Category Archive: 5) Global Macro

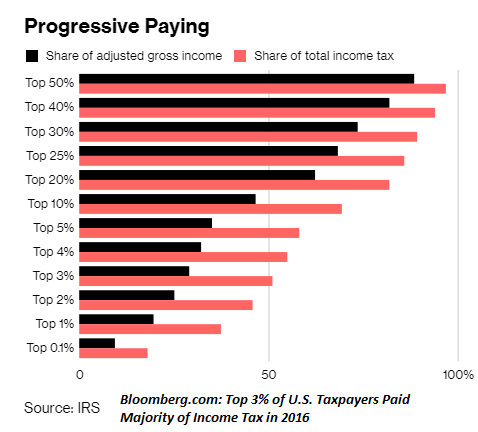

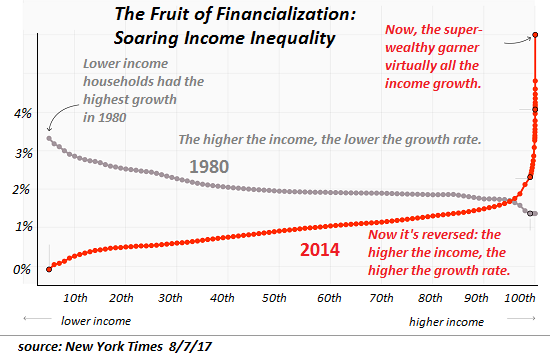

The “Working Rich” Are Not Like You and Me-or the Oligarchs

Rising income inequality may be a reflection of the changing nature of work. F. Scott Fitzgerald's story The Rich Boy included this famous line: "Let me tell you about the very rich. They are different from you and me." According to a recent paper published by the National Bureau of Economic Research (NBER),Capitalists in the Twenty-First Century (abstract only), the "working rich" are different from you and me, and from the Oligarchs above them...

Read More »

Read More »

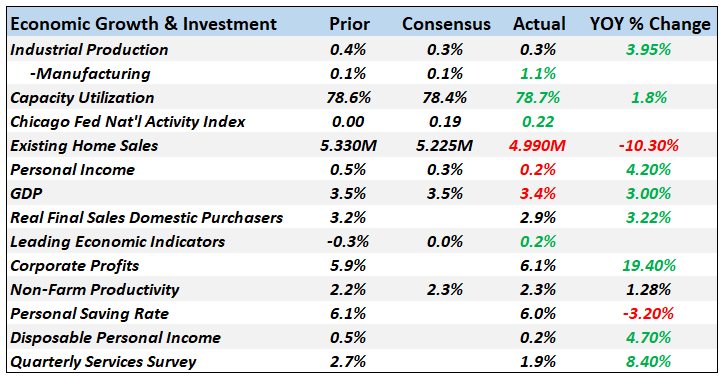

Monthly Macro Monitor – January 2019

A Return To Normalcy. In the first two years after a newly elected President takes office he enacts a major tax cut that primarily benefits the wealthy and significantly raises tariffs on imports. His foreign policy is erratic but generally pulls the country back from foreign commitments. He also works to reduce immigration and roll back regulations enacted by his predecessor.

Read More »

Read More »

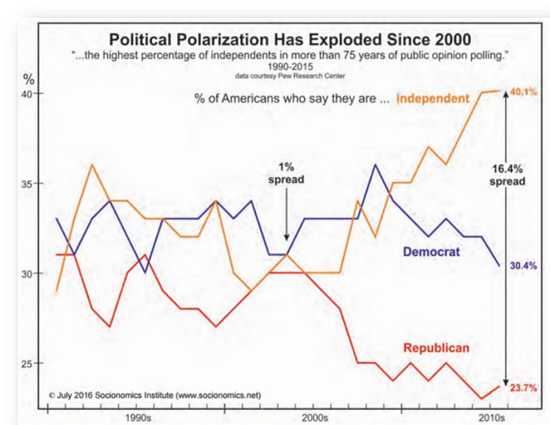

The Ruling Elites Love How Easily We’re Distracted and Turned Against Each Other

No wonder the ruling elites love how easily we're distracted and divided against ourselves: it's so easy to dominate a distracted, divided, blinded-by-propaganda and negative emotions populace. Let's say you're one of the ruling elites operating the nation for the benefit of the oligarchy.

Read More »

Read More »

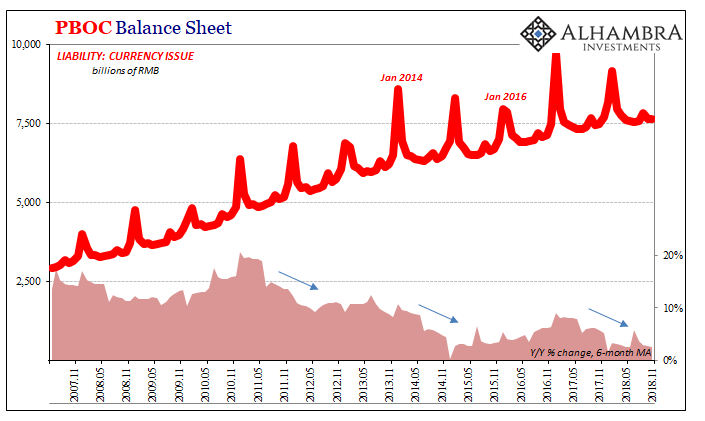

China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream.

Read More »

Read More »

Charles Hugh Smith On Pathfinding Our Destiny Amidst Social & Political Disunity

Click here for the full transcript: http://financialrepressionauthority.com/2019/01/24/the-roundtable-insight-charles-hugh-smith-on-pathfinding-our-destiny-amidst-social-political-disunity/

Read More »

Read More »

MH17: can Russia be held to account? | The Economist

Australia and the Netherlands say Russia is responsible for shooting down flight MH17 in 2014. The families of the 298 victims want justice—but which court can give it to them? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk …

Read More »

Read More »

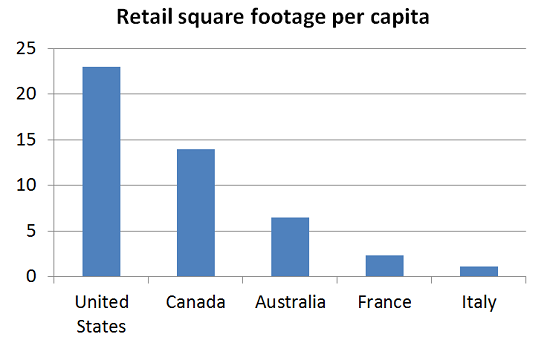

Gentrified Urban America Will Be Hit Hard by the Recession

Combine sky-high commercial rents in homogenized, gentrified urban areas and sharp declines in the incomes of the limited populace who can afford gentrified urban areas and what do you get? A number of macro dynamics have set up gentrified urban America for a big fall in the coming recession.

Read More »

Read More »

The Awakening Is Now Going World Wide, The Movement Has Started:Charles Hugh Smith

Today’s Guest: Charles Hugh Smith Website: Of Two Minds http://oftwominds.com Blog https://www.oftwominds.com/blog.html Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject matter. The representative artwork included with these videos shall not be construed as the actual events that are …

Read More »

Read More »

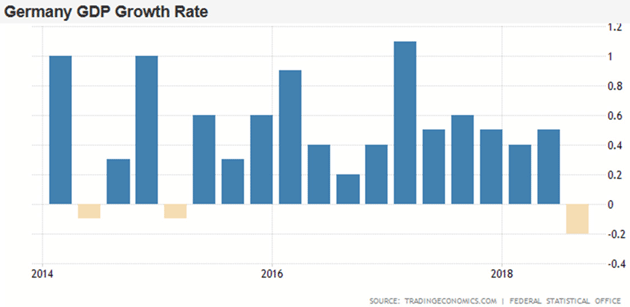

Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin. Shaky China: Chinese landing could be harder than expected. Brexit and EU Breakage: “I have long thought the EU will eventually fall apart”. Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold. We may see “yellow vests” spread globally: Economics is about to get interesting …

Read More »

Read More »

Congo: the race to beat Ebola | The Economist

Congo is in the grip of another Ebola outbreak, which has killed up to 400 people. There is no effective treatment for the deadly virus, but pioneering drug trials are under way Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

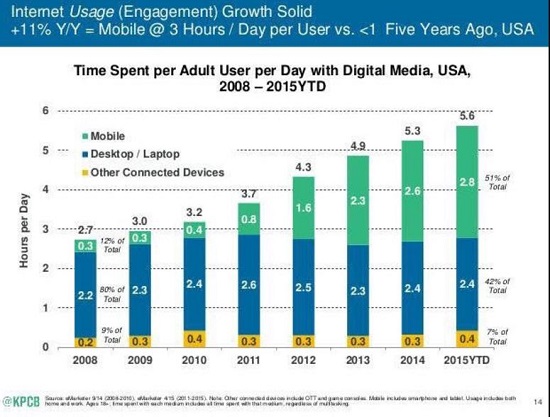

Want to Heal the Internet? Ban All Collection of User Data

The social media/search giants have mastered the dark arts of obfuscating how they're reaping billions of dollars in profits from monetizing user data, and lobbying technologically naive politicos to leave their vast skimming operations untouched.

Read More »

Read More »

Two Ways the System Is Rigged: HFT and Oligarchic Inheritance

We often hear how the system (i.e. our economy) is rigged to benefit the few at the expense of the many, but exactly how is it rigged? Longtime correspondent Zeus Y. recently highlighted two specific mechanisms that favor the top 0.01%: high frequency trading (HFT) and oligarchic inheritance, the generational transfer of immense wealth and the power it buys.

Read More »

Read More »

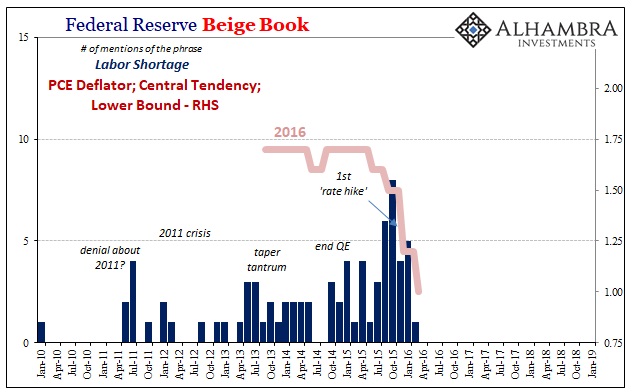

Hall of Mirrors, Where’d The Labor Shortage Go?

Today was supposed to see the release of the Census Bureau’s retail trade report, a key data set pertaining to the (alarming) state of American consumers, therefore workers by extension (income). With the federal government in partial shutdown, those numbers will be delayed until further notice. In their place we will have to manage with something like the Federal Reserves’ Beige Book.

Read More »

Read More »

How can Britain fix Brexit? | The Economist

Parliament’s rejection of Theresa May’s Brexit plan has created a democratic mess. The Economist’s Britain editor, Tom Wainwright, explains how the country got into this muddle, and the solution for getting out. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

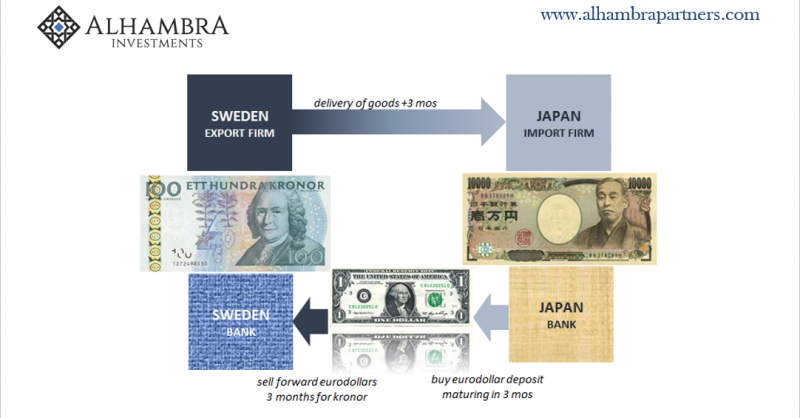

That’s A Big Minus

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention.

Read More »

Read More »

Spreading Sour Not Soar

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve.

Read More »

Read More »