economist

America spends $40bn a year on the war on drugs. But its “zero tolerance” approach has done little to curb addiction or overdose rates, which are the highest in the world. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

These Syrian refugees want to go home | The Economist

The war in Syria has forced around half of the country’s people from their homes. Although many dream of returning as soon as the war is over, in reality it may take years. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from …

Read More »

Read More »

RMR: Special Guest – Charles Hugh Smith – Of Two Minds (08/20/2018)

ROGUE NEWS is a group of political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. !PLEASE SUBSCRIBE! Support our media by participating in our products and services: ► ROGUE NEWS: ROGUEMONEY.net ► Watch Us Trade: https://wut.page.link/wut1 ► CBD …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish markets are closed this week for holiday.

Read More »

Read More »

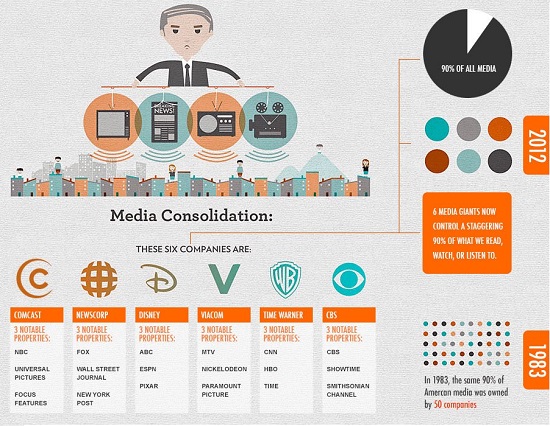

If You Want to Survive this Election with Your Mental Health Intact, Turn Off the “News” and Social Media Now

If you want to preserve your sanity and avoid unhappy derangement, turn off all corporate and social media from now to Thanksgiving. Since elections are extremely profitable for traditional media / social media corporations, your sanity will gleefully be sacrificed in the upcoming election--if you are gullible enough to watch the "news" and tune into social media.Elections are extremely profitable because candidates spend scads of cash on media...

Read More »

Read More »

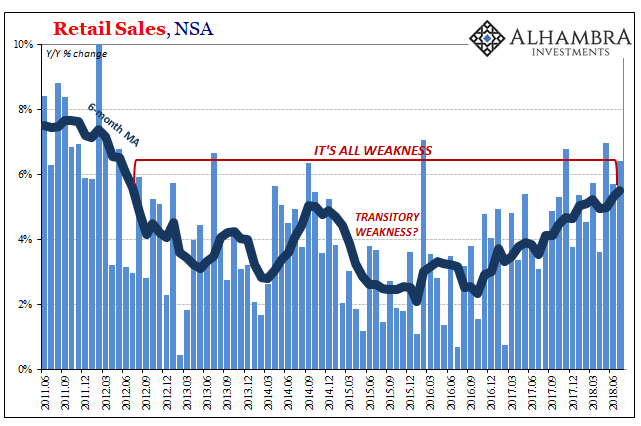

What’s Hot Isn’t Retail Sales Growth

Americans are spending more on filling up. A lot more. According the Census Bureau, retail sales at gasoline stations had increased by nearly 20% year-over-year (unadjusted) in both May and June 2018. In the latest figures for July, released today, gasoline station sales were up by more than 21%.

Read More »

Read More »

Dating in the digital age | The Economist

Over 200m people worldwide use online dating platforms and about one-third of married couples in America meet online. In this week’s cover story, The Economist examines the way online dating has changed the way we search for love. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the …

Read More »

Read More »

Monthly Macro Monitor – August 2018

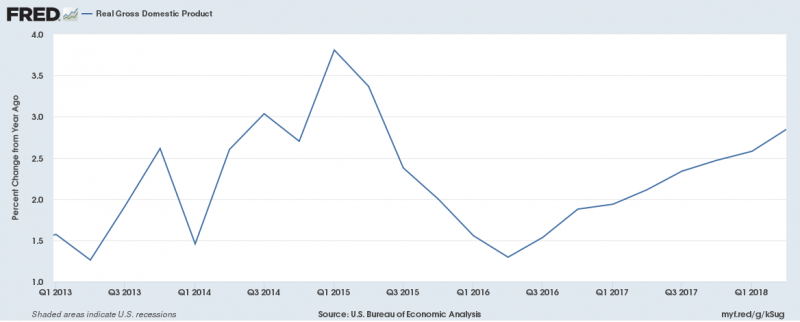

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%).

Read More »

Read More »

Can you really fight corruption? | The Economist

What does it take to clean up a corrupt state? In one of the European Union’s most corrupt countries a prosecutor has taken on the establishment, convicting over 1,000 Romanian officials. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

Our “Prosperity” Is Now Dependent on Predatory Globalization

Nowadays, trade and "prosperity" are dependent on currencies that are created out of thin air via borrowing or printing. So here's the story explaining why "free" trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost nation, and keep all the...

Read More »

Read More »

Where is the world’s most liveable city? | The Economist

Where is the world’s most liveable city? The Economist Intelligence Unit has ranked 140 cities based on their liveability. Melbourne, Australia, has been ranked the world’s most liveable city for the past seven years but it has lost the top spot to Vienna. See the full report: eiu.com/liveability Click here to subscribe to The Economist …

Read More »

Read More »

Capital Controls Next? Lira Rebounds After Turkey Bank Regulator Limits FX Swap Operations

In the first tentative step toward the final option available for Erdogan to halt the Lira's accelerating collapse - which crashed as low as 7.2362 earlier after the Wellington FX open following the the Turkish president's latest belligerent comments - namely capital controls, the Turkish Banking Regulation and Supervision Agency imposed a limit on the amount of foreign currency and lira swap and swap-like transactions, which are not to exceed 50%...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »

NEWS: CHARLES HUGH SMITH – Economic Slowdown 2018

NEWS: CHARLES HUGH SMITH – Economic Slowdown 2018 ►►► THANKS FOR WATCHING ◄◄◄ AND DON’T FORGET TO LIKE COMMENTS AND SUBSCRIBE! Thank you! ==================================================== ► Gerald Celente: http://bit.ly/2w1taF5 ► Finance Today: http://bit.ly/2w0vBHP ► RonPaulLibertyReport: http://bit.ly/2w0h5zS

Read More »

Read More »

Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the...

Read More »

Read More »

What Chinese Trade Shows Us About SHIBOR

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists were sure that it was just the...

Read More »

Read More »