Category Archive: 5) Global Macro

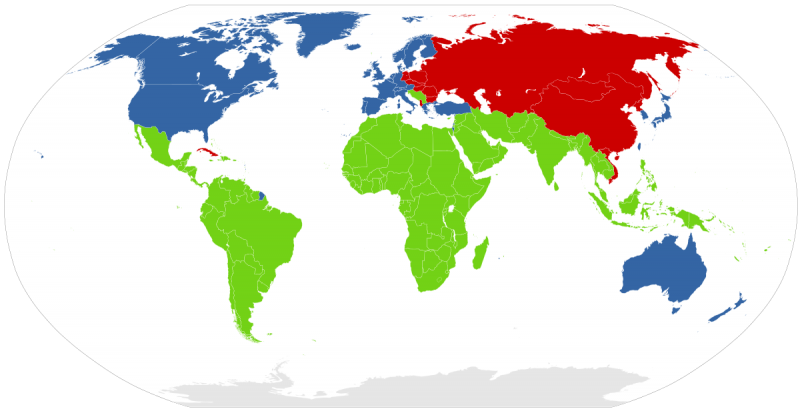

How to stop the ivory trade | The Economist

If ivory poaching continues at its current rate the African elephant could be extinct within decades. Science is being used to better map ivory-trafficking routes, but will it be enough to save the iconic animal? Click here to subscribe to The Economist on YouTube: http://econ.st/2sIlitG The African elephant population has been decimated by poaching over …

Read More »

Read More »

Our Approaching Winter of Discontent

The tragedy is so few act when the collapse is predictably inevitable, but not yet manifesting in daily life. That chill you feel in the financial weather presages an unprecedented--and for most people, unexpectedly severe--winter of discontent. Rather than sugarcoat what's coming, let's speak plainly for a change: none of the promises that have been made to you will be kept.

Read More »

Read More »

RMR: Special Guest – Charles Hugh Smith – Of Two Minds (02/19/2018)

Charles and “V” discuss the 13 indictments that show absolutely the stupidity of the Mueller investigation, the opportunity ahead with blockchain, cryptocurrency and why it’s important to take advantage now. We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally.

Read More »

Read More »

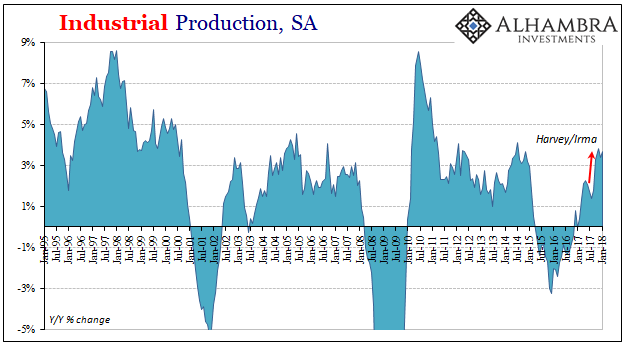

US IP On The Other Side of Harvey and Irma

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017).

Read More »

Read More »

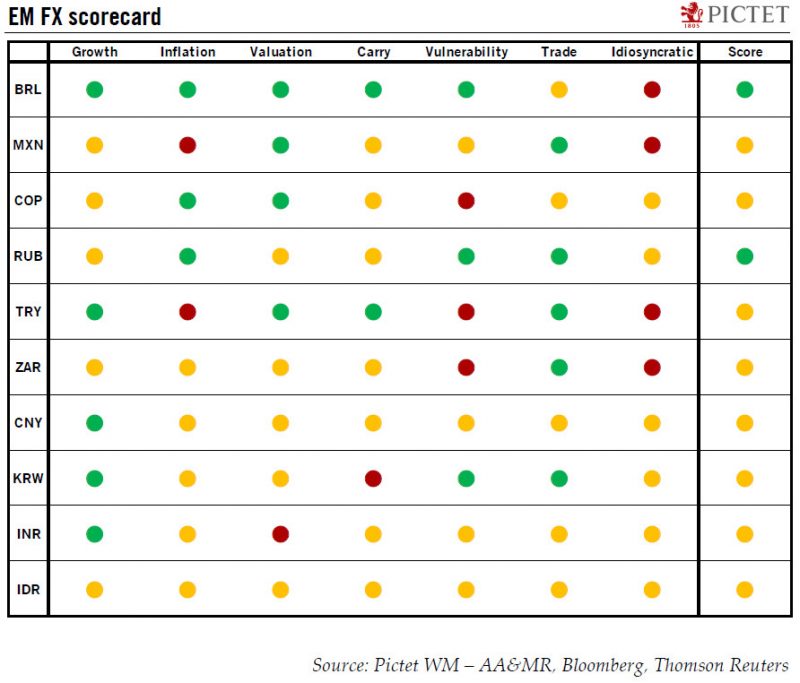

Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules - based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Read More »

Read More »

Charles Hugh Smith – All Currencies Will See Catastrophic Drop

Financial writer Charles Hugh Smith sees one very big problem coming at us, and that is a dramatic loss in buying power of the U.S. dollar, but it’s not just the dollar. According to Smith, “All these currencies, there is nothing backing the currencies except the government’s force. That’s the yen, the euro, the dollar …

Read More »

Read More »

Emerging Markets: What Changed

The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held.

Read More »

Read More »

America’s Jurassic-sized debt, cartooned | The Economist

America’s Jurassic-sized debt. Will America come to regret its abandonment of budget principles? Our cartoonist, KAL, imagines the deficits might be too monstrous to control Click here to subscribe to The Economist on YouTube: http://econ.st/2BZBGtD The US deficit is likely to rise to nearly 6% of GDP in 2019 and 2020. Our cartoonist, KAL, imagines …

Read More »

Read More »

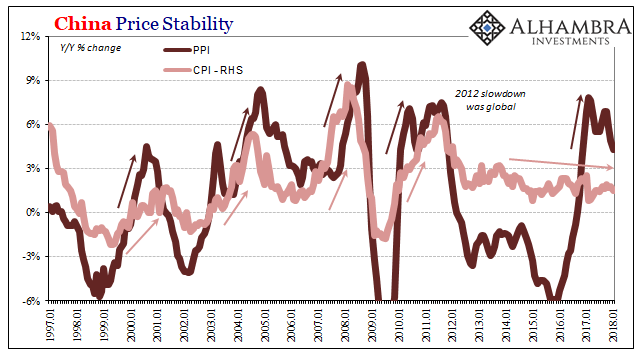

China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

How did Kosovo become a country? | The Economist

Kosovo, Europe’s newest country, was formed 10 years ago this week. It is peaceful today, but the path to its creation lay in one of Europe’s most brutal sectarian conflicts. Warning: this film contains graphic content. Click here to subscribe to The Economist on YouTube: http://econ.st/2BZBGtD In 2008, Kosovo became Europe’s newest country. This small, …

Read More »

Read More »

What Just Changed?

The illusion that risk can be limited delivered three asset bubbles in less than 20 years. Has anything actually changed in the past two weeks? The conventional bullish answer is no, nothing's changed; the global economy is growing virtually everywhere, inflation is near-zero, credit is abundant, commodities will remain cheap for the foreseeable future, assets are not in bubbles, and the global financial system is in a state of sustainable...

Read More »

Read More »

Online dating and its global impact | The Economist

Online-dating apps Tinder and Bumble have generated 20bn matches around the world. On Valentine’s day we examine the effect of the online-dating revolution. Click here to subscribe to The Economist on YouTube: http://econ.st/2suT4Tc Whether you’re after guys with bushy beards, a partner who has a passion for classical music or you want to find love …

Read More »

Read More »

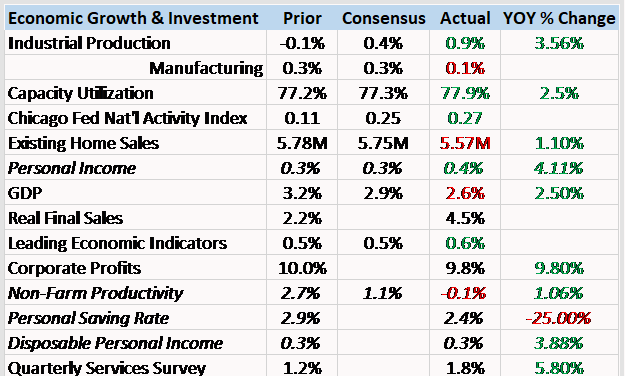

Bi-Weekly Economic Review

Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion.

Read More »

Read More »

Emerging Markets: The Week Ahead, February 12

EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM.

Read More »

Read More »

Charles Hugh Smith on Cyprus, Russia, the US, China and more

Subscribe to our newsletter at Episode 110: Charles Hugh Smith of talks to GoldMoney´s Alasdair Macleod. They talk about the. Subscribe to our newsletter at Episode 110: Charles Hugh Smith of talks to GoldMoney´s . Economic collapse and financial crisis is rising any moment. Getting informed about collapse. Bill Black: Standard Chartered admits to fraud, …

Read More »

Read More »

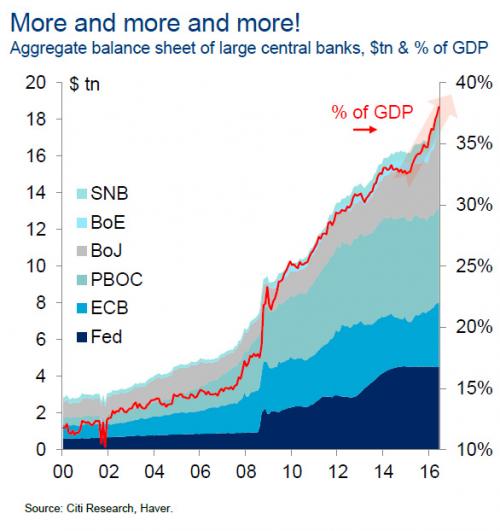

Three Crazy Things We Now Accept as “Normal”

How can central banks "retrain" participants while maintaining their extreme policies of stimulus? Human habituate very easily to new circumstances, even extreme ones. What we accept as "normal" now may have been considered bizarre, extreme or unstable a few short years ago.

Read More »

Read More »

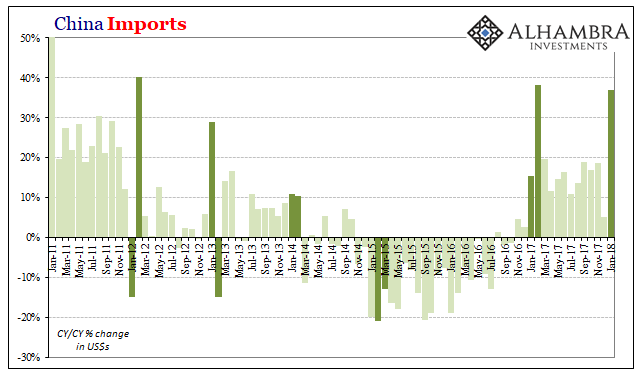

China: CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

Read More »

Read More »

Emerging Markets: What has Changed

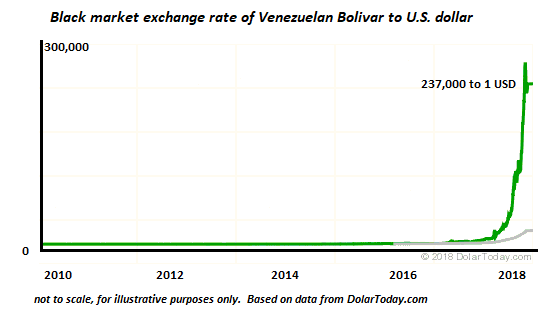

Reuters reported that China may loosen controls on outbound capital flows (QDLP). Samsung chief Lee was set free in an unexpected court reversal. Romania central bank hiked rates by 25 bp and raised its inflation forecasts for the next two years. South Africa President Zuma appears to be on the way out. Ecuador voters approved a referendum that reinstates term limits for the president. Venezuela central bank restarted FX auctions for the first time...

Read More »

Read More »

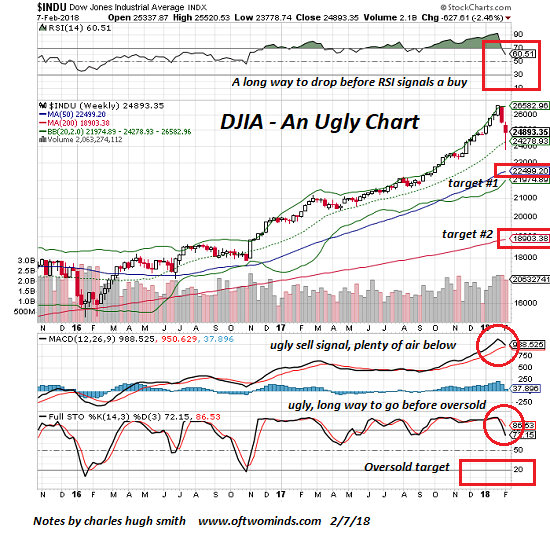

Before You “Buy the Dip,” Look at This One Chart

There's a place for fancy technical interpretations, but sometimes a basic chart tells us quite a lot. Here is a basic chart of the Dow Jones Industrial Average, the DJIA. It displays basic information: price candlesticks, volume, the 50-week and 200-week moving averages, RSI (relative strength), MACD (moving average convergence-divergence), stochastics and the MACD histogram. These kinds of charts are free (in this case, from StockCharts.com).

Read More »

Read More »