Category Archive: 5) Global Macro

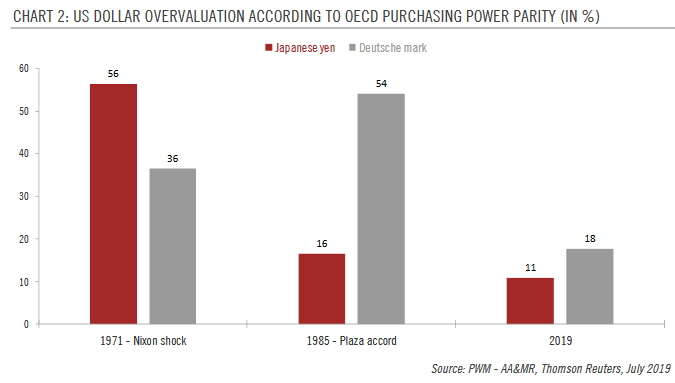

US FX intervention still someway off

The likelihood of active FX intervention by the US authorities remains low but is increasing and the Trump administration can be expected to continue to pressure the Fed to cut rates.The Trump administration has been focusing on the US’s trade deficit with some of its main trading partners such as China and Germany. A strong dollar is exacerbating this deficit and has visibly exasperated President Trump.

Read More »

Read More »

Who owns the Moon? | The Economist

50 years after the first Moon landing, humanity is getting ready to go back. Countries and companies are planning dozens of lunar missions—for research, for resources and even for tourism, which begs the question: who, if anyone, owns the Moon? Read more here: https://econ.st/2JK0A1O Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Who …

Read More »

Read More »

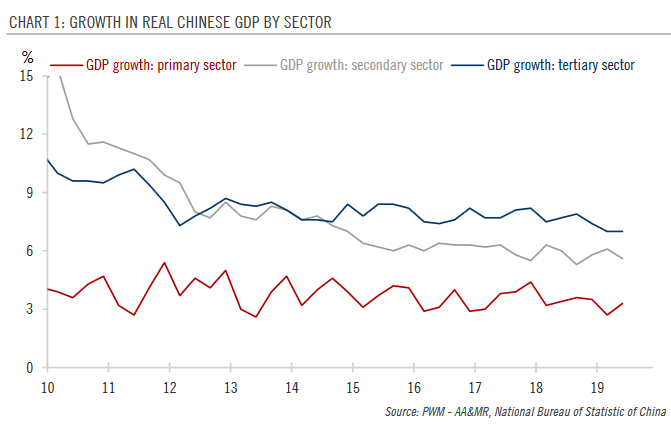

China: Q2 growth lowest in decades

Downward pressure on growth persists amid ongoing trade tensions.Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades.The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1.

Read More »

Read More »

Charles Hugh Smith on the Market’s Obsession with the Federal Reserve

Click here for the relevant charts and full written transcript: http://financialrepressionauthority.com/2019/07/16/fra-the-roundtable-insight-charles-hugh-smith-on-the-markets-obsession-with-the-federal-reserve/

Read More »

Read More »

Charles Hugh Smith on the Market’s Obsession with the Federal Reserve

Click here for the relevant charts and full written transcript: http://financialrepressionauthority.com/2019/07/16/fra-the-roundtable-insight-charles-hugh-smith-on-the-markets-obsession-with-the-federal-reserve/

Read More »

Read More »

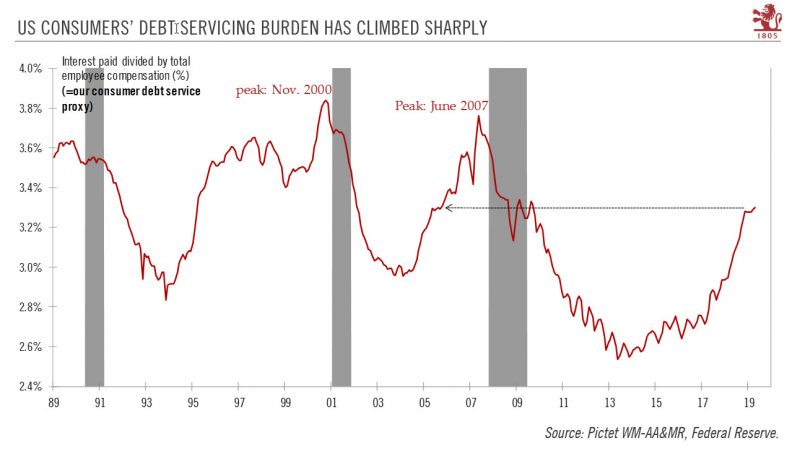

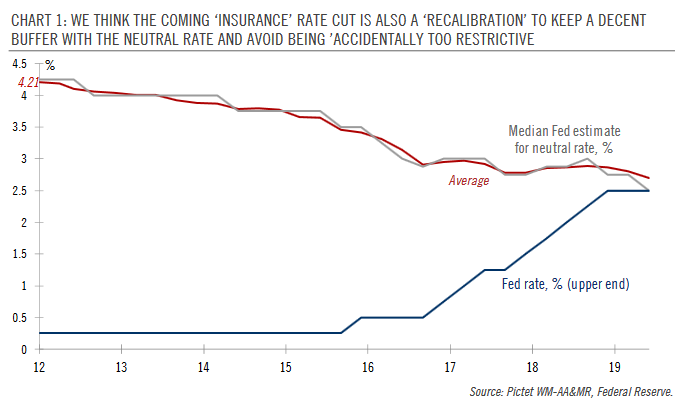

Is the Fed too focused on corporates?

Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch. The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s.

Read More »

Read More »

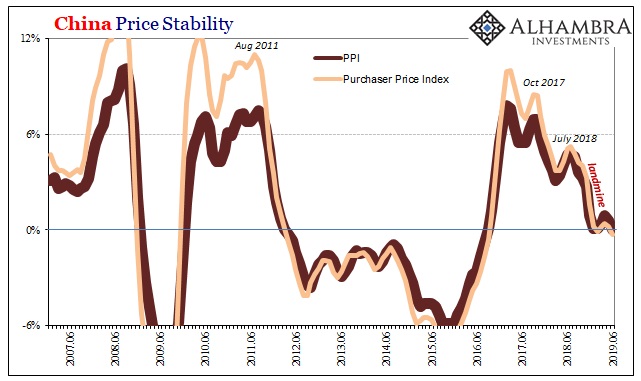

As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens.

Read More »

Read More »

WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare

WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare...

Read More »

Read More »

What do Moon rocks reveal about the universe? | The Economist

Between 1969 and 1972 six Apollo missions returned to Earth with Moon rocks. It was hoped that they would unlock lunar secrets but they also ended up teaching scientists more about the creation of the Earth and the universe beyond. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy These have been described as …

Read More »

Read More »

Powell’s Congressional testimony sets the scene for rate cut

The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September.During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July.

Read More »

Read More »

“Alexa, How Do We Subvert Big Tech’s Orwellian Internet-of-Things Surveillance?”

Convenience is the sales pitch, but the real goal is control in service of maximizing profits and extending state power. When every device in your life is connected to the Internet (the Internet of Things), your refrigerator will schedule an oil change for your car--or something like that--and it will be amazingly wunnerful.

Read More »

Read More »

Hong Kong unrest

The extradition bill is 'dead' but political turmoil is not over yet.Since early June, a series of large-scale demonstrations took place in Hong Kong in protest of proposed legislation that would allow extradition of criminal suspects to certain jurisdictions, including mainland China.

Read More »

Read More »

Predatory “Green Capitalism” Is Monetizing the Air, and It’s Going to Cost You

You want to reduce CO2? Then trigger a global depression that reduces global consumption of everything by 50% and destroys 95% of the phantom wealth owned by the global elites trying to monetize the air. I recently asked What's Left to Monetize?, and longtime correspondent Mark G. provided the answer: the air we breathe, via carbon taxes and markets for trading carbon credits, i.e. financializing / monetizing Nature to benefit the few at the...

Read More »

Read More »

How China is crushing the Uighurs | The Economist

China’s Muslim Uighurs face systematic oppression from their own government. Their home province of Xinjiang has been turned into a police state—an estimated one million of them are detained in camps where they are brainwashed. How and why are China’s leaders doing this? Read more from the Economist here: https://econ.st/2JCDIBr Click here to subscribe to …

Read More »

Read More »

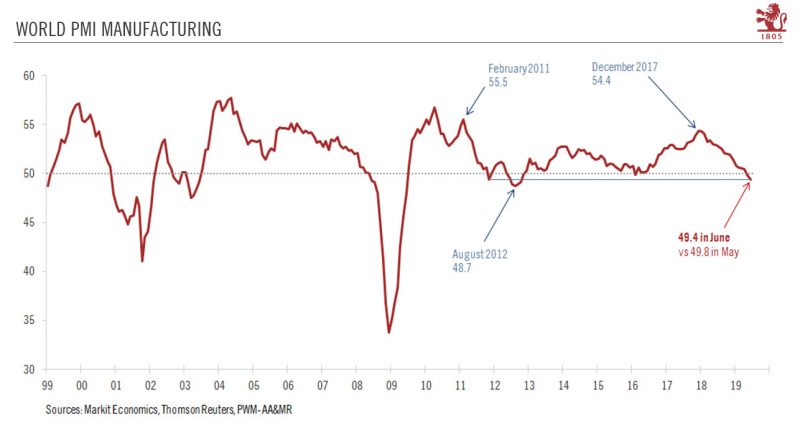

World trade and manufacturing hit by tariffs

In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting.Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting.

Read More »

Read More »

When Everything from Bat Guano to Quatloos Is Soaring, Speculative Euphoria Has Reached an Extreme

The more extreme the speculative euphoria, the greater the risks of a reversal. One sentence sums up the speculative euphoria gripping markets: January and June of this year are the only months in the last 150 which have seen all assets post a positive total return. (Zero Hedge)

Read More »

Read More »

Vested Interests in Charge = Guaranteed Failure

It boils down to two very simple principles: accredit the student, not the institution and teach every student how to rigorously learn on their own. Vested interests have every incentive to maintain the status quo: specifically, those who currently own the assets, income streams and power will continue to own the assets, income streams and power.

Read More »

Read More »

Who is the real Boris Johnson? | The Economist

Boris Johnson is likely to become Britain’s next prime minister. In today’s ugly politics he would be a dangerous leader. Read more here: https://econ.st/2JnZIzI Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Boris Johnson—you can love him, you can hate him but who is he? In some ways, he’s a very, very familiar …

Read More »

Read More »

What’s Left to Monetize?

What's left to monetize? It appears the answer is "very little." Advertising has always monetized consumers' time and attention, what we call engagement today. Newspapers and periodicals publish advertisements, radio/TV networks and stations air adverts, movie theaters run trailers/ads, billboards occupy our mental space while driving and websites and apps post adverts.

Read More »

Read More »

How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses.

Read More »

Read More »