|

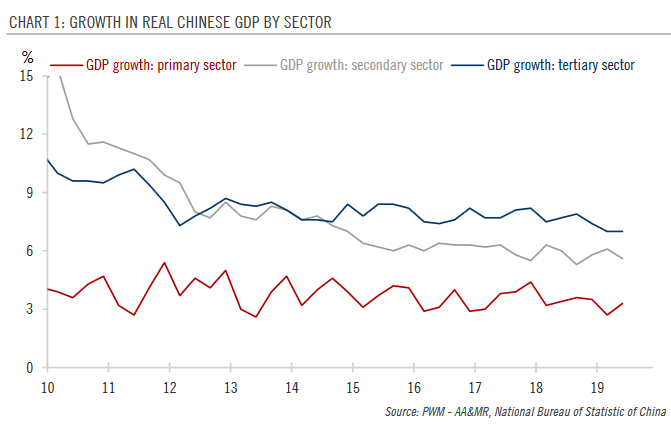

Downward pressure on growth persists amid ongoing trade tensions. Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades. The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1. In comparison, growth in the secondary sector (mainly manufacturing) declined to 5.6% y-o-y, from 6.1% in the previous quarter. From an expenditure perspective, consumption contributed 3.8% to the 6.2% headline growth in the first half of the year, while capital formation and net exports contributed 1.2% and 1.3% to headline growth, respectively. Lingering impact of deleveraging policies and the damages by the trade dispute will likely continue to create headwinds to Chinese growth in the second half of the year. |

Growth in Real Chinese GDP by Sector, 2010-2019(see more posts on China Gross Domestic Product, ) Source: perspectives.pictet.com - Click to enlarge |

We expect the Chinese government to maintain its policy easing to limit the downside risk. However, the government’s policy response will be event and data

dependent. Without the significant further escalation of trade tensions, the policy response may remain measured and contained.

Recent data for June show some early signs of stabilisation in the economy, especially in consumption and industrial production. However, they do not necessarily represent a decisive turning point yet, in our view. But we expect growth to pick up moderately in Q4 as policy easing gradually feeds into the economy, especially in the space of infrastructure investment.

At this point, our full-year Chinese GDP forecast of 6.3% for 2019 remains unchanged.

Full story here Are you the author? Previous post See more for Next postTags: China Gross Domestic Product,Macroview,newsletter