Category Archive: 5) Global Macro

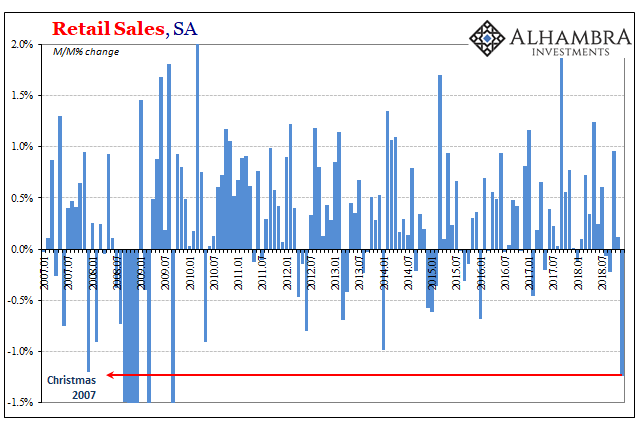

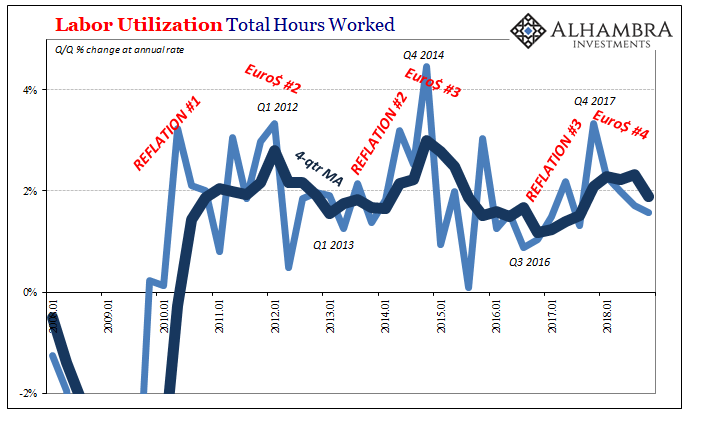

Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage.

Read More »

Read More »

Charles Hugh Smith On Debt & Demographics Leading To Government Crisis and Financial Repression

Click here for the full transcript: http://financialrepressionauthority.com/2019/03/01/the-roundtable-insight-charles-hugh-smith-on-debt-demographics-leading-to-government-crisis-and-financial-repression/

Read More »

Read More »

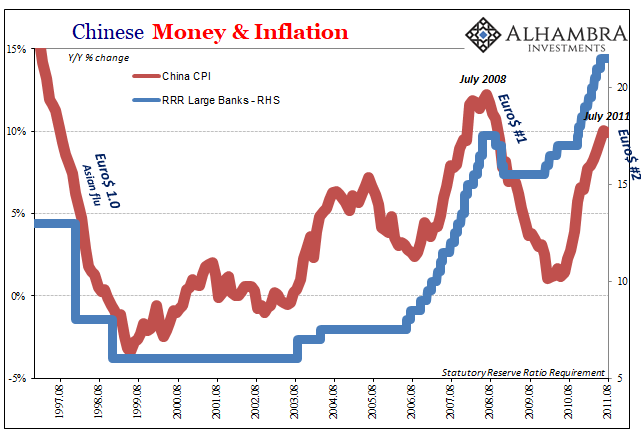

China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China.

Read More »

Read More »

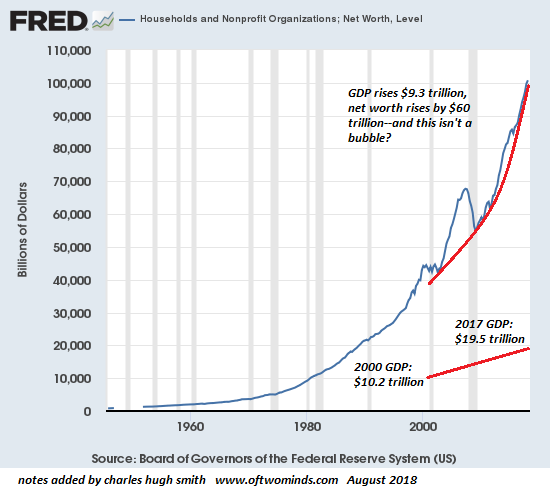

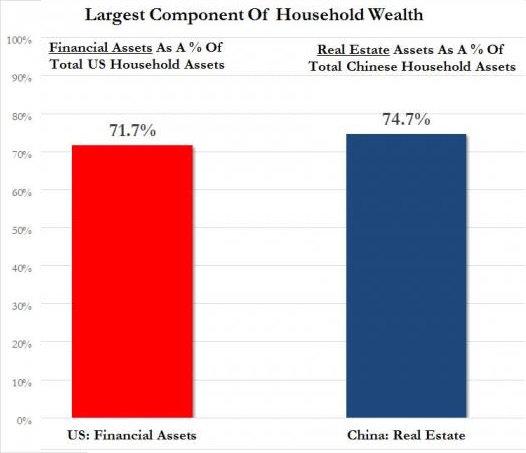

The Fed’s “Wealth Effect” Has Enriched the Haves at the Expense of the Young

The Fed is the mortal enemy of the young generations, and thus of the nation itself. The wealth effect" generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn't Target The Market, Eh?

Read More »

Read More »

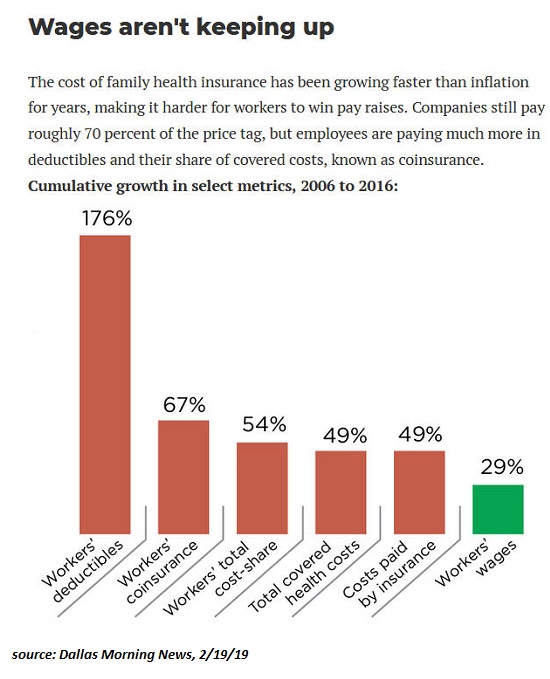

What Killed the Middle Class?

Rounding up the usual suspects won't restore a vibrant middle class. What killed the middle class? The answer may well echo an Agatha Christie mystery: rather than there being one guilty party, it may be that each of the suspects participated in the demise of the middle class.

Read More »

Read More »

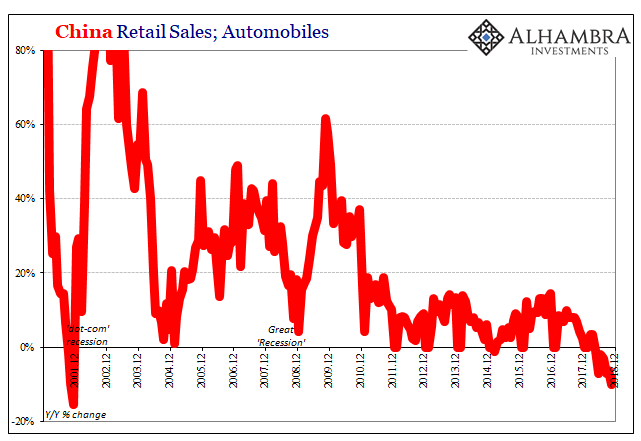

Meanwhile, Over In Asia

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something.

Read More »

Read More »

India v Pakistan: the threat of nuclear war | The Economist

A recent terrorist attack has reignited the possibility of war between India and Pakistan—and this time both have nuclear weapons. Will the countries’ leaders, Narendra Modi and Imran Khan, allow the Kashmir conflict to escalate? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The …

Read More »

Read More »

The Doomsday Scenario for the Stock and Housing Bubbles

It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy. The Doomsday Scenario for the stock and housing bubbles is simple: the Fed's magic fails. When dropping interest rates to zero and flooding the financial sector with loose money fail to ignite the economy and reflate the deflating bubbles, punters will realize the Fed's magic only worked the first three times: three bubbles...

Read More »

Read More »

Mars: when will humans get there? | The Economist

Sending astronauts to Mars is a daunting prospect. But this will not deter NASA and private companies from trying to put humans on the red planet. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on …

Read More »

Read More »

No Surprise, Hysteria Wasn’t a Sound Basis For Interpretation

What gets them into trouble is how they just can’t help themselves. Go back one year, to early 2018. Last February it was all-but-assured (in mainstream coverage) that the US economy was going to take off. The bond market, meaning UST’s, was about to be massacred because the overheating boom would force a double shot down its throat.

Read More »

Read More »

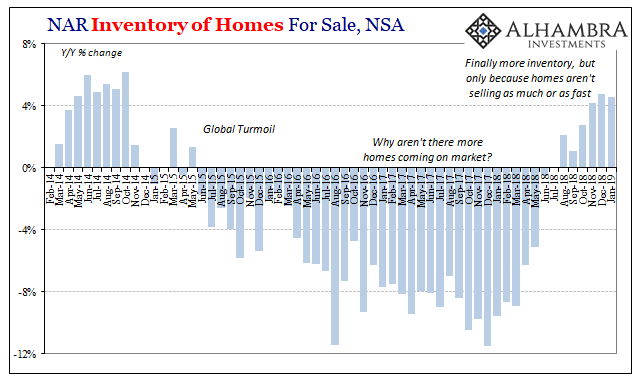

The Fate of Real Estate

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding.

Read More »

Read More »

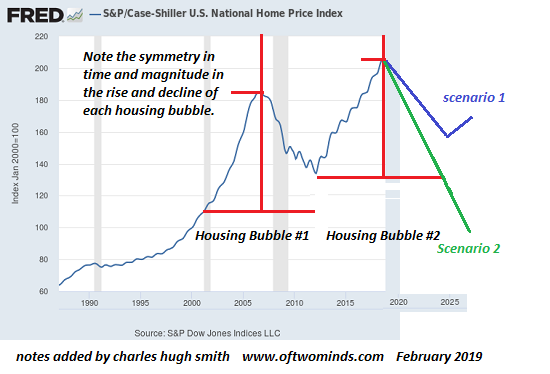

Now that Housing Bubble #2 Is Bursting…How Low Will It Go?

There are two generalities that can be applied to all asset bubbles: 1. Bubbles inflate for longer and reach higher levels than most pre-bubble analysts expected. 2. All bubbles burst, despite mantra-like claims that "this time it's different".

Read More »

Read More »

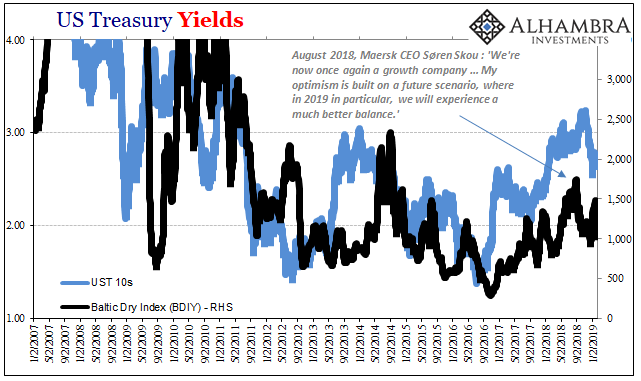

Sinking Shippers Signal Global Goods Troubles

It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength.

Read More »

Read More »

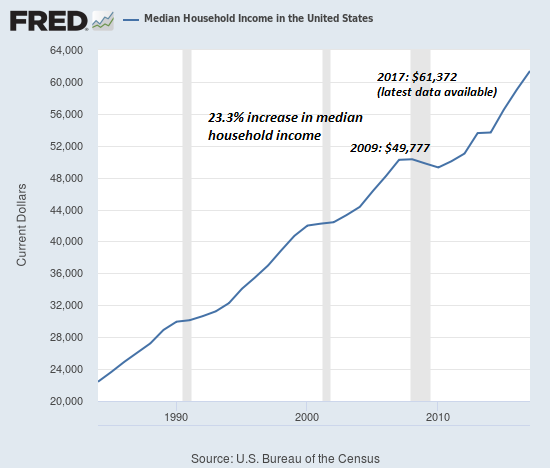

Homeless Encampments and Luxury Apartments: Our Long Strange Boom

It's been a long, strange economic boom since the nadir of the Global Financial Meltdown in 2009. A 10-year long boom that saw the S&P 500 rise from 666 in early 2009 to 2,780 and GDP rise by 43% has been slightly more uneven for most participants.

Read More »

Read More »

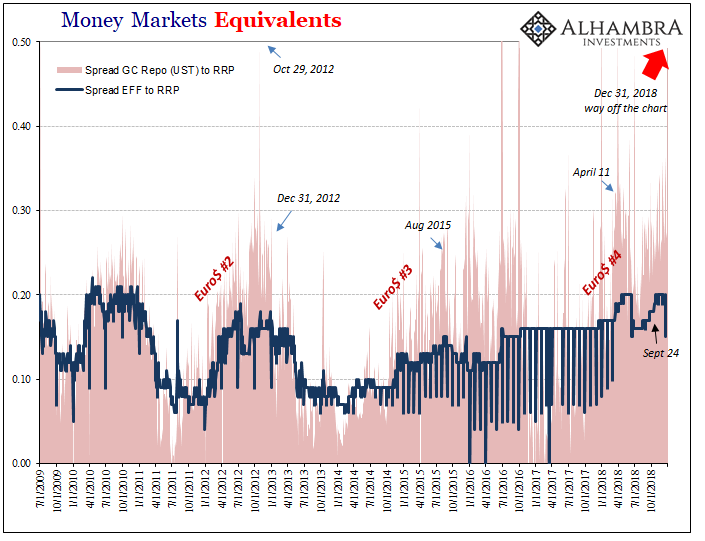

FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances.

Read More »

Read More »

Something Different About This One

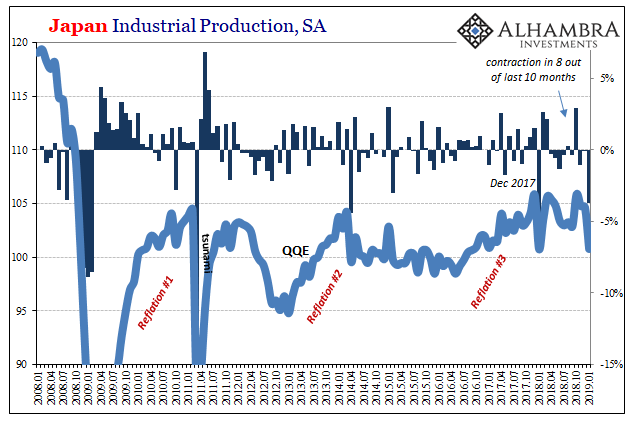

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes.

Read More »

Read More »

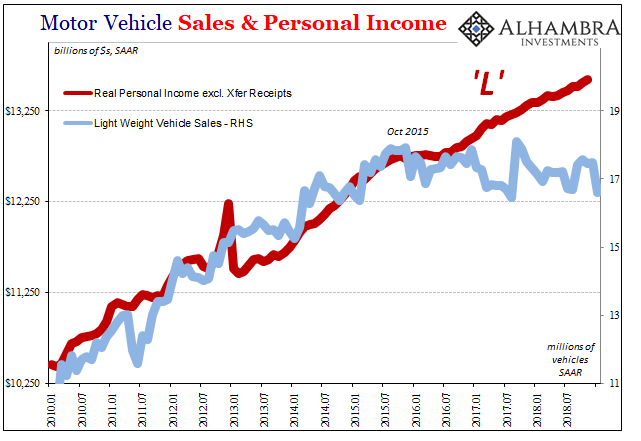

Getting Back Up To Speed On Loss Of Speed in US Economy

For much of 2018, the idea of “overseas turmoil” lived up to its name. At least in economic terms. Market-wise, there was a lot domestically to draw anyone’s honest attention. Warnings were everywhere by the end of the year. And that was what has been at issue. Some said Europe and China are on their own, the US is cocooned in a tax cut-fueled boom. Decoupling, only now the other way around.

Read More »

Read More »

Space: the next frontier for war? | The Economist

President Trump has just announced plans to create a new military Space Force, increasing the prospect of a new theatre of war. How might war in space be fought? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy The 1,300 active satellites above the earth provide a wide array of services – some of …

Read More »

Read More »

Credit Exhaustion Is Global

Europe is awash in credit exhaustion, and so is China. The signs are everywhere: credit exhaustion is global, and that means the global growth story is over: revenues and profits are all sliding as lending dries up and defaults pile up.

Read More »

Read More »

China’s Big Money Gamble

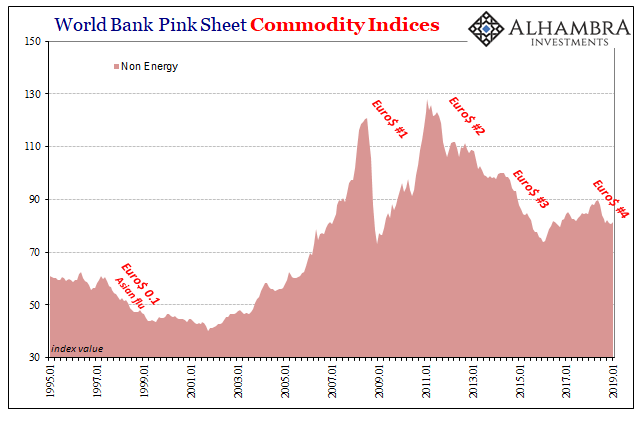

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018.

Read More »

Read More »