Category Archive: 5) Global Macro

Never Mind Volatility: Systemic Risk Is Rising

So who's holding the hot potato of systemic risk now? Everyone. One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

Read More »

Read More »

Jeffrey Snider // Gold swaps and how do central banks engage in them

Erik Townsend welcomes Jeffrey Snider to MacroVoices. Erik and Jeffrey discuss: — Gold swaps and how do central banks engage in them — What has changed in gold swaps, how are they done.

Read More »

Read More »

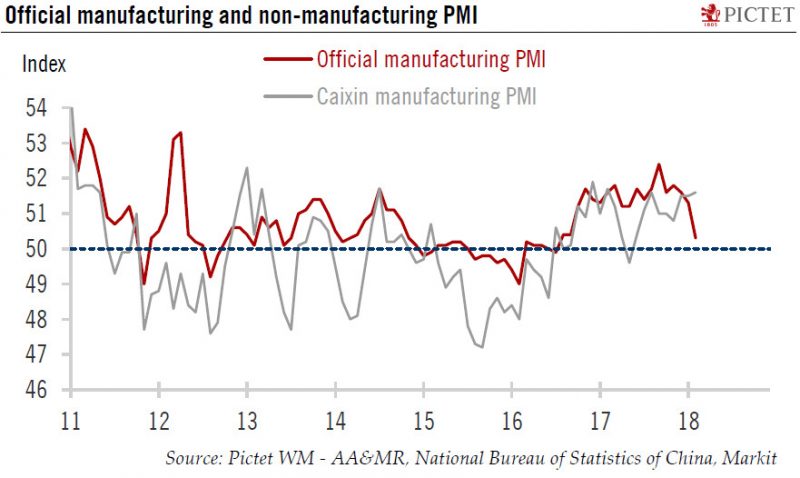

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

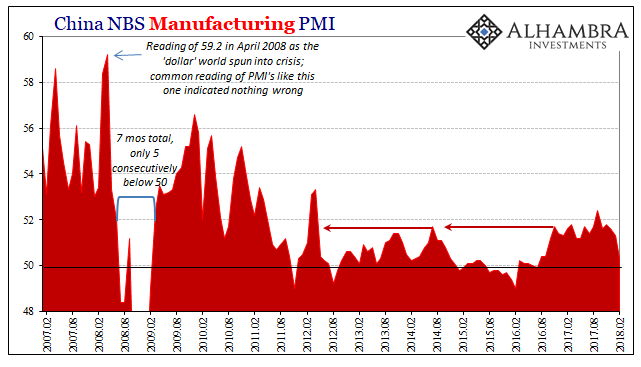

Data Distortions One Way Or Another

Back in October, we noted the likely coming of two important distortions in global economic data. The first was here at home in the form of Mother Nature. The other was over in China where Communist officials were gathering as they always do in their five-year intervals. That meant, potentially. In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes.

Read More »

Read More »

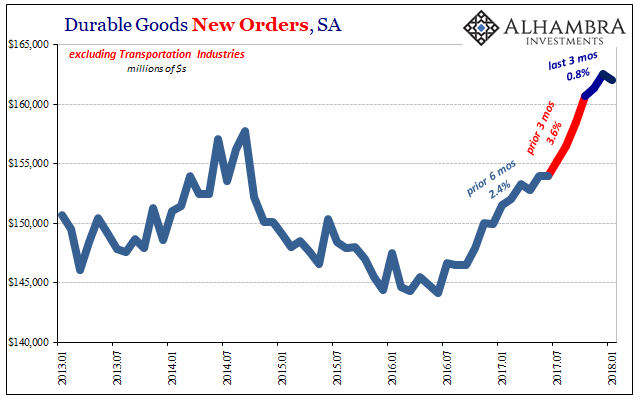

Durable and Capital Goods, Distortions Big And Small

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading.

Read More »

Read More »

Emerging Markets: What Changed

China plans to change its constitution to eliminate term limits for President Xi Jinping. Bank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Bank of Korea Governor Lee was reappointed by President Moon for a second term. Hungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. S&P upgraded Russia to BBB- with stable outlook.

Read More »

Read More »

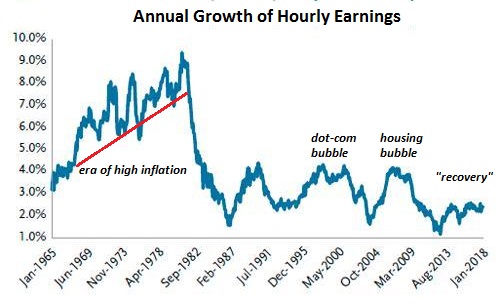

Our Fragmented Labor Markets Defy Outdated Conventions

There are hundreds of extraordinarily diverse labor markets in the U.S. economy, and it takes a much more granulated approach to make any sense of this highly fragmented and dynamic marketplace. onventional economists/media pundits typically view the labor market as monolithic, i.e. as one unified market. The reality is the labor market is highly fragmented. Thus it's little wonder that conventional measures are giving mixed signals on employment,...

Read More »

Read More »

Charles Hugh Smith On The Current Conditions In The Financial Markets

Click here for the full transcript: http://financialrepressionauthority.com/2018/03/02/the-roundtable-insight-charles-hugh-smith-on-the-current-conditions-in-the-financial-markets/

Read More »

Read More »

Career Advice to 20-Somethings: Create Value as a Mobile Creative

Finding work that fits who you are is rarely easy, especially if you don't fit into the mainstream, and usually it requires a lot of compromises, hard work and dead-ends. But that’s the process. Establishing a satisfying career is difficult in today's economy, doubly so for those who find life within hierarchical institutions (corporate America and government) unrewarding, and triply so for those burdened with student loan debt and college...

Read More »

Read More »

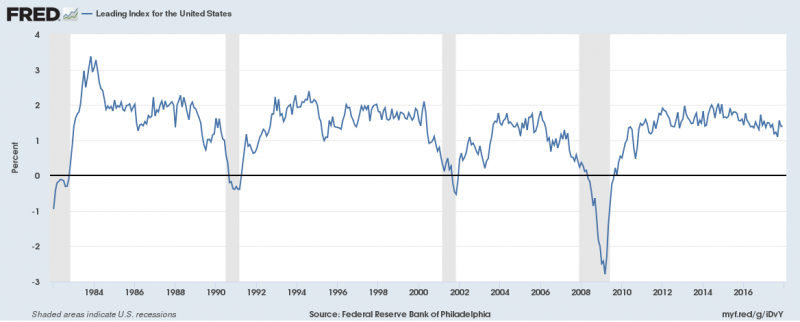

Bi-Weekly Economic Review: One Down, Three To Go

We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of recession, it is rare and unpredictable.

Read More »

Read More »

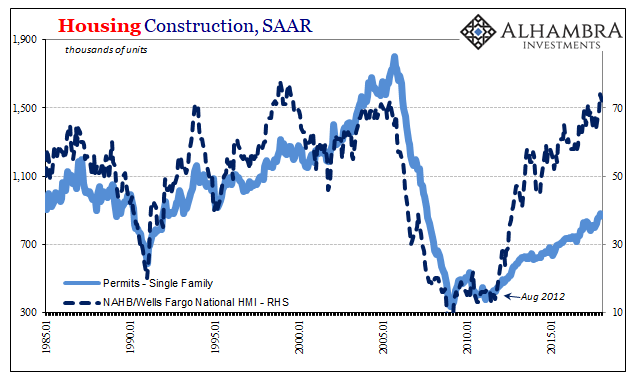

New Home Sales (Predictably) Fall Out of the Boom, Too

New home sales were down sharply again in January 2018. For the second straight month, the level of purchase activity fell substantially despite what are otherwise always described as robust or even booming economic conditions. Like the sales of existing homes, the sales of newly constructed units should be both moving upward as well as being significantly more than stuck at this low level.

Read More »

Read More »

Can horse taming prevent reoffending? | The Economist

This Arizona prison is teaching inmates how to break-in wild horses in the hope that the skills they learn will stop them from reoffending. So far, of the 50 inmates that have taken part, only two have found themselves back behind bars after being released. Click here to subscribe to The Economist on YouTube: http://econ.st/2F8I0jB …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »

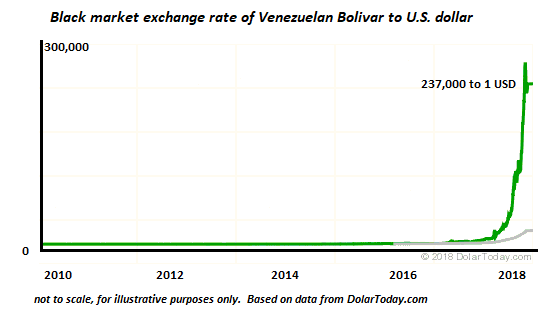

Venezuela’s New Cryptocurrency: Just Another Form of Control Fraud

The broke and broken country of Venezuela appears to be the first nation-state to issue a cryptocurrency token (the petro) as a means of escaping the financial black hole that's consuming its economy: Maduro Launches Oil-Backed Crypto "For The Welfare Of Venezuela".

Read More »

Read More »

Emerging Markets: What Changed

China regulators have taken over Anbang Insurance. Group for at least one year. RBI minutes from this month’s meeting were more hawkish than expected. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index.Israeli Prime Minister Netanyahu is coming under increasing pressure.

Read More »

Read More »

Russian spies in America, then and now | The Economist

Russia is accused of trying to influence the US election, which led to the Trump presidency. In a rare interview one of the Soviet Union’s highest-ranking KGB spies talks about the long-standing practice of subverting Western democracy. Click here to subscribe to The Economist on YouTube: http://econ.st/2F3pPvw Daily Watch: mind-stretching short films throughout the working …

Read More »

Read More »

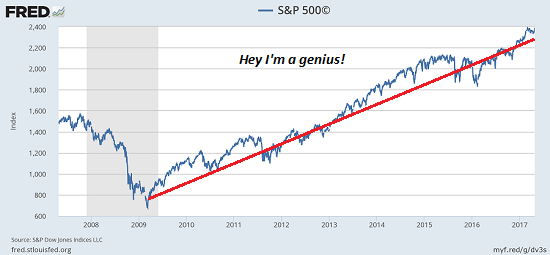

The End of (Artificial) Stability

The central banks'/states' power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as a result of a confluence of...

Read More »

Read More »

US-China Trade War Escalates As Further Measures Are Taken

US-China Trade War Escalates As Further Measures Are Taken. Trade war between two superpowers continues to escalate. White House likely to impose steep tariffs on aluminium and steel imports on ‘national security grounds’. US may impose global tariff of at least 24% on imports of steel and 7.7% on aluminium. China “will certainly take necessary measures to protect our legitimate rights.”

Read More »

Read More »